China's CMOC's $581 Million Lumina Gold Acquisition: Details And Implications

Table of Contents

Details of the CMOC Lumina Gold Acquisition

Transaction Structure

The CMOC Lumina Gold acquisition was structured as an all-cash offer, valuing Lumina Gold at a significant premium over its market price. This decisive move demonstrates CMOC's commitment to securing Lumina Gold's valuable assets. The exact terms and conditions, including any contingent payments, were detailed in official press releases and regulatory filings. The valuation reflects the high-quality nature of Lumina Gold's assets and their potential for future production.

Lumina Gold's Assets

Lumina Gold boasts a portfolio of impressive gold mining assets, primarily located in Ecuador and Canada. These assets represent a significant addition to CMOC's existing portfolio. Key assets include:

- The Cangrejos Project (Ecuador): A high-grade gold deposit with significant gold reserves and substantial potential for production expansion. This project offers substantial exploration upside and is a key driver of the acquisition.

- Other Projects: Lumina Gold possesses additional exploration and development projects with promising gold reserves, providing CMOC with further geographical diversification.

These assets collectively contribute to a considerable volume of gold reserves and production capacity, enhancing CMOC's overall gold production capabilities. The location of these assets, both in Ecuador and Canada, provides CMOC with geographical diversification in its gold mining operations. The quality of the deposits is crucial in determining the long-term profitability of this acquisition.

Regulatory Approvals and Timeline

Securing necessary regulatory approvals from various jurisdictions is a crucial step in completing the CMOC Lumina Gold acquisition. This process involves navigating complex mining regulations and meeting compliance standards in both Canada and Ecuador. The expected timeline for completion depends on the speed and efficiency of regulatory approvals. Potential delays could stem from unforeseen challenges in obtaining these approvals.

Implications for CMOC

Strategic Rationale

CMOC's acquisition of Lumina Gold serves several key strategic objectives. Firstly, it signifies a strategic diversification of CMOC's portfolio, reducing reliance on single commodities and mitigating risks associated with market volatility. Secondly, it's a major step toward securing additional gold resources to fuel future growth. Furthermore, the acquisition provides CMOC with access to new technologies and expertise in gold mining operations, particularly concerning environmentally responsible and sustainable mining practices. This acquisition aligns perfectly with CMOC's global mining strategy aimed at becoming a leading player in the global gold market.

Financial Impact

The $581 million acquisition represents a significant financial commitment for CMOC. However, the expected return on investment (ROI) is likely to be substantial given Lumina Gold's high-quality assets and strong growth potential. The financial implications for CMOC also include increased debt levels, which will need careful management. A thorough assessment of the deal's mining economics is essential in evaluating its overall long-term profitability.

Increased Market Share and Global Presence

The Lumina Gold acquisition substantially strengthens CMOC's position within the global gold market, boosting its market share and enhancing its brand reputation as a key player in the mining industry. This strategic move adds considerable weight to CMOC's global presence and positions it for continued growth and expansion in the international gold market.

Implications for the Canadian Gold Mining Sector

Impact on Competitors

The CMOC Lumina Gold acquisition is likely to have a significant impact on the competitive landscape of the Canadian gold mining industry. The deal could trigger a ripple effect, potentially leading to increased mergers and acquisitions (M&A) activity among other Canadian gold mining companies. Competitors may respond by seeking opportunities for growth and consolidation to maintain their market share in the face of this major acquisition.

Foreign Investment in Canadian Mining

This transaction highlights the significance of foreign direct investment (FDI) in the Canadian mining sector. The substantial Chinese investment in a major Canadian gold mining company underscores the growing role of international players in the Canadian mining landscape. This influx of foreign investment can stimulate economic growth and create employment opportunities in Canada's mining regions. However, it's also important to consider the broader geopolitical aspects of increased Chinese investment in strategic Canadian industries.

Broader Global Implications

Gold Market Dynamics

The CMOC Lumina Gold acquisition will likely influence global gold market dynamics. The increased gold production capacity resulting from this deal could affect gold supply, potentially influencing gold prices. However, the impact on gold demand will depend on various macroeconomic factors and overall global economic conditions. Analyzing the interplay between supply, demand, and pricing is crucial to understanding the overall consequences of this deal on the global commodity market.

Geopolitical Considerations

The involvement of a Chinese state-owned enterprise (SOE) like CMOC in acquiring a Canadian gold mining company raises geopolitical considerations. This acquisition highlights the increasingly interconnected nature of global trade and investment, and the growing influence of China in the global mining industry. This transaction requires careful consideration of its international trade implications and its role within the broader context of China's investments abroad.

Conclusion

The CMOC Lumina Gold acquisition is a landmark deal with significant implications for CMOC, the Canadian gold mining industry, and the global gold market. The acquisition strengthens CMOC's global reach, diversifies its portfolio, and enhances its market position. For Canada, it signals the continuing importance of foreign investment in the mining sector. Globally, the deal contributes to the shifting dynamics of the gold market and underscores the intricate geopolitical factors at play in the global mining industry. Stay informed about further developments in the CMOC Lumina Gold acquisition and other significant transactions in the global mining industry by subscribing to reputable financial news sources, and continue following the unfolding story of CMOC's acquisition of Lumina Gold – a deal that promises to reshape the landscape of global gold mining.

Featured Posts

-

Hipli La Solution De Colis Reutilisables Pour Une Livraison Durable

Apr 23, 2025

Hipli La Solution De Colis Reutilisables Pour Une Livraison Durable

Apr 23, 2025 -

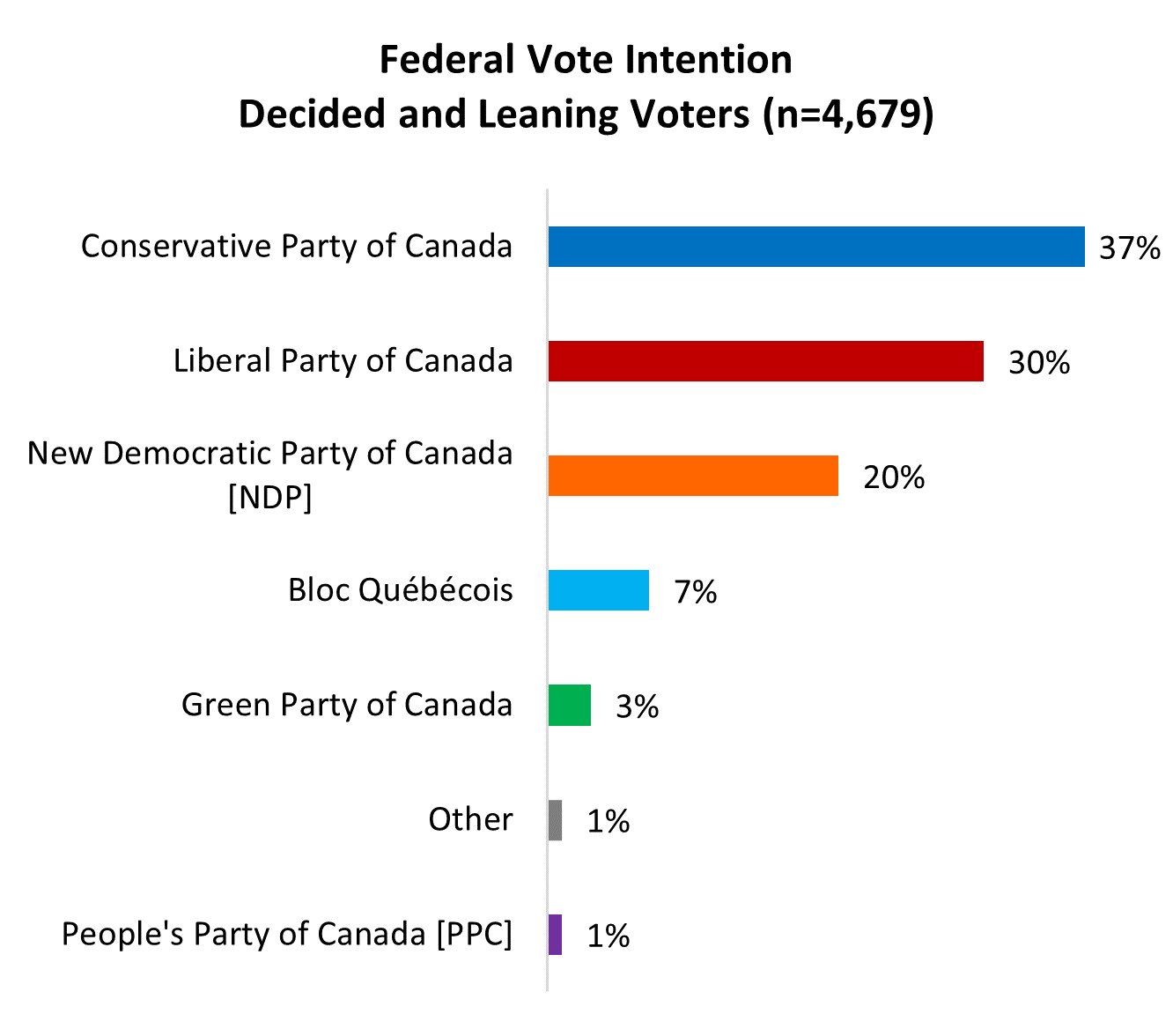

Understanding Poilievres Decline A Look At The Canadian Conservative Landscape

Apr 23, 2025

Understanding Poilievres Decline A Look At The Canadian Conservative Landscape

Apr 23, 2025 -

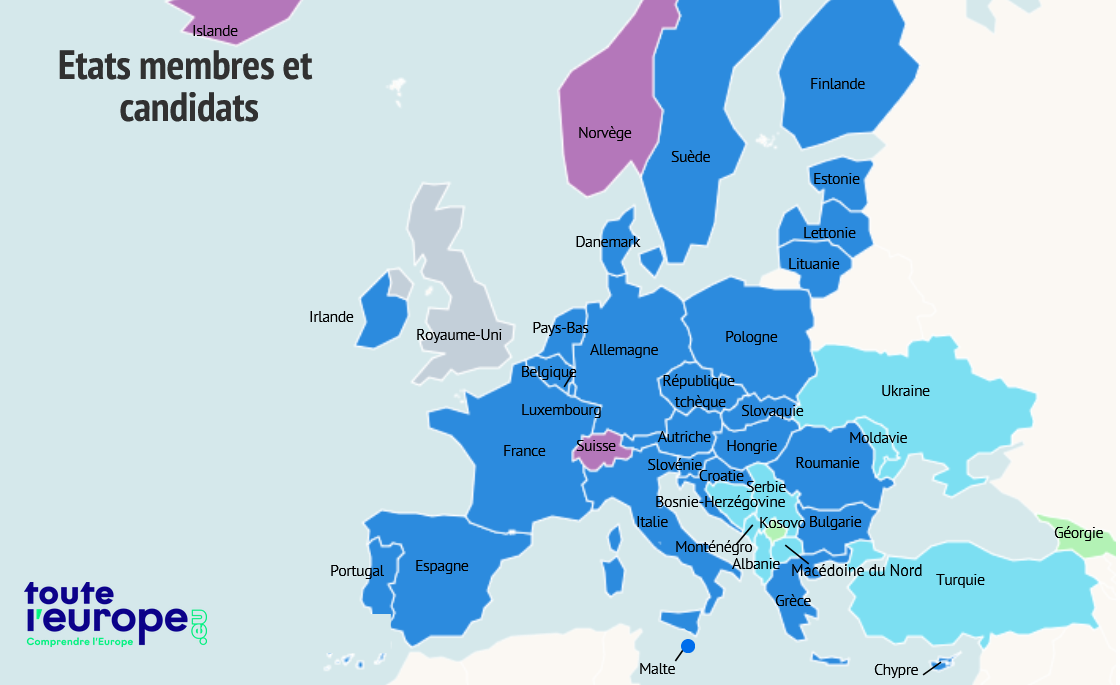

Legislatives Allemandes J 6 Un Apercu Des Principaux Candidats Et Partis

Apr 23, 2025

Legislatives Allemandes J 6 Un Apercu Des Principaux Candidats Et Partis

Apr 23, 2025 -

Bfm Bourse Du 24 Fevrier Le Resume Complet De La Journee

Apr 23, 2025

Bfm Bourse Du 24 Fevrier Le Resume Complet De La Journee

Apr 23, 2025 -

200 Manifestanti Protestano Contro Gli Attacchi Ai Ristoranti Palestinesi A Gerusalemme

Apr 23, 2025

200 Manifestanti Protestano Contro Gli Attacchi Ai Ristoranti Palestinesi A Gerusalemme

Apr 23, 2025