China's Economic Response To Tariffs: Lower Rates, Easier Bank Lending

Table of Contents

Lowering Interest Rates: A Monetary Policy Response

China's response to tariffs included a significant shift in its monetary policy. Lowering interest rates is a key mechanism used to stimulate economic activity. By reducing the cost of borrowing, the government aims to encourage investment and consumption, thereby boosting economic growth. This strategy is a cornerstone of China's economic response to tariffs.

- Reduced borrowing costs for businesses: Lower interest rates make it cheaper for businesses to take out loans, enabling them to invest in expansion, new equipment, and research and development. This increased investment fuels economic growth and job creation.

- Increased investment and consumption: With cheaper credit readily available, consumers are more likely to borrow for large purchases, such as homes and cars, stimulating consumer spending. Businesses, encouraged by lower borrowing costs, invest more, further boosting economic activity.

- Impact on inflation: While lower interest rates can stimulate the economy, there's a potential risk of increased inflation. The People's Bank of China (PBOC) carefully monitors inflation levels and adjusts its monetary policy accordingly to maintain a balance between economic growth and price stability.

- Examples of specific rate cuts implemented by the People's Bank of China (PBOC): The PBOC has implemented several rounds of interest rate cuts in recent years, particularly during periods of heightened trade tensions. These cuts, along with adjustments to reserve requirements (RRR), aimed to inject liquidity into the financial system and stimulate lending.

Easier Bank Lending: Boosting Credit Availability

In addition to lowering interest rates, China implemented measures to make bank lending more accessible. This involved a combination of tools aimed at increasing the flow of credit to businesses and consumers. Easier bank lending is a crucial component of China's economic response to tariffs.

- Increased credit availability for small and medium-sized enterprises (SMEs): SMEs are vital to China's economy, and access to credit is crucial for their survival and growth. The government implemented measures to encourage banks to lend more readily to SMEs, including loan guarantees and preferential lending rates.

- Support for infrastructure projects: Increased lending was also directed towards supporting large-scale infrastructure projects. These projects not only stimulate economic activity directly through construction and related industries but also provide long-term benefits in terms of improved infrastructure and enhanced connectivity.

- Potential risks associated with increased lending: While increased lending can boost economic activity, it also carries risks. An excessive increase in lending can lead to the accumulation of bad debts and financial instability.

- Government initiatives to manage these risks: The Chinese government implemented various measures to mitigate these risks, including stricter regulations on bank lending practices and increased supervision of financial institutions.

Fiscal Policy Measures in Conjunction with Monetary Policy

China's response to tariffs wasn't solely focused on monetary policy. Fiscal policy measures complemented the lower interest rates and easier bank lending, creating a comprehensive approach to economic stimulus.

- Tax cuts and rebates for businesses: Tax cuts and rebates provided much-needed relief to businesses struggling with the impact of tariffs, freeing up capital for investment and expansion. These measures were specifically targeted to support industries most affected by the trade war.

- Increased government spending on infrastructure: Increased government spending on infrastructure projects, such as roads, railways, and utilities, stimulated economic activity and job creation. These projects are designed to bolster long-term economic growth.

- Stimulus packages aimed at specific sectors: Targeted stimulus packages were allocated to specific sectors of the economy particularly hard hit by the tariffs. This strategic allocation of resources aimed to mitigate the negative impacts in a more focused manner.

- The effectiveness of fiscal stimulus in mitigating tariff impacts: The effectiveness of fiscal stimulus in mitigating the impacts of tariffs is a subject of ongoing debate. While it has undoubtedly provided support, its overall success in completely offsetting the negative effects remains a complex issue.

Assessing the Effectiveness of China's Response

Evaluating the effectiveness of China's multifaceted economic response to tariffs requires examining various key indicators. The combined monetary and fiscal policies aimed to stabilize the economy and maintain growth despite the external pressures.

- Economic growth indicators (GDP, industrial production): While the tariffs had a negative impact on economic growth, the implemented policies helped to mitigate the severity of the slowdown. China's GDP growth, while lower than previously projected, remained relatively resilient.

- Employment figures: The government's policies aimed to protect employment levels. While job losses occurred in certain sectors, the overall employment situation remained relatively stable, thanks in part to the stimulus measures.

- Foreign investment trends: The effects on foreign investment are mixed. While some investors were hesitant due to uncertainties, other investors saw opportunities and increased investment in certain sectors.

- Challenges and limitations of the strategy: Despite the positive aspects, the strategy faced challenges such as managing debt levels, preventing asset bubbles, and ensuring the long-term sustainability of the stimulus measures.

Conclusion

China's strategic response to tariffs involved a comprehensive approach using lower interest rates, easier bank lending, and complementary fiscal policies. These measures aimed to stabilize the economy and mitigate the negative impacts of trade tensions. The effectiveness of this response is still being assessed, with various economic indicators showing mixed results. Further research into China's economic response to tariffs, including detailed analysis of the long-term effects of these policies, is crucial for understanding the complex interplay between trade policy and economic management. Staying informed about the ongoing developments in China's economic policy and its implications for the global economy remains vital. Understanding China's economic response to tariffs provides valuable insights into managing economic challenges within a globalized world.

Featured Posts

-

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian World

May 08, 2025

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian World

May 08, 2025 -

Xrp Future Analyzing The Impact Of The Sec Lawsuit Dismissal On Price

May 08, 2025

Xrp Future Analyzing The Impact Of The Sec Lawsuit Dismissal On Price

May 08, 2025 -

Cyndi Lauper And Counting Crows Jones Beach Concert Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Announced

May 08, 2025 -

Batalla Campal Entre Flamengo Y Botafogo El Violento Enfrentamiento Que Paralizo El Partido

May 08, 2025

Batalla Campal Entre Flamengo Y Botafogo El Violento Enfrentamiento Que Paralizo El Partido

May 08, 2025 -

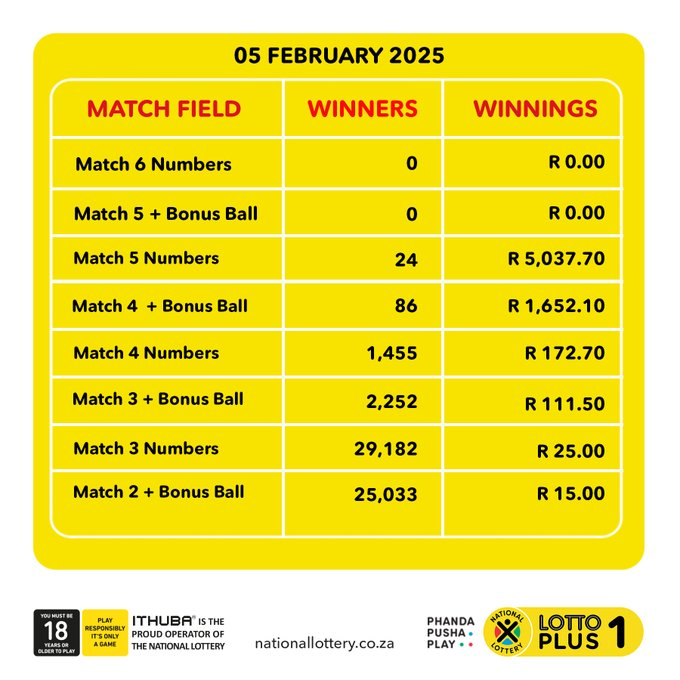

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025