Chinese Equities Soar: Hong Kong Market Responds To Trade Optimism

Table of Contents

Trade Deal Prospects Fuel Hong Kong's Market Rally

The positive momentum in the Hong Kong market is undeniably linked to the progress in US-China trade negotiations. The prospect of a comprehensive trade deal, or even further progress towards a "phase one" agreement, significantly reduces market uncertainty. This easing of trade tensions allows investors to regain confidence, leading to increased investment in both Chinese and Hong Kong assets. The reduced risk of escalating tariffs and trade disputes fuels economic growth, contributing to the overall market rally.

- Analysis of recent trade agreements and their implications: The recent announcements regarding trade talks have had a demonstrably positive impact on investor sentiment. Any further easing of trade restrictions is likely to further fuel market growth.

- Impact on specific sectors within the Hong Kong market (e.g., technology, finance): The technology and financial sectors within the Hong Kong market, heavily intertwined with mainland China's economic performance, have shown particularly strong gains. Reduced trade friction directly benefits these sectors.

- Mention specific indices showing market growth (Hang Seng Index, etc.): The Hang Seng Index, a key benchmark for the Hong Kong stock market, has seen a notable increase, reflecting the positive sentiment surrounding Chinese equities. Other related indices also show similar upward trends.

- Quote expert opinions on the future outlook based on trade developments: Analysts predict continued growth in the Hong Kong market contingent on the successful resolution of lingering trade issues and sustained progress in the economic relationship between the US and China.

Increased Investment in Chinese Companies Listed in Hong Kong

The Hong Kong Stock Exchange (HKEX) has witnessed a significant influx of foreign and domestic investment targeting Chinese companies listed there. This surge is driven by several factors, making H-shares—shares of mainland Chinese companies traded on the HKEX—particularly attractive.

- Statistics on increased investment volume and capital inflow: Data shows a marked increase in investment volume and capital flowing into HKEX-listed Chinese companies, confirming the trend of increased investor interest.

- Highlight specific examples of companies experiencing significant growth: Several Chinese companies listed in Hong Kong have experienced substantial growth, further bolstering investor confidence and attracting additional investment.

- Discuss the role of regulatory changes in attracting investment: Regulatory changes designed to facilitate investment and streamline processes have played a crucial role in attracting further capital into the Hong Kong market.

- Mention the potential for further growth in this area: Given the ongoing positive trends, significant potential for further growth in investment into Chinese companies listed in Hong Kong remains.

Economic Indicators Point to Positive Growth in China

Positive economic indicators emanating from mainland China are reinforcing the positive sentiment observed in the Hong Kong market. This strong economic performance directly translates into increased profitability for many Chinese companies, driving further growth in their stock prices.

- Analysis of recent GDP growth figures: Recent GDP growth figures for China have exceeded expectations, signaling a healthy and expanding economy. This robust growth fuels confidence in the performance of Chinese equities.

- Discussion of key economic drivers (e.g., consumer spending, infrastructure investment): Increased consumer spending and continued infrastructure investment are key drivers of China's economic growth, supporting the positive outlook for Chinese equities.

- Mention any positive shifts in employment or inflation rates: Stable employment rates and controlled inflation rates further contribute to a positive economic picture in China.

- Expert commentary on the long-term economic outlook for China: Experts remain largely positive about the long-term economic prospects for China, further bolstering the appeal of Chinese equities as an investment opportunity.

Potential Risks and Considerations for Investors

While the outlook appears positive, investors should always exercise caution and acknowledge potential risks. The market, while currently exhibiting strong growth, is subject to inherent volatility.

- Potential impact of future trade negotiations: The ongoing nature of trade negotiations introduces an element of uncertainty. Unexpected setbacks could impact market sentiment.

- Geopolitical risks and their influence on market stability: Geopolitical factors and global events can significantly influence market stability, introducing unexpected risks.

- The inherent volatility of the stock market: Investors should always be aware of the inherent volatility of the stock market and the potential for price fluctuations.

- Advice on diversification and risk management strategies: Diversification and implementing effective risk management strategies are crucial to mitigate potential losses. Thorough due diligence is paramount before committing to any investment.

Conclusion

The surge in Chinese equities and the resulting positive impact on the Hong Kong market are largely driven by increased trade optimism and positive economic indicators from mainland China. The easing of US-China trade tensions has significantly boosted investor confidence, leading to increased investment in both Chinese and Hong Kong assets. While this presents exciting investment opportunities, it is crucial to remember that the market is inherently volatile.

Capitalize on the soaring Chinese equities market and explore the investment opportunities available in the Hong Kong market. Conduct thorough research and understand the associated risks before making any investment decisions. Remember to consider diversification and implement sound risk management strategies as part of your overall investment plan.

Featured Posts

-

Blue Origin Postpones Launch Details On Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Postpones Launch Details On Vehicle Subsystem Issue

Apr 24, 2025 -

The Bold And The Beautiful April 9 Icu Drama Blame And Hidden Truths

Apr 24, 2025

The Bold And The Beautiful April 9 Icu Drama Blame And Hidden Truths

Apr 24, 2025 -

Where To Start A Business In Country Name A Guide To The Hottest Spots

Apr 24, 2025

Where To Start A Business In Country Name A Guide To The Hottest Spots

Apr 24, 2025 -

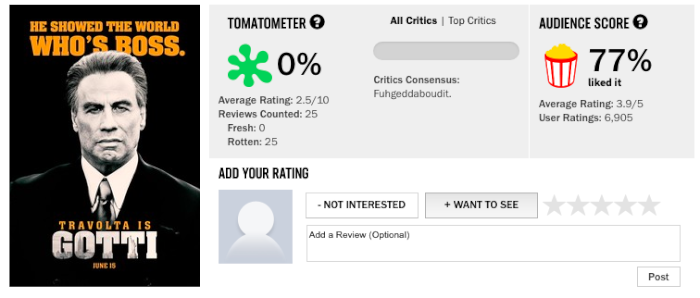

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

From Scatological Data To Engaging Audio An Ai Driven Poop Podcast Solution

Apr 24, 2025

From Scatological Data To Engaging Audio An Ai Driven Poop Podcast Solution

Apr 24, 2025

Latest Posts

-

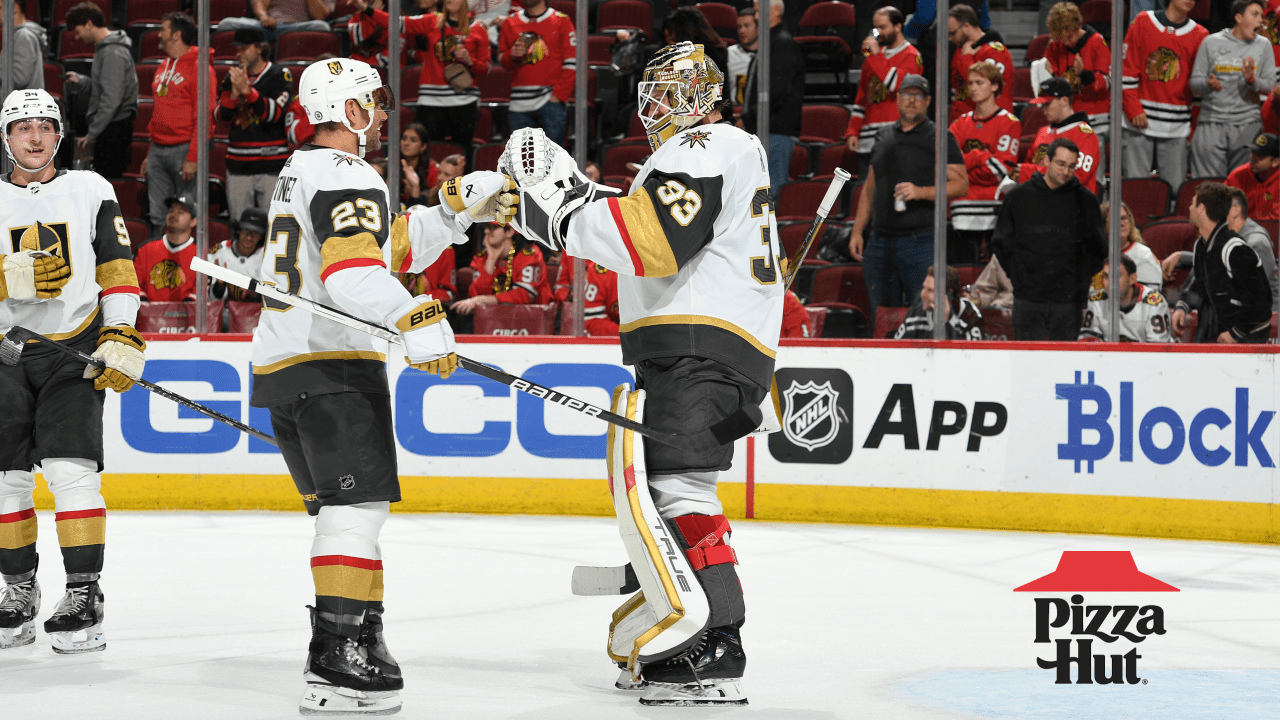

Barbashevs Ot Heroics Send Vegas Golden Knights And Minnesota Wild To Game 5

May 10, 2025

Barbashevs Ot Heroics Send Vegas Golden Knights And Minnesota Wild To Game 5

May 10, 2025 -

Stephen Kings 2024 Movie Slate The Monkey And Two More Thrilling Releases

May 10, 2025

Stephen Kings 2024 Movie Slate The Monkey And Two More Thrilling Releases

May 10, 2025 -

Vegas Golden Knights Win Game 4 Barbashevs Ot Goal Forces Series Tie

May 10, 2025

Vegas Golden Knights Win Game 4 Barbashevs Ot Goal Forces Series Tie

May 10, 2025 -

Binge Watch This Top Stephen King Show In Under 5 Hours

May 10, 2025

Binge Watch This Top Stephen King Show In Under 5 Hours

May 10, 2025 -

Hills Stellar Goaltending Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025

Hills Stellar Goaltending Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025