Climate Risk: The Unexpected Factor Affecting Your Home Purchase Creditworthiness

Table of Contents

Climate-related financial losses are skyrocketing. In 2022 alone, insured losses from natural catastrophes reached record levels, highlighting the escalating impact of climate change on our lives and finances. This unprecedented situation introduces a new, unexpected factor into the home-buying process: climate risk. Increasingly, climate risk is influencing lender's assessment of mortgage applications, significantly impacting potential homebuyers' creditworthiness. This article will explore how climate change is reshaping the mortgage landscape and what you can do to protect your financial future.

H2: How Climate Change Impacts Property Values

Climate change is not just an environmental concern; it's a significant financial one, directly impacting property values. This impact manifests in two key ways: through the increased frequency of extreme weather events and through the gradual effects of long-term climate risks.

H3: Increased Frequency of Extreme Weather Events

The devastating effects of floods, wildfires, hurricanes, and droughts are no longer isolated incidents. These extreme weather events are becoming more frequent and intense, causing widespread property damage and significantly decreasing property values.

- Hurricane Ian (2022): Caused billions of dollars in damage to Florida properties, leading to decreased home values and difficulties in obtaining insurance. [Link to relevant news article]

- California Wildfires (2020-2023): Destroyed thousands of homes, rendering entire neighborhoods uninhabitable and significantly impacting property values in affected areas. [Link to relevant study]

- Midwest Flooding (2019): Extensive flooding resulted in significant property damage and devaluation across several states. [Link to relevant news article]

The damage itself is only part of the equation. The aftermath includes inflated insurance premiums, or even the inability to secure insurance in high-risk areas, making properties less desirable and harder to finance.

H3: Long-Term Climate Risks

Beyond immediate catastrophes, long-term climate risks pose a serious threat to property values. These gradual changes, though less dramatic in the short term, will have a profound and lasting impact.

- Sea-level rise: Coastal properties are increasingly vulnerable to flooding and erosion, diminishing their value and increasing the risk of future damage. Government projections indicate significant sea-level rise within the next century. [Link to relevant government report]

- Desertification: Expanding deserts lead to decreased water availability and agricultural productivity, impacting property values in affected regions. [Link to relevant scientific study]

- Changing weather patterns: Shifts in temperature and rainfall patterns can affect agricultural yields, water resources, and infrastructure, all of which can influence property values.

These long-term risks significantly affect future property appreciation and resale value, making it crucial to consider these factors when purchasing a home.

H2: Lenders' Increasing Scrutiny of Climate Risk

Lenders are increasingly aware of the financial implications of climate change and are adapting their underwriting processes to reflect these risks. This increased scrutiny is impacting homebuyers' creditworthiness in significant ways.

H3: Increased Due Diligence

To mitigate their own risk, lenders are incorporating sophisticated climate risk assessments into their underwriting procedures. This includes:

- Flood risk maps: Analyzing properties' proximity to floodplains and their vulnerability to flooding.

- Wildfire risk scores: Assessing properties' vulnerability to wildfires based on factors such as vegetation density and proximity to fire-prone areas.

- Proximity to vulnerable areas: Evaluating the overall climate risk of the surrounding environment.

Lenders are leveraging advanced climate-related data and models to accurately assess the long-term risks associated with specific properties.

H3: Impact on Loan Approval and Interest Rates

Properties deemed to be at high climate risk are significantly more likely to face:

- Loan denials: Lenders may refuse to provide mortgages for properties with high climate risk, impacting buyers' ability to purchase a home.

- Higher interest rates: For properties with moderate climate risk, lenders may offer loans with higher interest rates to compensate for the increased risk.

- Stricter lending terms: Lenders might demand higher down payments or stricter loan-to-value ratios for properties in high-risk areas, making homeownership less affordable.

This means that the affordability and accessibility of homes, particularly in climate-vulnerable areas, are becoming increasingly dependent on climate risk assessments.

H2: Protecting Your Creditworthiness in a Climate-Conscious Lending Environment

Taking proactive steps to understand and mitigate climate risk can significantly improve your chances of securing a mortgage and protecting your creditworthiness.

H3: Understanding Your Property's Climate Risk

Thoroughly researching the climate risks associated with any potential property is crucial. Resources include:

- Government websites: Many government agencies provide flood risk maps, wildfire risk assessments, and other climate-related data.

- Insurance company reports: Insurance companies often have detailed risk assessments for specific areas, which can be valuable information.

- Climate risk assessment tools: Several online tools are emerging that assess the climate vulnerability of properties using a range of criteria.

By using these resources, you can gain a clear understanding of the risks involved and make informed decisions.

H3: Strategies for Mitigating Climate Risk

Improving a property's resilience to climate change can enhance its attractiveness to lenders and increase its long-term value:

- Flood defenses: Installing flood barriers, elevating structures, or implementing other flood mitigation measures.

- Fire-resistant landscaping: Replacing flammable vegetation with fire-resistant plants and creating defensible spaces around the property.

- Energy efficiency upgrades: Improving energy efficiency reduces reliance on fossil fuels, aligning with sustainable development goals and reducing the environmental impact.

While these improvements may involve upfront costs, they can lead to cost savings in the long run and significantly improve the property's insurability and market value, enhancing your chances of securing favorable loan terms.

Conclusion:

Climate risk is undeniably a significant and growing factor impacting home purchase creditworthiness. Lenders are increasingly incorporating climate assessments into their underwriting processes, making it crucial for homebuyers to understand and mitigate these risks. By researching the climate vulnerability of potential properties and considering mitigation strategies, you can significantly improve your chances of securing a mortgage and protecting your financial future. Don't let climate risk impact your dream home purchase. Conduct thorough climate risk assessments and consider investing in climate-resilient improvements before making a decision. Proactive planning and informed decision-making are key to navigating this evolving landscape and achieving your homeownership goals.

Featured Posts

-

The Us Typhon Missile System And The Philippines A Strategic Response To Chinese Expansionism

May 20, 2025

The Us Typhon Missile System And The Philippines A Strategic Response To Chinese Expansionism

May 20, 2025 -

Solve The Nyt Mini Crossword March 13 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers

May 20, 2025 -

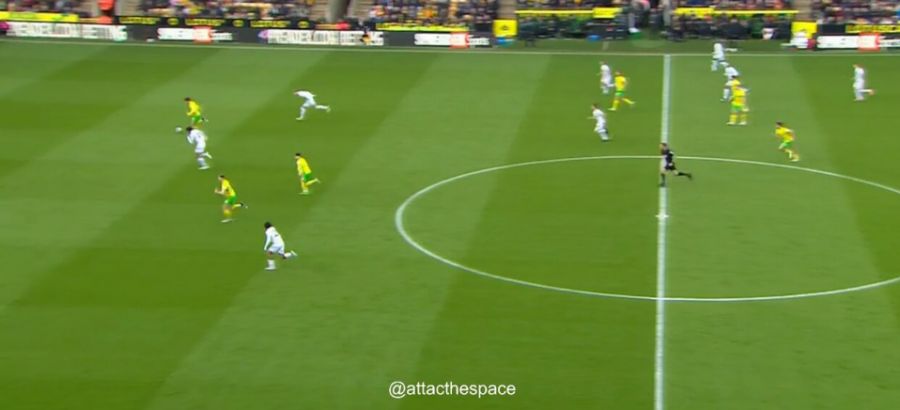

Championship Top Spot Leeds Rise Fueled By Tottenham Loanee

May 20, 2025

Championship Top Spot Leeds Rise Fueled By Tottenham Loanee

May 20, 2025 -

Rtl Groups Streaming Strategy A Path To Profitability

May 20, 2025

Rtl Groups Streaming Strategy A Path To Profitability

May 20, 2025 -

Resilience Turning Challenges Into Opportunities For Growth In Mental Health

May 20, 2025

Resilience Turning Challenges Into Opportunities For Growth In Mental Health

May 20, 2025