Clinton Vs. Congress: The Fight Over The One Percent Budget

Table of Contents

Clinton's Proposed "One Percent Budget": Austerity Measures and Economic Vision

President Clinton's proposed "One Percent Budget" was a comprehensive plan designed to tackle the burgeoning national deficit. The plan, framed as a necessary step towards long-term fiscal stability and economic growth, involved a combination of spending cuts and targeted investments. Key elements of the proposal included:

-

Significant Spending Cuts: The budget called for substantial reductions across various government departments. Defense spending faced cuts, along with reductions in social programs. Government bureaucracy also saw proposed reductions, aiming for increased efficiency. Exact percentage reductions varied across departments, but the overall goal was to reduce the federal budget deficit substantially.

-

Justification for Austerity: Clinton framed the austerity measures as crucial for restoring economic confidence and preventing a fiscal crisis. He argued that deficit reduction would lower interest rates, stimulate private investment, and ultimately lead to stronger economic growth. This contrasted with some prevailing economic theories at the time.

-

Strategic Investments: Despite the emphasis on austerity, the budget also included provisions for investments in key areas. Proposed investments in infrastructure, for example, were intended to create jobs and stimulate economic activity through improvements in transportation, communication, and public works.

-

Tax Policy Considerations: While not a central feature, the "One Percent Budget" did include considerations of tax policy reforms, aimed at either broadening the tax base or increasing revenue in specific areas. However, substantial tax increases were generally avoided in favor of spending cuts as the primary deficit reduction method.

Congressional Opposition: Ideological Divisions and Political Maneuvering

Clinton's "One Percent Budget" faced significant resistance from Congress, primarily from the Republican majority. The opposition stemmed from a combination of ideological differences and shrewd political maneuvering.

-

Republican Objections: Republicans largely opposed the proposed cuts to defense spending and social programs, viewing them as detrimental to national security and the well-being of vulnerable populations. They also questioned the economic assumptions underlying Clinton's projections and disagreed with his overall approach to fiscal policy.

-

Democratic Divisions: Even within the Democratic Party, there was not complete unity behind the president's budget. Some Democrats expressed reservations about the scale of spending cuts, particularly those affecting social programs important to their constituencies. This internal division weakened the Democrats' negotiating position.

-

Political Gridlock: The resulting political gridlock and budget impasse led to protracted negotiations, delays in government funding, and heightened political tensions. Both sides employed various political strategies, from public relations campaigns to behind-the-scenes negotiations, to advance their positions.

-

Legislative Process Challenges: The intricacies of the legislative process further fueled the impasse. The budget proposal had to navigate the complexities of committee hearings, amendments, and floor votes in both the House and the Senate, all while facing determined opposition.

The Core Disagreements: Competing Visions for the American Economy

At the heart of the Clinton vs. Congress budget battle lay fundamental disagreements over economic philosophy and the role of government.

-

Clash of Economic Philosophies: Clinton's approach leaned towards a more interventionist economic philosophy, incorporating elements of Keynesian economics—the belief that government spending can stimulate demand during economic downturns. Congress, on the other hand, often favored supply-side economics—the idea that tax cuts incentivize investment and job creation, leading to economic growth. This fundamental disagreement shaped their opposing approaches to the budget.

-

Specific Areas of Disagreement: The core disagreements played out in specific areas, including debates over the level of government spending on social programs, infrastructure projects, and defense. Disputes over tax policy also contributed significantly to the impasse, with differing views on tax rates, the tax base, and the overall burden of taxation.

-

Potential Long-Term Economic Consequences: The competing approaches held divergent implications for the long-term trajectory of the American economy. Proponents of Clinton's plan emphasized the importance of deficit reduction for long-term economic stability, while opponents argued that the proposed cuts would stifle economic growth and harm vital social programs.

The Impact of the Budget Fight: Short-Term and Long-Term Consequences

The "One Percent Budget" fight had profound short-term and long-term consequences:

-

Short-Term Impacts: The budget battle resulted in government shutdowns and a considerable delay in the passage of a budget resolution. This led to disruptions in government services, uncertainty in financial markets, and a general sense of political dysfunction.

-

Long-Term Effects: The long-term impacts are complex and still debated. The budget ultimately did contribute to a reduction in the national debt, but the full effects on economic growth and social programs are subject to ongoing analysis. The political fallout significantly shaped the political landscape for years to come.

-

Public Opinion and Political Landscape: The public perception of the budget fight was divided, with opinions varying depending on party affiliation and perspectives on government spending and fiscal policy. The political fallout shaped election campaigns and contributed to the ongoing partisan divisions in American politics.

Conclusion:

The conflict between President Clinton and Congress over the One Percent Budget vividly illustrates the complexities of American fiscal policy and the persistent tension between competing political and economic ideologies. The debate exposed fundamental disagreements about the role of government, the appropriate level of taxation, and optimal strategies for achieving sustainable economic growth. Understanding the historical context of this Clinton vs. Congress "One Percent Budget" debate is crucial for comprehending contemporary discussions surrounding fiscal policy and budget priorities. Further research into this significant political and economic clash can provide valuable insights into navigating similar challenges in the future. To delve deeper into the intricacies of this historical budget dispute and its lasting impact, explore additional resources and continue your research on the "One Percent Budget" and its legacy.

Featured Posts

-

Englands Zimbabwe Test In Jeopardy After Injury Crisis

May 23, 2025

Englands Zimbabwe Test In Jeopardy After Injury Crisis

May 23, 2025 -

Bbcs Four Year Agreement With The Ecb

May 23, 2025

Bbcs Four Year Agreement With The Ecb

May 23, 2025 -

Analyzing The Political Landscape Of Clintons Budget Vetoes

May 23, 2025

Analyzing The Political Landscape Of Clintons Budget Vetoes

May 23, 2025 -

Analyzing The Complex Dynamics In Succession Sky Atlantic Hd

May 23, 2025

Analyzing The Complex Dynamics In Succession Sky Atlantic Hd

May 23, 2025 -

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

May 23, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

May 23, 2025

Latest Posts

-

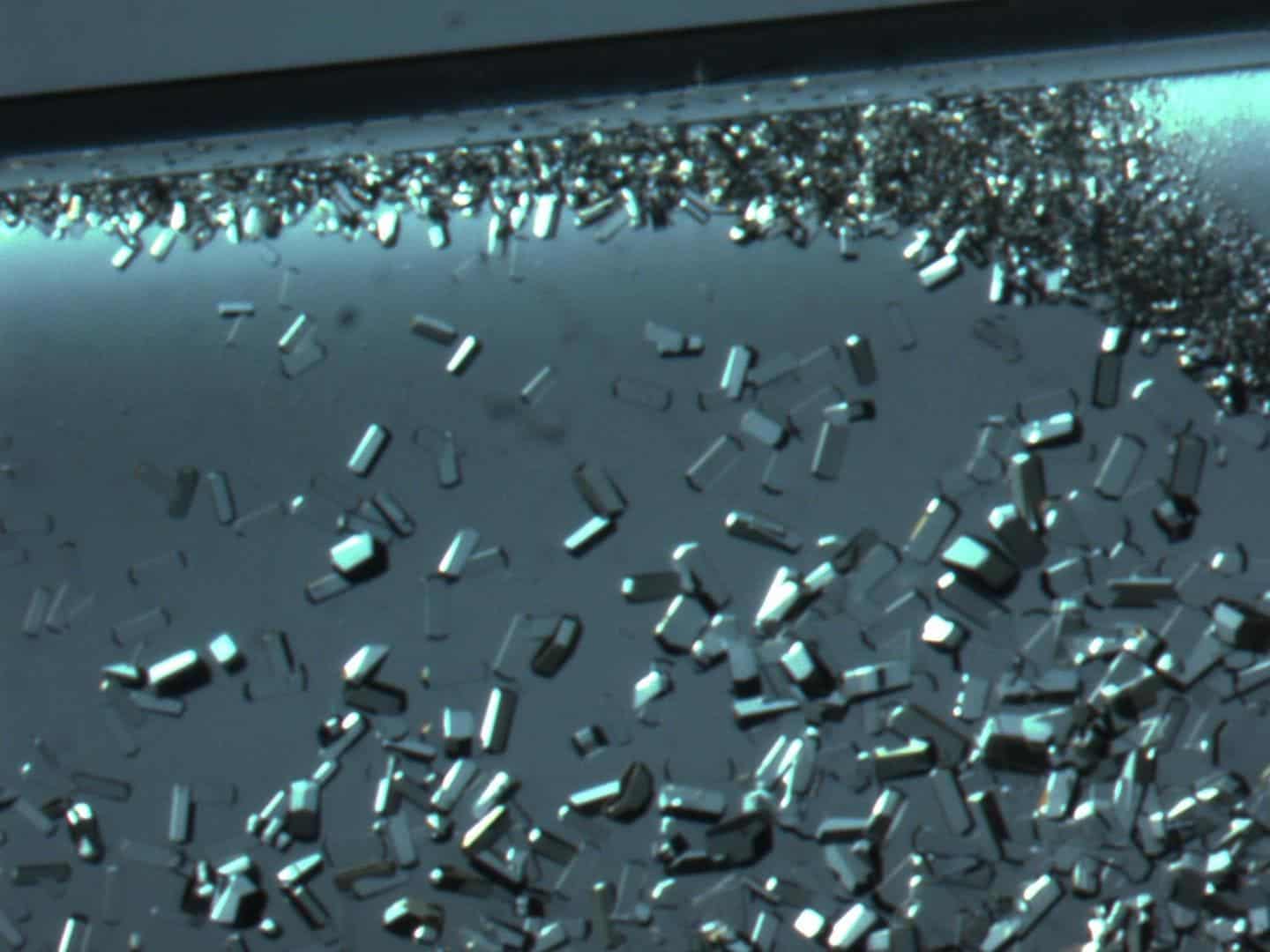

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025 -

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025 -

The Role Of Orbital Space Crystals In Enhancing Drug Production And Quality

May 23, 2025

The Role Of Orbital Space Crystals In Enhancing Drug Production And Quality

May 23, 2025 -

Orbital Space Crystals And Pharmaceutical Advancements A New Era In Drug Development

May 23, 2025

Orbital Space Crystals And Pharmaceutical Advancements A New Era In Drug Development

May 23, 2025 -

Harnessing Orbital Space Crystals The Next Frontier In Drug Discovery

May 23, 2025

Harnessing Orbital Space Crystals The Next Frontier In Drug Discovery

May 23, 2025