Commodity Market Outlook: 5 Key Charts For This Week's Trading

Table of Contents

Crude Oil Price Analysis: Chart 1 – Assessing Geopolitical Risks and Demand

Keywords: Crude oil price, oil market analysis, geopolitical risks, oil demand, OPEC, oil price forecast

The crude oil market remains highly sensitive to geopolitical events and global economic growth. Chart 1 illustrates the current price action, highlighting key support and resistance levels.

-

Geopolitical Impacts: Recent geopolitical instability in [mention specific region/event] has significantly impacted crude oil prices. Sanctions, supply disruptions, and uncertainty contribute to price volatility. Monitoring news related to OPEC+ meetings and potential production adjustments is crucial for understanding price fluctuations.

-

Demand Dynamics: Global economic growth is strongly correlated with oil demand. A slowdown in major economies could lead to lower oil consumption and subsequently lower prices. Conversely, robust economic growth in developing nations could drive demand upwards.

-

OPEC+ Influence: The decisions of OPEC+ (Organization of the Petroleum Exporting Countries and its allies) significantly influence global oil supply and prices. Their production quotas and agreements directly impact the commodity price forecast for crude oil.

-

Short-Term Price Forecast: Based on Chart 1's technical analysis, we anticipate a price range between [Price range] in the short term. However, unforeseen geopolitical events could significantly alter this projection.

-

Trading Opportunities: The chart suggests potential buying opportunities near [support level] and potential selling opportunities near [resistance level]. However, traders should employ appropriate risk management techniques.

Natural Gas Price Trends: Chart 2 – Weather Patterns and Storage Levels

Keywords: Natural gas price, natural gas market, weather patterns, natural gas storage, energy market, gas price forecast

Chart 2 shows the natural gas price trends, emphasizing the influence of weather and storage levels.

-

Weather's Impact: Extreme weather events significantly impact natural gas prices. Harsh winters increase heating demand, pushing prices higher, while unusually warm weather can depress prices. Seasonal forecasts are therefore vital for trading strategies.

-

Storage Levels: Analyzing current natural gas storage levels compared to historical averages provides insights into supply and demand dynamics. Low storage levels during peak demand seasons often lead to price spikes.

-

Government Regulation: Government policies regarding natural gas production, transportation, and consumption play a role in shaping market conditions and influencing the gas price forecast.

-

Short-Term Price Forecast: Chart 2 suggests a potential price range of [Price range] for natural gas in the coming weeks. This prediction is subject to change based on weather patterns and storage level changes.

-

Trading Opportunities and Risks: Traders should consider hedging strategies to mitigate the inherent risks associated with the volatility of the natural gas market. Opportunities arise during periods of significant price discrepancies from historical averages.

Gold Price Outlook: Chart 3 – Safe-Haven Demand and Inflation

Keywords: Gold price, gold market analysis, safe-haven asset, inflation, interest rates, gold investment

Chart 3 illustrates the gold price, showing its relationship with inflation and interest rates.

-

Safe-Haven Asset: Gold often serves as a safe-haven asset during times of economic uncertainty or geopolitical turmoil. Increased investor anxiety can push gold prices higher.

-

Inflation's Influence: Inflation erodes the purchasing power of fiat currencies. Gold, as a tangible asset, often appreciates in value during inflationary periods.

-

Interest Rate Impact: Higher interest rates generally increase the opportunity cost of holding non-interest-bearing assets like gold, potentially reducing demand. Central bank policies therefore have a significant impact.

-

Short-Term Price Forecast: Chart 3 indicates a potential price range of [Price range] for gold in the short term. This forecast considers current inflation rates and interest rate expectations.

-

Trading Opportunities: Traders might find opportunities in gold during periods of heightened market uncertainty or unexpected inflationary spikes. Risk management is paramount due to potential volatility.

Agricultural Commodity Prices: Chart 4 – Crop Yields and Global Supply Chain Disruptions

Keywords: Agricultural commodities, agricultural market analysis, crop yields, supply chain, food prices, soybean prices, corn prices, wheat prices

Chart 4 analyzes the prices of key agricultural commodities such as corn, soybeans, and wheat.

-

Crop Yields: Weather patterns significantly influence crop yields. Droughts, floods, or extreme temperatures can drastically reduce harvests and drive up prices.

-

Supply Chain Disruptions: Global supply chain bottlenecks can restrict the movement of agricultural commodities, impacting availability and driving prices higher.

-

Government Policies: Government subsidies, trade tariffs, and export restrictions influence agricultural commodity prices.

-

Short-Term Price Forecast: Based on Chart 4, we anticipate [Price range] for corn, [Price range] for soybeans, and [Price range] for wheat in the short term.

-

Trading Opportunities: Opportunities exist for traders to capitalize on seasonal price fluctuations and supply chain disruptions, but thorough market research is needed.

Industrial Metal Prices: Chart 5 – Global Economic Growth and Infrastructure Spending

Keywords: Industrial metals, industrial metal prices, copper price, aluminum price, global economic growth, infrastructure investment

Chart 5 displays the prices of crucial industrial metals like copper and aluminum.

-

Economic Growth's Role: Strong global economic growth boosts demand for industrial metals used in construction, manufacturing, and infrastructure projects.

-

Infrastructure Spending: Government investment in infrastructure projects significantly increases demand for industrial metals.

-

Mining Production and Supply: Mining production capacity and potential supply chain disruptions impact metal availability and prices.

-

Short-Term Price Forecast: Chart 5 suggests a potential price range of [Price range] for copper and [Price range] for aluminum in the near term.

-

Trading Opportunities: Traders can leverage insights into global economic growth forecasts and infrastructure spending plans to identify potential opportunities.

Conclusion

This week's commodity market outlook, as illustrated by these five key charts, reveals a dynamic and interconnected landscape. Understanding the interplay of geopolitical factors, weather patterns, economic growth, and supply chain issues is critical for successful commodity trading. By carefully analyzing these charts and incorporating your own due diligence, you can develop more effective commodity trading strategies. Remember to continue monitoring the commodity market outlook and adjust your strategies accordingly for optimal results. Stay informed and make confident trading decisions!

Featured Posts

-

Gypsy Rose Blanchards Net Worth Post Incarceration

May 06, 2025

Gypsy Rose Blanchards Net Worth Post Incarceration

May 06, 2025 -

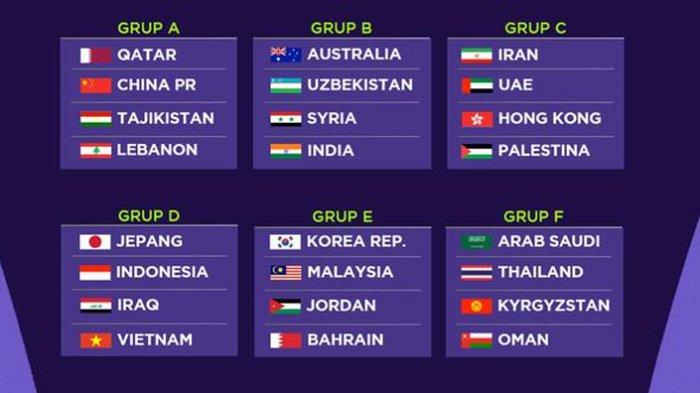

Hasil Pertandingan Piala Asia U 20 Iran Vs Yaman 6 0

May 06, 2025

Hasil Pertandingan Piala Asia U 20 Iran Vs Yaman 6 0

May 06, 2025 -

Tracking Global Commodity Markets 5 Key Charts To Monitor This Week

May 06, 2025

Tracking Global Commodity Markets 5 Key Charts To Monitor This Week

May 06, 2025 -

How Robert Pattinson Handles Diaper Changes A Look At Celebrity Parenting

May 06, 2025

How Robert Pattinson Handles Diaper Changes A Look At Celebrity Parenting

May 06, 2025 -

How To Unlock Sabrina Carpenter Skins In Fortnite

May 06, 2025

How To Unlock Sabrina Carpenter Skins In Fortnite

May 06, 2025