Congo's Cobalt Export Ban: Market Impact And The Awaiting Quota Plan

Table of Contents

Market Impact of the Cobalt Export Ban

The potential consequences of Congo's cobalt export ban are far-reaching and multifaceted. The immediate and long-term effects on the global cobalt market require careful consideration.

Immediate Price Volatility and Supply Chain Disruptions

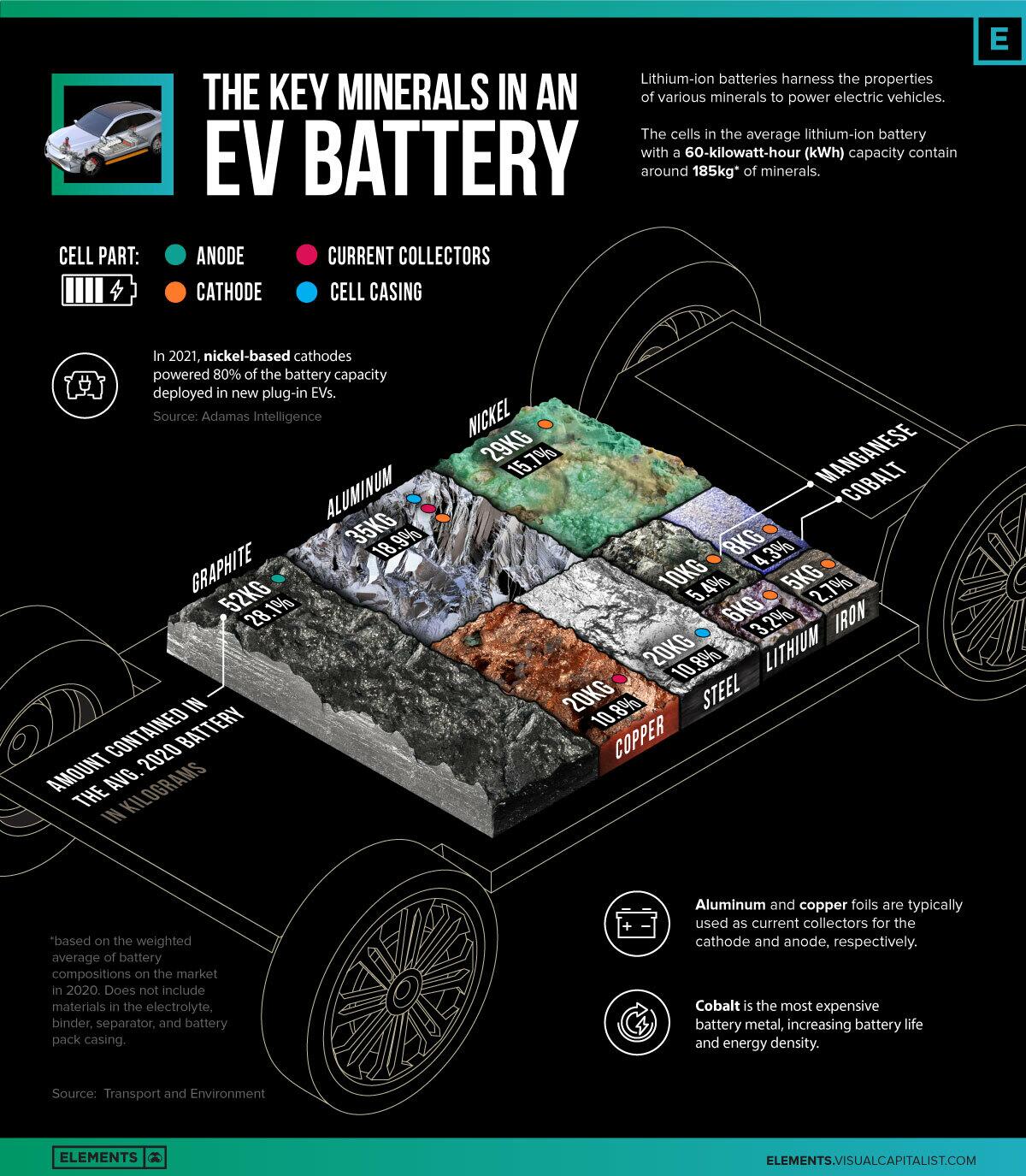

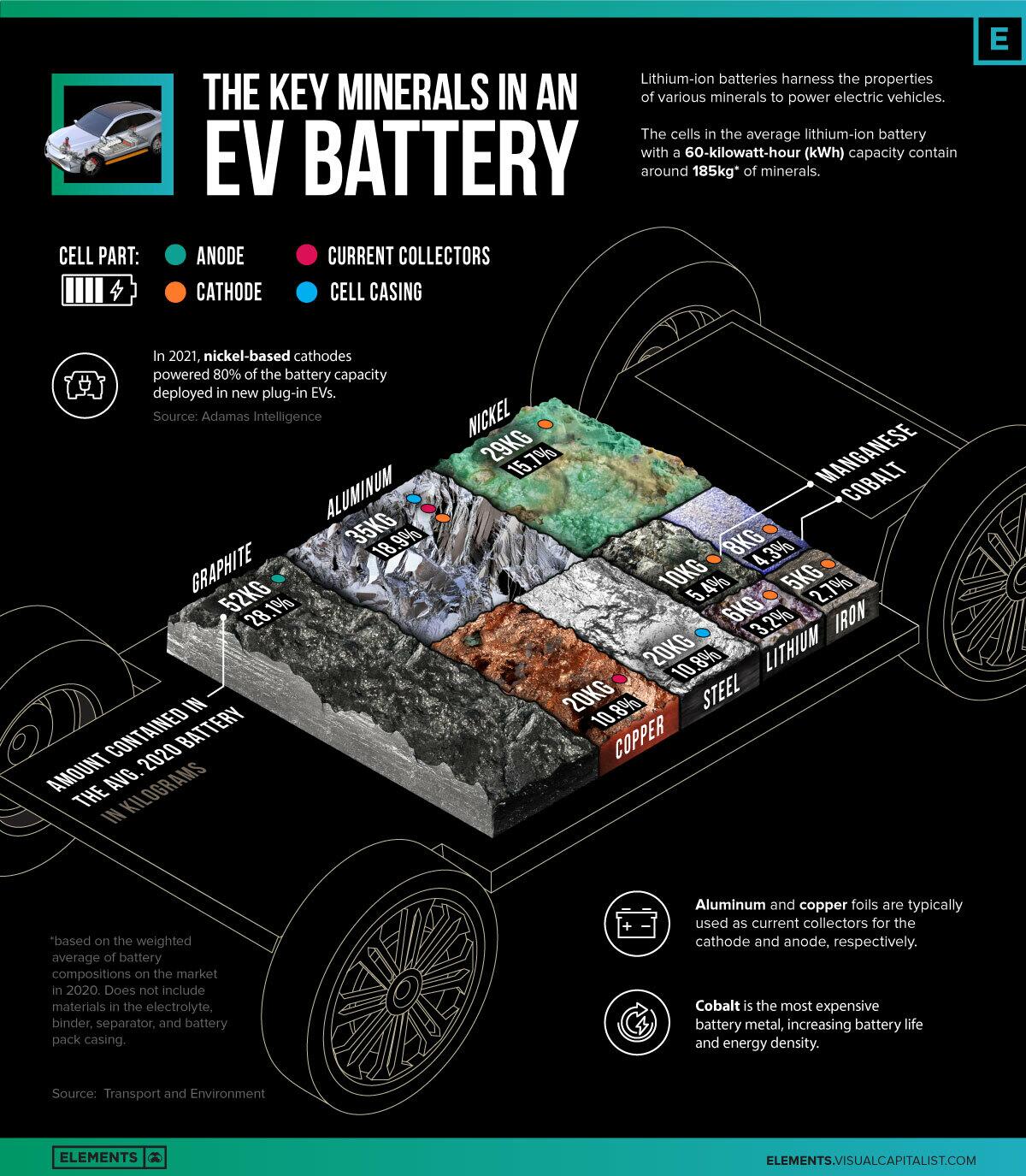

The announcement of a cobalt export ban has already triggered significant price volatility. The immediate impact on cobalt prices is likely to be a substantial surge, creating significant challenges for industries heavily reliant on this crucial mineral. The electric vehicle (EV) manufacturing sector and rechargeable battery production are particularly vulnerable. Supply chains meticulously designed around Congolese cobalt face potential paralysis.

- Delayed EV production timelines: Automakers may be forced to delay or reduce EV production due to cobalt shortages.

- Increased costs for battery manufacturers: The price surge will translate directly into higher production costs for battery manufacturers, potentially impacting the affordability and competitiveness of EVs.

- Increased competition for limited supply: Companies scramble to secure alternative cobalt sources, leading to potential price wars and market instability.

Long-Term Implications for Global Cobalt Markets

The long-term consequences extend beyond immediate price shocks. The export ban is likely to accelerate efforts towards diversification of cobalt sourcing, pushing companies and governments to invest in exploration and mining in other countries.

- Increased exploration and mining in other countries: Australia, Canada, and other nations with cobalt reserves are likely to see increased investment and production.

- Technological advancements reducing cobalt dependence: The high prices and supply uncertainty will spur innovation in the development of cobalt-free or low-cobalt battery technologies.

- Potential for increased price stability after initial volatility: Once alternative sources are developed and implemented, market stability might return, although at potentially higher price levels than before the ban. However, this depends heavily on the success of diversification efforts and the speed of technological advancements.

The Proposed Quota System: A Solution or a New Challenge?

In response to the export ban, a quota system is being proposed, aiming to regulate cobalt exports and potentially improve transparency and governance within the Congolese mining sector. However, the effectiveness and implications of this system remain uncertain.

Details of the Quota Plan

The specifics of the proposed quota plan are still evolving, but it is expected to control the amount of cobalt exported from the DRC. The government will likely allocate quotas to mining companies based on various criteria, potentially including environmental standards, social responsibility practices, and the level of local processing.

- Percentage of cobalt production subject to quotas: The exact percentage is yet to be determined but will significantly influence market access.

- Transparency and accountability mechanisms: Effective mechanisms for transparency and accountability are crucial to prevent corruption and ensure equitable allocation of quotas. The lack of such systems could potentially exacerbate existing issues.

- Potential for corruption and rent-seeking: The quota system, if not carefully implemented, could create opportunities for corruption and rent-seeking, further hindering market stability and fair competition.

Potential Benefits and Drawbacks of the Quota System

The quota system, in theory, could offer some benefits, including improved government revenue and potentially better environmental and social outcomes within the Congolese mining sector. However, it also poses significant risks.

- Improved mining practices and worker welfare: By incentivizing responsible mining, the system could lead to improved working conditions and reduced environmental damage.

- Increased government revenue for infrastructure development: Revenue generated from cobalt exports could be reinvested in infrastructure and social programs.

- Potential for black markets and smuggling: Strict quotas could drive a flourishing black market, undermining the system's effectiveness and potentially increasing illegal mining activity.

- Increased bureaucratic hurdles for legitimate businesses: Complex bureaucratic processes related to quota allocation could hinder the operations of legitimate mining companies.

Alternative Cobalt Sources and Technological Advancements

The challenges posed by Congo's cobalt export ban highlight the urgent need to diversify cobalt sources and invest in alternative technologies.

- Progress in battery recycling technologies: Recycling existing cobalt from end-of-life batteries is becoming increasingly efficient and cost-effective, reducing dependence on primary mining.

- Investment in research and development of alternative battery chemistries: Significant investments are being made in the development of lithium-iron-phosphate (LFP) batteries and other alternatives that minimize or eliminate the need for cobalt.

- The potential scale-up of cobalt production in alternative locations: Countries like Australia and Canada possess significant cobalt reserves and are actively expanding their production capacity.

Conclusion: Navigating the Future of Congo's Cobalt and its Global Impact

Congo's cobalt export ban and the accompanying quota plan present both significant challenges and potential opportunities. The immediate impact will likely be substantial price volatility and supply chain disruptions. However, the long-term effects depend heavily on the success of diversification efforts, technological advancements in battery technology, and the effective implementation of the quota system. Careful monitoring of the situation and proactive strategies for securing alternative cobalt sources and developing cobalt-free technologies are essential for navigating this critical juncture. Stay informed about developments regarding Congo's cobalt export ban and its implications for the global economy by following reputable news sources and industry publications. Understanding this dynamic situation is critical for businesses and policymakers alike.

Featured Posts

-

Apple Watches On Ice Nearly Every Nhl Referee Uses One

May 16, 2025

Apple Watches On Ice Nearly Every Nhl Referee Uses One

May 16, 2025 -

Inquinamento Da Microplastiche Quali Acque Sono Maggiormente A Rischio

May 16, 2025

Inquinamento Da Microplastiche Quali Acque Sono Maggiormente A Rischio

May 16, 2025 -

Barcelonas Furious Response Accusations Of Inappropriate Behavior Against Tebas And La Liga

May 16, 2025

Barcelonas Furious Response Accusations Of Inappropriate Behavior Against Tebas And La Liga

May 16, 2025 -

Firstposts First Up Daily News Roundup Bangladesh China Caribbean And Beyond

May 16, 2025

Firstposts First Up Daily News Roundup Bangladesh China Caribbean And Beyond

May 16, 2025 -

Paddy Pimblett Ufc 314 Travel Plans Centered On Liverpool Fc

May 16, 2025

Paddy Pimblett Ufc 314 Travel Plans Centered On Liverpool Fc

May 16, 2025