Conservative Party Promises Tax Cuts And Smaller Deficits In Canada

Table of Contents

Proposed Tax Cuts

The Conservative Party's platform centers around substantial tax cuts aimed at stimulating economic growth and benefiting Canadian families and businesses. Their proposals target various income brackets and corporate taxation. Key elements include:

-

Income Tax Cuts: The party proposes a reduction in income tax rates across multiple brackets. While precise percentages vary depending on the bracket, the proposed cuts generally aim to provide relief for middle-class families and high-income earners alike. For instance, they may propose a reduction from 20.5% to 19.5% in a specific bracket, or a more significant decrease in higher brackets. The exact details should be verified on the official Conservative Party website.

-

Corporate Tax Cuts: The Conservatives plan to reduce the corporate income tax rate, arguing this will encourage investment, job creation, and overall economic expansion. Lowering the corporate tax rate, for example, from 15% to 12%, is projected to boost business activity and increase competitiveness. This is a significant element of their plan to incentivize business growth within Canada.

-

Impact on Different Income Levels: While the proposed income tax cuts affect multiple brackets, the degree of benefit varies. High-income earners would receive a larger absolute tax reduction, while middle-class families would benefit from a percentage reduction in their tax burden. The Conservatives argue this will create a fairer system that stimulates the economy from the bottom up.

-

Changes to Tax Credits and Deductions: The platform may also include adjustments to existing tax credits and deductions, potentially expanding eligibility or increasing the amounts to further support families and small businesses. Details on specific changes would require further review of their official documentation.

The projected economic effects of these tax cuts include increased consumer spending, potentially leading to higher GDP growth. However, critics argue that substantial tax cuts could lead to increased income inequality and may reduce government revenue needed for essential public services. This is a point of contention that warrants further analysis.

Strategies for Deficit Reduction

The Conservative Party's promise of tax cuts is coupled with a commitment to deficit reduction, a key aspect of their fiscal responsibility plan. Their strategies for achieving this include:

-

Targeted Spending Cuts: The Conservatives plan to identify areas of government spending that can be reduced without significantly impacting essential public services. This could involve streamlining administrative processes, eliminating redundancies, and potentially reducing funding for certain programs. Specific programs targeted for cuts are typically detailed in their platform.

-

Projected Savings: The party provides projected savings from each area of spending reduction, aiming to demonstrate the feasibility of their fiscal plan. These projections, however, rely on various economic assumptions and require careful scrutiny.

-

Revenue Enhancement: While focusing on tax cuts, the Conservatives also plan to improve tax collection measures to increase government revenue. Efficient tax administration is crucial to offset the revenue impact of tax cuts.

-

Economic Growth as a Deficit Reducer: The party anticipates that the economic growth stimulated by their tax cuts will naturally lead to higher tax revenues, thus contributing to deficit reduction. This is a key component of their argument that the proposed cuts are fiscally responsible.

The feasibility of these deficit reduction plans is a subject of debate. Critics argue that the projected savings may be unrealistic, and the reliance on economic growth to offset the revenue impact of the tax cuts is optimistic. The potential impact on essential public services also needs careful consideration.

Economic Outlook and Forecasts

The Conservative Party's economic platform includes detailed economic forecasts, predicting positive outcomes under their proposed policies.

-

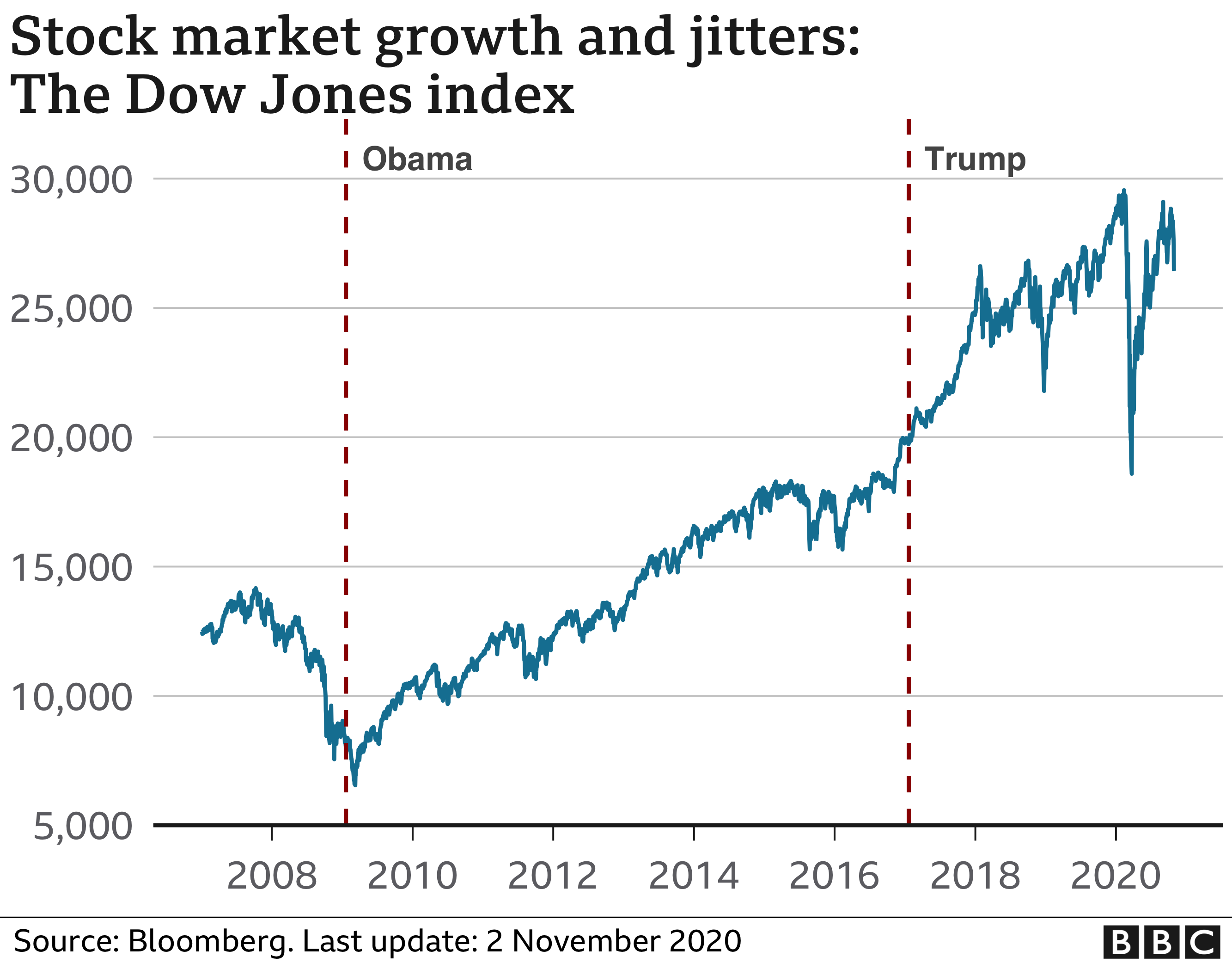

GDP Growth Rate: The party projects a specific GDP growth rate under their plan, typically higher than the projections from independent economic analysts. This projection is central to their claim of responsible fiscal policy.

-

Job Creation and Unemployment: The platform predicts positive impacts on job creation and reduced unemployment due to business investment stimulated by lower corporate taxes and increased consumer spending.

-

Inflation and Interest Rate Forecasts: The Conservatives typically offer forecasts for inflation and interest rates, suggesting that their policies will keep these indicators within acceptable ranges.

-

Comparison with Independent Forecasts: It's important to compare the Conservative Party's economic forecasts with those from independent economic institutions and analysts. Discrepancies can indicate areas of potential risk or uncertainty.

The accuracy and reliability of the Conservative Party's economic projections are crucial for evaluating the feasibility and potential impact of their fiscal plan. Independent analyses are essential for a comprehensive understanding.

Potential Challenges and Criticisms

The Conservative Party's proposals face potential criticism and challenges:

-

Opposition Party Criticisms: Opposition parties will likely criticize the Conservatives' plans, questioning the feasibility of the proposed tax cuts and spending reductions, particularly regarding the impact on social programs.

-

Feasibility and Sustainability: Critics may raise concerns about the long-term sustainability of the proposed tax cuts and whether the projected economic growth will materialize as anticipated.

-

Negative Consequences: Potential negative consequences, such as cuts to essential social programs or increased income inequality, are likely to be highlighted by critics.

A balanced perspective requires considering both the potential benefits and drawbacks of the Conservative Party's proposals. Independent analysis and consideration of alternative viewpoints are essential for informed decision-making.

Conclusion

The Conservative Party's platform promises significant tax cuts and a path towards smaller deficits in Canada. Their plan includes targeted income and corporate tax cuts, coupled with strategies for deficit reduction through spending cuts and revenue enhancement. However, the feasibility and long-term sustainability of their proposals remain subject to debate, and independent economic analysis is crucial for a comprehensive understanding. The potential impact on different income levels, essential public services, and overall economic stability should be carefully considered. Learn more about the Conservative Party's platform and their plans for Conservative Party tax cuts and deficit reduction by visiting their official website or researching independent analyses of their economic proposals. Understanding the details of their plan is crucial for informed voting in the upcoming election.

Featured Posts

-

John Travoltas Family Home A Look Inside After Recent Photo Controversy

Apr 24, 2025

John Travoltas Family Home A Look Inside After Recent Photo Controversy

Apr 24, 2025 -

Car Dealerships Step Up Pressure Against Electric Vehicle Regulations

Apr 24, 2025

Car Dealerships Step Up Pressure Against Electric Vehicle Regulations

Apr 24, 2025 -

Identifying The Countrys Fastest Growing Business Areas

Apr 24, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 24, 2025 -

A Day In The Life Of A Chalet Girl Responsibilities And Experiences

Apr 24, 2025

A Day In The Life Of A Chalet Girl Responsibilities And Experiences

Apr 24, 2025 -

Credit Card Companies Feel The Pinch As Consumer Spending Slows

Apr 24, 2025

Credit Card Companies Feel The Pinch As Consumer Spending Slows

Apr 24, 2025

Latest Posts

-

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

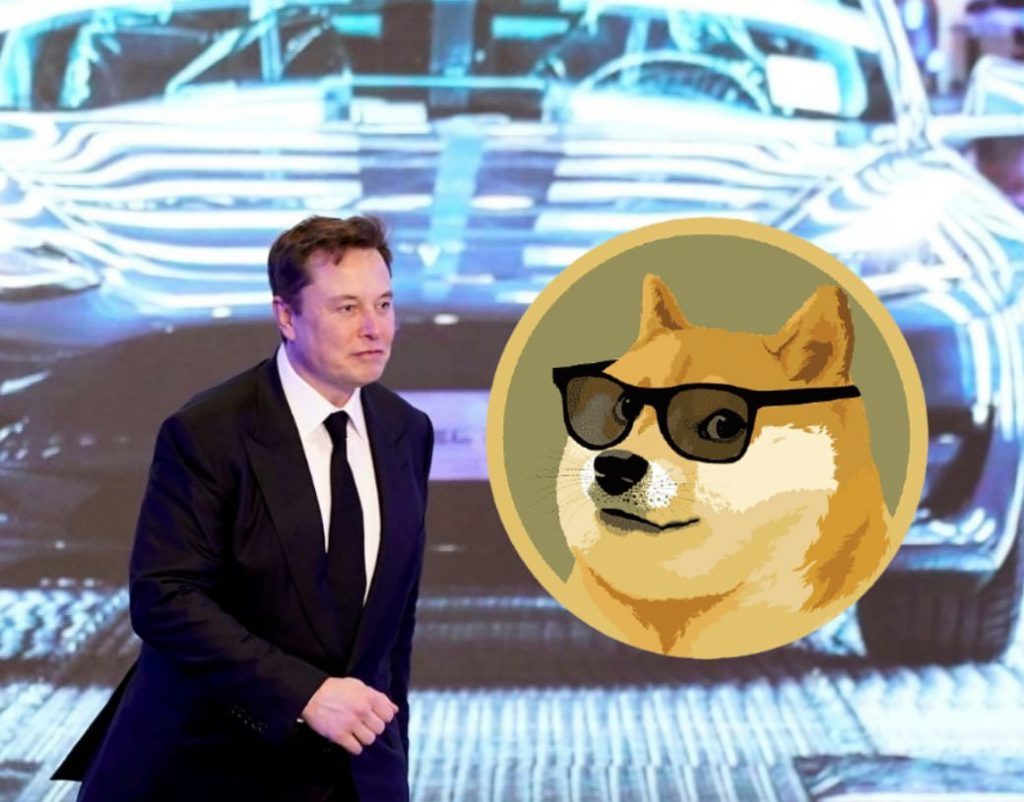

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025 -

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025 -

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025