Cooling UK Inflation: Impact On BOE Monetary Policy And The Pound

Table of Contents

Understanding the Current Inflationary Landscape in the UK

Inflation, the rate at which prices for goods and services rise, is a key economic indicator. Two primary measures in the UK are the Consumer Price Index (CPI) and the Retail Price Index (RPI). Recently, the UK has seen a significant surge in inflation, driven by a confluence of factors.

- Energy Price Shocks: Soaring global energy prices, exacerbated by the war in Ukraine, have significantly impacted household budgets and fueled inflation.

- Supply Chain Disruptions: The lingering effects of the pandemic continue to disrupt global supply chains, leading to shortages and higher prices for various goods.

- Wage Growth: While necessary to address the cost of living crisis, increased wages can contribute to a wage-price spiral, further pushing inflation upwards.

The UK inflation rate, as measured by CPI, reached a peak in [Insert most recent peak data and source], before showing signs of deceleration in [Insert recent data and source]. However, inflation remains stubbornly high, well above the BOE's target of 2%. Understanding these inflation drivers is crucial to analyzing the BOE's response and the impact on the GBP. Visualizing this UK inflation rate through charts and graphs can further clarify the trends (insert relevant chart/graph here). The cost of living crisis, a direct consequence of high inflation, continues to impact households across the UK.

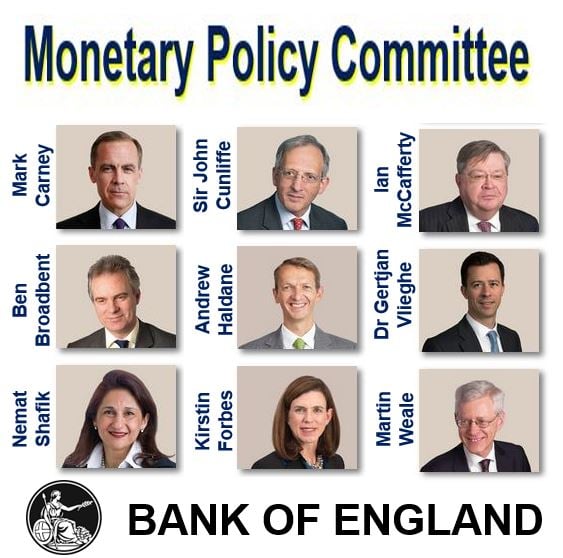

The Bank of England's Response to Cooling Inflation

The BOE's primary mandate is to maintain price stability and support sustainable economic growth. To manage inflation, the BOE employs several monetary policy tools:

- Interest Rate Hikes: Raising the BOE interest rates (also known as the base rate) makes borrowing more expensive, discouraging spending and investment, thus curbing inflation.

- Quantitative Easing (QE): This involves injecting money into the economy by purchasing assets like government bonds. While used during periods of low inflation or economic downturn, it's less likely to be employed during periods of high inflation.

In response to rising inflation, the BOE has implemented a series of interest rate hikes. [Insert specific examples of recent interest rate decisions and their justifications]. The impact of these interest rate hikes can be felt across the economy, impacting borrowing costs for individuals and businesses. The potential for future interest rate changes depends heavily on the trajectory of inflation. Further increases are possible if inflation proves persistent, while a pause or even cuts could be considered if inflation cools significantly. These Bank of England decisions are closely watched by markets globally.

The Impact of Cooling Inflation on the British Pound (GBP)

The relationship between inflation, interest rates, and currency exchange rates is complex but significant. Higher interest rates generally attract foreign investment, increasing demand for the GBP and strengthening its GBP exchange rate against other currencies.

- Investor Confidence: Cooling inflation can boost investor confidence, as it suggests greater economic stability. This can lead to increased capital inflows into the UK, further supporting the GBP.

- Exchange Rate Dynamics: As inflation cools, the BOE might slow or pause its interest rate hikes. This could potentially lead to a weaker GBP exchange rate compared to currencies with higher interest rates, like the USD or EUR. However, the GBP exchange rate is also influenced by global market sentiment, geopolitical events and speculation in the currency markets. Understanding these factors is key to forming accurate exchange rate forecasts.

Forecasting Future Trends: Inflation, BOE Policy, and the Pound

Predicting future economic trends is inherently uncertain, but analyzing potential scenarios can provide valuable insights.

- Persistent Inflation: If inflation remains stubbornly high, the BOE may continue its aggressive interest rate hikes, potentially impacting economic growth and potentially leading to a period of stagflation. The GBP forecast under this scenario could be mixed, depending on global economic conditions.

- Deflationary Pressures: An unexpected sharp drop in inflation could lead to concerns about deflation, which can be equally damaging to the economy. The BOE would likely respond with easing monetary policy, potentially weakening the GBP.

The BOE outlook, along with global economic factors, will play a significant role in shaping the GBP forecast. Economic forecasts, though helpful, are subject to revision based on incoming data and unexpected events. The UK economic growth will be intertwined with these factors, creating a complex interplay of cause and effect. A cautious approach to any inflation forecast is vital.

Conclusion: Navigating the Cooling UK Inflation Landscape

The cooling of UK inflation presents a complex challenge for the BOE, with significant ramifications for the GBP. The relationship between inflation, interest rates, and the GBP exchange rate is intricate, influenced by both domestic and global factors. While recent data indicates a slowdown in inflation, the path ahead remains uncertain. The BOE's monetary policy decisions will continue to be crucial in managing this transition and maintaining economic stability. To stay informed about developments related to cooling UK inflation and its effects on the BOE and the Pound, consider subscribing to reputable financial news sources and following expert commentary. Staying informed on these factors is essential to understanding and navigating the evolving Cooling UK Inflation landscape.

Featured Posts

-

Le Proces Qui A Marque La Vie De Marine Le Pen

May 26, 2025

Le Proces Qui A Marque La Vie De Marine Le Pen

May 26, 2025 -

Get Ready The Louisiana Horror Film Sinners Is Almost Here

May 26, 2025

Get Ready The Louisiana Horror Film Sinners Is Almost Here

May 26, 2025 -

A Fungi That Could Spread As The World Heats Up A Growing Threat

May 26, 2025

A Fungi That Could Spread As The World Heats Up A Growing Threat

May 26, 2025 -

Strengthening North American Trade Opportunities For Canada And Mexico Amidst Us Tariffs

May 26, 2025

Strengthening North American Trade Opportunities For Canada And Mexico Amidst Us Tariffs

May 26, 2025 -

Jamie Foxxs All Star Weekend Robert Downey Jr S Casting Controversy

May 26, 2025

Jamie Foxxs All Star Weekend Robert Downey Jr S Casting Controversy

May 26, 2025