CoreWeave (CRWV) Stock Performance Analysis: Last Week's Significant Increase

Table of Contents

Analyzing the Reasons Behind Last Week's CoreWeave (CRWV) Stock Price Increase

Several factors contributed to the significant increase in CoreWeave (CRWV) stock price last week. Understanding these contributing elements is crucial for assessing the company's future trajectory and the potential for continued growth.

Positive Market Sentiment and Investor Confidence

The recent surge in CoreWeave (CRWV)'s stock valuation reflects a considerable boost in investor confidence. This positive market sentiment can be attributed to several key developments:

- Strong Earnings Report: CoreWeave released unexpectedly strong Q[Insert Quarter] earnings, exceeding analyst expectations for revenue and demonstrating significant growth in market share. This positive news significantly impacted investor interest and boosted market capitalization.

- Strategic Partnerships: The announcement of new partnerships with major players in the AI and high-performance computing sectors infused significant optimism into the market. These collaborations expand CoreWeave's reach and solidify its position as a leading cloud infrastructure provider.

- Positive Analyst Ratings: Several prominent financial analysts upgraded their ratings for CoreWeave (CRWV) stock, citing its strong growth potential and favorable market positioning within the booming AI cloud computing sector. These positive assessments further fueled investor confidence.

- Favorable Market Trends: The overall positive trend in the technology sector, particularly within the cloud computing and AI infrastructure spaces, created a tailwind for CoreWeave's stock performance. The increasing demand for high-performance computing resources benefited CoreWeave significantly.

Increased Demand for CoreWeave's Cloud Computing Services

CoreWeave's specialized infrastructure, particularly its focus on GPU computing, is perfectly positioned to capitalize on the exploding demand for AI and machine learning applications. This increased demand is directly translating into revenue growth for the company.

- AI Boom Drives Demand: The rapid advancements and widespread adoption of artificial intelligence and machine learning are driving an unprecedented demand for powerful cloud computing resources. CoreWeave’s data center infrastructure is ideally suited to meet this surge in demand.

- Large Language Model (LLM) Support: CoreWeave’s infrastructure is increasingly utilized in the training and deployment of large language models (LLMs), a key driver of the current AI boom. This fuels the growth of its cloud computing services and its overall stock valuation.

- Expansion into New Markets: CoreWeave is actively expanding its services into new geographic markets and industry verticals, further diversifying its revenue streams and enhancing its long-term growth prospects. This expansion strategy contributes to improved stock performance.

Competitive Landscape and Market Positioning of CoreWeave (CRWV)

CoreWeave occupies a strong position within the competitive cloud computing landscape. Its unique selling propositions (USPs) differentiate it from competitors.

- Specialized GPU Infrastructure: CoreWeave's focus on providing high-performance GPU computing resources gives it a significant competitive advantage, catering specifically to the growing needs of AI and machine learning applications.

- Sustainability Focus: CoreWeave's commitment to sustainable data center operations is attracting environmentally conscious clients, further solidifying its market position. This focus is a key differentiator from some competitors.

- Strong Customer Base: CoreWeave boasts a robust customer base comprising leading technology companies and research institutions, demonstrating market acceptance and confidence in its services. This strength in customer acquisition contributes significantly to the positive stock performance.

Technical Analysis of CoreWeave (CRWV) Stock Chart

Analyzing the CoreWeave (CRWV) stock chart reveals several technical indicators supporting the recent price increase.

Chart Patterns and Trading Volume

- Breakout Pattern: The stock price experienced a clear breakout from a prior resistance level, indicating a shift in market sentiment and suggesting further upward potential.

- Increased Trading Volume: The price increase was accompanied by a significant surge in trading volume, confirming the strength of the move and suggesting strong investor interest. This high volume supports the legitimacy of the price increase.

- Bullish Engulfing Candle: The appearance of a bullish engulfing candle pattern on the daily chart further reinforced the upward momentum and suggested potential for continued gains.

Key Indicators and Their Implications

- Relative Strength Index (RSI): The RSI moved above the oversold threshold, indicating that the stock was no longer undervalued and confirming the bullish momentum.

- Moving Average Convergence Divergence (MACD): The MACD histogram showed a clear bullish crossover, supporting the positive trend and hinting at potential further gains.

- Support and Resistance Levels: The stock price has now established new support levels, indicating a strengthening of the upward trend and reducing the likelihood of a significant pullback.

Conclusion: Future Outlook for CoreWeave (CRWV) Stock and Call to Action

The significant increase in CoreWeave (CRWV) stock price last week is primarily attributable to a combination of strong financial performance, positive market sentiment, increased demand for its services, and a favorable competitive position. While future performance is always subject to market volatility, the current indicators suggest a cautiously optimistic outlook for CoreWeave (CRWV). The company's strategic positioning within the rapidly expanding AI and high-performance computing sectors points towards substantial long-term growth potential. To stay informed on CoreWeave (CRWV) stock performance and future developments, we encourage you to learn more about CoreWeave (CRWV) stock by visiting their investor relations page and monitoring their performance closely. Investing in CoreWeave (CRWV) should be considered carefully within your overall investment strategy.

Featured Posts

-

Thousands Of Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025

Thousands Of Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025 -

Pound Gains Momentum Boe Rate Cut Expectations Fade Following Inflation Figures

May 22, 2025

Pound Gains Momentum Boe Rate Cut Expectations Fade Following Inflation Figures

May 22, 2025 -

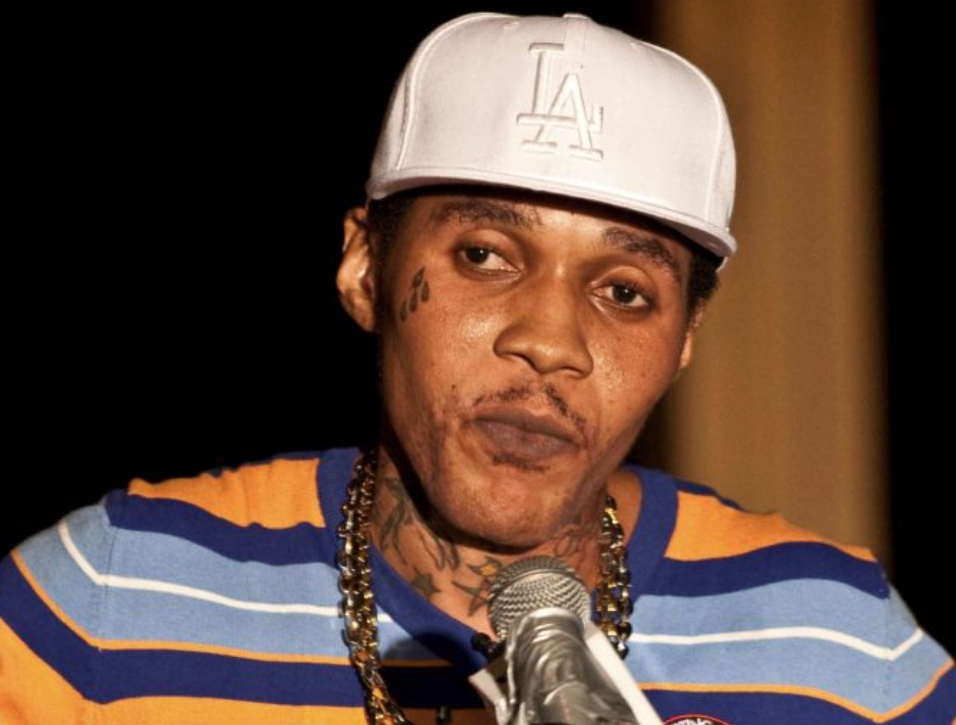

Trinidad And Tobago Imposes Movement Restrictions On Vybz Kartel

May 22, 2025

Trinidad And Tobago Imposes Movement Restrictions On Vybz Kartel

May 22, 2025 -

Core Weave Inc Crwv Stock Performance Wednesday Causes And Implications

May 22, 2025

Core Weave Inc Crwv Stock Performance Wednesday Causes And Implications

May 22, 2025 -

Sold Out Shows Prove Vybz Kartels Continued Popularity In Brooklyn Ny

May 22, 2025

Sold Out Shows Prove Vybz Kartels Continued Popularity In Brooklyn Ny

May 22, 2025