CoreWeave's IPO: $40 Listing Price Falls Short Of Initial Estimates

Table of Contents

Initial Expectations vs. Reality

The CoreWeave IPO initially generated significant buzz, with analysts predicting a price range considerably higher than the eventual listing price. While precise figures varied among analysts, many predicted a price range between $45 and $55 per share. The final listing price of $40 represented a substantial shortfall, falling 11.1% below the lowest end of the initially projected range and significantly more below the higher estimates. This discrepancy occurred amidst a period of broader market volatility and caution among investors.

- Initial Price Range Speculation: $45 - $55 per share (analyst estimates).

- Final Listing Price: $40 per share.

- Percentage Difference: Approximately 11.1% to 27.3% below initial expectations.

- Market Conditions: A period of economic uncertainty and investor apprehension regarding technology stocks.

Factors Contributing to the Lower-Than-Expected IPO Price

Several factors likely contributed to the CoreWeave IPO's lower-than-expected price. The interplay of these elements created a less-than-ideal environment for a high-value listing.

- Market Volatility and Investor Apprehension: The prevailing market uncertainty surrounding interest rate hikes, inflation, and geopolitical instability significantly impacted investor risk appetite, leading to a more cautious approach to tech IPOs.

- Company Financials and Recent Performance: While CoreWeave boasts impressive growth in the rapidly expanding cloud computing market, concerns may have existed regarding its profitability and path to sustained revenue growth. Detailed scrutiny of its financials, including key metrics such as revenue growth rate and operating margins, would have been crucial for investors.

- Competitive Landscape: The cloud computing sector is fiercely competitive, with established giants like AWS, Azure, and Google Cloud dominating the market. CoreWeave’s ability to differentiate itself and carve out a significant market share is a key factor impacting investor confidence.

- Concerns Regarding Business Model or Long-Term Strategy: Investors may have harbored concerns about the sustainability of CoreWeave’s business model or its long-term strategic vision within the ever-evolving cloud landscape. Any perceived weaknesses in these areas could have negatively influenced the IPO valuation.

Investor Sentiment and Market Reaction

The market's immediate reaction to the CoreWeave IPO pricing was muted. While the stock opened at $40 per share, trading volume was relatively modest on the first day, suggesting a lack of significant initial buying pressure. Many analysts issued cautious "hold" or "neutral" ratings in the wake of the IPO, reflecting a general lack of strong bullish sentiment. This indicates a wait-and-see attitude from many investors.

- Opening Day Trading Performance: Opened at the listing price of $40.

- Trading Volume: Relatively low compared to other major tech IPOs.

- Analyst Comments/Ratings: Predominantly cautious "hold" or "neutral" ratings.

- Investor Sentiment: Cautious and reserved.

Long-Term Implications for CoreWeave

The lower-than-expected IPO price carries several potential long-term implications for CoreWeave.

- Impact on Capital Raising: Securing future funding through equity financing might prove more challenging, potentially impacting expansion plans.

- Implications for Acquisitions and Expansion: The lower valuation could limit CoreWeave's ability to pursue strategic acquisitions or aggressive expansion into new markets.

- Employee Morale and Retention: A lower-than-expected IPO price could affect employee morale and potentially increase employee turnover.

- Impact on Valuation: The lower IPO price sets a lower valuation benchmark for the company, making future fundraising potentially more difficult.

Conclusion

The CoreWeave IPO's $40 listing price significantly undershot initial expectations, highlighting the complexities of navigating the public market, particularly during times of economic uncertainty. Market volatility, investor apprehension, and the competitive landscape of the cloud computing sector all played a role in shaping the final outcome. Understanding market conditions and investor sentiment remains paramount when assessing the performance and future prospects of any IPO.

Call to Action: Stay informed on the latest developments concerning the CoreWeave IPO and its ongoing stock performance. Follow our coverage for in-depth analysis and updates on the CoreWeave IPO and other key events in the dynamic cloud computing industry. Learn more about the implications of the CoreWeave IPO price and its impact on the broader market. Keep up-to-date on the CoreWeave IPO story here.

Featured Posts

-

The Enduring Appeal Of Little Britain A Gen Z Perspective

May 22, 2025

The Enduring Appeal Of Little Britain A Gen Z Perspective

May 22, 2025 -

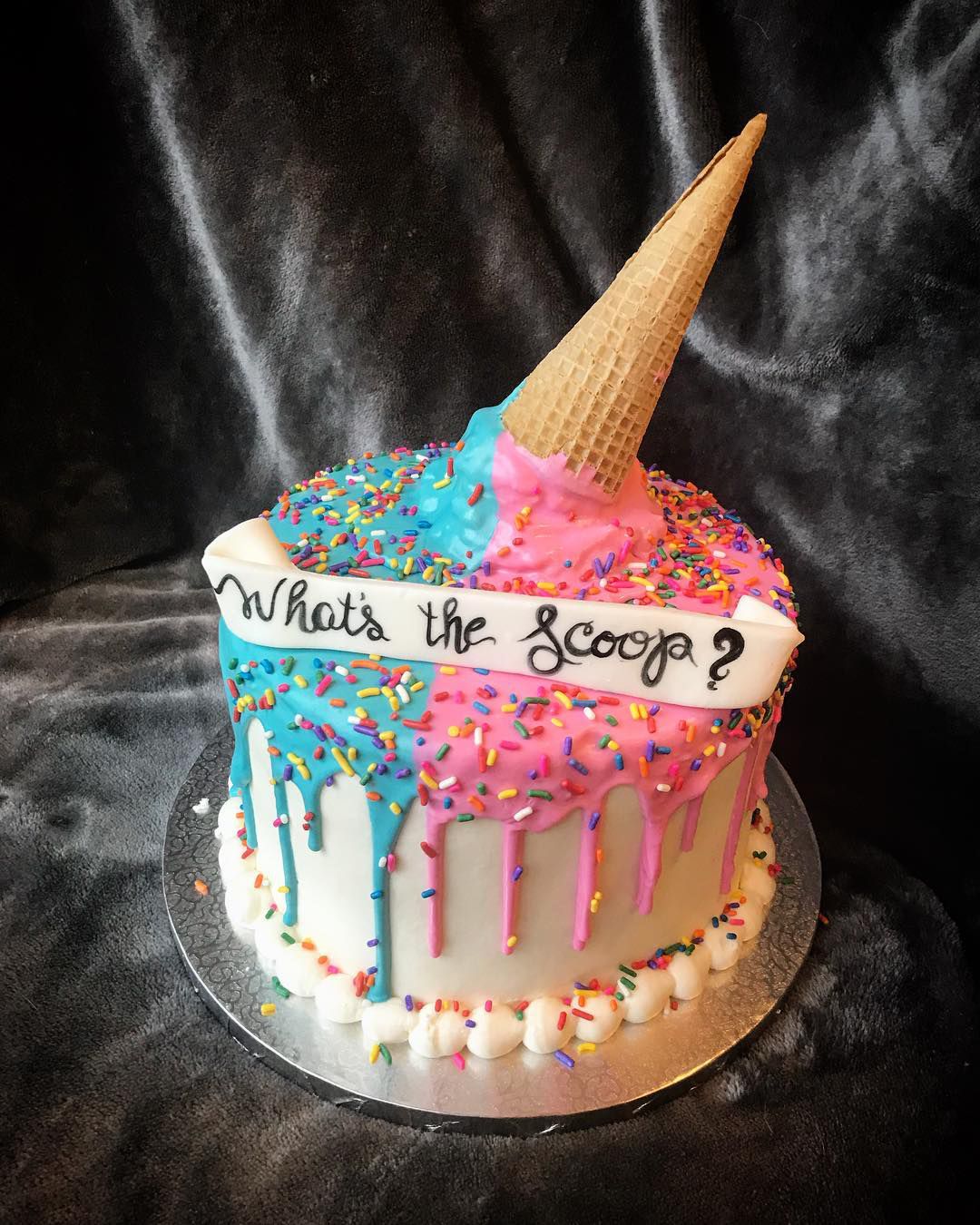

Peppa Pigs Gender Reveal Parents Announce Babys Sex

May 22, 2025

Peppa Pigs Gender Reveal Parents Announce Babys Sex

May 22, 2025 -

Resistance Mounts Car Dealerships Renew Opposition To Ev Mandates

May 22, 2025

Resistance Mounts Car Dealerships Renew Opposition To Ev Mandates

May 22, 2025 -

Shooting In Lancaster County Pa Police Investigation Ongoing

May 22, 2025

Shooting In Lancaster County Pa Police Investigation Ongoing

May 22, 2025 -

S Sh A Ta Ukrayina Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi

May 22, 2025

S Sh A Ta Ukrayina Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi

May 22, 2025