Corporate Earnings: A Temporary Trend Or Sustainable Growth?

Table of Contents

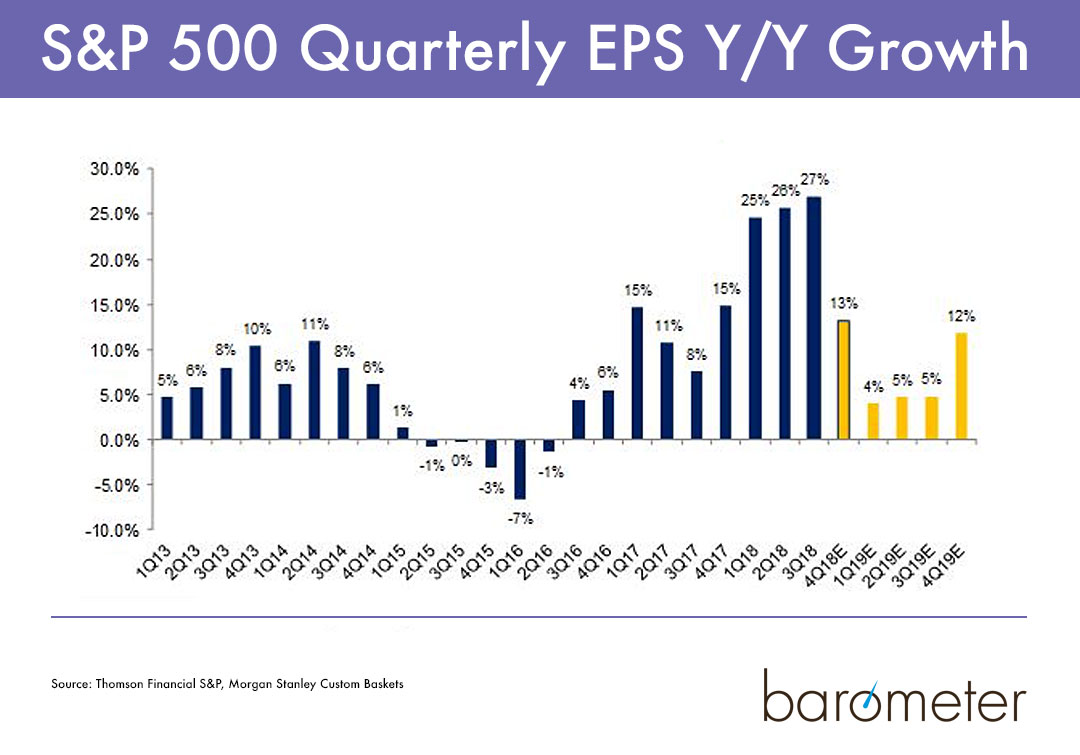

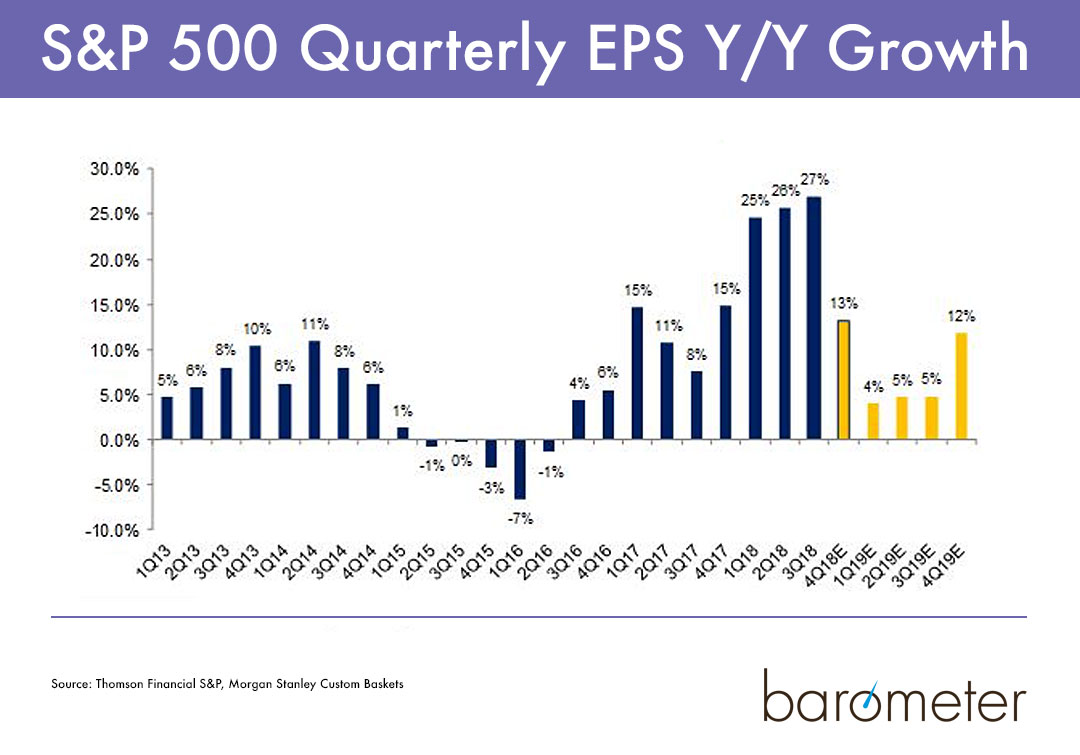

Analyzing Current Corporate Earnings Trends

Recent corporate earnings reports paint a mixed picture. While the overall market performance has shown some resilience, a closer look reveals significant disparities across sectors. Analyzing key performance indicators such as earnings growth, profit margins, and revenue trends is essential to understand the broader economic landscape.

-

Key Sectors Showing Strong Performance: The technology sector, fueled by ongoing digital transformation and robust demand for software and cloud services, continues to demonstrate impressive earnings growth. Similarly, the healthcare sector, driven by an aging population and advancements in medical technology, has shown consistent profitability. This strong performance reflects innovation and adaptation to evolving market needs.

-

Sectors Exhibiting Weak Performance: Conversely, certain sectors, like manufacturing and retail, are facing challenges. Supply chain disruptions, persistent inflation, and weakening consumer confidence are key contributors to weaker-than-expected earnings in these areas. Increased input costs and reduced consumer spending are significantly impacting profit margins.

-

Impact of Macroeconomic Factors: Macroeconomic factors play a significant role in shaping corporate earnings. Rising interest rates, high inflation, and lingering recessionary fears are impacting business investment and consumer spending, creating uncertainty for many companies. These factors influence borrowing costs, investment decisions, and ultimately, the bottom line. Careful analysis of these trends is vital for predicting future corporate earnings.

Identifying Factors Contributing to Earnings Growth (or Decline)

Several intertwined factors drive corporate earnings growth or decline. Understanding these underlying forces is key to forming accurate predictions.

-

Technological Advancements: Digital transformation and automation are reshaping industries, creating opportunities for increased efficiency and revenue growth. Companies that embrace innovation and invest in cutting-edge technologies often experience better earnings performance. This includes advancements in artificial intelligence, machine learning, and cloud computing.

-

Geopolitical Events and Global Trade: Geopolitical instability and global trade tensions, including supply chain disruptions and trade wars, significantly impact corporate earnings. These factors lead to increased costs, reduced productivity, and market volatility. Understanding geopolitical risks is critical for assessing corporate earnings sustainability.

-

Consumer Spending and Behavior Shifts: Fluctuations in consumer confidence and shifts in consumer spending habits directly impact corporate earnings. Increased consumer confidence generally leads to higher demand and increased revenues, while decreased confidence can lead to reduced spending and lower earnings.

-

Government Policies and Regulations: Fiscal and monetary policies, as well as regulatory changes, influence the business environment and subsequently, corporate earnings. Tax policies, interest rate adjustments, and new regulations can create both opportunities and challenges for businesses.

Evaluating the Sustainability of Current Trends

Assessing the long-term sustainability of current corporate earnings trends requires a cautious and comprehensive approach. Focusing solely on short-term gains can be misleading.

-

Potential for Continued Growth: While certain sectors show strong growth potential, it's crucial to identify the drivers of that growth and assess their long-term viability. Is the growth sustainable, or is it based on temporary factors?

-

Risks and Challenges: Inflation, a potential recession, increased competition, and unexpected geopolitical events pose significant risks to sustainable growth. Companies must proactively manage these risks to ensure long-term profitability.

-

Company-Specific Factors: Evaluating sustainability also requires examining company-specific factors. A company's financial health, management team, and business model all contribute to its long-term prospects.

-

Long-Term Growth Prospects: Investors should prioritize companies with strong long-term growth prospects, sustainable business models, and a robust risk management strategy. This long-term perspective is crucial for sustainable investment success.

Investing Strategically Based on Corporate Earnings Analysis

Corporate earnings analysis is fundamental to informed investment decisions. However, it shouldn't be the sole factor considered.

-

Diversification: Diversifying your investment portfolio across various sectors and asset classes mitigates risk and improves the chances of long-term success. Don't put all your eggs in one basket.

-

Thorough Due Diligence: Before making any investment decisions, conduct thorough due diligence on the companies you're considering. Analyze their financial statements, understand their business model, and assess their competitive landscape.

-

Long-Term Perspective: Investing should be a long-term strategy. Avoid making impulsive decisions based solely on short-term fluctuations in corporate earnings.

-

Risk Management: Implement a sound risk management strategy to protect your investments. Understand the risks associated with each investment and take steps to mitigate those risks.

Conclusion: Understanding the Future of Corporate Earnings – Making Informed Decisions

Analyzing corporate earnings requires a holistic approach, considering both short-term trends and long-term prospects. While some sectors show strong growth, the macroeconomic environment and various risk factors must be accounted for. Continuous monitoring of corporate earnings reports and a strategic, diversified investment approach are crucial for navigating the complexities of the market. Stay informed about the latest corporate earnings reports to make sound financial decisions and understand the future trajectory of corporate earnings. Regularly reviewing and adapting your investment strategy based on evolving corporate earnings data will be key to your long-term financial success.

Featured Posts

-

Ultimas Noticias Sobre La Caida De Ticketmaster 8 De Abril Grupo Milenio

May 30, 2025

Ultimas Noticias Sobre La Caida De Ticketmaster 8 De Abril Grupo Milenio

May 30, 2025 -

Wiedergeburt Des Sports Die Rueckkehr Juedischer Athleten Nach Augsburg

May 30, 2025

Wiedergeburt Des Sports Die Rueckkehr Juedischer Athleten Nach Augsburg

May 30, 2025 -

La Moselle A L Assemblee Nationale L Influence De Laurent Jacobelli

May 30, 2025

La Moselle A L Assemblee Nationale L Influence De Laurent Jacobelli

May 30, 2025 -

Unseeded Eala Upsets Keys In Miami Secures Quarterfinal Spot

May 30, 2025

Unseeded Eala Upsets Keys In Miami Secures Quarterfinal Spot

May 30, 2025 -

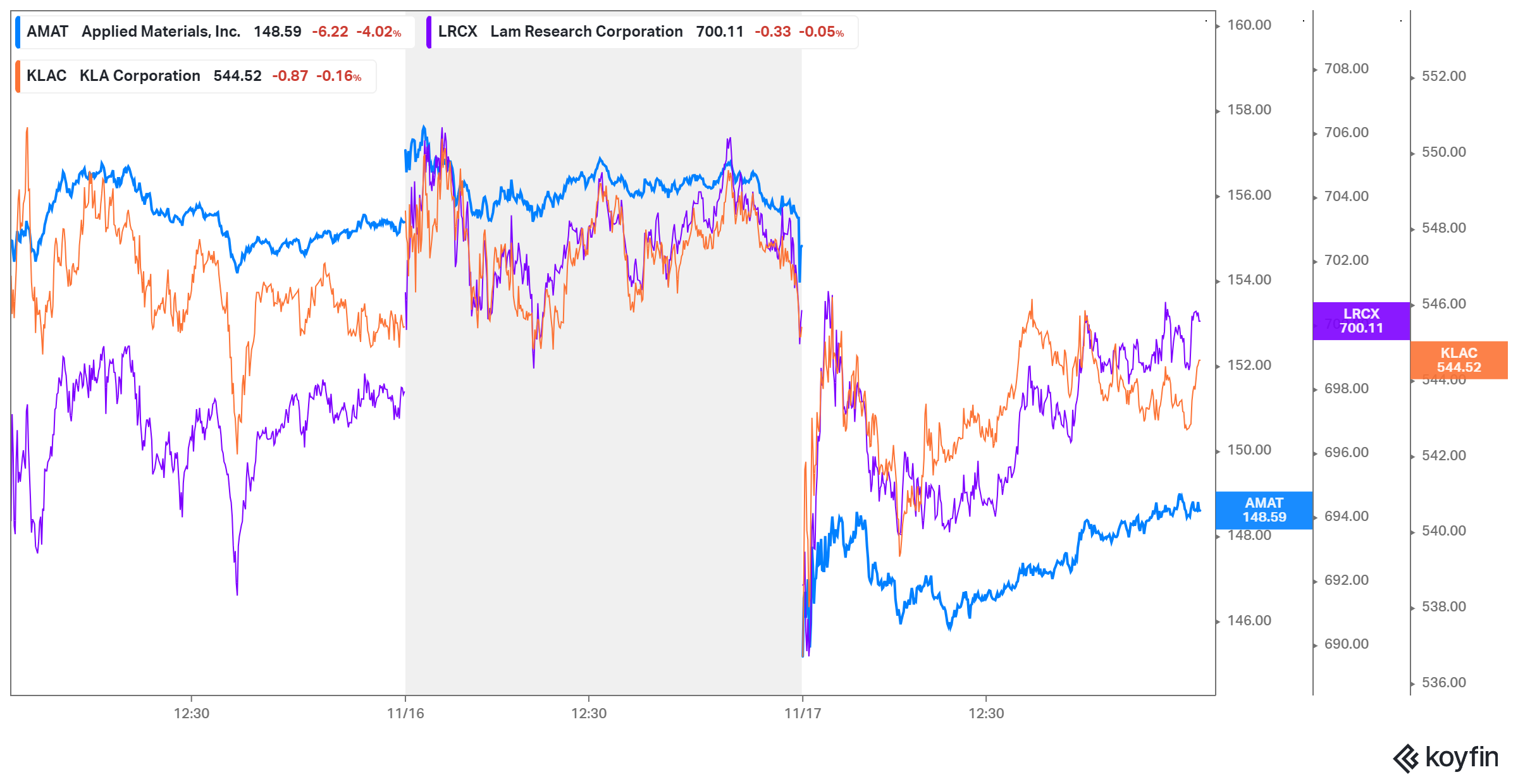

Nvidias Upbeat Forecast Despite China Slowdown

May 30, 2025

Nvidias Upbeat Forecast Despite China Slowdown

May 30, 2025