Could A 10x Bitcoin Multiplier Reshape Wall Street? A Weekly Chart Review

Table of Contents

Analyzing Bitcoin's Historical Price Performance and Potential for a 10x Multiplier

Past Market Cycles and Their Implications

Bitcoin's history is punctuated by significant bull and bear markets. Examining these cycles provides valuable insights into its potential for future growth.

- 2010-2013: Bitcoin's early years saw exponential growth, driven by early adoption and increasing awareness. The price rose from pennies to hundreds of dollars.

- 2017: The infamous "Bitcoin bubble" saw prices skyrocket to nearly $20,000, fueled by mainstream media attention and speculation. This represented a significant multiplier effect from previous lows.

- 2021: Another bull run propelled Bitcoin to over $60,000, driven by institutional investment and growing acceptance as a store of value.

Analyzing these cycles reveals periods of explosive growth followed by corrections. While a 10x multiplier from current prices is a significant leap, the historical data demonstrates Bitcoin's capacity for substantial price appreciation. [Include a relevant chart showing Bitcoin's price history here]. Understanding Bitcoin price history is key to predicting potential future movements.

Assessing Current Market Conditions and Future Price Projections

Predicting Bitcoin's future price is inherently challenging, but analyzing current market conditions offers clues.

- Macroeconomic Factors: Inflationary pressures and geopolitical instability could drive investors towards alternative assets like Bitcoin, potentially fueling its price.

- Adoption Rates: Increasing adoption by institutional investors and integration into mainstream financial systems suggest a growing level of acceptance.

- Regulatory Changes: While regulatory clarity remains an ongoing issue, increased regulatory frameworks could foster greater confidence and investment.

- Technological Advancements: Developments like the Lightning Network aim to improve Bitcoin's scalability, potentially boosting its utility and appeal.

Expert opinions vary widely. Some analysts foresee a continued upward trend, potentially leading to a 10x multiplier in the long term. Others remain cautious, highlighting the inherent volatility of the cryptocurrency market. [Cite reputable sources and their predictions here]. Accurate Bitcoin price prediction requires a careful evaluation of these multifaceted market forces.

The Impact of a 10x Bitcoin Multiplier on Wall Street Institutions

Hedge Funds and Investment Strategies

A 10x Bitcoin multiplier would dramatically reshape the landscape for hedge funds and institutional investors.

- Portfolio Diversification: Bitcoin would become a significantly larger component of diversified portfolios, potentially reducing the importance of traditional asset classes.

- Risk Management: Hedge funds would need to adapt their risk management strategies to accommodate Bitcoin's volatility, exploring new hedging techniques.

- Investment Strategies: Traditional investment strategies might be fundamentally altered, with a greater emphasis on Bitcoin-related opportunities. The allocation of assets would undergo a massive shift.

A significant increase in Bitcoin's value would incentivize greater institutional investment, potentially leading to a massive reallocation of assets within the financial industry.

Traditional Financial Markets and Regulatory Responses

The impact of a 10x Bitcoin multiplier on traditional financial markets would be profound.

- Market Disruption: A surge in Bitcoin's dominance could divert capital away from traditional asset classes like stocks and bonds, impacting market valuations.

- Regulatory Responses: Governments and regulatory bodies would likely respond with tighter regulations aimed at managing the risks associated with Bitcoin's increased influence. This could range from stricter KYC/AML guidelines to new tax policies.

- Wall Street Reaction: Wall Street's reaction would be a complex mix of adaptation, resistance, and potentially, even fear. Some institutions might embrace Bitcoin wholeheartedly, while others might view it as a disruptive force to be contained.

The scale of disruption would necessitate a significant shift in regulatory frameworks and a fundamental reassessment of traditional financial models.

Societal and Economic Consequences of a 10x Bitcoin Multiplier

Impact on Global Finance and Wealth Distribution

A 10x Bitcoin multiplier would have far-reaching societal and economic consequences.

- Wealth Distribution: The significant price increase would drastically alter wealth distribution, potentially exacerbating existing inequalities. Early Bitcoin adopters would see massive gains, while those who entered later might miss out.

- Global Finance: The role of central banks and traditional fiat currencies could be challenged as Bitcoin's market capitalization grows significantly.

- Economic Impact: The macroeconomic impact would depend on various factors, including the speed and nature of the price increase. This could lead to both opportunities and potential economic instability.

Navigating the implications of this transformative event would require significant global economic coordination.

Technological and Infrastructure Implications

The sheer volume of transactions associated with a 10x Bitcoin multiplier would put immense strain on existing infrastructure.

- Bitcoin Scalability: The current blockchain infrastructure may struggle to handle the increased transaction volume, highlighting the need for scalability solutions like the Lightning Network.

- Technological Advancements: The increased demand would stimulate further innovation in blockchain technology and cryptocurrency infrastructure.

The Uncharted Territory of a 10x Bitcoin Multiplier and What Lies Ahead

This weekly chart review explored the potential for a 10x Bitcoin multiplier and its potential ramifications for Wall Street and the global economy. While the likelihood remains uncertain, the analysis suggests a significant potential impact on various sectors. The historical data shows Bitcoin's capacity for exponential growth, while current market conditions indicate a possible catalyst for a considerable price increase. However, the volatility inherent in cryptocurrencies necessitates careful consideration of the potential risks.

Stay tuned for our next weekly chart review to continue tracking the potential for a 10x Bitcoin multiplier and its impact on the future of finance. Understanding the potential of a 10x Bitcoin multiplier is crucial for navigating the ever-changing world of cryptocurrency investment.

Featured Posts

-

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Reasons To Believe So

May 08, 2025

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Reasons To Believe So

May 08, 2025 -

Dwp Doubles Home Visits For Benefit Claimants Thousands Affected

May 08, 2025

Dwp Doubles Home Visits For Benefit Claimants Thousands Affected

May 08, 2025 -

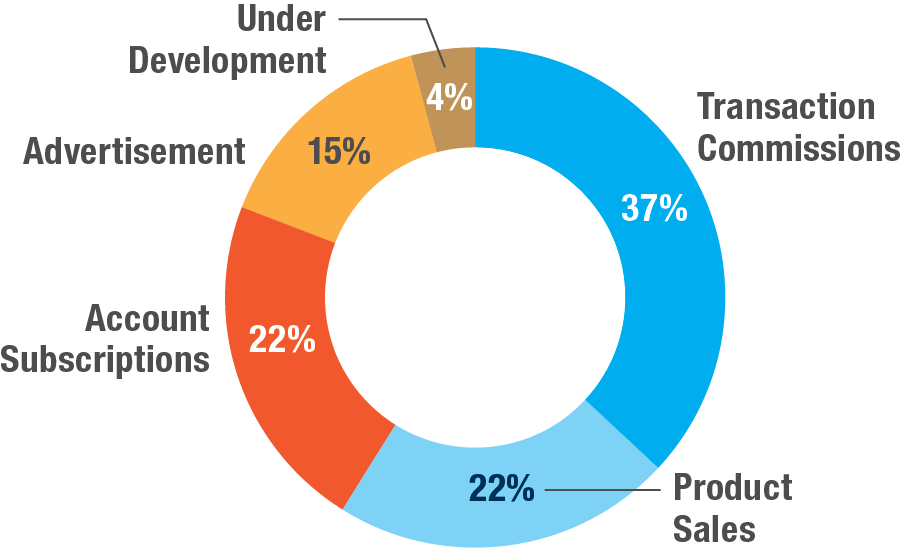

A Data Driven Guide To The Countrys Top Emerging Business Locations

May 08, 2025

A Data Driven Guide To The Countrys Top Emerging Business Locations

May 08, 2025 -

Oscars Snubs A Look Back At The Academys Most Controversial Decisions

May 08, 2025

Oscars Snubs A Look Back At The Academys Most Controversial Decisions

May 08, 2025 -

Bitcoin In Son Durumu Ve Guencel Degeri

May 08, 2025

Bitcoin In Son Durumu Ve Guencel Degeri

May 08, 2025