Court Extends Creditor Protection For Hudson's Bay Company To July 31

Table of Contents

Details of the Court's Decision

The court's decision to grant an extension to HBC's creditor protection provides crucial breathing room, but the specifics are vital to understanding the company's path forward. The ruling, issued on [Insert Date of Ruling] by [Insert Court Name and Judge's Name], extends the protection granted under the Companies' Creditors Arrangement Act (CCAA). This legal framework allows financially distressed companies to restructure their debt and operations outside of formal bankruptcy proceedings.

- Date of the Ruling: [Insert Date of Ruling]

- Legal Framework: Companies' Creditors Arrangement Act (CCAA)

- Conditions of Extension: [Insert Specific Conditions, e.g., submission of a revised restructuring plan by a specific date, continued cooperation with creditors].

The judge's reasoning, likely centered on the potential for a successful reorganization, is crucial to understanding the outlook for HBC. Further details regarding the court’s rationale will be released in the coming days. This HBC creditor protection extension offers a path to reorganization and financial stability, but this path is still filled with hurdles.

Implications of the Extended Creditor Protection for HBC

The extension of creditor protection has significant short-term and long-term implications for HBC, impacting various stakeholders.

Impact on:

- HBC's Operations: The extension allows HBC to continue operating while working on its restructuring plan. This includes maintaining its existing stores and online presence, although potential store closures or sales remain a possibility.

- Employees: While the extension safeguards against immediate job losses, long-term job security depends heavily on the success of the restructuring process.

- Suppliers: Suppliers will likely be closely monitoring HBC's progress and may adjust their credit terms or delivery schedules.

- Shareholders: Shareholder value remains highly uncertain, pending the success of the restructuring and the eventual outcome.

Potential Strategies:

- Restructuring Plans: HBC is likely to focus on debt reduction strategies, potentially including asset sales, cost-cutting measures, and negotiations with creditors.

- Debt Reduction: The extended creditor protection provides an opportunity to negotiate more favorable terms with lenders and potentially reduce its debt burden.

- Store Closures or Sales: While not confirmed, the possibility of store closures or the sale of certain assets remains a realistic consideration as HBC seeks to streamline its operations.

Potential Scenarios for HBC's Future

The extension of creditor protection doesn't guarantee success, and several possible scenarios could unfold for HBC in the coming months.

- Successful Restructuring: HBC might successfully restructure its debt, improve its operational efficiency, and return to profitability. This would require a robust plan, strong market performance, and continued support from creditors.

- Asset Sales: HBC might sell off non-core assets or parts of the business to raise capital and reduce its debt burden. This could involve divesting certain brands or properties.

- Bankruptcy: If HBC fails to develop a viable restructuring plan and secure creditor support, bankruptcy remains a possibility. This would likely lead to significant job losses and asset liquidation.

Influencing Factors:

- Market Conditions: The overall economic climate and consumer spending patterns will significantly impact HBC's ability to rebound.

- Consumer Behavior: Changing consumer preferences and the rise of e-commerce will also shape HBC's future prospects.

- Expert Opinions: Financial analysts will continue to monitor HBC's progress and offer insights into its prospects, shaping investor and public perception.

Impact on the Retail Industry

HBC's struggle and subsequent creditor protection extension have broader implications for the retail sector. The situation highlights the challenges faced by many traditional brick-and-mortar retailers in the face of online competition and evolving consumer habits.

- Increased Competition: The potential restructuring or liquidation of HBC could intensify competition among remaining retailers, creating opportunities for some and challenges for others.

- Changes in Consumer Behavior: HBC's challenges reflect broader trends in consumer behavior, highlighting the importance of adapting to evolving preferences.

- Potential Consolidation: The situation could trigger further consolidation in the retail sector, with larger players acquiring struggling businesses or assets.

Conclusion: The Future of Creditor Protection for Hudson's Bay Company

The court's decision to extend creditor protection for Hudson's Bay Company until July 31st offers a temporary lifeline, but the future remains uncertain. The success of HBC hinges on its ability to develop and implement a viable restructuring plan, navigate market challenges, and secure the support of its creditors. The July 31st deadline marks a crucial juncture. The coming weeks will be pivotal in determining whether HBC can successfully navigate this challenging period. Follow the HBC Creditor Protection case closely to stay updated on the company's financial restructuring efforts and learn more about the future of creditor protection for HBC. Check back for updates, or subscribe to reputable financial news sources for the latest developments.

Featured Posts

-

Toxic Chemicals Lingered In Buildings Months After Ohio Train Derailment

May 15, 2025

Toxic Chemicals Lingered In Buildings Months After Ohio Train Derailment

May 15, 2025 -

Caloocan City Election Malapitan Extends Lead Against Trillanes

May 15, 2025

Caloocan City Election Malapitan Extends Lead Against Trillanes

May 15, 2025 -

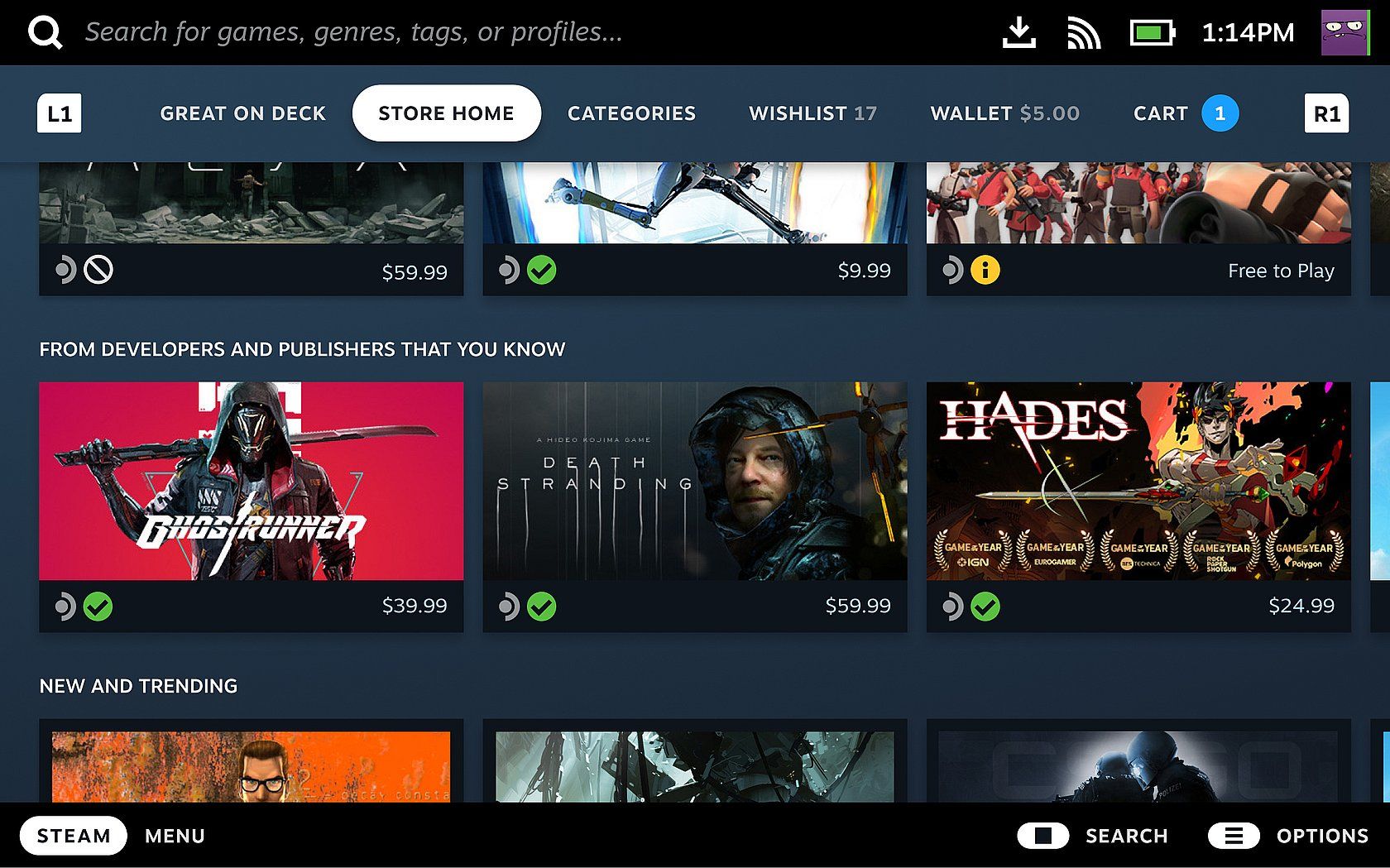

Enhanced Ps 1 Gaming Exploring The New Steam Deck Verified Titles

May 15, 2025

Enhanced Ps 1 Gaming Exploring The New Steam Deck Verified Titles

May 15, 2025 -

Baazar Style Retail Investment Opportunity Jm Financial At R400

May 15, 2025

Baazar Style Retail Investment Opportunity Jm Financial At R400

May 15, 2025 -

Zach Steffens Mistakes Cost Earthquakes In Loss To Rapids

May 15, 2025

Zach Steffens Mistakes Cost Earthquakes In Loss To Rapids

May 15, 2025