Credit Suisse Whistleblower Case: A $150 Million Payout

Table of Contents

The Allegations at the Heart of the Credit Suisse Whistleblower Case

The Credit Suisse whistleblower case centers around serious allegations of unethical and potentially illegal activities within the bank. While specific details remain partially confidential due to settlement agreements, the allegations broadly involve misconduct related to the bank's risk management practices and potentially fraudulent activities.

-

Specific examples of alleged misconduct: Reports suggest the whistleblower exposed instances of inadequate risk assessments, potentially leading to significant financial losses. Further allegations may have involved non-compliance with anti-money laundering regulations and potential tax evasion schemes. The exact nature and scope of all accusations remain somewhat obscured due to confidentiality clauses in the settlement.

-

Type of misconduct: The alleged misconduct encompasses a range of serious offenses, including potential securities fraud, money laundering, and violations of banking regulations. The scale and impact of these alleged actions raise significant concerns about the bank's internal controls and overall ethical culture.

-

The scale of the alleged wrongdoing: The sheer size of the settlement – $150 million – suggests the scale of the alleged wrongdoing was substantial. The potential impact on investors and the broader financial system is a matter of ongoing concern and investigation.

-

How the alleged actions impacted investors, clients, or the financial system: The alleged misconduct potentially jeopardized investor confidence, risked client assets, and could have contributed to systemic instability within the financial system. The long-term consequences are still unfolding, with ongoing regulatory scrutiny and reputational damage to Credit Suisse.

The Whistleblower's Role and the Legal Process

The whistleblower, whose identity remains largely protected, played a crucial role in bringing these allegations to light. They likely utilized a combination of internal and external reporting mechanisms to expose the alleged wrongdoing. Internal reporting may have initially been unsuccessful, prompting the whistleblower to seek external channels such as regulatory bodies or law enforcement agencies.

-

Timeline of events: The timeline likely spans several years, from the initial discovery of alleged misconduct, through internal reporting, external reporting, investigations, and ultimately, the settlement. Precise dates and details are usually confidential in these cases.

-

Key players involved: The key players include the whistleblower, their legal counsel, Credit Suisse's legal team, various regulatory bodies (e.g., the SEC in the US, FINMA in Switzerland), and potentially other investigative agencies.

-

Legal strategies employed by both sides: Credit Suisse's legal strategy likely focused on minimizing liability, potentially challenging the evidence presented by the whistleblower, and negotiating a settlement to avoid protracted litigation. The whistleblower's legal team aimed to secure a substantial settlement that fairly reflects the severity of the alleged misconduct.

-

Role of regulatory bodies: Regulatory bodies played a critical role in investigating the allegations and potentially influencing the settlement negotiations. Their involvement highlights the importance of regulatory oversight in safeguarding the integrity of the financial system.

The $150 Million Payout: A Record-Breaking Settlement?

The $150 million settlement is significant, though whether it constitutes a record-breaking payout in the context of whistleblower cases involving major financial institutions requires further analysis. The size of the settlement likely reflects several factors.

-

Comparison to similar whistleblower payouts: While the exact figure may not be an outright record, it falls within the upper echelon of payouts in comparable whistleblower cases, signifying the seriousness of the allegations and the potential damage to Credit Suisse.

-

Breakdown of the settlement amount: The settlement likely involves a combination of fines levied against Credit Suisse and compensation awarded to the whistleblower. The exact breakdown is usually confidential.

-

Credit Suisse’s financial implications: The $150 million payout undoubtedly impacts Credit Suisse's financial performance, though the extent will depend on the bank's overall financial health and the proportion of the settlement deemed as a necessary expense.

The Implications for Corporate Governance and Compliance

The Credit Suisse whistleblower case has significant implications for corporate governance and compliance programs across the financial industry.

-

Recommendations for companies to prevent similar situations: Companies must strengthen their internal reporting mechanisms, ensuring they are easily accessible, confidential, and free from retaliation. Improvements to risk management systems and enhanced training on regulatory compliance are vital.

-

Importance of whistleblower protection laws: Robust whistleblower protection laws are essential to encourage individuals to come forward with information about potential wrongdoing, without fear of reprisal.

-

Strengthening of internal controls: This case underscores the need for stronger internal controls, including regular audits and independent reviews of compliance procedures.

-

Increased regulatory scrutiny: Expect increased regulatory scrutiny of financial institutions following this case, leading to more rigorous enforcement of compliance regulations and potentially harsher penalties for misconduct.

The Future of Whistleblowing in Finance

The Credit Suisse whistleblower case could have a profound and lasting impact on whistleblowing in the financial industry.

-

Increased awareness of whistleblower rights: The case has raised public awareness of whistleblower rights and the potential for substantial financial rewards for exposing wrongdoing.

-

Potential for more significant settlements in the future: This case might set a precedent for larger settlements in future whistleblower cases, potentially encouraging more individuals to come forward with information.

-

Changes in regulatory frameworks: Regulatory bodies may respond by strengthening whistleblower protection laws and increasing penalties for corporate misconduct.

-

Impact on corporate culture and ethical behavior: The case could foster a change in corporate culture, encouraging a more ethical and transparent work environment, with increased emphasis on compliance and accountability.

Conclusion:

The Credit Suisse whistleblower case and its substantial $150 million payout serve as a stark reminder of the crucial role whistleblowers play in maintaining ethical standards and regulatory compliance within the financial sector. The sheer scale of the settlement underscores the severe consequences of ignoring internal concerns and the potential for significant financial and reputational damage. This landmark case highlights the urgent need for organizations to establish robust whistleblower protection programs, foster a culture of ethical behavior, and ensure effective internal controls. Understanding the implications of this case is paramount for all financial institutions seeking to maintain their integrity and avoid similar costly outcomes. Learn more about strengthening your own whistleblower protection programs and ensuring robust corporate governance.

Featured Posts

-

Edmonton Unlimited A New Strategy For Tech And Innovation Growth

May 09, 2025

Edmonton Unlimited A New Strategy For Tech And Innovation Growth

May 09, 2025 -

Phan No Vu Bao Hanh Tre Em O Tien Giang Can Xu Ly Nghiem Minh

May 09, 2025

Phan No Vu Bao Hanh Tre Em O Tien Giang Can Xu Ly Nghiem Minh

May 09, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Performance

May 09, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Performance

May 09, 2025 -

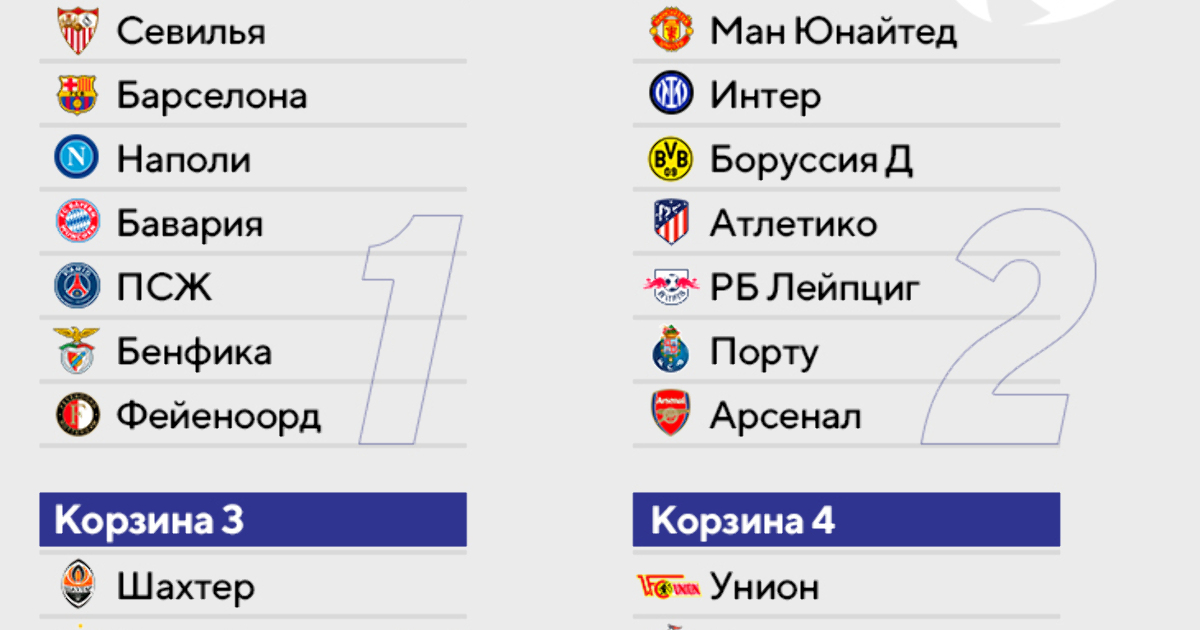

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025 -

Bayern Munich Vs Eintracht Frankfurt Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Eintracht Frankfurt Match Preview And Prediction

May 09, 2025