Crypto Bro's Short Sell On $TRUMP: A White House Dinner Story

Table of Contents

The Crypto Bro's Bold Strategy: Shorting $TRUMP

Understanding the Short Sell

Short selling is a risky investment strategy where an investor borrows an asset (in this case, a hypothetical $TRUMP investment), sells it in the market, hoping the price will drop. If the price falls, they buy it back at a lower price, return it to the lender, and pocket the difference as profit. However, if the price rises, they face substantial losses.

- Define short selling: Borrowing an asset to sell, hoping to buy it back cheaper later.

- Potential profits: Significant if the asset's price declines substantially.

- Inherent risks: Unlimited potential losses if the price rises.

- Market volatility: Political markets are extremely volatile, amplifying risks.

- Leverage: Using borrowed funds magnifies both profits and losses.

Why short sell a political figure? Reasons might include: disagreement with their policies, anticipation of electoral defeat, or a belief their actions will negatively impact the economy, all potentially affecting the hypothetical $TRUMP investment's value.

The Crypto Bro's Rationale

Our crypto bro, let's call him "Max," possessed a background in cryptocurrency trading and a keen interest in political markets. His rationale for shorting $TRUMP stemmed from his analysis of various factors:

- Cryptocurrency background: Max's experience with volatile crypto markets gave him a tolerance for risk.

- Market analysis: He identified what he believed to be negative trends in public opinion and potential economic headwinds.

- Political views: Max held strong political views opposing the figure represented by $TRUMP.

- Specific predictions: He predicted a decline in the hypothetical $TRUMP investment based on his analysis.

Max’s investment strategy relied heavily on sentiment analysis of social media, polling data, and economic forecasts. He employed leverage to amplify potential returns, unknowingly increasing the risk significantly.

The White House Dinner: A Twist of Fate

Unexpected Connections

Through a series of fortunate (or perhaps unfortunate) events, Max found himself invited to a White House dinner. The details remain somewhat shrouded in mystery, but it involved a connection he made through a cryptocurrency conference and a shared acquaintance with a high-ranking administration official.

- Access to the dinner: The details surrounding Max's invitation remain unclear, adding to the intrigue of the story.

- Who he met: He interacted with influential figures, sparking both excitement and apprehension.

- Influencing the investment: The potential for bias or altered perspective due to the event presents a serious conflict of interest.

The Dinner's Impact on the Short Sell

The White House dinner proved to be a pivotal turning point. The conversations and interactions Max had profoundly impacted his perspective on the $TRUMP investment.

- Changed position? The dinner caused him to question his initial analysis and short position.

- Hold, cover, or double down? He grappled with the ethical and financial implications of his decision.

- Consequences: His actions, influenced by the unexpected events, resulted in significant consequences.

The dinner presented Max with conflicting information and emotional pressure, creating a significant ethical dilemma. The pressure to conform to the prevailing sentiment in such an environment could lead to rash and potentially financially damaging decisions.

The Aftermath: Lessons Learned from the $TRUMP Short Sell

Analyzing the Success (or Failure)

The outcome of Max's $TRUMP short sell remains undisclosed (for dramatic effect!), however, the story highlights a powerful lesson.

- Profits or losses: The final financial result underscores the volatility of political investments.

- Impact of the White House dinner: The dinner's influence highlights the unexpected external factors that can affect investments.

- Lessons learned: Max's experience offers valuable insights into the challenges of high-risk, high-reward strategies.

The financial analysis could potentially demonstrate the power of leverage and the significant losses incurred even with seemingly well-researched investment strategies.

Key Takeaways for Investors

Max's story provides several crucial takeaways for those considering similar ventures:

- Due diligence: Thorough research and analysis are paramount.

- Risk management: Understanding and mitigating risk is essential for long-term success.

- Ethical implications: Political investments raise significant ethical concerns.

Diversification, thorough research across multiple sources, and avoiding emotional decision-making based on limited or biased information are key to successful investing. Remember, every investment carries risk, and understanding that risk is crucial.

Conclusion

The crypto bro's high-stakes $TRUMP short sell, punctuated by an unexpected White House dinner, serves as a compelling case study in the unpredictable nature of political investing. The story highlights the significant risks, potential rewards, and ethical considerations associated with this type of investment. Max’s journey underscores the importance of thorough due diligence, effective risk management, and the need to avoid emotionally driven decisions. Don't let the allure of a quick profit blind you to the potential for substantial losses. Learn from the crypto bro's experience and make informed decisions when exploring high-risk investments. Don't be another crypto bro caught in a White House gamble! Remember to thoroughly research and manage your risks before engaging in any $TRUMP or similar political-themed investment strategies.

Featured Posts

-

Vater Machinery Awarded Cnh Capital New Holland Dealer Of The Year

May 29, 2025

Vater Machinery Awarded Cnh Capital New Holland Dealer Of The Year

May 29, 2025 -

Heitinga Topkandidaat Voor Ajax Trainerschap

May 29, 2025

Heitinga Topkandidaat Voor Ajax Trainerschap

May 29, 2025 -

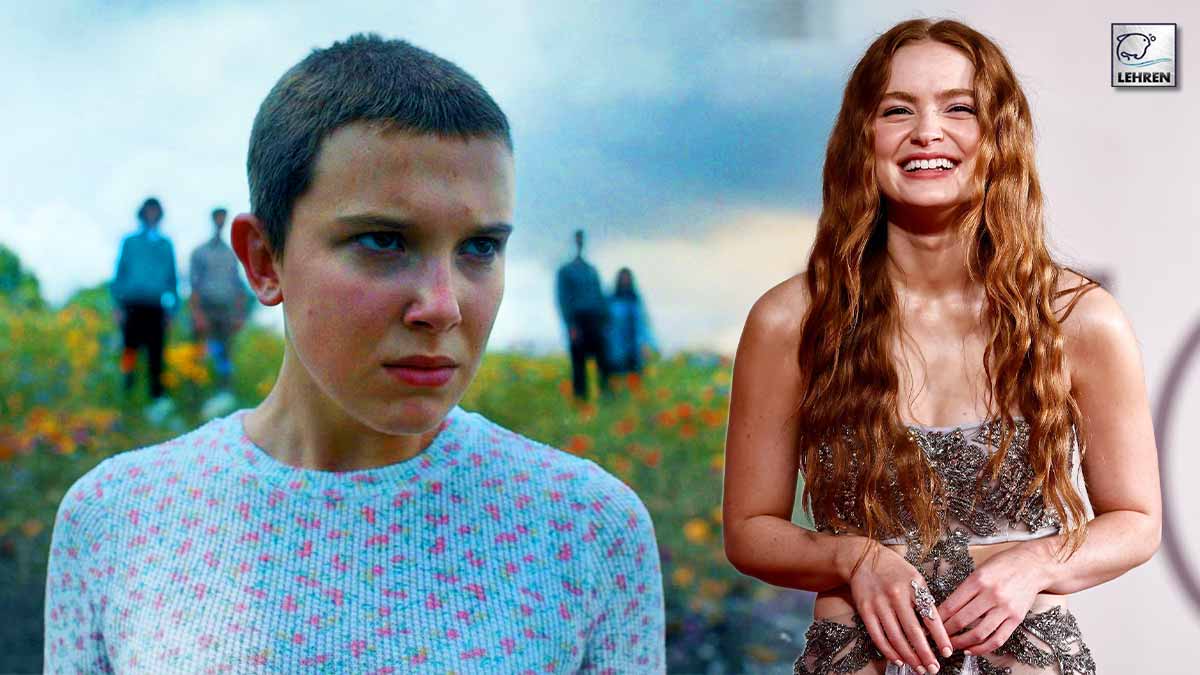

Stranger Things Season 5 Sadie Sink Reveals Production Difficulties And Teases Character Growth

May 29, 2025

Stranger Things Season 5 Sadie Sink Reveals Production Difficulties And Teases Character Growth

May 29, 2025 -

Felbecsuelhetetlen Erteku Targyak Keresd Meg A Szazezreket Ero Kincseket Otthonodban

May 29, 2025

Felbecsuelhetetlen Erteku Targyak Keresd Meg A Szazezreket Ero Kincseket Otthonodban

May 29, 2025 -

Securing Morgan Wallen Concert Tickets For 2025 Dates Venues And Pricing

May 29, 2025

Securing Morgan Wallen Concert Tickets For 2025 Dates Venues And Pricing

May 29, 2025