D-Wave Quantum Inc. (QBTS) Stock's Sharp Decline: A Monday Market Analysis

Table of Contents

H2: Market Sentiment and Investor Concerns

The sharp decline in D-Wave Quantum Inc. (QBTS) stock on Monday can be attributed to a confluence of factors impacting investor sentiment and creating significant concerns.

H3: Negative News Impact

While no single catastrophic news event triggered the drop, a combination of factors likely contributed to the negative sentiment.

- Lack of Recent Positive Catalysts: The absence of significant positive announcements or progress reports regarding technological breakthroughs or major partnerships could have fueled investor uncertainty. Investors often react negatively to periods of perceived stagnation in rapidly evolving tech sectors.

- Increased Competition: The burgeoning quantum computing industry is increasingly competitive. News of advancements from rival companies, even if not directly impacting D-Wave, could indirectly pressure QBTS stock. For example, a competitor securing a significant funding round or announcing a key partnership might shift investor attention and capital away from D-Wave. [Link to relevant news source about competitor advancements, if available]

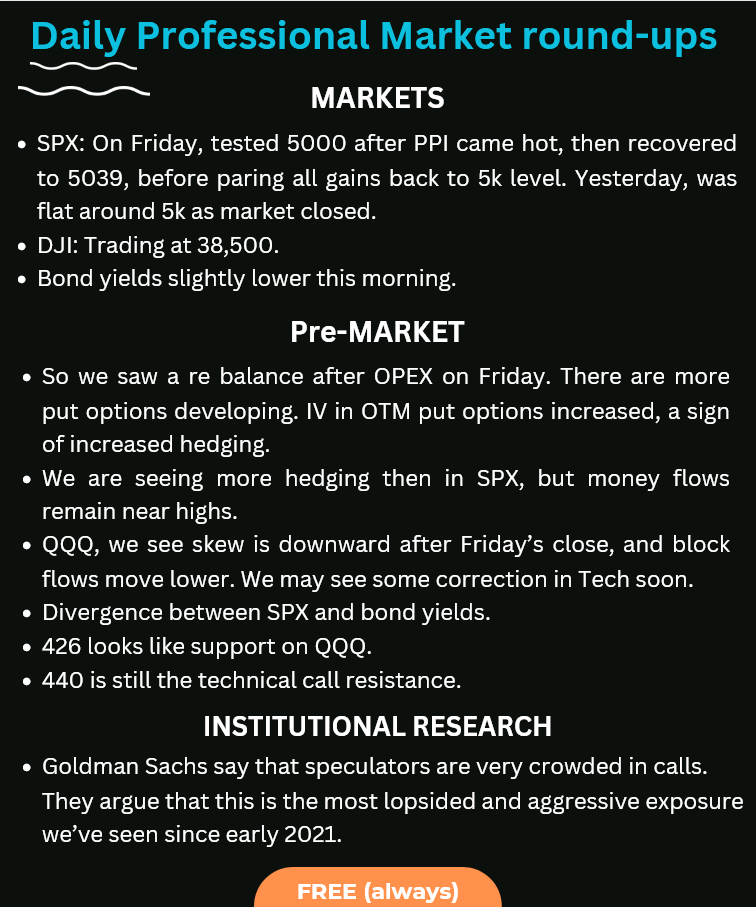

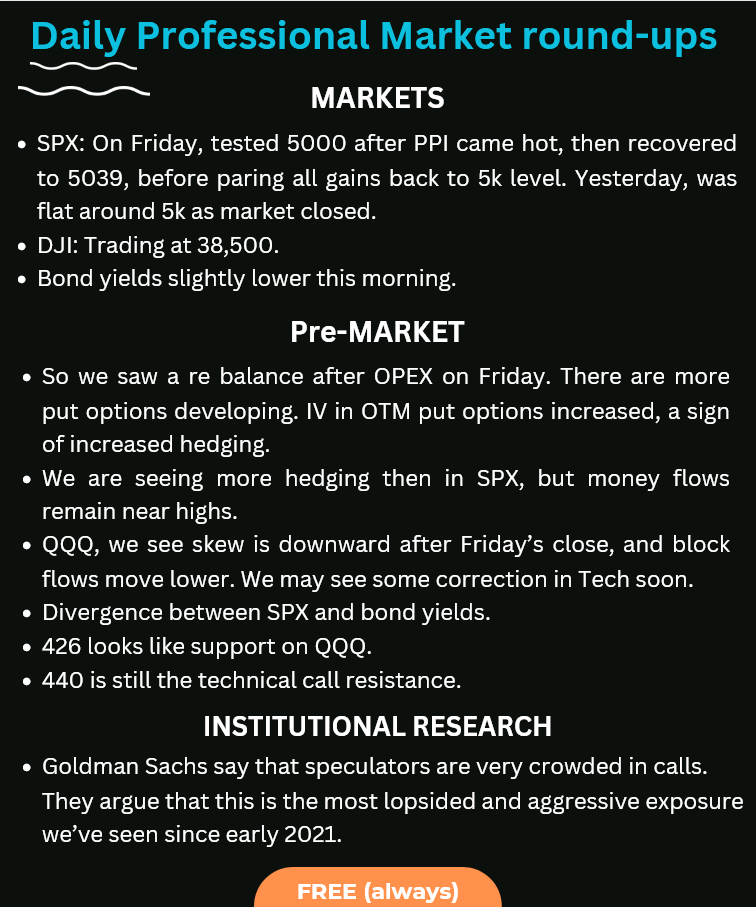

H3: Broader Market Trends

Monday's overall market conditions also played a role. A general downturn in the technology sector or a broader market correction could have disproportionately impacted a growth stock like QBTS.

- Downturn in Tech Indices: A decline in major technology indices like the Nasdaq Composite could have contributed to the selling pressure on QBTS stock. [Link to relevant market index data]

- Macroeconomic Factors: Concerns about macroeconomic factors such as inflation, interest rate hikes, or geopolitical instability can create a risk-off sentiment, leading investors to sell more volatile stocks like those in the quantum computing sector.

H3: Short Selling and Analyst Downgrades

While concrete evidence is often hard to come by, it's plausible that increased short selling activity or negative analyst reports contributed to the downward pressure on QBTS stock.

- Increased Short Interest: A surge in short selling might indicate that some investors believe the stock is overvalued and poised for further decline. [Link to relevant financial data on short interest, if available]

- Analyst Downgrades: Negative analyst reports, if any, would likely have exerted significant downward pressure on the stock price, especially given the speculative nature of investments in quantum computing companies. [Link to relevant analyst reports, if available]

H2: D-Wave Quantum's Business Performance and Outlook

Analyzing D-Wave's recent performance and future outlook is critical in understanding the stock price fluctuation.

H3: Recent Financial Results

D-Wave's latest financial reports (if available) should be scrutinized for clues explaining the drop.

- Revenue Growth: Investors closely watch revenue growth to assess a company's trajectory. Slower-than-expected revenue growth or a decline could have triggered selling. [Insert relevant financial data from D-Wave’s financial reports if available]

- Earnings Per Share (EPS): EPS is a key profitability metric. A miss on EPS expectations could have significantly impacted investor sentiment. [Insert relevant financial data from D-Wave’s financial reports if available]

H3: Technological Advancements and Competition

The pace of technological progress and competitive dynamics within the quantum computing industry are paramount.

- Technological Milestones: The absence of significant technological breakthroughs or milestones announced by D-Wave might have disappointed investors expecting faster progress.

- Competitive Landscape: Strong competition in quantum computing means that any perceived lag in technological development or market adoption compared to rivals could hurt investor confidence.

H3: Long-Term Growth Potential

Despite the short-term volatility, the long-term growth potential of D-Wave and the quantum computing industry remains a key factor.

- Market Adoption: The timeline for widespread market adoption of quantum computing technologies remains uncertain, contributing to risk.

- Regulatory Landscape: Regulatory changes and government policies related to quantum computing could significantly impact D-Wave's future prospects.

H2: Technical Analysis of QBTS Stock

Technical analysis offers additional insights into the QBTS stock price movement on Monday.

H3: Chart Patterns and Indicators

Examining the QBTS stock chart can reveal potential reasons for the decline.

- Candlestick Patterns: Certain candlestick patterns (e.g., bearish engulfing patterns) might suggest a shift in market sentiment. [Include relevant chart examples, if possible]

- Moving Averages: Crossovers of moving averages can indicate potential trend reversals. [Include relevant chart examples, if possible]

H3: Support and Resistance Levels

Identifying support and resistance levels can help predict future price movements.

- Support Levels: These are price levels where buying pressure is expected to outweigh selling pressure, potentially preventing further declines.

- Resistance Levels: These are price levels where selling pressure is expected to outweigh buying pressure, potentially halting upward price movements. [Include chart examples indicating support and resistance levels, if possible]

H3: Trading Volume

High trading volume on Monday could indicate significant selling pressure driving the decline. Comparing this volume to historical averages provides context. [Include chart showing trading volume, if possible]

3. Conclusion

The sharp decline in D-Wave Quantum Inc. (QBTS) stock on Monday resulted from a combination of factors. Negative market sentiment, fuelled by the absence of recent positive catalysts and broader market trends, played a crucial role. While D-Wave's long-term potential remains significant, concerns about its recent performance and the competitive landscape likely contributed to the stock's drop. Technical analysis supports the observation of significant selling pressure. Understanding these factors affecting D-Wave Quantum Inc. (QBTS) stock is crucial for informed investment decisions. Keep monitoring the market for updates on QBTS and other quantum computing stocks.

Featured Posts

-

The Enduring Appeal Of Agatha Christies Hercule Poirot

May 20, 2025

The Enduring Appeal Of Agatha Christies Hercule Poirot

May 20, 2025 -

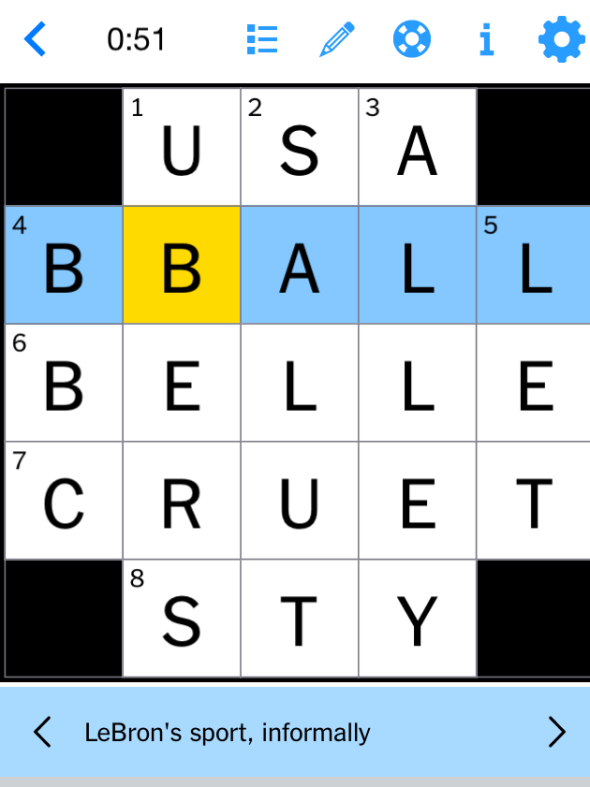

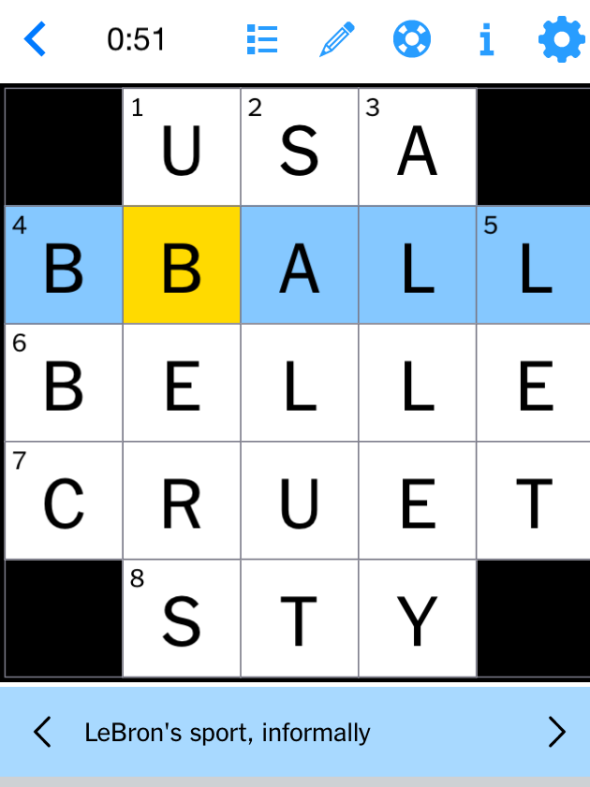

Nyt Mini Crossword Solutions March 13 Hints And Complete Answers

May 20, 2025

Nyt Mini Crossword Solutions March 13 Hints And Complete Answers

May 20, 2025 -

Man Utd Transfer News Cunha Signing Imminent Plan B Revealed

May 20, 2025

Man Utd Transfer News Cunha Signing Imminent Plan B Revealed

May 20, 2025 -

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 20, 2025

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 20, 2025 -

I Martha Kai Ta Tampoy Mia Deyteri Eykairia

May 20, 2025

I Martha Kai Ta Tampoy Mia Deyteri Eykairia

May 20, 2025