D-Wave Quantum (NYSE: QBTS) Stock Decline: Analyzing Kerrisdale Capital's Critique

Table of Contents

Kerrisdale Capital's Key Arguments Against D-Wave Quantum

Kerrisdale Capital's report leveled several serious accusations against D-Wave Quantum, casting doubt on the company's technology, market positioning, and financial projections. Their core arguments centered on:

-

Overstated Technological Capabilities: Kerrisdale argued that D-Wave's claims regarding the capabilities of its quantum annealing technology were significantly inflated. They questioned the practical applications and the actual speed advantage compared to classical computing solutions in real-world scenarios. The report highlighted specific instances where D-Wave's marketed capabilities appeared to fall short of reality.

-

Unrealistic Revenue Projections: The report challenged D-Wave's ambitious revenue forecasts, suggesting they were based on overly optimistic assumptions about market adoption and future technological advancements. Kerrisdale presented alternative revenue models indicating significantly lower potential earnings. Specific examples were provided to support their claims of unrealistic financial projections.

-

Weak Market Position: Kerrisdale questioned D-Wave's ability to compete effectively against other players in the burgeoning quantum computing market. The report highlighted the growing competition from companies developing gate-based quantum computers, arguing that D-Wave's technology might be quickly becoming obsolete. This analysis included comparisons to competitors and predictions on market share.

-

Concerns Regarding Financial Performance: The report expressed concerns about D-Wave's financial health, pointing to potential inconsistencies in their financial reporting and raising questions about their long-term viability. Specific financial metrics were cited to support this claim.

D-Wave Quantum's Response and Counterarguments

D-Wave Quantum responded to Kerrisdale's report with a point-by-point rebuttal, aiming to refute the key allegations. While they acknowledged certain points, D-Wave largely defended its technological advancements and future outlook. However, the effectiveness of their counterarguments is debatable.

-

Technological Defense: D-Wave highlighted successful collaborations and applications of their technology, emphasizing the unique capabilities of quantum annealing. However, they provided limited concrete evidence to directly address some of Kerrisdale's specific technical criticisms.

-

Market Position Rebuttal: D-Wave countered the concerns about market competitiveness by emphasizing its established customer base and ongoing research and development. Yet, they offered limited response to the argument regarding the potential obsolescence of their technology.

-

Financial Performance Clarification: D-Wave addressed concerns regarding financial performance by clarifying specific accounting practices and outlining their long-term strategic plan. The overall clarity and persuasiveness of their financial arguments, however, remain open to debate.

Analyzing both sides' arguments reveals inconsistencies and areas where further investigation is needed. The lack of definitive evidence from either party leaves investors in a difficult position.

Impact on D-Wave Quantum's Stock Price and Investor Sentiment

Following the release of Kerrisdale's report, D-Wave Quantum's stock price experienced a significant decline. [Insert chart illustrating QBTS stock price fluctuations here]. This drop reflects a sharp decrease in investor confidence. The market reacted negatively to the allegations of overstated capabilities and unrealistic financial projections. The negative sentiment further fueled short selling activity, exacerbating the price decrease. The long-term impact on D-Wave's reputation and ability to secure future funding remains to be seen. The change in investor sentiment is undeniable and has significant implications for future investment decisions.

The Future of D-Wave Quantum and the Quantum Computing Industry

The long-term prospects of D-Wave Quantum and the broader quantum computing industry are subject to considerable uncertainty. While Kerrisdale's report cast a shadow on D-Wave's immediate future, the overall potential of quantum computing remains vast. The technology is still in its early stages, and unforeseen breakthroughs could significantly alter the competitive landscape. Alternative viewpoints suggest that even if D-Wave faces challenges, the overall quantum computing market will continue to grow. This necessitates continued monitoring and analysis of advancements across all quantum computing technologies. The future of D-Wave Quantum hinges on its ability to innovate, adapt, and prove the practical value of its technology in the face of increasing competition. This will be a key factor in shaping future investment opportunities in the quantum computing sector.

Conclusion: Evaluating the D-Wave Quantum (QBTS) Stock Situation After the Kerrisdale Critique

Kerrisdale Capital's report has undeniably impacted D-Wave Quantum's stock price and investor sentiment. While D-Wave has attempted to counter the allegations, several uncertainties remain. Investors need to carefully weigh the arguments presented by both sides, acknowledging the limitations of currently available information. The future of D-Wave Quantum and the broader quantum computing industry remains uncertain. Before making any investment decisions concerning D-Wave Quantum (QBTS) stock, conduct thorough due diligence, carefully assess the inherent risks, and consider the potential rewards. Further research into quantum computing investments and the QBTS stock outlook is strongly encouraged.

Featured Posts

-

Immigration Fraud Allegations Lead To Us Ban For Wealthy Miami Hedge Fund Manager

May 20, 2025

Immigration Fraud Allegations Lead To Us Ban For Wealthy Miami Hedge Fund Manager

May 20, 2025 -

The Essential Wayne Gretzky Fast Facts Stats Records And More

May 20, 2025

The Essential Wayne Gretzky Fast Facts Stats Records And More

May 20, 2025 -

Giakoymakis I Kroyz Azoyl Prokrinetai Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis I Kroyz Azoyl Prokrinetai Ston Teliko Toy Champions League

May 20, 2025 -

Fa Cup Rashfords Two Goals Secure Manchester United Win Against Aston Villa

May 20, 2025

Fa Cup Rashfords Two Goals Secure Manchester United Win Against Aston Villa

May 20, 2025 -

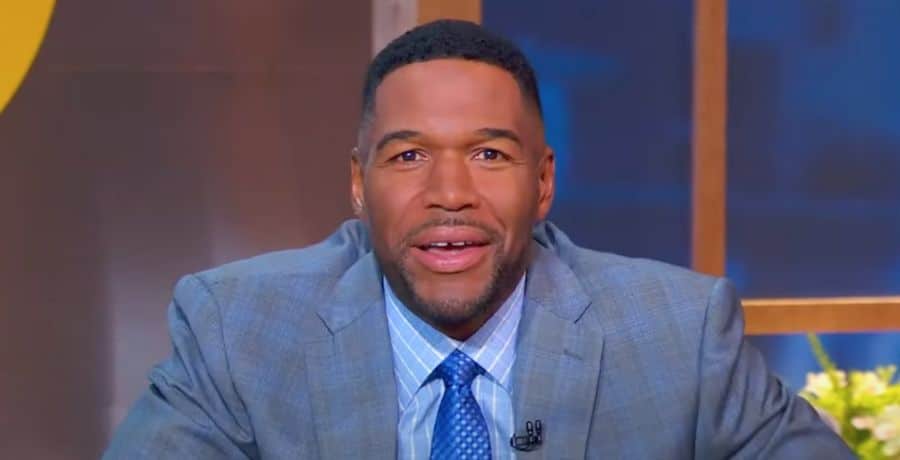

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025