D-Wave Quantum (QBTS) Stock Market Activity On Monday: A Deep Dive

Table of Contents

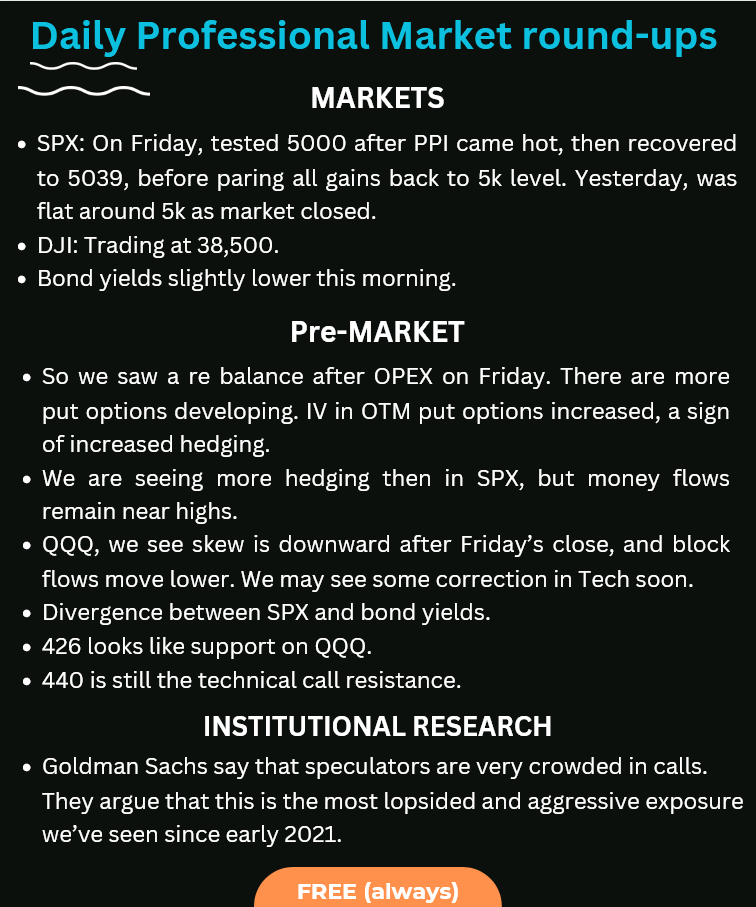

Monday's trading session for D-Wave Quantum (QBTS) stock presented a fascinating case study in market dynamics. This deep dive analyzes the key factors influencing QBTS's performance on Monday, examining the interplay of market sentiment, news events, and broader trends within the burgeoning quantum computing sector. We will dissect the day's price fluctuations and discuss potential implications for investors interested in this innovative technology.

Opening Bell and Early Trading

The opening price of QBTS on Monday offered an immediate insight into the prevailing market sentiment. Comparing the opening price to Friday's closing price reveals the initial trajectory of the stock. For instance, if the opening price was significantly higher, it might suggest positive overnight news or a generally bullish outlook on the quantum computing sector. Conversely, a lower opening price might indicate caution or profit-taking following Friday's trading.

- Opening price vs. closing price (Friday): A direct comparison provides the immediate percentage change, setting the stage for the day's activity.

- Percentage change in the first hour of trading: This metric illustrates the initial market reaction to the opening price and any early news.

- Volume of trades in the early session: High volume early on often suggests strong buying or selling pressure, while low volume might indicate indecision or a lack of significant catalysts.

- Relevant news or announcements: Any press releases, analyst reports, or industry news released before the market opened could heavily influence the early price movements. For example, a successful partnership announcement or a positive research finding could drive the price up.

Intraday Price Swings and Volume

Monday's QBTS trading likely exhibited intraday price swings, reflecting the fluctuating market sentiment throughout the session. Analyzing the high and low points helps determine the overall volatility of the stock on that particular day. Furthermore, correlating these price movements with the trading volume provides crucial insights into market forces.

- Daily high and low prices: These values define the range of price fluctuation for the day, highlighting the volatility of QBTS.

- Average trading volume for Monday: Comparing this to the average volume over a longer period can reveal if Monday's activity was unusually high or low.

- Significant volume spikes and their correlation to price changes: Large increases in volume often accompany sharp price movements, indicating significant buying or selling pressure. For example, a spike in volume during a price drop might suggest panic selling.

- Resistance and support levels: Technical analysis may reveal whether QBTS breached any significant resistance or support levels during Monday's trading, further informing the analysis.

Impact of News and Announcements

News events significantly influence stock prices. Any press releases, announcements from D-Wave Quantum itself, or broader news impacting the quantum computing sector could have directly affected QBTS's performance on Monday.

- Specific news items impacting QBTS: This could range from company-specific announcements (e.g., new contracts, product launches, funding rounds) to broader sector-specific news (e.g., government initiatives supporting quantum technology development, breakthroughs in quantum computing research).

- Market response (price increase/decrease, volume changes): A positive announcement is likely to cause an increase in price and volume, whereas negative news might lead to a price drop and increased trading activity.

- Analysis of the news's short-term and long-term effects: The immediate market reaction might differ from the long-term impact. A short-term price spike might fade if the news doesn't translate to sustained growth.

- Expert opinions or analyst comments: Analyst ratings and comments from financial experts often influence investor sentiment and consequently, the stock price.

Comparison to Sector Performance

Benchmarking QBTS's performance against its peers in the quantum computing sector and the broader technology market provides crucial context. Did QBTS outperform or underperform its competitors? Understanding the sector's overall performance helps determine if QBTS's movements were unique or reflective of broader market trends.

- Performance of major competitors in the quantum computing field: Comparing QBTS's performance to companies like IBM, Google, or IonQ reveals whether it's outperforming or underperforming in relation to its competition.

- Comparison of QBTS's performance to relevant market indices (e.g., Nasdaq): This helps to assess whether QBTS's movements are industry-specific or part of a broader market trend.

- Discussion of any macroeconomic factors impacting the tech sector: Broader economic conditions, interest rate changes, or investor confidence in the tech sector can influence the performance of all tech stocks, including QBTS.

Technical Analysis (Optional)

A brief overview of technical indicators could provide additional insights into Monday's QBTS performance.

- Support and resistance levels: Identification of these crucial price points can help explain price movements and predict future trends.

- Moving averages: Analyzing moving averages (e.g., 50-day, 200-day) can provide insights into the underlying trend.

Conclusion

Monday's trading activity for D-Wave Quantum (QBTS) revealed a volatile session influenced by a combination of company-specific news, broader market sentiment, and the overall performance of the quantum computing sector. Investors should consider the long-term potential of QBTS within the growing quantum computing market and the need to monitor news and sector performance closely. Stay informed about future D-Wave Quantum (QBTS) stock market activity to make informed investment decisions. Monitor QBTS and the quantum computing sector closely to capitalize on future opportunities in this exciting and rapidly evolving field.

Featured Posts

-

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

Breite Ton Efimereyonta Giatro Sas Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Ton Efimereyonta Giatro Sas Stin Patra 10 And 11 Maioy

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Market Movement Unpacking The Recent Spike

May 20, 2025

D Wave Quantum Inc Qbts Stock Market Movement Unpacking The Recent Spike

May 20, 2025 -

Taiwans Energy Shift Lng Imports To Fill Nuclear Gap

May 20, 2025

Taiwans Energy Shift Lng Imports To Fill Nuclear Gap

May 20, 2025 -

Aj Styles Contract Situation What We Know From Wwe Insiders

May 20, 2025

Aj Styles Contract Situation What We Know From Wwe Insiders

May 20, 2025