D-Wave Quantum (QBTS) Stock Plunge: Understanding Monday's Decline

Table of Contents

Analyzing the Magnitude of the D-Wave Quantum (QBTS) Stock Drop

Percentage Decrease and Trading Volume

Monday's trading saw a dramatic [Insert Specific Percentage]% decrease in the D-Wave Quantum (QBTS) stock price. This represents a significant departure from recent trends. To put this into perspective, let's compare it to recent volatility:

- Average Daily Volatility: [Insert Data – e.g., The average daily fluctuation in the past month was approximately X%].

- Average Weekly Volatility: [Insert Data – e.g., The average weekly fluctuation in the past month was approximately Y%].

- Average Monthly Volatility: [Insert Data – e.g., The average monthly fluctuation in the past three months was approximately Z%].

- Trading Volume: Trading volume on Monday surged to [Insert Data], [Insert Interpretation – e.g., significantly higher than the average daily volume, suggesting increased market activity and possibly panic selling]. This unusually high volume further underscores the severity of the drop. [Mention any unusual trading patterns observed, e.g., a large number of sell orders at the opening bell].

Potential Factors Contributing to the D-Wave Quantum (QBTS) Stock Decline

Lack of Recent Positive News or Announcements

The absence of positive catalysts is a key factor contributing to the QBTS stock decline. Recent weeks lacked significant positive news that could have buoyed investor confidence.

- Recent News Review: A review of recent press releases and company announcements reveals [Summarize recent news, highlighting the absence of significant positive developments].

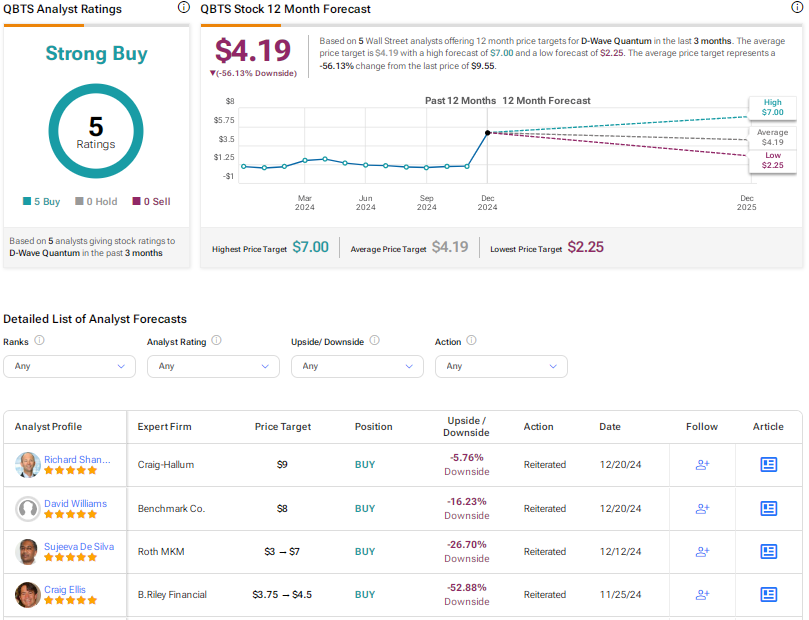

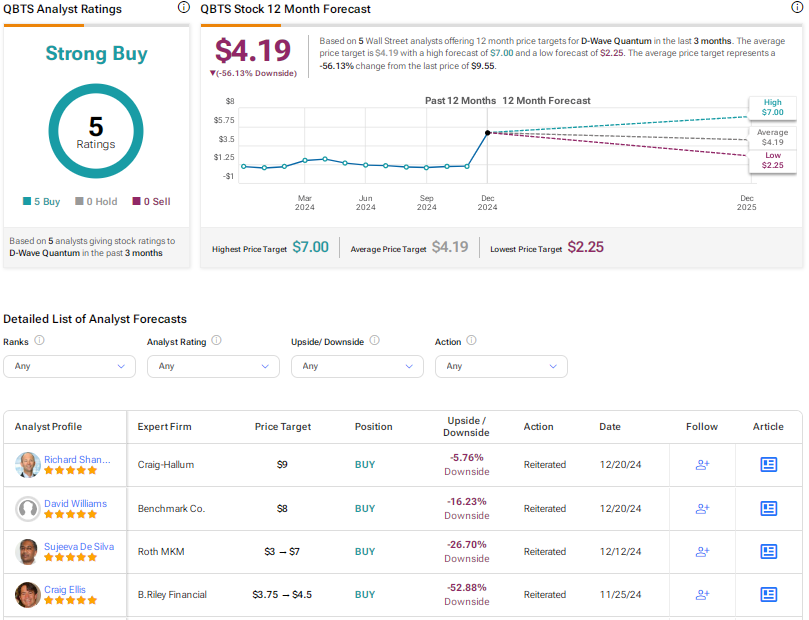

- Analyst Reports and Downgrades: [Mention any analyst reports or downgrades issued before or after the drop, including specific details about the reasoning behind any negative assessments].

- Quantum Computing Sector Sentiment: The overall sentiment surrounding the quantum computing sector has been [Describe the general market sentiment – e.g., somewhat cautious due to the long-term nature of the technology and the high investment required].

Broader Market Sentiment and Sector-Specific Concerns

The broader market context also played a role in the D-Wave Quantum (QBTS) stock drop.

- Performance of Other Quantum Computing Stocks: [Analyze the performance of competitor stocks in the quantum computing sector on Monday and in the preceding period. Did they experience similar drops, or was QBTS uniquely affected?].

- Macroeconomic Factors: [Mention any macroeconomic factors, such as interest rate hikes or broader economic uncertainty, that may have influenced investor behavior].

- Regulatory Changes and Competitive Pressures: [Discuss any recent regulatory changes or increased competitive pressure within the quantum computing market that might have contributed to the downturn].

Investor Reactions and Speculation

Analyzing investor sentiment across various platforms provides valuable insights.

- Social Media Sentiment: Social media discussions about QBTS on platforms like Twitter and StockTwits revealed [Summarize the prevailing sentiment – e.g., a mix of concern, speculation, and some short-term bearish predictions].

- Financial News Articles: Major financial news outlets reported on the drop, [Summarize the coverage, highlighting any recurring themes or explanations for the decline].

- Short-Selling Activity: [Mention if there was any significant increase in short-selling activity, which could have exacerbated the decline].

Assessing the Long-Term Implications for D-Wave Quantum (QBTS) Stock

Future Outlook and Potential Recovery

Despite Monday's decline, assessing D-Wave Quantum's long-term prospects requires a nuanced perspective.

- Technological Roadmap: D-Wave's technological roadmap includes [Mention key technological advancements and future plans, highlighting their potential to drive future growth].

- Financial Health and Stability: [Analyze D-Wave's financial health, including cash reserves, revenue streams, and debt levels].

- Future Partnerships and Collaborations: [Discuss the potential for future partnerships and collaborations that could boost D-Wave's market position and revenue].

Recommendations for Investors

Navigating this situation requires careful consideration.

- Avoid Impulsive Decisions: Investors should avoid making hasty decisions based solely on short-term market fluctuations.

- Conduct Thorough Due Diligence: Before making any investment decisions, thorough research on D-Wave Quantum (QBTS) and the quantum computing market is crucial. Assess the company's fundamentals, competitive landscape, and long-term growth potential.

- Risk Assessment: Evaluate your risk tolerance and investment horizon before investing in QBTS. This stock is considered high-risk due to the speculative nature of the quantum computing sector.

Conclusion:

The significant drop in D-Wave Quantum (QBTS) stock on Monday underscores the inherent volatility in the quantum computing sector. Understanding the various contributing factors—ranging from broader market trends to a lack of immediate positive company news and investor sentiment—is crucial for making informed decisions. Before making any investment decisions regarding your D-Wave Quantum (QBTS) stock holdings, thorough research and a careful risk assessment are paramount. Stay informed about future developments and announcements from D-Wave Quantum to effectively manage your D-Wave Quantum (QBTS) stock portfolio.

Featured Posts

-

Cin Gp Skandali Hamilton Ve Leclerc Yaristan Cikarildi

May 20, 2025

Cin Gp Skandali Hamilton Ve Leclerc Yaristan Cikarildi

May 20, 2025 -

Tampoy I Eksoysia Tis Alitheias Kai Oi Katastrofikes Epiptoseis

May 20, 2025

Tampoy I Eksoysia Tis Alitheias Kai Oi Katastrofikes Epiptoseis

May 20, 2025 -

I Tzenifer Lorens Kai Koyki Maroni Deytero Paidi Gia To Zeygari

May 20, 2025

I Tzenifer Lorens Kai Koyki Maroni Deytero Paidi Gia To Zeygari

May 20, 2025 -

China Assembles Supercomputer In Space Technological Leap Forward

May 20, 2025

China Assembles Supercomputer In Space Technological Leap Forward

May 20, 2025 -

Jutarnji List Nova Drama Najboljeg Hrvatskog Dramskog Pisca

May 20, 2025

Jutarnji List Nova Drama Najboljeg Hrvatskog Dramskog Pisca

May 20, 2025