D-Wave Quantum (QBTS) Stock Soars: Analyzing The Week's Price Increase

Table of Contents

Potential Catalysts Behind the QBTS Stock Increase

Several factors likely contributed to the recent QBTS stock price surge. These include positive news and announcements, increased investor interest in quantum computing as a whole, and potentially, market speculation and short covering.

Positive News and Announcements

Positive press releases, partnerships, and technological advancements can significantly impact investor sentiment. Recent events could include:

- New Partnerships: A newly announced partnership with a major technology company or research institution could signal increased adoption of D-Wave's quantum systems, boosting investor confidence.

- Successful Deployments: Reports of successful deployments of D-Wave's quantum annealing systems in solving complex real-world problems (e.g., materials science, drug discovery, financial modeling) would demonstrate the practical applications of their technology and attract more investment.

- Technological Breakthroughs: Any significant improvements in D-Wave's quantum processors or software, such as increased qubit count or improved performance metrics, would solidify their position in the market and enhance investor optimism. For example, the successful implementation of a new algorithm for optimized logistics solutions would be a major positive catalyst.

Increased Investor Interest in Quantum Computing

The quantum computing sector as a whole is experiencing a surge in investor interest. This broader trend positively impacts companies like D-Wave Quantum.

- Growing Venture Capital Investment: Significant investments by venture capitalists and other large investors into quantum computing startups signal a growing belief in the industry's long-term potential. This positive sentiment spills over to publicly traded companies like D-Wave.

- Market Forecasts: Positive forecasts predicting substantial growth in the quantum computing market in the coming years bolster investor confidence and encourage investment in the sector. Reports estimating a multi-billion dollar market by [Year] are likely to create a ripple effect across the industry.

- Competitor Activity: Positive news from competitors, even indirectly, can sometimes boost the entire sector, benefiting companies like D-Wave through association and increased market awareness.

Market Speculation and Short Covering

Market speculation and short-covering can also contribute significantly to rapid price increases.

- Short Squeeze: If a substantial number of investors had bet against D-Wave Quantum (short selling), a sudden surge in demand could trigger a short squeeze, forcing these investors to buy back shares to limit their losses, further driving up the price.

- Unusual Trading Activity: Monitoring unusual trading patterns, such as a sudden increase in trading volume or a significant jump in the price without apparent news, can indicate the influence of speculation and short-covering.

Analyzing the Financial Performance of D-Wave Quantum (QBTS)

Understanding D-Wave Quantum's financial performance is crucial for evaluating the sustainability of its stock price increase.

Recent Financial Results (if available)

Access to D-Wave's recent financial reports (e.g., quarterly earnings) is essential. Key performance indicators (KPIs) to analyze include:

- Revenue Growth: Sustained revenue growth demonstrates increasing demand for D-Wave's quantum computing solutions.

- Customer Acquisition: The number of new customers and their size indicates market penetration and the company's ability to attract and retain clients.

- Operational Efficiency: Improvements in operational efficiency show cost control and profitability, which are important factors for investors.

Valuation and Future Projections

Analyzing D-Wave Quantum's valuation relative to its competitors and considering analyst forecasts helps determine whether the current stock price is justified.

- Market Capitalization: Understanding D-Wave's market capitalization provides context for its valuation compared to the overall quantum computing market.

- Competitor Comparison: Comparing D-Wave's valuation with other publicly traded quantum computing companies helps determine whether it is overvalued or undervalued.

- Analyst Price Targets: Consulting analyst reports and price targets provides insights into future price expectations and potential investment risks.

Risks and Considerations for QBTS Investors

While the recent price increase is encouraging, it's essential to acknowledge the risks associated with investing in QBTS.

Volatility of the Quantum Computing Sector

The quantum computing sector is characterized by significant volatility.

- Early-Stage Technology: Quantum computing is still an early-stage technology, making it inherently risky. Unexpected technological challenges or slower-than-anticipated market adoption could significantly impact the company's performance.

- Market Volatility: The overall market volatility of the technology sector further amplifies the risk associated with investing in QBTS.

Competition and Technological Advancements

D-Wave Quantum faces intense competition in the quantum computing industry.

- Competitive Landscape: Several other companies are developing alternative approaches to quantum computing, potentially disrupting D-Wave's market position.

- Technological Disruption: Rapid advancements in competing technologies could render D-Wave's current technology obsolete or less competitive in the future.

Conclusion: D-Wave Quantum (QBTS) Stock Outlook and Investment Considerations

The recent surge in D-Wave Quantum (QBTS) stock price can be attributed to a combination of positive news, increased investor interest in the quantum computing sector, and potentially, market speculation. However, investors should also consider the inherent volatility of the quantum computing market and the competitive landscape. While the future outlook for D-Wave Quantum is promising, thorough due diligence is crucial before making any investment decisions. Continue researching D-Wave Quantum and the quantum computing market to make informed decisions about your investment portfolio. Understanding the potential catalysts and risks associated with QBTS is paramount for any investor considering adding this exciting, yet volatile, stock to their holdings.

Featured Posts

-

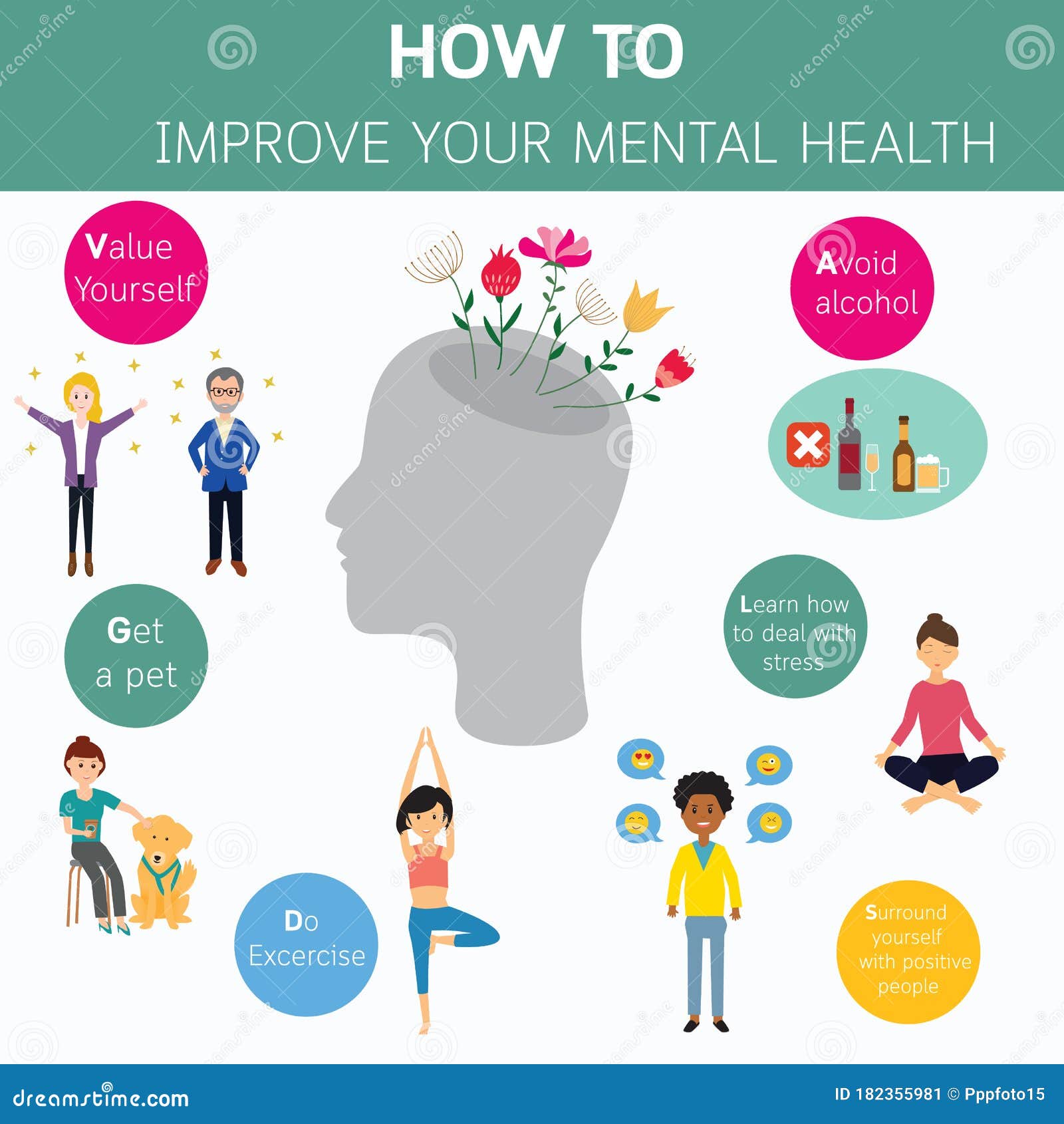

Boosting Resilience Strategies For Better Mental Health

May 21, 2025

Boosting Resilience Strategies For Better Mental Health

May 21, 2025 -

Nyt Mini Crossword May 1st Solution Marvel The Avengers Clue Explained

May 21, 2025

Nyt Mini Crossword May 1st Solution Marvel The Avengers Clue Explained

May 21, 2025 -

Strong Mainz Performance Earns Top Four Spot In Bundesliga

May 21, 2025

Strong Mainz Performance Earns Top Four Spot In Bundesliga

May 21, 2025 -

The Goldbergs A Nostalgic Look Back At 80s Family Life

May 21, 2025

The Goldbergs A Nostalgic Look Back At 80s Family Life

May 21, 2025 -

Original Sin Season 1 Finale Dexters Debra Morgan Mistake Revisited

May 21, 2025

Original Sin Season 1 Finale Dexters Debra Morgan Mistake Revisited

May 21, 2025