D-Wave Quantum (QBTS) Stock's Unexpected Increase: A Detailed Look

Table of Contents

Potential Catalysts for the D-Wave Quantum (QBTS) Stock Increase:

Positive Financial Results or Announcements: A significant driver behind any stock price increase is strong financial performance. Positive financial news regarding D-Wave Quantum (QBTS) could directly impact investor sentiment and drive up the stock price.

- Increased Revenue: Reports of substantial revenue growth, potentially fueled by increased adoption of D-Wave's quantum computing systems, would be a strong positive signal.

- Improved Profit Margins: Demonstrating an ability to improve profitability signifies a healthier and more sustainable business model, attractive to investors.

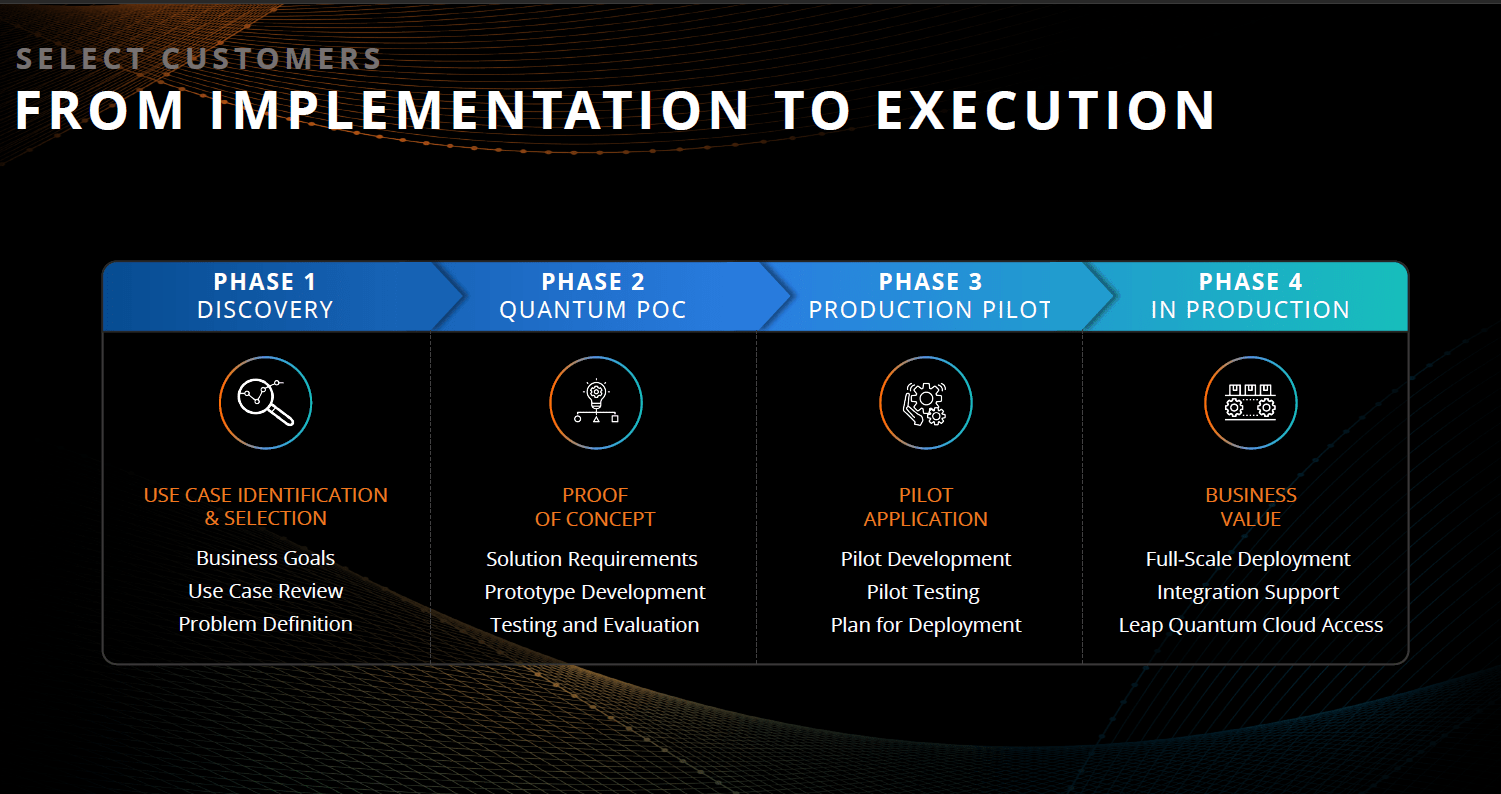

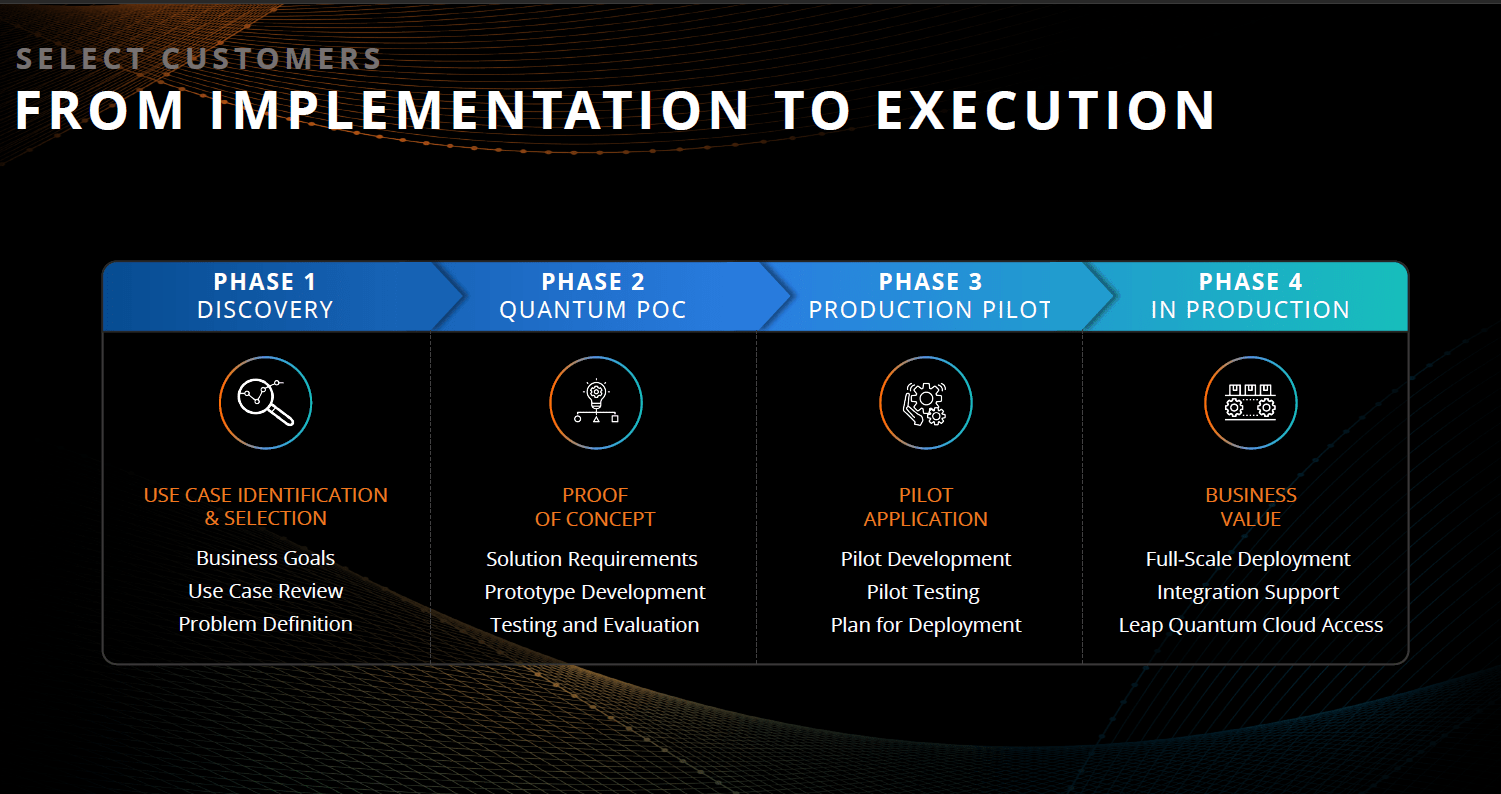

- New Customer Acquisitions: Securing contracts with major corporations or research institutions could significantly boost revenue projections and investor confidence in D-Wave Quantum (QBTS) stock.

- Strategic Partnerships: Announcements of collaborations with leading technology companies or research organizations can signal a significant leap in market penetration and potential for future growth. Any press releases highlighting these achievements would likely influence the stock price positively.

Technological Advancements and Breakthroughs: D-Wave's success hinges on its technological advancements. Breakthroughs in quantum annealing technology are likely to translate into increased investor confidence.

- Increased Qubit Count: Announcing an increase in the number of qubits in their quantum computers would signify a significant improvement in processing power and capabilities, making D-Wave more competitive.

- Improved System Stability: Demonstrating higher stability and reliability in their quantum systems would alleviate concerns about the practical application of their technology.

- New Algorithm Development: Creating innovative algorithms tailored for their quantum annealers would open doors to new applications and potentially attract more customers.

- Enhanced Performance Metrics: Publicly released benchmarks showing significant improvements in speed and accuracy compared to previous generations would attract investors.

Increased Industry Interest and Investment in Quantum Computing: The overall growth of the quantum computing sector impacts all players, including D-Wave.

- Government Funding: Increased government funding for quantum computing research and development often benefits the entire sector, boosting investor sentiment.

- Venture Capital Investments: Significant investments in other quantum computing companies can indicate a growing market and potentially spill over into increased interest in D-Wave Quantum (QBTS) stock.

- Industry Partnerships: Collaborations between major technology firms and quantum computing startups can generate positive media attention and boost market confidence.

- For example, increased collaboration with cloud providers could expand D-Wave's reach and accessibility, thus influencing its stock value. (Link to relevant news articles on industry partnerships could be inserted here).

Market Speculation and Analyst Upgrades: Market sentiment and analyst opinions significantly influence stock prices.

- Analyst Upgrades: Positive revisions of price targets or ratings from reputable financial analysts often trigger buying pressure.

- Increased Trading Volume: A sudden increase in trading volume might indicate a significant shift in investor interest and could be an early indicator of price changes.

- Positive Media Coverage: Favorable news coverage about D-Wave's progress or the quantum computing market overall can contribute to positive market speculation and drive up stock prices.

Analyzing the Risks Associated with Investing in D-Wave Quantum (QBTS) Stock:

Volatility and Market Uncertainty: Investing in the quantum computing sector carries significant risk due to its nascent nature.

- Market Corrections: The overall stock market's volatility can negatively affect even promising companies like D-Wave.

- Technological Setbacks: Unexpected technical challenges or delays in development could lead to significant stock price declines.

- Regulatory Uncertainty: Changes in government regulations or policies related to technology could impact D-Wave's operations and financial performance.

Competition in the Quantum Computing Industry: D-Wave faces fierce competition from established tech giants.

- Gate-based Quantum Computing: Companies developing gate-based quantum computers, such as IBM and Google, represent a significant competitive threat.

- Alternative Annealing Technologies: Other companies may develop competing annealing technologies that could outperform D-Wave's approach.

- Market Share: Securing a significant market share in the still-developing quantum computing industry is a major challenge for D-Wave.

Long-Term Viability and Profitability: D-Wave's long-term success depends on achieving profitability.

- Revenue Generation: Successfully transitioning from research and development to a commercially viable business model is critical.

- Scalability Challenges: Scaling up their quantum computing systems to meet growing market demand will be crucial for long-term success.

- Customer Adoption: Wide-scale adoption of D-Wave's technology by various industries is essential for sustainable revenue streams.

Conclusion:

The recent unexpected increase in D-Wave Quantum (QBTS) stock can be attributed to a combination of factors, including positive financial indicators, technological advancements, increased industry interest, and market speculation. However, investors should carefully consider the inherent risks associated with investing in a relatively young company operating in a volatile and competitive market. The long-term viability and profitability of D-Wave remain crucial factors to assess. Before making any investment decisions related to D-Wave Quantum (QBTS) stock, conduct thorough research and consider the information presented in this analysis. Learn more about D-Wave Quantum (QBTS) stock and analyze the potential of D-Wave Quantum (QBTS) before investing.

Featured Posts

-

March 24 2025 Nyt Mini Crossword Solutions And Hints

May 20, 2025

March 24 2025 Nyt Mini Crossword Solutions And Hints

May 20, 2025 -

Sinners Monte Carlo Training Weather Interrupts Preparations

May 20, 2025

Sinners Monte Carlo Training Weather Interrupts Preparations

May 20, 2025 -

Urgent New Wave Of Hmrc Nudge Letters What You Need To Know

May 20, 2025

Urgent New Wave Of Hmrc Nudge Letters What You Need To Know

May 20, 2025 -

Agatha Christies Poirot A Detective For The Ages

May 20, 2025

Agatha Christies Poirot A Detective For The Ages

May 20, 2025 -

Backstage Report The Latest On Aj Styles Wwe Contract

May 20, 2025

Backstage Report The Latest On Aj Styles Wwe Contract

May 20, 2025