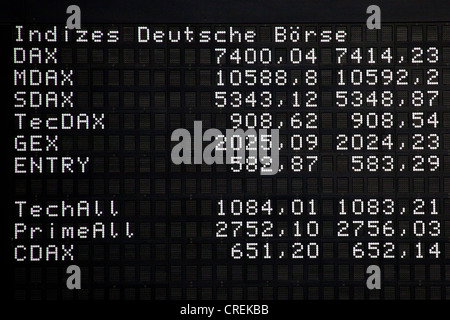

DAX Performance: Frankfurt Stock Market Opens Steady Following Record

Table of Contents

Factors Influencing Today's DAX Performance

Several interconnected factors contribute to the current DAX performance. Understanding these nuances is crucial for investors seeking to navigate the complexities of the Frankfurt Stock Exchange.

Global Market Sentiment

The overall global economic climate significantly impacts the DAX. Investor sentiment, a key driver of market movements, is influenced by a multitude of international events. Currently, several key factors are at play:

-

Impact of US inflation data on European markets: Recent US inflation data releases have sent ripples across global markets, impacting investor confidence and influencing risk appetite. Higher-than-expected inflation could lead to further interest rate hikes, potentially dampening economic growth and affecting German exports.

-

Influence of Chinese economic growth on German exports: China's economic performance plays a crucial role in the German economy, given the significant trade relationship between the two countries. Slowdowns in Chinese growth can negatively impact German exporters, leading to decreased profitability and potentially impacting DAX performance.

-

Effect of potential interest rate hikes by the European Central Bank (ECB): The ECB's monetary policy decisions have a direct impact on borrowing costs and investment decisions within the Eurozone. Potential interest rate hikes aimed at combating inflation could curb economic activity and influence DAX performance. Investors are closely monitoring the ECB's communication for clues regarding future policy decisions.

Company-Specific News

Significant news impacting individual DAX companies can cause considerable fluctuations in the index. Today's DAX performance is partially shaped by:

-

Performance of specific sectors within the DAX: Certain sectors, such as the automotive and technology industries, are particularly sensitive to global economic conditions. Strong performance in these key sectors can bolster the overall DAX performance, while underperformance can drag the index down.

-

Analysis of individual company stock performance within the index: The performance of individual DAX components, like Allianz, Volkswagen, or SAP, significantly impacts the overall index. Strong earnings reports or positive news for these major companies can contribute to a positive DAX performance, while negative news can have the opposite effect.

-

Impact of any recent regulatory changes on listed companies: New regulations or policy changes can influence the profitability and outlook of specific DAX companies, subsequently impacting their stock prices and overall DAX performance.

Technical Analysis of DAX Movement

Technical analysis offers further insights into the current DAX trends. Observing key indicators helps gauge potential future movements:

-

Analysis of trading volume and its implications: High trading volume often suggests strong conviction behind price movements, indicating a potential continuation of the trend. Low volume, conversely, may signal indecision and a potential for price reversal.

-

Interpretation of moving averages and other technical indicators: Moving averages, Relative Strength Index (RSI), and other technical indicators provide signals about potential support and resistance levels, as well as the strength of the current trend. These are valuable tools for short-term trading strategies.

-

Discussion of potential short-term and long-term price targets: Based on technical analysis, analysts can set potential short-term and long-term price targets for the DAX, offering guidance for investors with different time horizons.

DAX Performance Compared to Other Major Indices

Comparing the DAX's performance to other major global indices like the Dow Jones Industrial Average (DJIA), FTSE 100, and CAC 40 provides valuable context.

-

Correlation between DAX movement and other global indices: The DAX often correlates with other major global indices, reflecting the interconnectedness of global financial markets. However, there are also instances of divergence, driven by factors specific to the German economy or European Union policies.

-

Factors contributing to divergence or convergence with other markets: Divergence can stem from factors such as differing economic growth rates, sector-specific performance variations, or unique geopolitical risks affecting specific regions. Convergence, on the other hand, suggests a shared response to broader global macroeconomic events.

-

Comparative analysis of sector-specific performance across different indices: Analyzing sector-specific performance across different indices can reveal whether the DAX's performance is being driven by broad market trends or specific sector dynamics within the German economy.

Future Outlook for DAX Performance

Predicting future DAX performance requires considering various factors, and any forecast should be viewed with caution.

-

Potential impact of upcoming economic data releases: Upcoming economic data releases, such as GDP growth figures, inflation reports, and unemployment data, will significantly influence investor sentiment and potentially impact DAX performance.

-

Influence of geopolitical events on investor confidence: Geopolitical events, such as international conflicts or policy changes, can create uncertainty and volatility in the markets, affecting investor confidence and influencing DAX performance.

-

Forecast of potential DAX price movements based on various scenarios: Analysts develop forecasts based on different economic scenarios, ranging from optimistic to pessimistic outlooks. These forecasts can help investors make informed decisions based on various risk appetites.

Conclusion

The DAX opened steadily today, following a record high, showcasing resilience despite global market uncertainties. Several factors including global sentiment, company-specific news, and technical indicators have all played a role in shaping today’s DAX performance. Comparing the DAX to other major indices provides a broader context for understanding its current trajectory.

Call to Action: Stay informed about the latest developments impacting DAX performance to make informed investment decisions. Continue following our analysis for further updates on the DAX and other key market indicators. Monitor DAX performance closely for crucial insights into the German and European economies. Understanding DAX performance is key to navigating the German and broader European markets effectively.

Featured Posts

-

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

Investasi Di Mtel And Mbma Panduan Setelah Penambahan Ke Msci Small Cap

May 24, 2025

Investasi Di Mtel And Mbma Panduan Setelah Penambahan Ke Msci Small Cap

May 24, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025 -

The Kyle Walker Annie Kilner Dispute Poisoning Accusations Investigated

May 24, 2025

The Kyle Walker Annie Kilner Dispute Poisoning Accusations Investigated

May 24, 2025

Latest Posts

-

French Presidents Party Seeks Public Hijab Ban For Minors

May 24, 2025

French Presidents Party Seeks Public Hijab Ban For Minors

May 24, 2025 -

Dreyfus Case A Modern Examination Of Justice And Military Honor In France

May 24, 2025

Dreyfus Case A Modern Examination Of Justice And Military Honor In France

May 24, 2025 -

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 24, 2025

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 24, 2025 -

France Revisits Dreyfus Affair Legislators Advocate For Promotion

May 24, 2025

France Revisits Dreyfus Affair Legislators Advocate For Promotion

May 24, 2025 -

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025