DAX Soars: Frankfurt Equities Open Higher, Record High In Sight

Table of Contents

Strong Opening for DAX – Key Drivers Behind the Surge

The DAX experienced a robust opening, surging by X% (replace X with the actual percentage). This impressive increase isn't a random event; several key factors are contributing to this positive market momentum.

- Positive Corporate Earnings Reports: Numerous DAX-listed companies have recently released strong quarterly earnings reports, exceeding analysts' expectations. This positive news boosts investor confidence and fuels further investment. Strong corporate profits are a major indicator of economic health and future growth potential.

- Robust Economic Indicators: Germany's economy is showing signs of resilience. Positive GDP growth figures, coupled with relatively stable inflation numbers, are creating a favorable environment for stock market investment. This economic growth directly translates into increased corporate earnings and a more bullish investor sentiment.

- Positive Global Market Sentiment: The positive trajectory of the DAX is also influenced by positive global market sentiment. Positive developments in other major markets, like the US and Asia, often have a ripple effect, boosting investor confidence worldwide. This international investment climate contributes significantly to the overall market performance.

- Strong Sector Performance: Certain sectors within the DAX are particularly thriving. The technology sector, in particular, is experiencing significant growth, while the automotive industry is also showing promising signs of recovery. This sector performance reflects broader economic trends and technological advancements.

Frankfurt Equities – Sector-Specific Performance

The surge in the DAX isn't uniform across all sectors. Several sectors within the Frankfurt Stock Exchange are experiencing particularly significant gains.

- The technology sector witnessed the most dramatic increase, with companies like [Company A] and [Company B] experiencing double-digit percentage gains. This strong performance reflects the ongoing digital transformation and robust demand for tech products and services.

- The automotive sector also displayed strong growth, with [Company C] and [Company D] showing substantial increases due to [reason for growth, e.g., new model launches, increased demand]. This signifies a positive outlook for the sector after a period of challenges.

Here's a list of some top performers and their approximate percentage gains (replace with actual data):

- Company A: +15%

- Company B: +12%

- Company C: +8%

- Company D: +7%

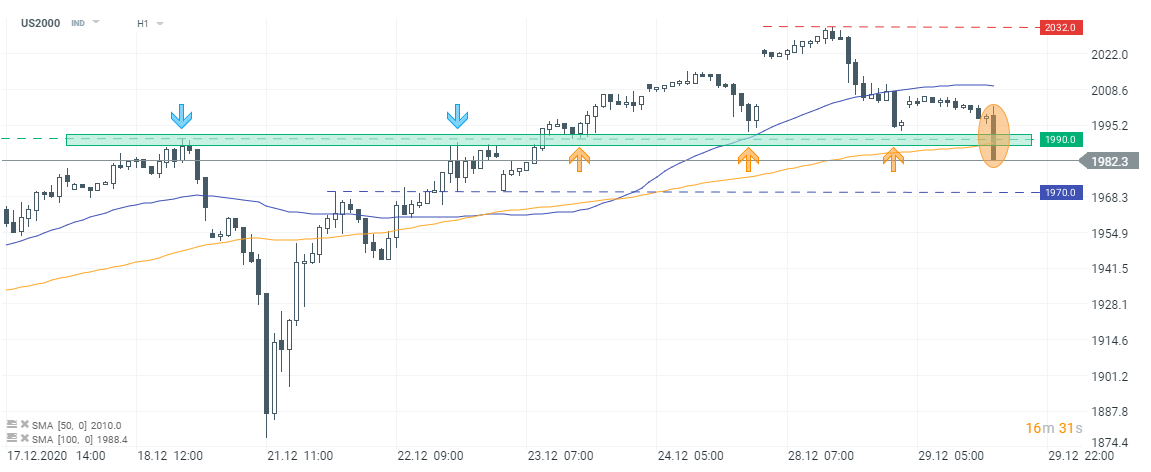

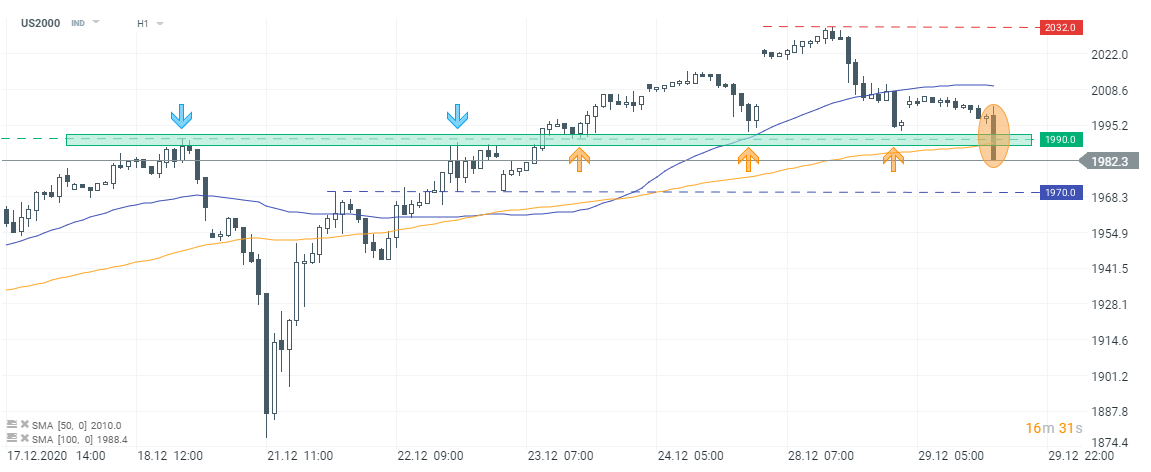

Record High in Sight – Implications for Investors

The current trajectory strongly suggests that the DAX is on track to reach a new all-time high. This prospect presents both exciting opportunities and potential risks for investors.

- Potential for Further Gains: The sustained positive momentum increases the likelihood of further gains in the short to medium term. This presents significant investment opportunities for those willing to take on some risk.

- Risks Associated with Market Highs: It's crucial to remember that markets at record highs are inherently more vulnerable to corrections. The potential for volatility increases, and investors need to be prepared for potential downturns. A cautious approach to risk assessment is paramount.

Advice for Investors:

- Diversify your portfolio across different asset classes to mitigate risk.

- Implement a robust risk management strategy.

- Consider long-term investment strategies rather than short-term speculation.

Global Market Context – DAX's Position in the Broader Picture

The DAX's strong performance needs to be viewed within the broader context of global market trends. While the surge is partly driven by domestic factors, it also reflects positive global sentiment and interconnectedness of international markets.

- The DAX's performance is showing a positive correlation with other major indices, such as the Dow Jones and FTSE 100, suggesting a global upswing. However, the magnitude of the increase varies across markets, highlighting regional differences in economic conditions and investor sentiment.

Conclusion: DAX Soars – Navigating the Market's Ascent

The DAX's significant rise is driven by a confluence of factors, including strong corporate earnings, robust economic indicators, positive global market sentiment, and impressive sector performance within the Frankfurt equities market. The potential for a record high is undeniable, presenting both exciting opportunities and inherent risks. Thorough market analysis and informed investment decisions are crucial for navigating this upward trajectory. Stay informed about the DAX and Frankfurt equities market trends through regular monitoring and, if necessary, seek professional financial advice. Continue researching and understanding the nuances of DAX investing to make the most of this dynamic market.

Featured Posts

-

The Ultimate Guide To An Escape To The Country

May 24, 2025

The Ultimate Guide To An Escape To The Country

May 24, 2025 -

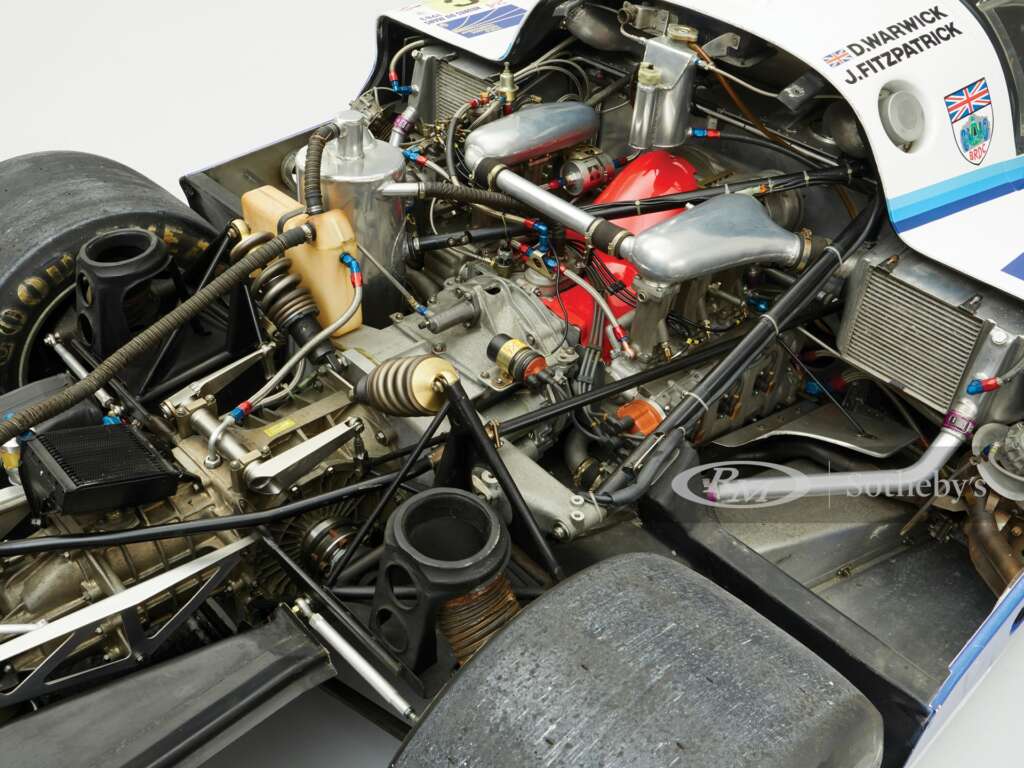

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025 -

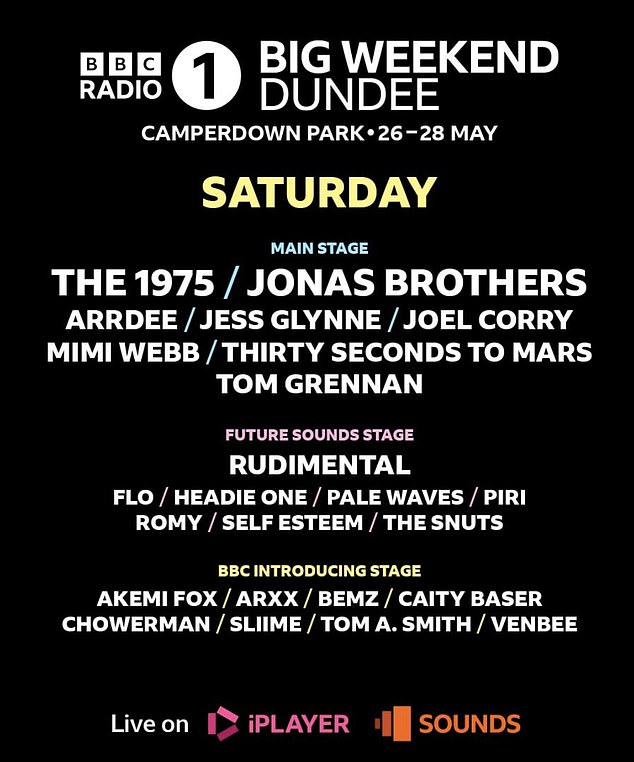

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025 -

Finding Your Perfect Country Escape A Practical Guide

May 24, 2025

Finding Your Perfect Country Escape A Practical Guide

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

Latest Posts

-

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025 -

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025 -

Seeking Change Facing Punishment Navigating Reprisals For Dissent

May 24, 2025

Seeking Change Facing Punishment Navigating Reprisals For Dissent

May 24, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025