DBS Singapore: Giving Polluters Time To Reform?

Table of Contents

DBS's Current Environmental, Social, and Governance (ESG) Policies

DBS Bank Singapore publicly champions robust Environmental, Social, and Governance (ESG) commitments. Their stated goals include significant investments in renewable energy, sustainable supply chains, and carbon reduction initiatives. However, the effectiveness of these policies in curbing pollution from financed companies remains a subject of ongoing debate. While DBS highlights its progress in areas such as renewable energy financing, critics argue that a lack of transparency and insufficient enforcement hinder meaningful change.

-

Specific examples of DBS's ESG initiatives: DBS has pledged to mobilize S$50 billion in green financing by 2024 and has invested in several solar energy projects across Southeast Asia. They also claim to be actively promoting sustainable supply chain practices among their clients.

-

Criticisms of their ESG policies: Critics point to a lack of detailed, publicly available data on the environmental impact of companies they finance. Furthermore, concerns exist about the lack of consequences for companies failing to meet agreed-upon ESG targets.

-

Comparison with other major banks' ESG strategies: Compared to international counterparts like HSBC or Citibank, some argue that DBS Bank Singapore's ESG framework lacks the stringent enforcement mechanisms and transparency seen elsewhere. This comparison is essential for evaluating the effectiveness of DBS Singapore’s approach.

Case Studies: Analyzing DBS's Financing of Polluting Industries

Examining specific cases illuminates the complexities involved. Let's consider three examples:

-

Case Study 1: Company X (Petrochemicals): Company X, a petrochemical firm financed by DBS Singapore, has faced significant criticism for high greenhouse gas emissions and waste discharge. Despite public pressure, DBS's response has been largely muted, leading to accusations of prioritizing profit over environmental protection.

- Polluting Activities: High carbon emissions, significant plastic waste generation.

- DBS's Financial Involvement: Significant loans and investment in expansion projects.

- Public Response: Protests, petitions, and media scrutiny.

- DBS's Response: Limited public statements, no announced changes in financing practices.

-

Case Study 2: Company Y (Palm Oil): Company Y, a palm oil producer, has been linked to deforestation and habitat destruction. DBS Singapore’s continued financial support, despite the company's controversial practices, has drawn considerable negative attention.

- Polluting Activities: Deforestation, habitat loss, peatland drainage.

- DBS's Financial Involvement: Provision of working capital and expansion loans.

- Public Response: Boycotts, NGO campaigns targeting DBS.

- DBS's Response: Commitments to “responsible sourcing” but lacking concrete action.

-

Case Study 3: Company Z (Coal Mining): Company Z, a coal mining operation, presents a clear example of a high-carbon-emitting industry receiving financing from DBS Singapore. This investment raises questions about DBS's commitment to its stated ESG goals.

- Polluting Activities: Significant carbon emissions, land degradation.

- DBS's Financial Involvement: Funding for equipment and operational expenses.

- Public Response: Pressure from investors and environmental activists.

- DBS's Response: Limited public engagement, no clear indication of divestment plans.

The Role of Regulatory Pressure and Public Opinion

Singapore's government plays a crucial role. While Singapore has implemented various environmental regulations, their effectiveness in influencing DBS's practices requires further scrutiny. Public pressure, through activist campaigns and media attention, can also significantly impact corporate behavior.

- Relevant Singaporean environmental regulations: Singapore's carbon tax and various environmental protection acts provide a regulatory framework.

- Examples of public campaigns: Numerous NGOs and activist groups actively monitor and publicly criticize DBS's financing practices.

- Analysis of the impact: While public pressure and regulations have had some impact, the extent to which they have driven substantial change at DBS Singapore remains debatable.

The Balancing Act: Economic Growth vs. Environmental Sustainability

Singapore faces a complex challenge: balancing rapid economic growth with environmental protection. Arguments exist for a more lenient approach to reforming polluting industries to avoid economic disruption. However, the long-term economic and social costs of environmental damage – including health issues, resource scarcity, and climate change impacts – must be considered. A failure to act decisively now could lead to far greater economic and social costs in the future.

Conclusion: Holding DBS Singapore Accountable for Environmental Impact

Our examination of DBS Singapore's approach to financing polluting industries reveals a mixed picture. While the bank has made some progress in its ESG initiatives, concerns remain regarding the transparency, enforcement, and impact of its policies. The question of whether DBS Singapore is giving polluters enough time to reform remains unanswered. However, it's clear that stronger action is needed. We must demand better from DBS Singapore. Holding DBS Singapore accountable requires active engagement from all stakeholders.

Call to Action: Write to DBS Singapore, urging them to implement stricter ESG standards and increase transparency. Support environmental NGOs working to hold financial institutions accountable. Engage in public discussions about responsible financing practices. Demand concrete action, not just promises, from DBS Singapore to improve its environmental performance. Together, we can push for meaningful change and ensure DBS Bank Singapore plays a constructive role in safeguarding Singapore's environment for future generations.

Featured Posts

-

Celtics Vs Nets Jayson Tatums Status For Tonights Game

May 08, 2025

Celtics Vs Nets Jayson Tatums Status For Tonights Game

May 08, 2025 -

Jysws Wflamnghw Ray Alshmrany Fy Alsfqt Fydyw Kaml

May 08, 2025

Jysws Wflamnghw Ray Alshmrany Fy Alsfqt Fydyw Kaml

May 08, 2025 -

Can Ripples Xrp Break Through Resistance To Hit 3 40

May 08, 2025

Can Ripples Xrp Break Through Resistance To Hit 3 40

May 08, 2025 -

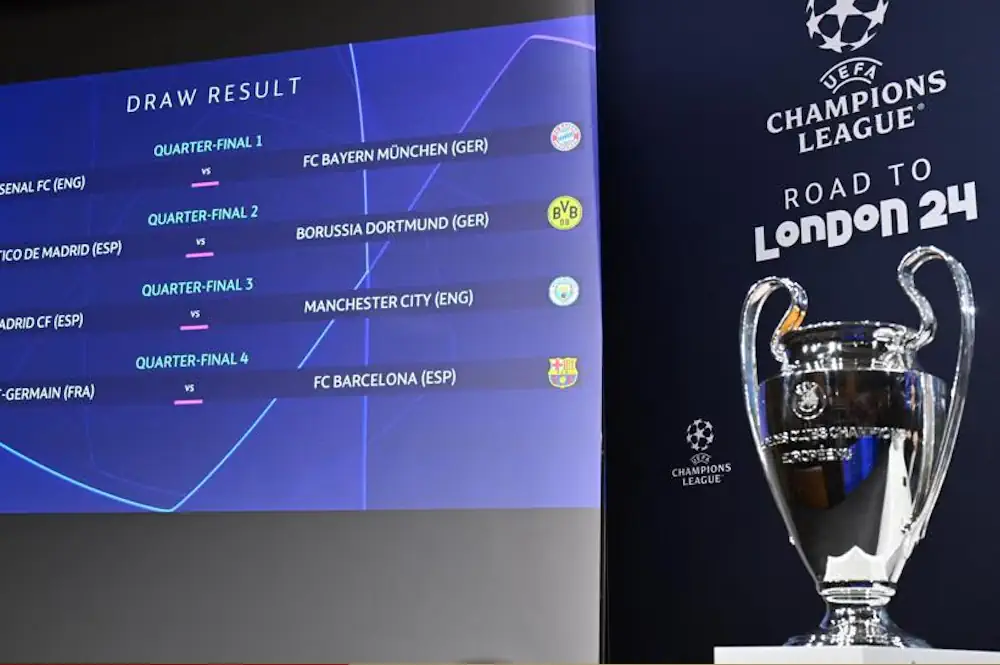

Liga Chempionov 2024 2025 Predmatcheviy Obzor Igr Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predmatcheviy Obzor Igr Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

Xrps Recent Increase Exploring The Link To President Trump

May 08, 2025

Xrps Recent Increase Exploring The Link To President Trump

May 08, 2025