De Minimis Tariffs On Chinese Goods: G-7's Upcoming Discussion

Table of Contents

The Current State of De Minimis Tariffs on Chinese Goods

Understanding De Minimis Tariffs

De minimis tariffs refer to the value threshold below which imported goods are exempt from import duties or customs duties. This threshold, the "de minimis value," varies significantly across countries. These tariffs aim to simplify customs procedures for small shipments, often those associated with e-commerce. However, the impact on imports from China, a major global exporter, is substantial.

- Definition: A de minimis tariff is a policy that exempts small import shipments from customs duties, simplifying the import process for low-value goods.

- Current Thresholds: The current de minimis value for import duty varies widely. Some countries have relatively high thresholds, while others maintain lower limits, influencing the cost-effectiveness of importing smaller quantities of goods from China.

- Impact on Small Businesses: Small and medium enterprises (SMEs) often rely on importing smaller quantities of goods. Higher de minimis thresholds can significantly reduce their import costs and administrative burden.

The Impact of Current Tariffs on Businesses

The current de minimis tariff structure significantly impacts businesses importing goods from China. Higher tariffs increase import costs, creating logistical challenges and competitive disadvantages, particularly for smaller businesses.

- Increased Costs: Higher import duties increase the final cost of goods, reducing profit margins and potentially impacting consumer prices.

- Logistical Challenges: Navigating customs procedures and paying import duties adds complexity and cost to the supply chain.

- Competitive Disadvantages for SMEs: Smaller businesses are disproportionately affected by higher tariffs due to their limited resources and lower economies of scale.

- Impact on Consumer Prices: Increased import costs can translate to higher consumer prices, potentially reducing consumer demand.

The G-7's Planned Discussion and Potential Outcomes

Reasons for the G-7 Review

The G-7's decision to review the de minimis tariff structure stems from a confluence of factors. Economic pressures, geopolitical considerations, and lobbying by businesses all play a role.

- Economic Pressures: Global economic slowdowns and supply chain disruptions have highlighted the need for a more efficient and predictable trade environment.

- Geopolitical Considerations: The relationship between the G-7 nations and China significantly influences the discussion, with trade policy often intertwined with broader geopolitical strategies.

- Lobbying by Businesses: Businesses, particularly those involved in e-commerce and importing goods from China, have actively lobbied for adjustments to the de minimis tariff structure.

- Consumer Impact: The impact of tariffs on consumer prices and access to goods is a key factor influencing the G-7's deliberations.

Possible Scenarios

The G-7 discussions could result in several outcomes, each with significant implications.

- Increased Tariffs: Raising de minimis tariffs could protect domestic industries but might also increase consumer prices and reduce global trade.

- Decreased Tariffs: Lowering tariffs could boost economic growth and increase consumer choice, but might raise concerns about unfair competition and job displacement in domestic industries.

- Maintaining the Status Quo: Keeping the current structure could provide stability, but might not address the underlying challenges faced by businesses and consumers. This could lead to ongoing uncertainty.

Arguments For and Against Changes to De Minimis Tariffs

Arguments for Increasing Tariffs

Proponents of raising de minimis tariffs on Chinese goods argue that this approach is necessary to protect domestic industries and ensure fair trade practices.

- Protecting Domestic Jobs: Higher tariffs could safeguard jobs in domestic industries by reducing competition from cheaper imports.

- Addressing Unfair Trade Practices: Increasing tariffs might be viewed as a means to counteract perceived unfair trade practices, such as dumping or government subsidies.

- Bolstering National Security: In certain sectors deemed critical to national security, higher tariffs could protect domestic production capabilities.

Arguments for Decreasing Tariffs

Conversely, arguments for lowering de minimis tariffs emphasize the benefits for consumers and businesses.

- Lower Consumer Prices: Reduced tariffs would likely lead to lower prices for consumers, increasing affordability and purchasing power.

- Increased Choice: Lower tariffs increase the availability of a wider range of goods, boosting competition and consumer choice.

- Boosting Economic Competitiveness: Lower import costs can increase the competitiveness of businesses that rely on imported goods from China.

- Promoting Global Trade: Lowering tariffs promotes a more open and integrated global trading system.

Conclusion

The G-7's upcoming discussion on de minimis tariffs on Chinese goods represents a critical juncture in global trade relations. The potential outcomes—increased tariffs, decreased tariffs, or maintaining the status quo—will significantly impact businesses, consumers, and the overall economic landscape. Understanding the arguments for and against changes to these tariffs is crucial to navigating this complex trade negotiation. The decision will affect supply chains, consumer prices, and the competitive balance between domestic and imported goods.

To stay abreast of the implications of de minimis tariffs on Chinese goods, continue to follow the latest news and analysis from reputable sources. The outcome of this G-7 discussion will have lasting consequences for the global economy, making it a pivotal event to monitor closely.

Featured Posts

-

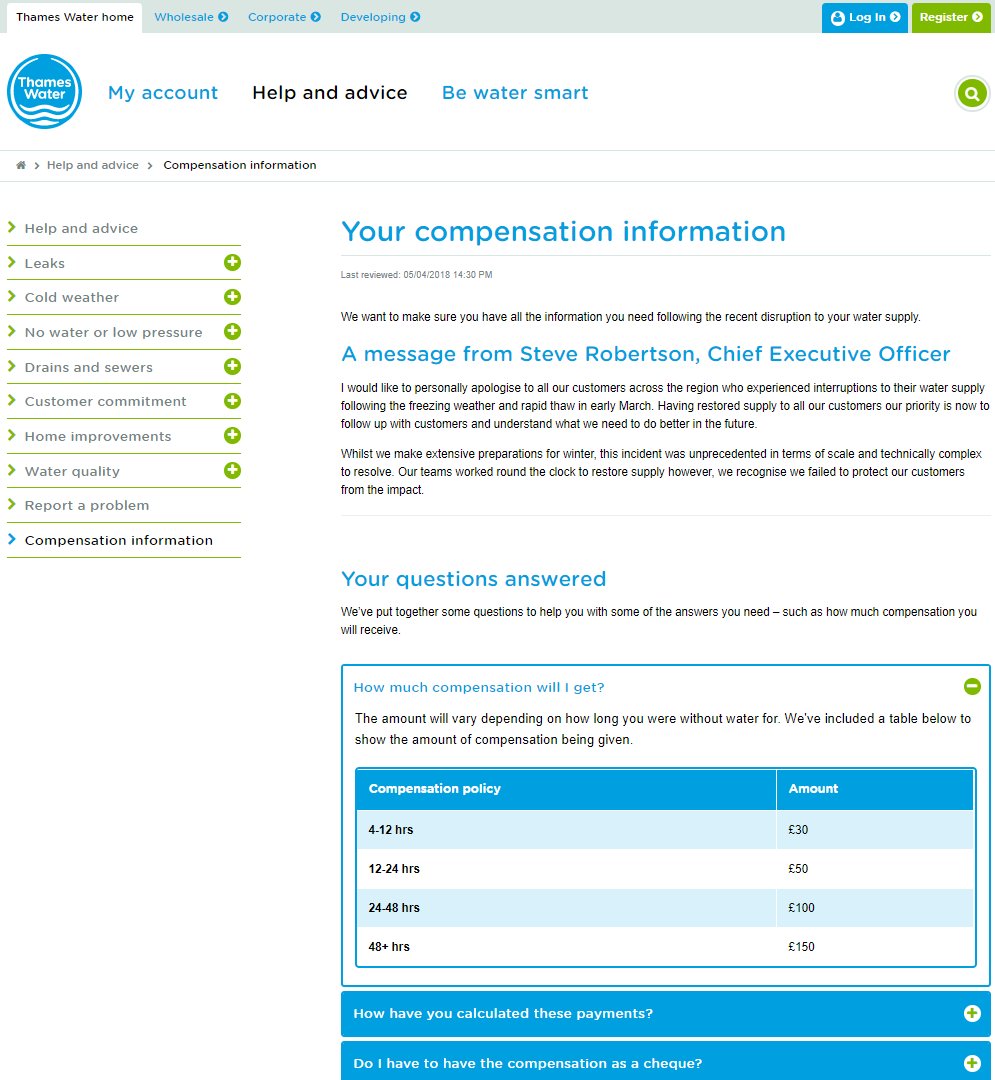

Are Thames Water Executive Bonuses Fair Public Outcry And Analysis

May 26, 2025

Are Thames Water Executive Bonuses Fair Public Outcry And Analysis

May 26, 2025 -

Zwischen Zwei Grossereignissen Der Kampf Des Hsv Um Den Aufstieg

May 26, 2025

Zwischen Zwei Grossereignissen Der Kampf Des Hsv Um Den Aufstieg

May 26, 2025 -

Thierry Ardisson Soirees Endiablees Devant 50 Personnes

May 26, 2025

Thierry Ardisson Soirees Endiablees Devant 50 Personnes

May 26, 2025 -

Tl Abyb Tshhd Tzahrat Hashdt Llmtalbt Bitlaq Srah Alasra

May 26, 2025

Tl Abyb Tshhd Tzahrat Hashdt Llmtalbt Bitlaq Srah Alasra

May 26, 2025 -

Jadwal Moto Gp Inggris 2025 Live Streaming Trans7 And Spotv Klasemen Terbaru

May 26, 2025

Jadwal Moto Gp Inggris 2025 Live Streaming Trans7 And Spotv Klasemen Terbaru

May 26, 2025