Decoding Buffett's Apple Success: Insights For Smart Investing

Table of Contents

Understanding Buffett's Investment Philosophy and its Alignment with Apple

Buffett's investment philosophy, rooted in value investing principles, perfectly aligns with Apple's characteristics. This synergy is a major reason behind the success of his Apple investment.

Value Investing Principles

Buffett's approach centers around identifying undervalued companies with strong fundamentals, long-term growth potential, and a durable competitive advantage, often referred to as a "moat." This involves:

- Intrinsic value calculation: Determining a company's true worth based on its future cash flows.

- Margin of safety: Buying assets significantly below their intrinsic value to cushion against potential losses.

- Long-term perspective: Focusing on long-term growth and avoiding short-term market fluctuations.

- Understanding business models: Thoroughly researching and understanding how a company generates revenue and profits.

Apple perfectly fits this criteria. Its strong brand, loyal customer base, and recurring revenue streams from services like iCloud and Apple Music provide a durable competitive advantage, aligning seamlessly with Buffett's value investing principles. The Buffett's Apple investment demonstrates the power of this philosophy.

The Power of Brand and Consumer Loyalty

Apple's success is inextricably linked to its powerful brand and the unwavering loyalty of its customers. This translates into significant competitive advantages:

- Brand value as an intangible asset: Apple's brand is arguably one of the most valuable assets in the world, commanding premium pricing and fostering strong customer loyalty.

- Customer stickiness: Once a customer enters the Apple ecosystem, they're less likely to switch to competing platforms.

- The Apple ecosystem: The seamless integration of Apple's devices and services creates a powerful network effect, further strengthening customer loyalty.

This strong brand loyalty translates into predictable revenue streams and significant pricing power, making Apple an attractive investment for a value investor like Buffett. The enduring strength of the Apple brand is a key element in understanding the success of Buffett's Apple investment.

Analyzing Apple's Financial Performance and Growth Potential

Apple’s financial performance has consistently impressed, providing a strong foundation for Buffett’s investment decision and its subsequent success.

Consistent Profitability and Cash Flow

Apple boasts consistently strong financial performance:

- Revenue growth analysis: Apple has shown sustained revenue growth over the years, demonstrating consistent market demand for its products and services.

- Profit margin trends: High profit margins indicate strong pricing power and efficient operations.

- Cash flow generation: Apple generates massive amounts of free cash flow, allowing it to reinvest in research and development, return capital to shareholders through dividends and buybacks, and make strategic acquisitions.

- Dividend history: Apple's dividend payments have grown steadily over time, providing a reliable income stream for investors.

These metrics firmly supported Buffett's belief in Apple's long-term growth trajectory, a cornerstone of his Buffett's Apple investment strategy.

Innovation and Future Growth Opportunities

Apple's ongoing commitment to innovation fuels future growth potential:

- New product launches: The continued success of iPhones is complemented by the expansion into wearables (Apple Watch, AirPods), and robust growth in the services sector (Apple Music, Apple TV+, iCloud).

- Expansion into emerging markets: Apple continues to expand its market reach into developing economies with significant growth potential.

- Technological advancements: Continuous investment in research and development ensures Apple remains at the forefront of technological innovation.

These factors contribute significantly to the long-term investment appeal of Apple, illustrating why it was such a compelling opportunity for Buffett's investment portfolio. The foresight of the Buffett's Apple investment is clear in this perspective.

Managing Risk and Diversification in a Portfolio

Buffett’s approach to risk management in his Apple investment offers valuable lessons.

Concentrated vs. Diversified Holdings

Buffett is known for taking concentrated positions, a stark contrast to traditional diversification strategies.

- Benefits and drawbacks of concentrated holdings: Concentrated positions can lead to outsized returns, but also increase risk.

- Thorough due diligence: The key is meticulous due diligence to thoroughly understand the investment before committing significant capital.

- Risk management strategies: Even with concentrated positions, risk management is crucial; understanding the business intimately helps mitigate potential downsides.

Buffett's deep understanding of Apple’s business model, financial strength, and competitive advantages mitigated the risk of his concentrated position. His expertise allowed him to confidently place a significant portion of Berkshire Hathaway's portfolio into this single investment.

The Importance of Patience and Long-Term Perspective

Patience is paramount in successful investing:

- Avoiding short-term market fluctuations: Focusing on long-term value creation minimizes the impact of short-term market volatility.

- The power of compounding: Long-term investments benefit from the power of compounding returns over time.

- Staying disciplined during market downturns: Maintaining a disciplined approach, even during market declines, is critical for long-term success.

The success of Buffett's Apple investment underscores the importance of this long-term approach. It showcases the rewards that patience and a steadfast focus on fundamental value can deliver.

Conclusion

Warren Buffett's success with Apple underscores the importance of thorough due diligence, a long-term perspective, and a deep understanding of a company's fundamentals. By applying similar principles of value investing, analyzing financial performance, and managing risk effectively, investors can increase their chances of achieving similar success in their own portfolios. Understanding and applying the insights gained from Buffett's Apple investment is crucial for anyone looking to improve their investment strategy and achieve long-term investment success. Begin your journey towards smarter investing today by researching companies with strong fundamentals and long-term growth potential. Learn to identify the next Buffett's Apple investment opportunity!

Featured Posts

-

Celtics Vs Heat Live Stream February 10th Game Information

May 06, 2025

Celtics Vs Heat Live Stream February 10th Game Information

May 06, 2025 -

Trump Downplays Economic Risks In Trade Deal Pursuit

May 06, 2025

Trump Downplays Economic Risks In Trade Deal Pursuit

May 06, 2025 -

Bollywood Outsider Priyanka Chopras Journey As Revealed By Her Mother

May 06, 2025

Bollywood Outsider Priyanka Chopras Journey As Revealed By Her Mother

May 06, 2025 -

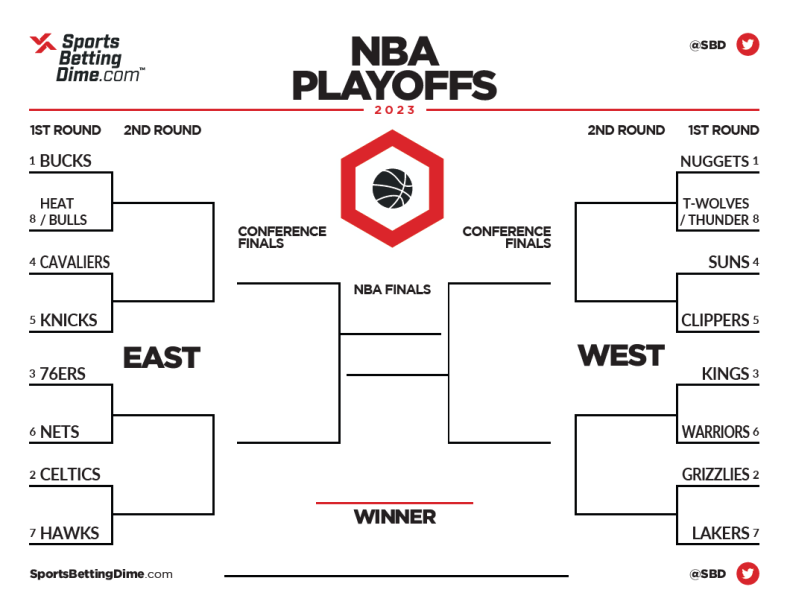

Round 1 Nba Playoffs 2025 Bracket And Tv Listings

May 06, 2025

Round 1 Nba Playoffs 2025 Bracket And Tv Listings

May 06, 2025 -

Piala Asia U 20 Iran Raih Kemenangan Besar 6 0 Melawan Yaman

May 06, 2025

Piala Asia U 20 Iran Raih Kemenangan Besar 6 0 Melawan Yaman

May 06, 2025