Decoding X's Finances: A Post-Debt Sale Analysis

Table of Contents

Assessing X's Liquidity Post-Debt Sale

This section analyzes X's short-term financial position, focusing on its ability to meet immediate obligations. A thorough understanding of X's liquidity is crucial for assessing its ability to operate effectively and efficiently in the short term.

Current Ratio Analysis

The current ratio, calculated by dividing current assets by current liabilities, provides a snapshot of X's ability to pay its short-term debts. By comparing the current ratio before and after the debt sale, we can assess the impact of the sale on X's short-term liquidity.

- Before Debt Sale: [Insert hypothetical data, e.g., Current Ratio = 1.8] This indicates a relatively healthy short-term liquidity position.

- After Debt Sale: [Insert hypothetical data, e.g., Current Ratio = 1.5] A slight decrease suggests a minor reduction in short-term liquidity, though still within an acceptable range. Further investigation into the specific changes in current assets and liabilities is necessary for a complete picture.

Quick Ratio Analysis

The quick ratio (or acid-test ratio), which excludes less liquid current assets like inventory, provides a more conservative measure of liquidity. This ratio offers a more stringent assessment of X's ability to meet its short-term obligations using readily available assets.

- Before Debt Sale: [Insert hypothetical data, e.g., Quick Ratio = 1.2] Demonstrating a strong capacity to meet immediate liabilities.

- After Debt Sale: [Insert hypothetical data, e.g., Quick Ratio = 1.0] A decrease in the quick ratio may indicate a slight tightening of liquidity, but this requires further context from other financial metrics.

Cash Flow Analysis

Analyzing X's statement of cash flows—specifically, cash flow from operations, investing, and financing activities—is essential for understanding its overall cash position. The debt sale significantly impacts the financing activities section, providing valuable information about how this transaction affected X's liquidity.

- Cash Flow from Operations: [Analyze and comment on trends before and after the sale. Was there an increase or decrease in operating cash flow? What does this suggest about the company's core business performance?]

- Cash Flow from Investing: [Analyze capital expenditures and other investing activities. Did the debt sale free up cash for investments?]

- Cash Flow from Financing: [This section will show the impact of the debt sale. Did the proceeds from the debt sale improve the company's cash balance significantly?]

Evaluating X's Solvency After the Debt Sale

This section examines X's long-term financial stability and its capacity to meet its long-term obligations. Solvency analysis provides crucial insights into the company's ability to weather economic downturns and continue operating in the long run.

Debt-to-Equity Ratio

The debt-to-equity ratio measures the proportion of X's financing that comes from debt versus equity. A higher ratio indicates greater financial risk. Analyzing the changes in this ratio after the debt sale is critical in understanding the impact of deleveraging (or increased leverage) on the company's financial structure.

- Before Debt Sale: [Insert hypothetical data, e.g., Debt-to-Equity Ratio = 0.8] Indicating a relatively moderate level of debt.

- After Debt Sale: [Insert hypothetical data, e.g., Debt-to-Equity Ratio = 0.5] A decrease suggests improved financial stability and reduced financial risk.

Times Interest Earned Ratio

The times interest earned ratio (TIE) assesses X's ability to cover its interest expenses. A higher TIE ratio implies a greater capacity to service its debt obligations.

- Before Debt Sale: [Insert hypothetical data, e.g., TIE Ratio = 4.0] Showing a substantial capacity to meet interest payments.

- After Debt Sale: [Insert hypothetical data, e.g., TIE Ratio = 3.5] While still strong, a slight decrease may warrant further scrutiny, especially if combined with other negative indicators.

Debt Service Coverage Ratio

The debt service coverage ratio (DSCR) evaluates X's ability to cover both principal and interest payments on its debt. This is a more comprehensive measure of debt servicing capacity compared to the TIE ratio.

- Before Debt Sale: [Insert hypothetical data, e.g., DSCR = 1.5] Indicating a comfortable margin for debt servicing.

- After Debt Sale: [Insert hypothetical data, e.g., DSCR = 1.2] A decrease warrants careful review of X's cash flow projections and debt repayment schedule.

Overall Financial Health and Future Outlook for X

This section synthesizes the findings and provides an outlook on X's future financial performance, combining liquidity and solvency analyses to offer a complete picture of X's financial health.

Profitability Analysis

Analyzing profitability ratios—such as gross profit margin, operating profit margin, and net profit margin—helps assess X's ability to generate profits. These metrics provide insights into the efficiency and effectiveness of X's operations. [Insert analysis of these ratios before and after the debt sale.]

Potential Risks and Opportunities

The post-debt sale environment presents both risks and opportunities for X. Potential risks include [list potential risks, e.g., changes in interest rates, increased competition, economic downturn]. Opportunities include [list potential opportunities, e.g., new strategic investments, market expansion, improved efficiency].

Strategic Implications

The debt sale's strategic implications are multifaceted. [Discuss the impact of the debt sale on X's capital structure, its ability to pursue growth opportunities, and its overall strategic direction. Did the debt sale allow for a strategic repositioning or investment?]

Conclusion

This analysis of X's finances post-debt sale offers a comprehensive evaluation of its liquidity, solvency, and overall financial health. While the debt sale has undeniably restructured X's financial position, the true implications depend on a holistic view of multiple financial metrics. Understanding X's finances post-sale is crucial for all stakeholders. Continuous monitoring of X's financial performance through regular analysis of its financial statements—including further analysis of its post-debt sale strategy—is vital for gaining a complete understanding of X's finances and its future prospects. Regular review of X's financial statements and a continued analysis of X's finances are highly recommended for a thorough understanding of the long-term implications of this debt sale.

Featured Posts

-

Mesa Stage Set For Shen Yuns Performance

Apr 29, 2025

Mesa Stage Set For Shen Yuns Performance

Apr 29, 2025 -

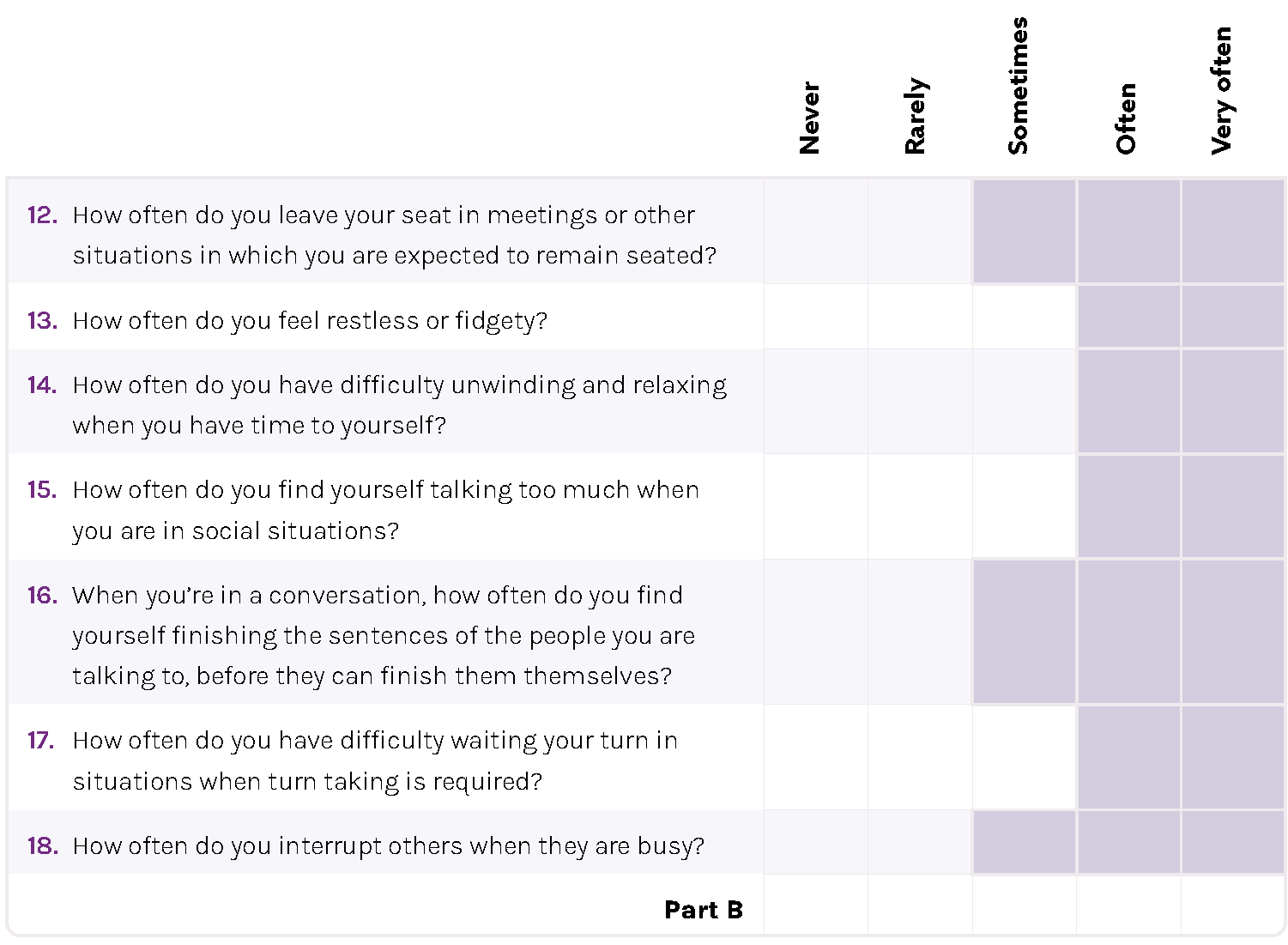

Navigating An Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025

Navigating An Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025 -

The Ramiro Helmeyer Story Loyalty And The Pursuit Of Blaugrana Glory

Apr 29, 2025

The Ramiro Helmeyer Story Loyalty And The Pursuit Of Blaugrana Glory

Apr 29, 2025 -

New Business Hotspots Where To Invest And Grow In Country Name

Apr 29, 2025

New Business Hotspots Where To Invest And Grow In Country Name

Apr 29, 2025 -

American Made Products A Look At The Manufacturing Landscape

Apr 29, 2025

American Made Products A Look At The Manufacturing Landscape

Apr 29, 2025