Defense Sector Investment Boost: BigBear.ai (BBAI) Maintains Buy Rating

Table of Contents

BigBear.ai's (BBAI) Position in the Defense Technology Market

BigBear.ai is a leading provider of AI-powered solutions for national security and defense. Their core offerings leverage advanced data analytics and machine learning to deliver critical capabilities across various defense applications. This positions BBAI at the forefront of the rapidly evolving defense technology landscape. Key strengths include their expertise in: AI in defense, national security, data analytics, BigBear.ai solutions, defense technology companies.

Their unique selling propositions include:

- Advanced AI Algorithms: BigBear.ai utilizes cutting-edge algorithms for superior accuracy and efficiency in data analysis and prediction.

- Domain Expertise: The company possesses deep understanding of the defense industry's unique requirements and challenges.

- Scalable Solutions: Their platforms can adapt to the evolving needs of various defense agencies and organizations.

Specific applications of their technology within the defense sector include:

- Intelligence Analysis: Processing vast amounts of intelligence data to identify threats and patterns.

- Cybersecurity: Protecting critical infrastructure and sensitive data from cyberattacks.

- Logistics Optimization: Improving the efficiency and effectiveness of military supply chains.

- Situational Awareness: Providing real-time insights for better decision-making in dynamic environments.

Factors Contributing to the Maintained Buy Rating

The maintained "buy" rating for BigBear.ai (BBAI) is supported by several key factors. Recent financial performance indicates strong growth potential, aligning with the overall expansion of the defense industry. Keywords: stock analysis, financial performance, growth potential, market forecast, defense spending, BBAI stock price.

Analysts point to:

- Significant Contract Wins: Securing large contracts with government agencies and defense contractors demonstrates market confidence and revenue stability.

- Consistent Revenue Growth: Demonstrates the company's ability to deliver value and capture market share.

- Technological Advancements: Continuous innovation in AI and data analytics keeps BigBear.ai ahead of the competition.

- Positive Market Outlook: Increased global defense spending and the growing demand for AI-powered solutions contribute to a favorable market forecast for BBAI.

Investment Opportunities and Risks Associated with BBAI

Investing in BigBear.ai (BBAI) presents both significant opportunities and inherent risks. The potential return on investment (ROI) is substantial given the company’s position in a rapidly growing market. However, investors should carefully consider the risks involved. Keywords: investment opportunities, risk assessment, competitive analysis, market volatility, BBAI stock forecast, return on investment.

Potential Opportunities:

- High growth potential in the expanding defense technology market.

- First-mover advantage in leveraging AI for defense applications.

- Strong potential for future contract wins and revenue growth.

Potential Risks:

- Market volatility and dependence on government contracts.

- Intense competition from established players and emerging startups.

- Technological disruption and the need for continuous innovation.

- Geopolitical uncertainties that could impact defense spending.

Conclusion: BigBear.ai (BBAI) – A Promising Investment in the Booming Defense Sector?

BigBear.ai (BBAI) holds a strong "buy" rating driven by its leading position in the AI-powered defense technology market, robust financial performance, and significant growth potential within the expanding defense sector. While the investment presents substantial opportunities, investors should carefully assess the inherent risks, including market volatility and competition. Consider investing in BigBear.ai (BBAI) after conducting thorough due diligence. Learn more about defense sector investments and explore BBAI investment opportunities to make informed decisions. Remember to always consult with a financial advisor before making any investment decisions. Keywords: BigBear.ai, BBAI, defense sector investment, AI in defense, defense technology.

Featured Posts

-

Trade Wars And Porsche Navigating The Tightrope Between Ferrari And Mercedes

May 21, 2025

Trade Wars And Porsche Navigating The Tightrope Between Ferrari And Mercedes

May 21, 2025 -

Kaellmanin Kasvu Huuhkajissa Kentaellae Ja Sen Ulkopuolella

May 21, 2025

Kaellmanin Kasvu Huuhkajissa Kentaellae Ja Sen Ulkopuolella

May 21, 2025 -

Unexpected Waterworks Susan Lucci And Michael Strahans Funny Encounter

May 21, 2025

Unexpected Waterworks Susan Lucci And Michael Strahans Funny Encounter

May 21, 2025 -

Analyse Abn Amro De Impact Van Invoertarieven Op De Export Van Voedingsmiddelen Naar De Vs

May 21, 2025

Analyse Abn Amro De Impact Van Invoertarieven Op De Export Van Voedingsmiddelen Naar De Vs

May 21, 2025 -

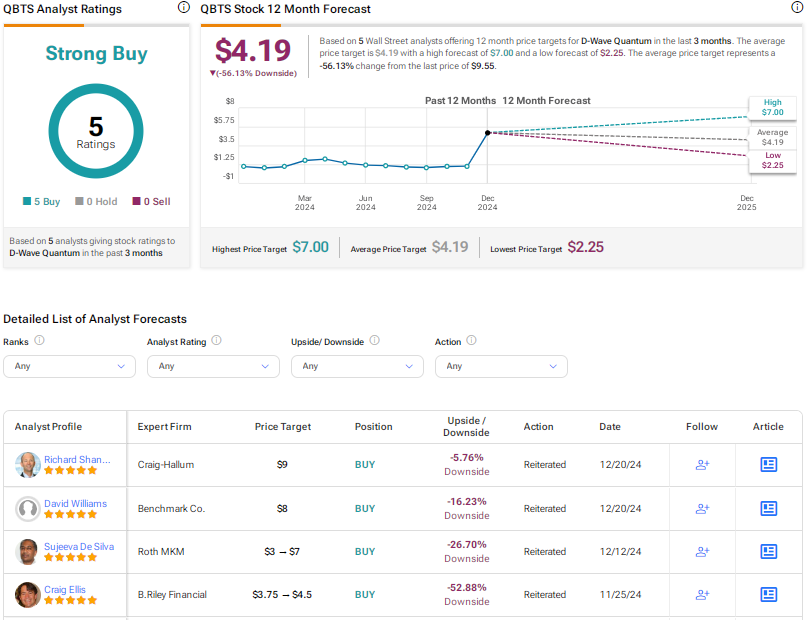

D Wave Quantum Qbts Unpacking The Reasons For This Weeks Stock Increase

May 21, 2025

D Wave Quantum Qbts Unpacking The Reasons For This Weeks Stock Increase

May 21, 2025