Delays In Kentucky Storm Damage Assessments Explained

Table of Contents

The Sheer Scale of Damage and High Demand

After a large-scale disaster like a major storm in Kentucky, the sheer volume of damage claims overwhelms insurance companies and assessment teams. This leads to significant backlogs and extended wait times for Kentucky storm damage appraisals. The impact of widespread damage from severe Kentucky weather events necessitates a huge amount of resources, creating a bottleneck in the system. This is further compounded by mass casualty events which often accompany such storms, diverting resources towards immediate life-saving efforts.

- Increased demand for adjusters exceeding available resources. There simply aren't enough insurance adjusters to handle the massive influx of claims following a widespread disaster.

- Difficulties in accessing damaged areas due to road closures or debris. Impassable roads and widespread debris fields make it challenging and sometimes impossible for adjusters to reach damaged properties promptly. This significantly impacts the speed of damage assessment.

- Prioritization of life-saving efforts before damage assessments. In the immediate aftermath of a storm, emergency services rightfully prioritize rescuing and aiding survivors. Damage assessment becomes a secondary concern until the immediate crisis subsides.

Insurance Company Procedures and Protocols

Insurance companies have established procedures and protocols for verifying claims, which can contribute to delays in processing Kentucky storm damage. This methodical approach, while necessary for accuracy and preventing fraudulent claims, often involves multiple steps. The detailed nature of the insurance claim process, including thorough policy reviews and inspections, adds to the overall processing time.

- Detailed documentation requirements for claims. Homeowners must typically provide extensive documentation, including photos, videos, and receipts, to support their claims. This can be a time-consuming process, particularly for those dealing with significant property damage.

- Multiple levels of review within the insurance company. Claims often go through several internal reviews and approvals before final settlement, slowing down the process considerably.

- Potential need for independent appraisals to verify damage costs. In cases of significant damage or disputes over repair costs, an independent appraisal may be required, which adds further delays to the assessment timeline.

Challenges in Accessing and Assessing Damaged Properties

Accessing severely damaged properties after a Kentucky storm can be extremely challenging and even dangerous. Safety concerns are paramount, and these concerns significantly impact the speed of assessments. Before an adjuster can even begin their evaluation of the property damage, many safety hurdles must be overcome.

- Safety inspections required before access is granted. Before an adjuster can enter a damaged property, a safety inspection is often necessary to ensure the area is structurally sound and free from immediate hazards.

- Debris removal necessary before a full assessment can be done. Significant debris removal may be required before a proper assessment of the damage can be conducted. This adds substantial time to the process.

- Potential need for specialized equipment or expertise. Certain types of damage, such as significant structural damage or hazardous materials, may require specialized equipment or expertise, further delaying the assessment.

Communication Gaps and Lack of Transparency

A lack of clear and consistent communication from insurance companies is a major source of frustration for homeowners dealing with Kentucky storm damage. The uncertainty surrounding the claim status and the lack of timely updates exacerbate the stress of dealing with a major loss. Effective communication is crucial during this stressful period.

- Inconsistent communication from adjusters. Adjusters may not consistently update claimants on the progress of their assessments.

- Long wait times for claim updates. Homeowners may experience significant delays in receiving updates on the status of their claims, leading to frustration and uncertainty.

- Difficulty reaching customer service representatives. Reaching customer service representatives to inquire about claim status may prove difficult, further compounding the frustration.

Conclusion

Delays in Kentucky storm damage assessments are often due to a combination of factors: the sheer scale of damage, rigorous insurance company procedures, challenges in accessing and assessing properties, and communication gaps. Understanding these factors helps homeowners manage their expectations and advocate effectively for timely processing of their claims. If you're experiencing delays in your Kentucky storm damage assessment, proactively contact your insurance provider and persistently advocate for clear communication and a timely resolution. Understanding the reasons behind Kentucky storm damage assessment delays empowers you to navigate this challenging process more effectively and secure the necessary repairs for your property.

Featured Posts

-

Khaznas Saudi Expansion A Data Center Giants Next Move After Silver Lake Investment

Apr 29, 2025

Khaznas Saudi Expansion A Data Center Giants Next Move After Silver Lake Investment

Apr 29, 2025 -

Brain Drain The Global Scramble For Us Researchers Following Trump Era Funding Reductions

Apr 29, 2025

Brain Drain The Global Scramble For Us Researchers Following Trump Era Funding Reductions

Apr 29, 2025 -

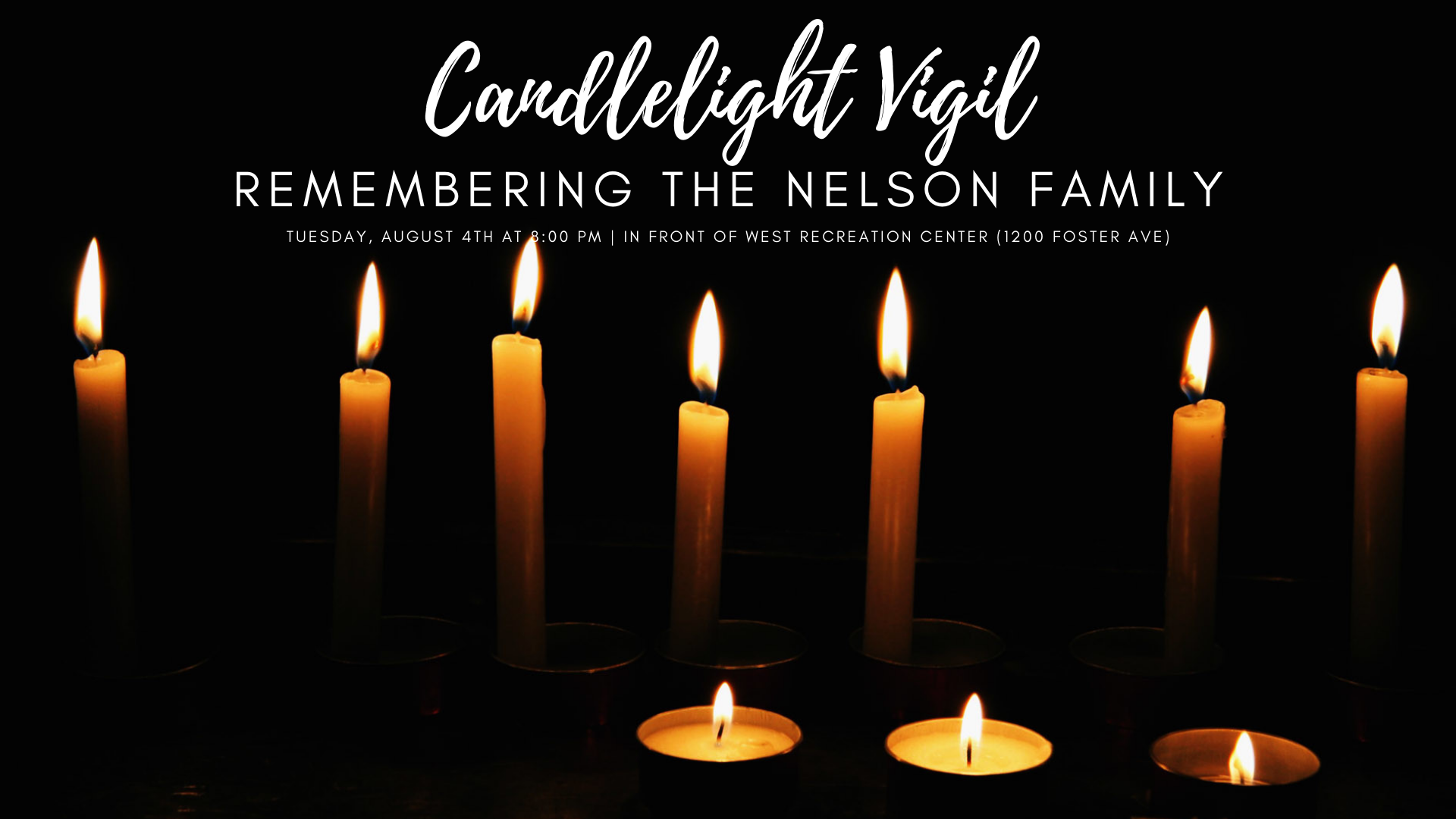

Remembering Fallen Soldiers A Candlelight Vigil At Fort Belvoir

Apr 29, 2025

Remembering Fallen Soldiers A Candlelight Vigil At Fort Belvoir

Apr 29, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

Apr 29, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Rare Find

Apr 29, 2025 -

Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025