Desan's Potential Takeover Of Mangalia Shipyard

Table of Contents

Desan's Strategic Goals and the Mangalia Shipyard Acquisition

Desan's interest in acquiring the Mangalia Shipyard suggests a strategic move aimed at expanding its market share and diversifying its operations. Let's examine the potential financial incentives and returns.

Financial Incentives and Potential Returns

Desan's motivations for acquiring the Mangalia Shipyard likely stem from several key financial advantages:

- Potential cost savings through synergies: Combining operations could lead to economies of scale, reducing operational costs.

- Access to new markets: The Mangalia Shipyard's existing contracts and market presence could open new avenues for Desan.

- Expansion of Desan's portfolio: The acquisition would diversify Desan's offerings and reduce its reliance on a single market segment.

- Diversification of revenue streams: The Mangalia Shipyard brings a new revenue stream, mitigating risk associated with focusing on a single business area.

While precise financial data regarding the transaction remains confidential, analysts suggest that the Mangalia Shipyard, despite its current challenges, possesses valuable assets and infrastructure, representing a potentially lucrative investment for Desan, given its established financial strength and experience in the industry. The projected returns on investment will depend heavily on successful integration and modernization efforts.

Impact on Employment and the Local Economy

The potential takeover of the Mangalia Shipyard has significant implications for employment and the local economy. Understanding the potential effects on job security and creation is crucial.

Job Security and Creation

The impact on employment is a key concern. While potential outcomes range from job creation to job losses, a careful analysis is needed.

- Potential for increased employment: Successful modernization and expansion could lead to increased demand for skilled labor.

- Retraining programs: Desan might implement retraining programs to upskill the existing workforce to meet new technological requirements.

- Potential job losses due to restructuring: Inevitably, some redundancies might occur during the integration process due to operational streamlining.

The Mangalia Shipyard currently employs a substantial workforce, and their future security is paramount. Desan's commitment to employee retention and retraining will be crucial in minimizing negative impacts and fostering positive community relations. The local economy, heavily reliant on the shipyard, will also experience ripple effects based on the employment outcome.

Challenges and Potential Obstacles to the Takeover

The acquisition process will likely face numerous challenges. These include regulatory hurdles and the complexities of integrating two distinct operational structures.

Regulatory Hurdles and Approval Processes

Navigating the Romanian regulatory landscape will be a significant undertaking for Desan.

- Competition regulations: Authorities will assess the impact on competition within the Romanian and potentially European shipbuilding markets.

- Environmental impact assessments: Thorough environmental assessments might be required, particularly concerning potential environmental impacts.

- Negotiations with unions: Reaching agreements with labor unions representing the Mangalia shipyard workforce is crucial for a smooth transition.

- Government approvals: Various government ministries will need to approve the acquisition before it can proceed.

Financial and Operational Integration

Integrating the Mangalia Shipyard into Desan's existing operations presents significant operational and logistical challenges.

- Differences in management styles: Harmonizing different management styles and corporate cultures will be essential for efficient operations.

- Technological integration: Integrating different technological systems and processes will require significant investment and expertise.

- Supply chain integration: Streamlining supply chains and optimizing logistics will be crucial for cost efficiency and improved productivity.

- Potential cultural clashes: Differences in organizational culture can hinder integration if not properly addressed.

The Future Outlook for Mangalia Shipyard under Desan's Ownership

The success of Desan's potential ownership depends on successful modernization, growth strategies, and broader implications for the Romanian shipbuilding industry.

Potential for Modernization and Growth

Under Desan's leadership, the Mangalia Shipyard could undergo significant modernization.

- Investment in new technologies: Desan's investment in modern shipbuilding technologies could significantly improve efficiency and competitiveness.

- Increased efficiency: Streamlining operations and optimizing processes could boost productivity and reduce costs.

- Expansion into new shipbuilding sectors: The shipyard could diversify into new market segments, increasing revenue streams.

- Potential for international collaborations: Desan's global network could facilitate collaborations with international partners, leading to new contracts and technologies.

Impact on the Romanian Shipbuilding Industry

The acquisition could have far-reaching implications for the Romanian shipbuilding sector.

- Increased competitiveness: Modernization and efficiency improvements could increase the competitiveness of Romanian shipyards on the global stage.

- Potential for attracting foreign investment: A successful revitalization of the Mangalia Shipyard could attract further foreign investment in the Romanian shipbuilding industry.

- Improved infrastructure development: Investment in the Mangalia Shipyard could stimulate broader infrastructure development in the region.

- Potential for creating a shipbuilding cluster: The Mangalia Shipyard could become a central hub, fostering the growth of a specialized shipbuilding cluster.

Conclusion

The potential Desan's takeover of Mangalia Shipyard presents both significant opportunities and challenges. While the acquisition could revitalize the shipyard, create jobs, and boost the Romanian shipbuilding industry, navigating the regulatory hurdles and integrating the operations effectively will be crucial. The success of this potential takeover hinges on careful planning, strategic investment, and a collaborative approach. Further monitoring of the situation and detailed analysis of Desan's plans are necessary to fully assess the long-term impact of this potential acquisition on Mangalia Shipyard and the Romanian economy. Stay informed about the developments regarding Desan's takeover of Mangalia Shipyard to understand the future of this important sector. The future of Romanian shipbuilding may well depend on the successful outcome of Desan's potential acquisition.

Featured Posts

-

2700 Miles From Dc How Trumps Policies Affected One Rural School

Apr 26, 2025

2700 Miles From Dc How Trumps Policies Affected One Rural School

Apr 26, 2025 -

Shedeur Sanders A Sons Dedication To The Deion Sanders Nike Legacy

Apr 26, 2025

Shedeur Sanders A Sons Dedication To The Deion Sanders Nike Legacy

Apr 26, 2025 -

Fusions Newest Gem Dong Duong Hotel In Hue

Apr 26, 2025

Fusions Newest Gem Dong Duong Hotel In Hue

Apr 26, 2025 -

Trump Administrations Pressure Campaign Europes Ai Rulebook At Risk

Apr 26, 2025

Trump Administrations Pressure Campaign Europes Ai Rulebook At Risk

Apr 26, 2025 -

Is Gavin Newsoms Liberal Agenda Failing

Apr 26, 2025

Is Gavin Newsoms Liberal Agenda Failing

Apr 26, 2025

Latest Posts

-

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 10, 2025 -

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025

Resistance Grows Car Dealerships Challenge Ev Mandate

May 10, 2025 -

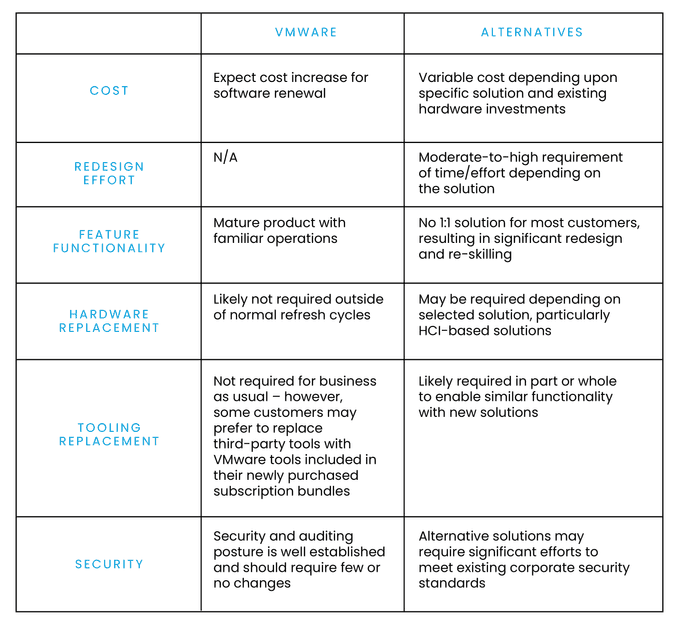

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Increase

May 10, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

May 10, 2025 -

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 10, 2025