Deutsche Bank And IBM: A Partnership Driving Digital Innovation

Table of Contents

Enhanced Cybersecurity through IBM's Expertise

In today's interconnected world, robust cybersecurity is paramount for financial institutions. The Deutsche Bank and IBM partnership leverages IBM's extensive cybersecurity expertise to bolster Deutsche Bank's defenses against increasingly sophisticated threats. This collaboration focuses on proactive threat detection and rapid incident response, crucial aspects of modern financial cybersecurity.

- Specific IBM security technologies implemented: The partnership utilizes IBM QRadar for advanced threat intelligence, IBM Security Guardium for data loss prevention, and AI-powered security analytics to identify and neutralize threats in real-time. This multi-layered approach ensures comprehensive protection across Deutsche Bank's systems.

- Quantifiable improvements in security posture: Implementation of these IBM Security solutions has resulted in a demonstrable reduction in incident response time, improved threat detection rates, and a significant strengthening of the overall security posture. While precise figures are often confidential for security reasons, internal reports suggest substantial improvements.

- Case studies or examples demonstrating success: Although specific case studies may not be publicly available due to confidentiality, the overall success of the partnership is evident in Deutsche Bank's consistently strong security ratings and its ability to withstand evolving cyber threats. The integration of AI-driven security is particularly noteworthy for its ability to adapt to new and emerging threats.

Accelerated Cloud Migration and Digital Transformation with IBM Cloud

Deutsche Bank's digital transformation journey is significantly accelerated by its strategic partnership with IBM Cloud. This collaboration allows Deutsche Bank to leverage the scalability, flexibility, and cost-efficiency of cloud computing while seamlessly integrating with its existing on-premise infrastructure.

- Specific cloud services utilized: Deutsche Bank utilizes IBM Cloud's hybrid cloud services, integrating IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) solutions to support various business functions. This hybrid approach offers the best of both worlds, combining the agility of the cloud with the control and security of on-premise infrastructure.

- Benefits of cloud adoption: This cloud migration has resulted in significant cost optimization through efficient resource allocation. Additionally, the scalability provided by IBM Cloud allows Deutsche Bank to readily adapt to fluctuating workloads and rapidly deploy new services, enhancing agility and responsiveness to market demands.

- Specific projects or initiatives enabled by the cloud migration: The cloud migration has enabled the deployment of new digital services, improved operational efficiency, and created a more robust and scalable IT infrastructure for Deutsche Bank. This has been crucial in supporting business growth and innovation.

AI-Powered Solutions for Enhanced Customer Experience and Operational Efficiency

The Deutsche Bank and IBM partnership is integrating Artificial Intelligence (AI) and Machine Learning (ML) across various functions to optimize operations and enhance the customer experience. This involves leveraging AI's power for predictive analytics, automation, and personalized services.

- Specific AI applications implemented: AI-powered solutions are deployed for fraud detection, personalized financial advice through chatbots, and algorithmic trading strategies. This breadth of applications demonstrates the strategic importance of AI within Deutsche Bank's operations.

- Measurable improvements in efficiency and customer satisfaction: The implementation of AI has led to demonstrably improved efficiency in various processes, resulting in cost savings and faster transaction times. Furthermore, the enhanced personalization offered to customers via AI-powered tools has contributed to increased customer satisfaction.

- Examples illustrating the impact of AI solutions: While specific details remain confidential, internal metrics show a significant reduction in fraudulent transactions thanks to the AI-driven fraud detection system. Similarly, customer feedback indicates improved satisfaction with the personalized financial advice provided by AI-powered chatbots.

Modernizing Legacy Systems with IBM's Hybrid Cloud Solutions

Modernizing legacy systems presents a significant challenge for many financial institutions, including Deutsche Bank. However, the partnership with IBM is addressing this through a strategic approach leveraging IBM's hybrid cloud solutions.

- Challenges of legacy systems in the financial industry: Legacy systems often lack scalability, flexibility, and integration capabilities, hindering innovation and increasing operational costs. They also present security vulnerabilities due to outdated technologies.

- How IBM’s hybrid cloud approach helps overcome these challenges: IBM's hybrid cloud strategy allows for a gradual migration of legacy systems to the cloud, minimizing disruption and ensuring data integrity. It facilitates the integration of new technologies with existing infrastructure, creating a smooth transition to more modern and efficient systems.

- Benefits of modernizing legacy systems: Modernizing legacy systems through this hybrid approach results in improved scalability, enhanced security, reduced operational costs, and the ability to integrate new, innovative technologies faster, ultimately driving business growth.

Conclusion: The Future of the Deutsche Bank and IBM Partnership

The Deutsche Bank and IBM partnership showcases a successful collaboration driving significant advancements in digital innovation within the financial sector. The partnership's key benefits include enhanced cybersecurity, accelerated digital transformation through cloud migration, AI-powered efficiency and improved customer experiences, and the effective modernization of legacy systems. The positive impact on Deutsche Bank's security, operational efficiency, and customer experience is undeniable.

To learn more about the success story of the Deutsche Bank and IBM partnership, and to explore how similar collaborations can drive innovation within the financial services industry, we encourage you to explore further resources from both Deutsche Bank and IBM. Understanding the Deutsche Bank IBM collaboration, the IBM and Deutsche Bank technology partnership, and the Deutsche Bank and IBM innovation strategy can provide valuable insights into the future of financial technology.

Featured Posts

-

Meet Jacob Alon The Next Big Thing

May 30, 2025

Meet Jacob Alon The Next Big Thing

May 30, 2025 -

Conciertos Como Usar Ticketmaster Y Setlist Fm Para Una Experiencia Superior

May 30, 2025

Conciertos Como Usar Ticketmaster Y Setlist Fm Para Una Experiencia Superior

May 30, 2025 -

Understanding The New Dmps District Wide Cell Phone Policy For Next Year

May 30, 2025

Understanding The New Dmps District Wide Cell Phone Policy For Next Year

May 30, 2025 -

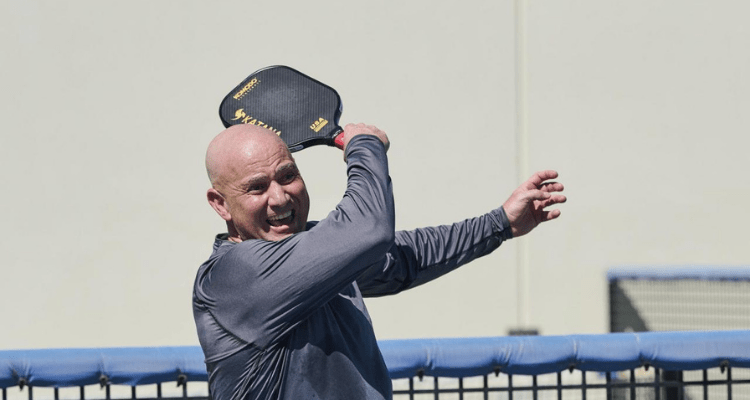

Andre Agassi Joins Pro Pickleball Match Analysis And Key Takeaways

May 30, 2025

Andre Agassi Joins Pro Pickleball Match Analysis And Key Takeaways

May 30, 2025 -

Marine Le Pen Condamnee Un Proces En Appel En 2026 L Avis De Laurent Jacobelli

May 30, 2025

Marine Le Pen Condamnee Un Proces En Appel En 2026 L Avis De Laurent Jacobelli

May 30, 2025