Deutsche Bank Courts Global Investors In Saudi Arabia

Table of Contents

Deutsche Bank's Strategic Objectives in Saudi Arabia

Deutsche Bank's foray into the Saudi Arabian market is driven by several key strategic objectives. The bank aims to establish itself as a leading player in this high-growth economy, leveraging its global expertise and network to capture significant market share.

-

Gaining a foothold in the lucrative Saudi Arabian wealth management sector: Deutsche Bank seeks to attract high-net-worth individuals and family offices in Saudi Arabia, offering bespoke wealth management solutions tailored to their specific needs. This includes investment advisory, portfolio management, and private banking services. The growth of private wealth in Saudi Arabia presents a massive opportunity for Deutsche Bank Saudi Arabia.

-

Securing mandates for large-scale infrastructure projects aligned with Vision 2030: Saudi Arabia's Vision 2030 initiative involves massive infrastructure development projects. Deutsche Bank aims to secure advisory and financing mandates for these projects, contributing to the Kingdom's ambitious modernization plans. This includes projects related to NEOM, Red Sea Project, and Qiddiya.

-

Expanding its corporate banking services to Saudi Arabian businesses: Deutsche Bank is targeting Saudi Arabian businesses of all sizes, providing corporate finance, treasury management, and trade finance solutions. This involves building strong relationships with key businesses across various sectors. Supporting SMEs is also part of the Deutsche Bank Saudi Arabia strategy.

-

Leveraging Saudi Arabia's strategic geopolitical position to enhance global reach: Saudi Arabia's geopolitical importance provides Deutsche Bank with a strategic gateway to access other markets in the Middle East and beyond. This enhances the bank's global network and expands its reach to new client bases.

Attracting Global Investment to Saudi Arabia: Deutsche Bank's Role

Deutsche Bank plays a crucial role in facilitating the inflow of foreign direct investment (FDI) into Saudi Arabia. The bank's global network and deep understanding of both international and Saudi Arabian markets make it a key bridge connecting investors with opportunities.

-

Providing expert advice and guidance to international investors navigating the Saudi Arabian regulatory landscape: Deutsche Bank offers expert guidance to international investors, helping them understand and comply with local regulations and laws. This includes support with licensing, compliance, and other regulatory matters.

-

Facilitating cross-border transactions and investments: The bank facilitates seamless cross-border transactions, simplifying the investment process for international clients and ensuring efficient capital flow. This includes structuring complex deals and managing currency risks.

-

Promoting Saudi Arabian investment opportunities to its global network of clients: Deutsche Bank actively promotes promising investment opportunities in Saudi Arabia to its extensive global client base, attracting foreign investment across various sectors. This involves targeted marketing campaigns and direct outreach to potential investors.

-

Building relationships with key Saudi Arabian government agencies and regulatory bodies: Deutsche Bank maintains strong relationships with relevant government bodies, ensuring smooth operation and facilitating regulatory approvals for investments. This includes engagement with the Saudi Arabian Monetary Authority (SAMA) and other relevant institutions.

Vision 2030 and Deutsche Bank's Contribution

Deutsche Bank's activities are closely aligned with the objectives of Saudi Vision 2030. The bank's contributions actively support the Kingdom's economic diversification and modernization efforts.

-

Participation in privatization projects and the development of the private sector: Deutsche Bank actively participates in privatization initiatives, advising on and financing the transfer of state-owned assets to the private sector. This contributes to a more competitive and efficient economy.

-

Support for the growth of the Saudi Arabian capital markets: Deutsche Bank is supporting the development of the Saudi Arabian capital markets by facilitating listings on the Tadawul, the Saudi Stock Exchange. This encourages investment and provides businesses with access to capital.

-

Contribution to the development of a sustainable and diversified economy: Deutsche Bank's investments and advisory services are geared toward promoting sustainable and diversified economic growth in Saudi Arabia, aligning with the long-term goals of Vision 2030.

Challenges and Opportunities for Deutsche Bank in Saudi Arabia

While the Saudi Arabian market offers substantial opportunities, Deutsche Bank also faces several challenges.

-

Competition from established international and local banks: The Saudi Arabian banking sector is competitive, with established international and local players vying for market share. Deutsche Bank needs to differentiate itself through specialized services and strong client relationships.

-

Navigating the complexities of the Saudi Arabian regulatory framework: Understanding and complying with the Saudi Arabian regulatory environment requires expertise and careful navigation. This involves staying updated on regulatory changes and adapting to local requirements.

-

Adapting to the cultural nuances of the Saudi Arabian business environment: Success requires a deep understanding of Saudi Arabian business culture and practices. Building trust and fostering strong relationships are critical for success in this market.

-

Capitalizing on the growth potential of the Saudi Arabian economy: Despite challenges, Saudi Arabia's robust economic growth offers substantial opportunities for Deutsche Bank to expand its operations and build a strong presence.

Conclusion

Deutsche Bank's strategic focus on Saudi Arabia represents a significant commitment to a burgeoning market. By actively courting global investors and aligning with Saudi Arabia's Vision 2030, Deutsche Bank aims to capture significant market share and contribute to the Kingdom's economic transformation. The bank's success will depend on its ability to navigate the challenges and capitalize on the numerous opportunities presented by this dynamic market. To stay informed about Deutsche Bank's progress and its continued impact on the Saudi Arabian financial landscape, stay tuned for future updates on Deutsche Bank Saudi Arabia and its ongoing contributions to the Kingdom's economic growth.

Featured Posts

-

Del Toro Names Top Video Game World A Shocking Choice

May 30, 2025

Del Toro Names Top Video Game World A Shocking Choice

May 30, 2025 -

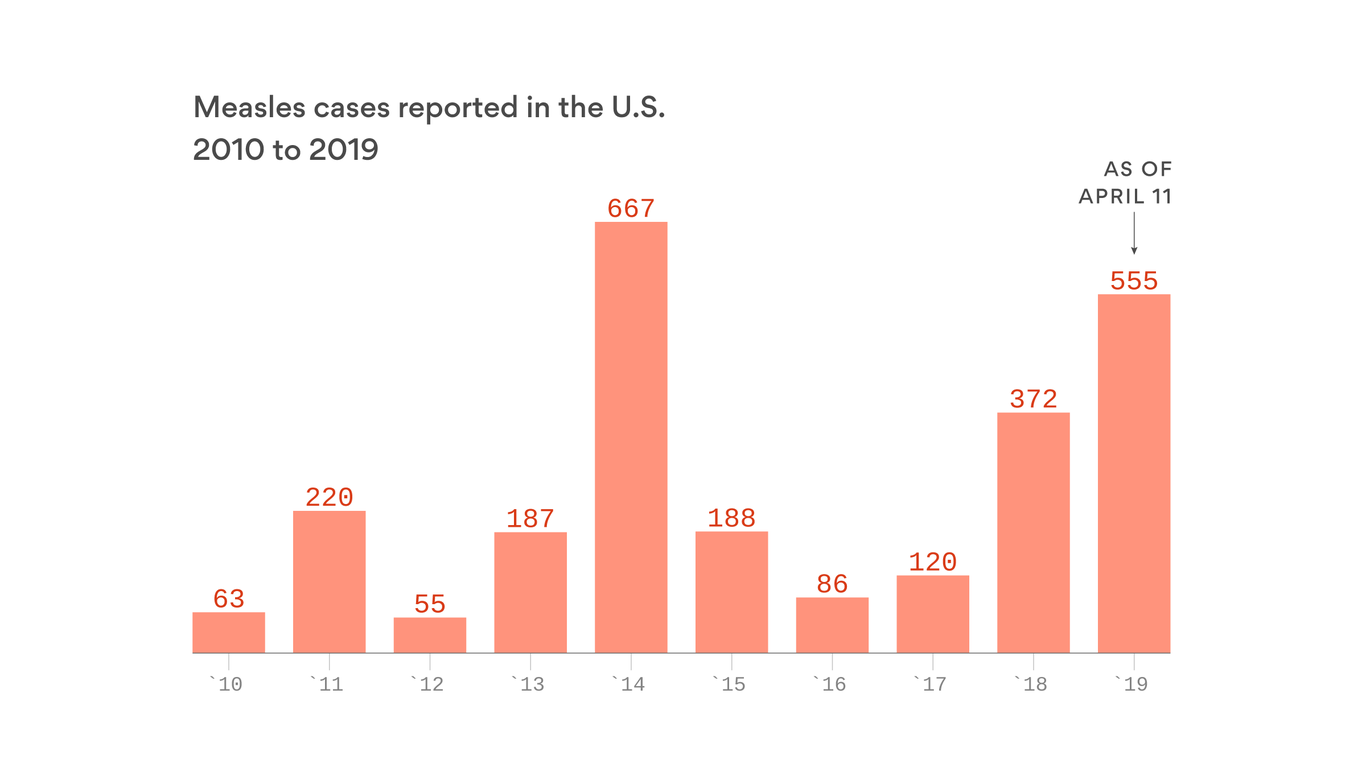

Why Are Us Measles Cases Decreasing Exploring The Contributing Factors

May 30, 2025

Why Are Us Measles Cases Decreasing Exploring The Contributing Factors

May 30, 2025 -

Setlist Fm Potencia La Experiencia Del Fan Gracias A Su Integracion Con Ticketmaster

May 30, 2025

Setlist Fm Potencia La Experiencia Del Fan Gracias A Su Integracion Con Ticketmaster

May 30, 2025 -

Wichtige Ereignisse Des 10 April Ein Ueberblick Ueber Geschichte Und Gegenwart

May 30, 2025

Wichtige Ereignisse Des 10 April Ein Ueberblick Ueber Geschichte Und Gegenwart

May 30, 2025 -

Mudanca Na Lideranca Fernando Cabral De Mello Assume Ceo Da Sony Music Brasil

May 30, 2025

Mudanca Na Lideranca Fernando Cabral De Mello Assume Ceo Da Sony Music Brasil

May 30, 2025