Deutsche Bank Depositary Receipts Virtual Investor Conference: May 15, 2025

Table of Contents

The Deutsche Bank Depositary Receipts (DB DRs) virtual investor conference, held on May 15, 2025, provided valuable insights into the company's performance, strategic direction, and future prospects for investors interested in Deutsche Bank Depositary Receipts. This article summarizes the key takeaways from the event, focusing on the announcements relevant to DB DR investment opportunities.

Key Financial Performance Highlights

The Q1 2025 financial results presented at the conference showcased a positive trajectory for Deutsche Bank. The reported financial results revealed strong revenue growth and improved profit margins, exceeding analyst expectations. Key performance indicators (KPIs) directly impacting DB DR performance were particularly noteworthy.

- Specific revenue figures and year-over-year comparisons: Revenue reached €X billion, representing a Y% increase compared to Q1 2024. This growth was driven by strong performance across multiple business segments.

- Profitability metrics and their trends: Net income increased significantly, resulting in an improved earnings per share (EPS) of €Z. This demonstrates enhanced profitability and operational efficiency within Deutsche Bank.

- Return on equity (ROE) and other relevant financial ratios: The ROE improved to A%, showcasing a better return on shareholder investments. Other key financial ratios also indicated a strengthening financial position for the bank, positively impacting the value of DB DRs.

These positive Deutsche Bank financial results, coupled with improved DB DR performance, suggest a healthy outlook for investors interested in Deutsche Bank investor relations and financial reporting.

Strategic Initiatives and Future Outlook

The conference also highlighted several strategic initiatives designed to further enhance Deutsche Bank's growth and competitiveness, directly impacting the future outlook for DB DRs. These initiatives focus on expanding into new markets, strengthening key partnerships, and enhancing technological capabilities.

- Summary of major strategic announcements and their implications: A key announcement involved a new strategic partnership focused on expanding into the Asian market, which is expected to contribute significantly to DB DR growth. Further details regarding specific projects will be shared in subsequent investor updates.

- Growth projections and market forecasts for DB DRs: Deutsche Bank projected a B% increase in revenue for FY 2025 and sustained growth in subsequent years, supported by robust market forecasts and positive investor sentiment.

- Discussion of risk factors and mitigation strategies: Management addressed potential risks including geopolitical uncertainty and regulatory changes. They detailed comprehensive risk management strategies designed to mitigate these challenges and ensure sustainable growth for DB DRs. This proactive approach to risk management is crucial for investor confidence.

This clear Deutsche Bank strategy, outlining future outlook and DB DR growth, inspires investor confidence in long-term growth and investment strategy.

Q&A Session and Investor Sentiment

The Q&A session provided valuable insights into investor concerns and perceptions regarding Deutsche Bank Depositary Receipts. Several questions focused on the long-term growth potential of DB DRs, particularly in the context of the new strategic initiatives.

- Key questions addressed concerning DB DRs: Investors sought clarification on the timeline for implementing the new strategic initiatives and the potential impact on DB DR dividend yield.

- Management's responses to investor concerns: Management provided detailed responses, reassuring investors about the soundness of their plans and their commitment to delivering strong returns on investment.

- Overall assessment of investor confidence in Deutsche Bank Depositary Receipts: The overall sentiment expressed during the Q&A session reflected a high degree of investor confidence in the future prospects of DB DRs.

The positive analyst opinion and robust investor Q&A underscored the positive Deutsche Bank investor sentiment regarding the company's future, influencing the outlook for DB DRs.

Opportunities and Risks Associated with DB DRs

Investing in DB DRs presents both opportunities and risks, and a balanced assessment is crucial before making an investment decision.

- Potential benefits of investing in DB DRs (e.g., dividend yield, diversification): DB DRs offer investors potential for dividend yield and a way to diversify their portfolios with exposure to a significant player in the global financial market.

- Significant risks to consider (e.g., geopolitical risks, regulatory changes): As with any investment, there are risks associated with DB DRs. These include potential impacts from geopolitical instability, regulatory changes, and currency fluctuations.

- Recommendations for mitigating these risks: Investors should conduct thorough due diligence, diversify their investment portfolio appropriately, and stay informed about market developments and regulatory changes that may affect DB DRs. Consider conducting a risk assessment before investing.

Understanding both DB DR investment opportunities and investment risks is critical for informed decision-making and effective risk assessment within a diversified investment strategy.

Conclusion

The Deutsche Bank Depositary Receipts virtual investor conference on May 15, 2025, offered valuable insights into the company's current financial state, strategic plans, and future prospects for investors considering Deutsche Bank Depositary Receipts. While opportunities exist, investors should carefully assess the associated risks before investing in DB DRs and conduct a thorough risk assessment.

Call to Action: To learn more about Deutsche Bank Depositary Receipts and make informed investment decisions, visit [Link to relevant Deutsche Bank investor relations page]. Stay updated on future Deutsche Bank Depositary Receipts announcements and events by subscribing to our newsletter.

Featured Posts

-

Manchester United E Arsenal Empatam Em Jogo Emocionante

May 30, 2025

Manchester United E Arsenal Empatam Em Jogo Emocionante

May 30, 2025 -

San Diego Water Authority Surplus Water Sales And Cost Reduction

May 30, 2025

San Diego Water Authority Surplus Water Sales And Cost Reduction

May 30, 2025 -

Kee To Bala Summer Concert Series Kicks Off Victoria Day Weekend

May 30, 2025

Kee To Bala Summer Concert Series Kicks Off Victoria Day Weekend

May 30, 2025 -

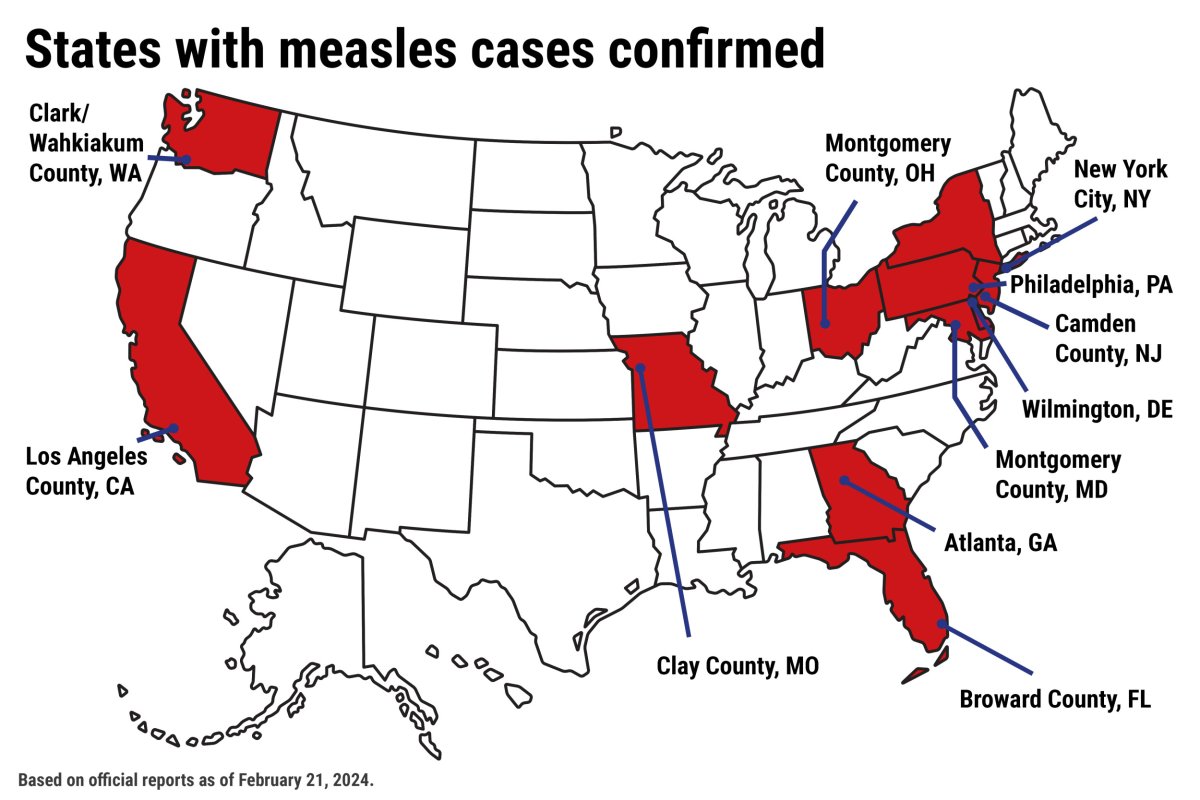

Recent Drop In Us Measles Cases Whats Behind The Improvement

May 30, 2025

Recent Drop In Us Measles Cases Whats Behind The Improvement

May 30, 2025 -

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

May 30, 2025

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

May 30, 2025