DiCenzo V Mone: New York Court Rules On Kirby Road Apartments Fraud Claims

Table of Contents

The Allegations of Fraud in DiCenzo v Mone

The DiCenzo v Mone case revolves around serious allegations of fraud perpetrated against investors in the Kirby Road Apartments. Plaintiffs, represented by [Law Firm Name], claimed that defendant, Mone, engaged in various fraudulent activities to secure investments.

Specific Fraudulent Activities Alleged Against Mone

The accusations against Mone include a range of deceptive practices designed to mislead potential investors. These alleged actions constitute serious violations of New York's robust real estate fraud laws. Specifically, the plaintiffs alleged:

- Misrepresentation of Property Value: Mone allegedly inflated the appraised value of the Kirby Road Apartments, significantly overstating its worth to attract investors. Documents submitted as evidence suggested a discrepancy of [Dollar Amount] between the actual value and the value presented to investors.

- Undisclosed Financial Liabilities: Plaintiffs claim Mone concealed substantial financial liabilities associated with the property, including outstanding loans and pending legal disputes. This omission painted a misleadingly positive financial picture for prospective investors.

- Misrepresentation of Occupancy Rates: Evidence suggests Mone falsely represented the occupancy rates of the apartments, leading investors to believe the property generated higher rental income than it actually did. This involved providing falsified rental income reports and occupancy data.

- Failure to Disclose Material Facts: Mone allegedly withheld crucial information pertaining to the property's condition, ongoing repairs, and potential future expenses, effectively concealing material facts necessary for informed investment decisions.

DiCenzo's Claims and Legal Representation

The plaintiffs, DiCenzo and others, initiated legal action against Mone, claiming significant financial losses due to the alleged fraudulent activities. Their legal team, [Law Firm Name], presented a compelling case outlining the fraudulent scheme and its detrimental impact on the plaintiffs. The legal strategy employed involved detailed financial analysis, witness testimonies, and the presentation of documentary evidence supporting the allegations of real estate fraud and investment fraud. The case leveraged New York's laws regarding property misrepresentation and breach of contract.

The New York Court's Decision in DiCenzo v Mone

The New York court's decision in DiCenzo v Mone delivered a significant victory for the plaintiffs. The ruling provided important clarity regarding investor protection and New York fraud laws within the context of real estate transactions.

Key Findings of the Court Ruling

The court found in favor of the plaintiffs, determining that Mone had engaged in fraudulent activities as alleged. The court ruling specifically highlighted the following:

- The court accepted the evidence demonstrating the misrepresentation of property value and financial liabilities.

- The judge ruled that Mone's actions constituted a clear breach of contract and violated New York state laws concerning property misrepresentation.

- The court ordered Mone to compensate the plaintiffs for their financial losses, establishing a significant legal precedent within the realm of New York real estate investment.

Implications of the Verdict for Real Estate Investors

The DiCenzo v Mone ruling has significant implications for real estate investors in New York. It underscores the importance of rigorous due diligence and highlights the potential legal recourse available to investors who are victims of real estate fraud.

- Enhanced Due Diligence: The case emphasizes the necessity for investors to conduct thorough background checks, scrutinize financial documents, and independently verify all claims made by developers or sellers.

- Investor Protection: The ruling serves as a strong reminder that New York's legal system provides mechanisms for protecting investors from fraudulent schemes.

- Legal Recourse: The successful outcome demonstrates the potential for recovering significant losses incurred through fraudulent real estate transactions.

Analysis of the DiCenzo v Mone Ruling and its Precedent

The DiCenzo v Mone decision establishes a notable legal precedent within New York's legal system, impacting future real estate investment cases.

Legal Precedents Set by the Decision

This ruling likely sets a precedent for similar cases involving property misrepresentation and undisclosed financial liabilities. The court’s detailed analysis of the fraudulent actions and its clear articulation of the relevant legal principles provides a solid framework for future litigation. This case law will be invaluable in similar appellate court proceedings.

Expert Commentary and Opinions

[Name of Legal Expert], a prominent real estate attorney specializing in fraud cases, commented, “The DiCenzo v Mone decision reinforces the importance of meticulous due diligence. This ruling provides a powerful tool for investors to pursue legal action against fraudulent actors in New York.” Further analysis by legal commentators and experts suggests a shift in how courts will interpret similar cases involving investment fraud in New York's legal system.

Conclusion: Key Takeaways from the DiCenzo v Mone Case and a Call to Action

The DiCenzo v Mone case serves as a stark reminder of the risks inherent in real estate investment and the importance of investor vigilance. The New York court's decision underscores the potential consequences of fraudulent activities and provides crucial guidance for investors and legal professionals alike. Understanding the DiCenzo v Mone ruling is crucial for anyone involved in New York real estate. The ruling emphasizes the significance of thorough due diligence and the availability of legal recourse for victims of real estate fraud. Protect your investments; learn more about avoiding real estate fraud today by seeking legal counsel specializing in real estate law and conducting comprehensive due diligence before committing to any real estate investment.

Featured Posts

-

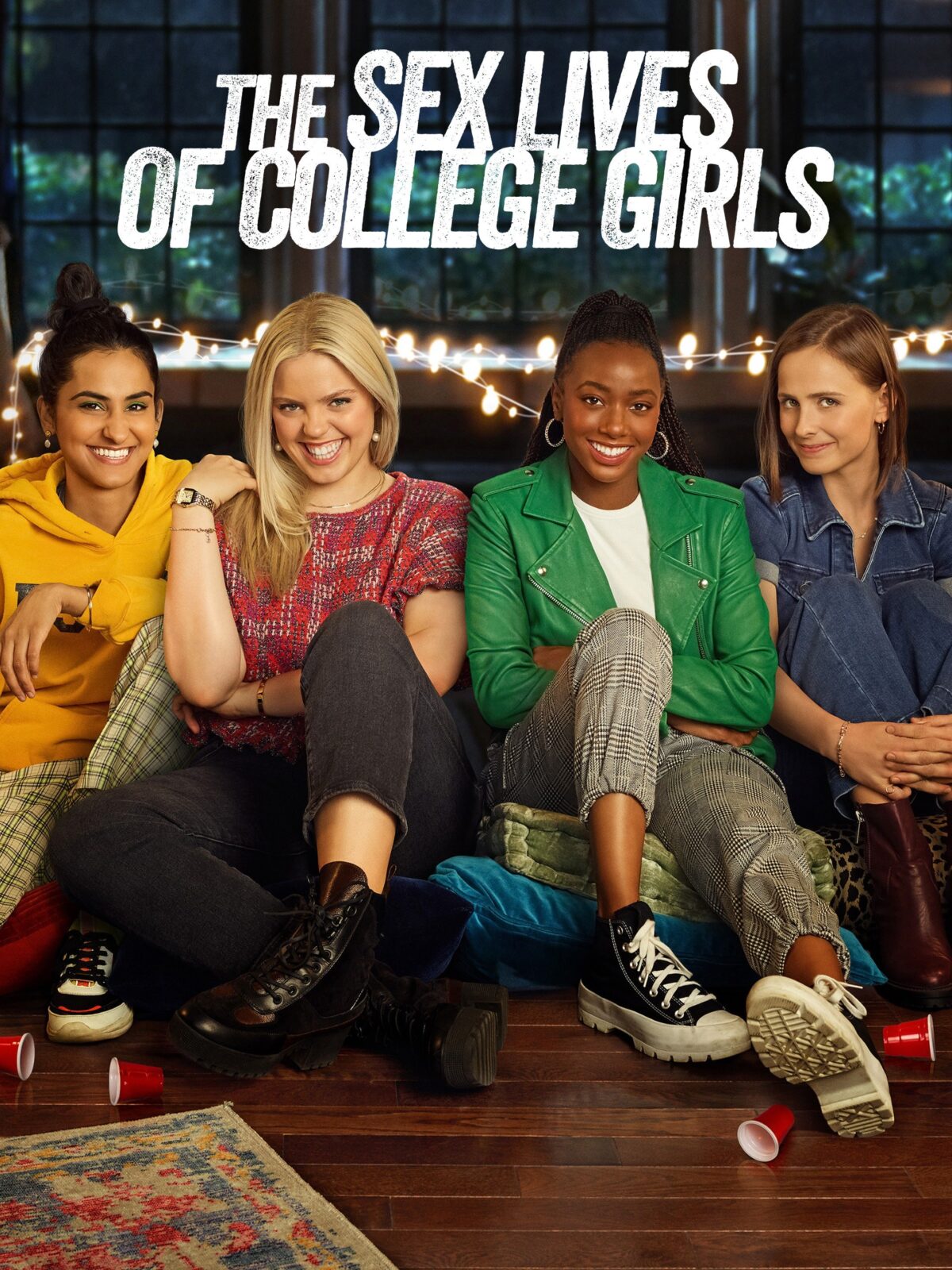

Sex Lives Of College Girls Cancelled No Season 4 Renewal

May 27, 2025

Sex Lives Of College Girls Cancelled No Season 4 Renewal

May 27, 2025 -

Ilektrika Aytokinita Sto Stoxastro Klopi Kalodion Vinteo Ntokoymento

May 27, 2025

Ilektrika Aytokinita Sto Stoxastro Klopi Kalodion Vinteo Ntokoymento

May 27, 2025 -

Bundesliga Showdown Can Leverkusen Maintain Their Title Challenge

May 27, 2025

Bundesliga Showdown Can Leverkusen Maintain Their Title Challenge

May 27, 2025 -

Air Algerie Receives Ncaa Operating Authorization

May 27, 2025

Air Algerie Receives Ncaa Operating Authorization

May 27, 2025 -

How To Stream 1923 Season 2 Episode 4 For Free Tonight

May 27, 2025

How To Stream 1923 Season 2 Episode 4 For Free Tonight

May 27, 2025