Dismissing Market Valuation Concerns: A BofA Analysis

Table of Contents

BofA's Macroeconomic Outlook and its Impact on Valuations

BofA's macroeconomic outlook significantly influences their assessment of current market valuations. Their predictions for key economic indicators – GDP growth, inflation, and interest rates – form the foundation of their analysis. Understanding BofA's economic outlook is crucial for interpreting their valuation perspective.

- BofA's Economic Outlook: BofA's recent reports suggest a continued, albeit moderated, pace of GDP growth, a gradual decline in inflation towards the central bank's target, and a potential pause or even slight decrease in interest rate hikes. (Specific figures should be cited here from the actual BofA report).

- Impact on Asset Classes: These predictions imply different impacts on various asset classes. For example, slower GDP growth might negatively affect certain sectors, while lower inflation could support higher valuations for growth stocks. Bond yields are expected to respond to interest rate changes, influencing fixed-income investments. (Again, specific examples from BofA's report are needed here).

- Comparison to Other Analysts: It is important to compare BofA's predictions to the consensus view of other market analysts. This provides context and highlights areas of agreement or divergence, further refining our understanding of the market valuation picture. (Include comparative data here if available). Keywords: BofA Economic Outlook, Macroeconomic Factors, Market Predictions, Asset Valuation.

Addressing Specific Valuation Metrics and Concerns

Many investors are concerned about high valuation metrics like the Price-to-Earnings (P/E) ratio and the Shiller PE ratio (CAPE). BofA's analysis addresses these concerns by providing a more nuanced perspective.

- Specific Valuation Metrics: Currently, the S&P 500's P/E ratio might be X, while the Shiller PE ratio is Y. (Insert current figures). These numbers are often compared to historical averages to gauge whether valuations are overextended.

- BofA's Justification: BofA's analysts likely justify these levels by considering several factors. For instance, they might argue that low interest rates historically support higher valuation multiples. They might also point to strong corporate earnings growth or other factors supporting current valuations. (Specific reasoning from BofA's report should be included here).

- Comparison to Historical Data: Comparing current valuation multiples to historical data, especially during periods with similar macroeconomic conditions, provides crucial context. This helps determine if current valuations are truly extreme or fall within a reasonable range considering the prevailing economic environment. (Include relevant historical data and comparisons). Keywords: Price-to-Earnings Ratio, Shiller PE Ratio, Valuation Metrics, Market Cycles.

The Role of Interest Rates and Monetary Policy in Shaping Valuations

Interest rate changes exert a significant influence on market valuations. BofA's stance on future monetary policy is crucial in understanding their overall valuation assessment.

- BofA's Interest Rate Predictions: BofA likely projects future interest rate movements, considering factors such as inflation, economic growth, and the central bank's policy goals. (Include BofA's specific predictions).

- Impact on Asset Classes: Changes in interest rates have differing effects on asset classes. Rising rates generally hurt bond prices but can support higher equity valuations in specific sectors. (Explain the impacts according to BofA's analysis).

- Monetary Policy Adjustments: The central bank's policy responses to economic shifts will likely be factored into BofA's analysis. This impacts the future trajectory of interest rates and consequently, market valuations. (Include information about BofA's outlook on future central bank actions). Keywords: Interest Rate Risk, Monetary Policy, Central Bank Policy, Bond Yields.

Identifying Potential Opportunities and Risks Based on the BofA Analysis

BofA's analysis not only addresses valuation concerns but also highlights potential investment opportunities and risks.

- Investment Opportunities: Based on their valuation analysis, BofA might identify undervalued sectors or specific companies poised for growth. (List specific opportunities mentioned in the BofA report).

- Potential Risks: The report likely acknowledges potential downside scenarios, such as a sharper-than-expected economic slowdown or a more aggressive tightening of monetary policy. (Highlight the risks identified by BofA).

- Risk Mitigation Strategies: Understanding these risks is crucial for effective portfolio management. BofA may suggest risk mitigation strategies to help investors navigate potential market downturns. (Include risk mitigation strategies suggested by BofA). Keywords: Investment Opportunities, Risk Assessment, Portfolio Management, Investment Strategy.

Conclusion: Navigating Market Valuation Concerns with BofA's Insights

BofA's analysis offers a valuable counterpoint to prevailing anxieties surrounding market valuations. By considering their macroeconomic outlook, analyzing key valuation metrics, and factoring in the role of interest rates and monetary policy, investors can develop a more nuanced perspective. While acknowledging potential risks, BofA's findings also highlight opportunities. Understanding the nuances of market valuation and leveraging BofA's comprehensive analysis is crucial for making informed investment choices. Access the full BofA report here [link]. Keywords: Market Valuation Strategy, Investment Decisions, BofA Global Research.

Featured Posts

-

Busca La Garantia De Gol El Sistema De Alberto Ardila Olivares

Apr 29, 2025

Busca La Garantia De Gol El Sistema De Alberto Ardila Olivares

Apr 29, 2025 -

D C Midair Collision The Danger Of Unverified Social Media Posts

Apr 29, 2025

D C Midair Collision The Danger Of Unverified Social Media Posts

Apr 29, 2025 -

Nyt Spelling Bee February 25 2025 Clues Answers And Spangram

Apr 29, 2025

Nyt Spelling Bee February 25 2025 Clues Answers And Spangram

Apr 29, 2025 -

Kuxiu Solid State Power Bank Review Performance And Value Assessment

Apr 29, 2025

Kuxiu Solid State Power Bank Review Performance And Value Assessment

Apr 29, 2025 -

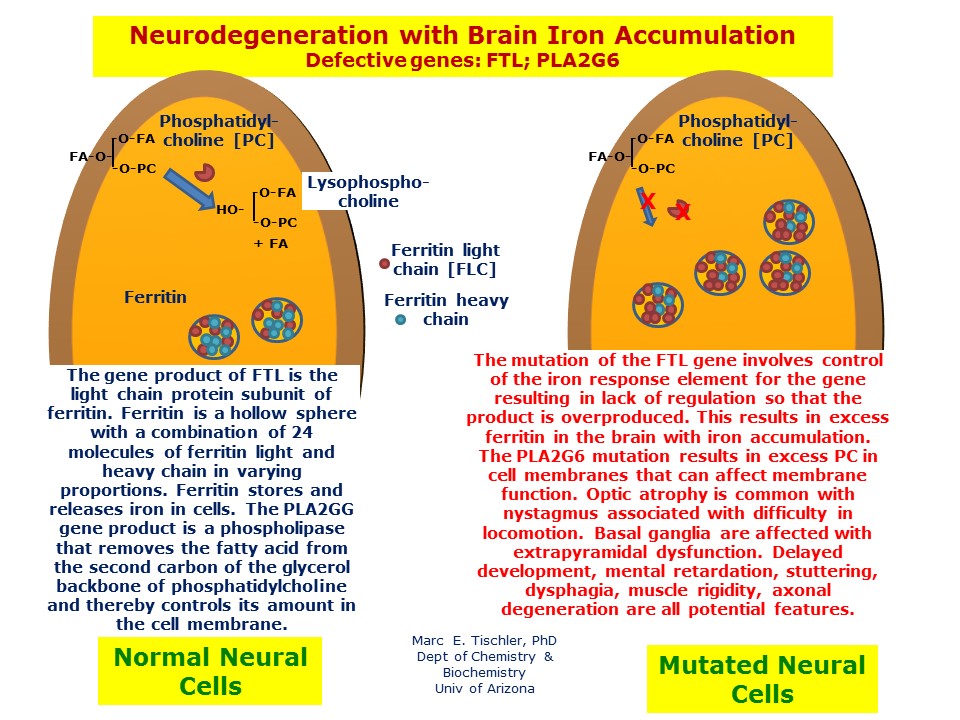

The Impact Of Brain Iron On Adhd And Cognitive Decline In Older Adults

Apr 29, 2025

The Impact Of Brain Iron On Adhd And Cognitive Decline In Older Adults

Apr 29, 2025