Dismissing Stock Market Valuation Concerns: A BofA-Based Argument

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's analysis relies on a multifaceted approach, incorporating various economic indicators and long-term growth projections to temper concerns about overvaluation. Their methodology involves analyzing fundamental data points and comparing them to historical trends, rather than solely focusing on headline-grabbing valuation metrics. Key factors supporting their argument include:

-

Strong Corporate Earnings Growth Projections: BofA projects robust earnings growth for many sectors in the coming years, driven by factors such as technological innovation and increasing consumer demand. Their forecasts suggest that current valuations are sustainable, even considering inflation. They cite specific industry examples to support this claim, highlighting the potential for continued profitability.

-

Resilient Consumer Spending Despite Inflation: While inflation remains a concern, BofA's data suggests that consumer spending remains surprisingly resilient. This indicates underlying economic strength that can support higher stock valuations. They analyze consumer confidence indices and spending patterns to substantiate this assertion.

-

Positive Long-Term Economic Outlook: BofA maintains a relatively positive outlook on the long-term economic trajectory, predicting sustained, albeit potentially slower, growth. This long-term perspective helps contextualize current valuations, suggesting that they may not be as excessive when considering future growth potential.

-

Technological Advancements Driving Future Growth: The ongoing technological revolution, particularly in areas like artificial intelligence and renewable energy, is viewed by BofA as a significant driver of future economic expansion and corporate profitability. This technological optimism helps justify higher valuations for companies positioned to benefit from these advancements.

-

Low Interest Rates (Relative to Historical Context): While interest rates have risen, they remain relatively low compared to historical averages. This low-rate environment supports higher price-to-earnings (P/E) ratios, as the cost of borrowing remains manageable for businesses.

Addressing Common Valuation Metrics

Concerns about market overvaluation often center around common valuation metrics like the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller P/E). BofA's analysis addresses these concerns by:

-

Contextualizing Historical P/E Ratios: BofA compares current P/E ratios to their historical counterparts, demonstrating that while current valuations are elevated, they are not unprecedented. They often present charts illustrating the historical range of P/E ratios, placing current levels within a broader context.

-

Highlighting the Influence of Specific Sectors or Companies: BofA acknowledges that certain sectors or individual companies may be overvalued, but emphasizes that this doesn't necessarily reflect the overall market. They often dissect valuations sector by sector, providing a more nuanced view.

-

Addressing the Impact of Low Interest Rates on Valuation Multiples: BofA explicitly explains how low interest rates, while increasing, continue to support higher valuation multiples compared to periods of higher interest rates.

Potential Risks and Caveats

While BofA presents a relatively optimistic view, it's crucial to acknowledge potential risks and caveats:

-

Geopolitical Risks and Their Potential Impact: Geopolitical instability, such as the ongoing war in Ukraine, poses significant risks to global economic growth and market stability. BofA acknowledges this uncertainty, though their analysis likely incorporates some assessment of these risks.

-

Inflationary Pressures and Their Effect on Corporate Profitability: Persistent inflation can erode corporate profit margins, impacting valuations. While BofA believes the resilience of consumer spending will mitigate this, this remains a key risk factor.

-

Unforeseen Economic Downturns: The possibility of an unexpected economic downturn remains a significant risk. No model can perfectly predict such events, emphasizing the inherent uncertainty in any market forecast.

-

Potential for Interest Rate Hikes and Their Impact on Valuations: Further interest rate increases by central banks could impact valuations negatively by increasing the cost of borrowing and reducing corporate profitability.

Alternative Perspectives and Comparisons

It's important to note that not all analysts share BofA's optimistic view. Some firms maintain more cautious stances, emphasizing the risks associated with high valuations and potential economic slowdowns. Comparing and contrasting these perspectives offers a more comprehensive understanding of the current market dynamics. Understanding the differing methodologies and assumptions of various analysts provides a more complete picture.

Reassessing Stock Market Valuation Concerns – A BofA Perspective

In summary, BofA's analysis suggests that while current stock market valuations are elevated, they are not necessarily indicative of an imminent market crash. Their argument rests on strong corporate earnings projections, resilient consumer spending, a positive long-term economic outlook, technological advancements, and a relatively low interest rate environment (relative to historical precedent). However, it's crucial to acknowledge the inherent risks and uncertainties involved in market forecasting.

Call to Action: We encourage readers to conduct their own research, reviewing BofA's reports and other reputable financial analyses to form their own informed opinion on dismissing stock market valuation concerns. Explore different valuation metrics, consider various economic forecasts, and understand the diverse viewpoints present within the financial community to develop a personal investment strategy. Remember that understanding diverse perspectives is crucial when evaluating stock market valuations.

Featured Posts

-

Ubers Future Is It A Good Long Term Investment

May 17, 2025

Ubers Future Is It A Good Long Term Investment

May 17, 2025 -

Ultraviolette Tesseract Electric Scooter Launched Price Range Specs And Features

May 17, 2025

Ultraviolette Tesseract Electric Scooter Launched Price Range Specs And Features

May 17, 2025 -

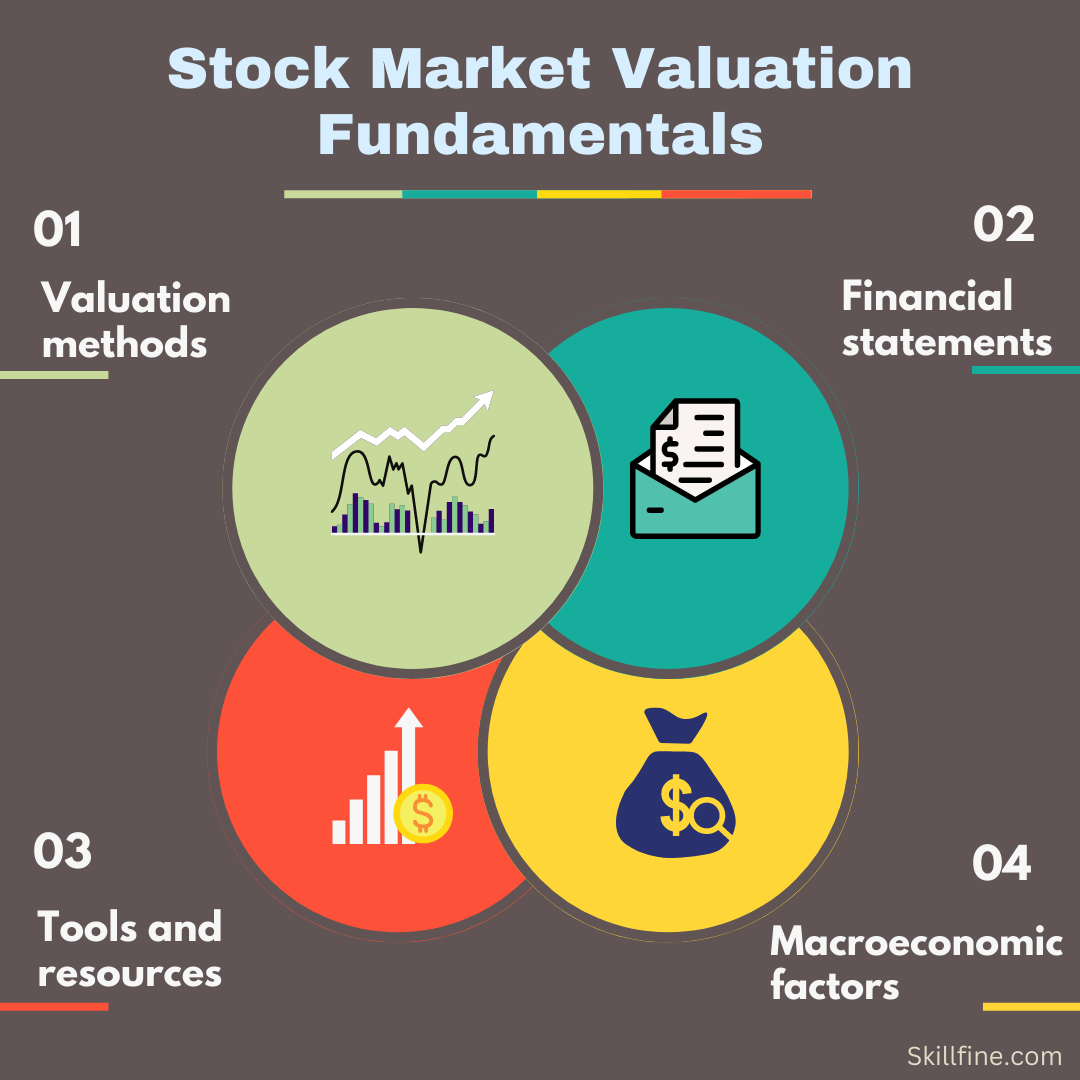

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025 -

Rep Crockett On Trumps Economic Policies Rising Food Costs And Wage Stagnation

May 17, 2025

Rep Crockett On Trumps Economic Policies Rising Food Costs And Wage Stagnation

May 17, 2025 -

Razvitie Industrialnykh Parkov Kak Spravitsya S Perenaselennostyu

May 17, 2025

Razvitie Industrialnykh Parkov Kak Spravitsya S Perenaselennostyu

May 17, 2025