Don't Ignore: Crucial HMRC Updates On Child Benefit Payments

Table of Contents

Recent Changes to Child Benefit Eligibility Criteria

Understanding the eligibility criteria for HMRC Child Benefit is crucial to ensuring you receive the payments you're entitled to. Recent changes have impacted many families, so it's essential to stay updated.

Income thresholds and their impact

The HMRC determines Child Benefit eligibility based on your household income. The current income threshold is [insert current income threshold from official HMRC source – ensure this is up-to-date]. Any income above this threshold may affect your entitlement.

Recent changes to these thresholds include [insert details of any recent changes from official HMRC source]. For example, previously only earned income was considered, but now [explain any changes, e.g., self-employment income is now included].

- Example 1: A family with one parent working part-time and the other self-employed might find their eligibility affected by these changes.

- Example 2: An increase in household income due to a promotion or a second job could result in a reduction or complete cessation of Child Benefit payments.

New rules regarding residency requirements

To claim Child Benefit, you must meet specific residency requirements. You generally need to be [explain current residency requirements as per official HMRC source].

Recent modifications to these rules include [insert details of any recent changes to residency rules from official HMRC source]. For example, [explain changes, e.g., the definition of "ordinarily resident" has been clarified].

- What constitutes residency? This includes factors such as your primary residence, length of stay in the UK, and intention to remain in the UK.

- Implications for those living abroad: Changes to residency rules may affect those living abroad who were previously eligible for Child Benefit.

Updates to the Child Benefit Application Process

Applying for Child Benefit has been streamlined, but it’s vital to be aware of the latest procedures.

Online application process improvements

HMRC has made improvements to the online application system for Child Benefit. These improvements include [insert details of any improvements to online application system from official HMRC source, e.g., enhanced security measures, a more user-friendly interface].

- Steps involved: Visit the official GOV.UK website, complete the online form, and submit the necessary supporting documentation.

- Links: [Insert links to relevant HMRC websites for Child Benefit application].

Changes to required documentation

The documents required to support your Child Benefit application may have changed. Currently, you’ll generally need [insert list of current required documents as per official HMRC source, e.g., National Insurance number, details of children].

Recent changes to the required documentation include [insert details of any changes to required documentation from official HMRC source, e.g., additional proof of address might be necessary].

- List of documents: [List the updated required documents].

- Preparation advice: Ensure all documents are clear, legible, and up-to-date.

Important Information on Child Benefit Payments

Understanding how Child Benefit is paid and addressing any discrepancies is crucial.

Payment frequency and methods

Child Benefit is usually paid [insert payment frequency as per official HMRC source, e.g., every four weeks] into your bank account, building society account, or via a postal order.

- Payment methods: [List available payment methods, including direct debit].

- Advantages/Disadvantages: [Discuss the pros and cons of each payment method].

Addressing potential overpayments or underpayments

If you receive an overpayment, you must repay it to HMRC. The process for this is [insert process for repayment as per official HMRC source]. If you believe you've received an underpayment, you should contact HMRC immediately by [insert contact details for HMRC].

- Contact details for HMRC: [Include phone number, email address, and online contact form link].

- Steps to take if an error occurs: Report the issue promptly and provide all necessary information.

Avoiding Penalties and Staying Compliant with HMRC

Providing accurate information and regularly reviewing your eligibility is key to avoiding penalties.

The importance of accurate information

It's crucial to provide accurate and up-to-date information to HMRC when applying for or updating your Child Benefit claim. Failure to do so can result in [insert potential consequences of providing inaccurate information as per official HMRC source, e.g., fines, prosecution].

- Examples of inaccurate information: Incorrect income details, failure to report a change in circumstances.

- Penalties: [Explain the potential penalties for providing false or misleading information].

Regular review of your Child Benefit entitlement

Regularly review your eligibility for Child Benefit to ensure you're receiving the correct amount. Notify HMRC immediately of any changes in your circumstances that might affect your entitlement.

- Key changes to report: Changes in address, changes in income, changes in the number of children.

Conclusion: Stay Up-to-Date with HMRC Child Benefit Updates

Staying informed about HMRC Child Benefit updates is crucial for avoiding potential problems and ensuring you receive the payments you're entitled to. We've covered recent changes to eligibility criteria, the application process, payment methods, and how to avoid penalties. Remember to regularly review your Child Benefit entitlement and report any changes in your circumstances to HMRC. Don't ignore crucial HMRC updates; visit the HMRC website regularly for the latest information and contact them directly if you have any questions. Regularly review your Child Benefit entitlement to ensure you are receiving the correct payments. Stay informed about HMRC Child Benefit updates to avoid potential issues.

Featured Posts

-

O Giakoymakis Sto Stoxastro Omadon Tis Los Antzeles

May 20, 2025

O Giakoymakis Sto Stoxastro Omadon Tis Los Antzeles

May 20, 2025 -

I Dynami Toy Tampoy Erotas Fygi Kai Syllipsi Se Istorika Kai Sygxrona Keimena

May 20, 2025

I Dynami Toy Tampoy Erotas Fygi Kai Syllipsi Se Istorika Kai Sygxrona Keimena

May 20, 2025 -

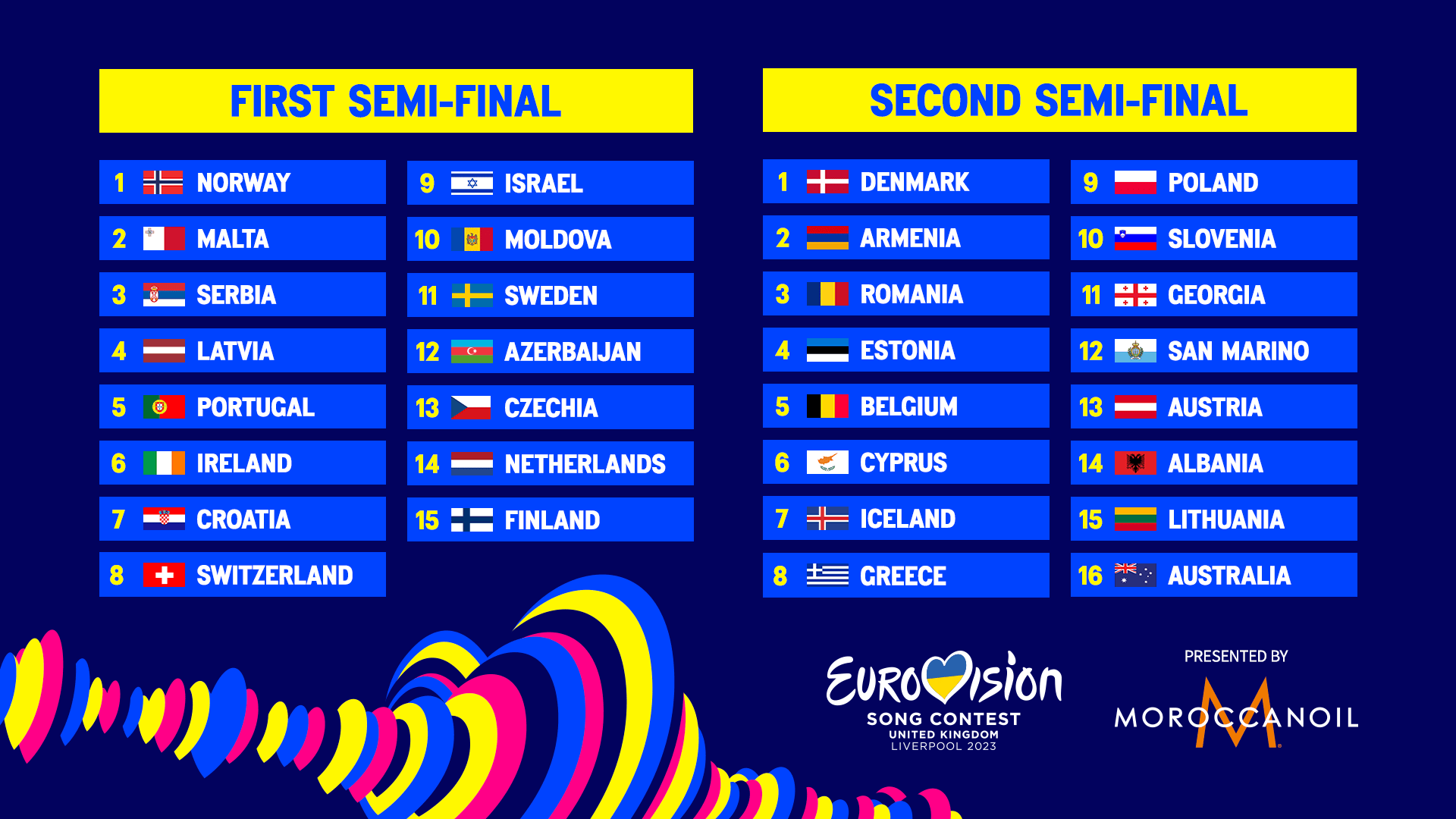

Eurovision Final 2025 Top 5 Favorites Preview

May 20, 2025

Eurovision Final 2025 Top 5 Favorites Preview

May 20, 2025 -

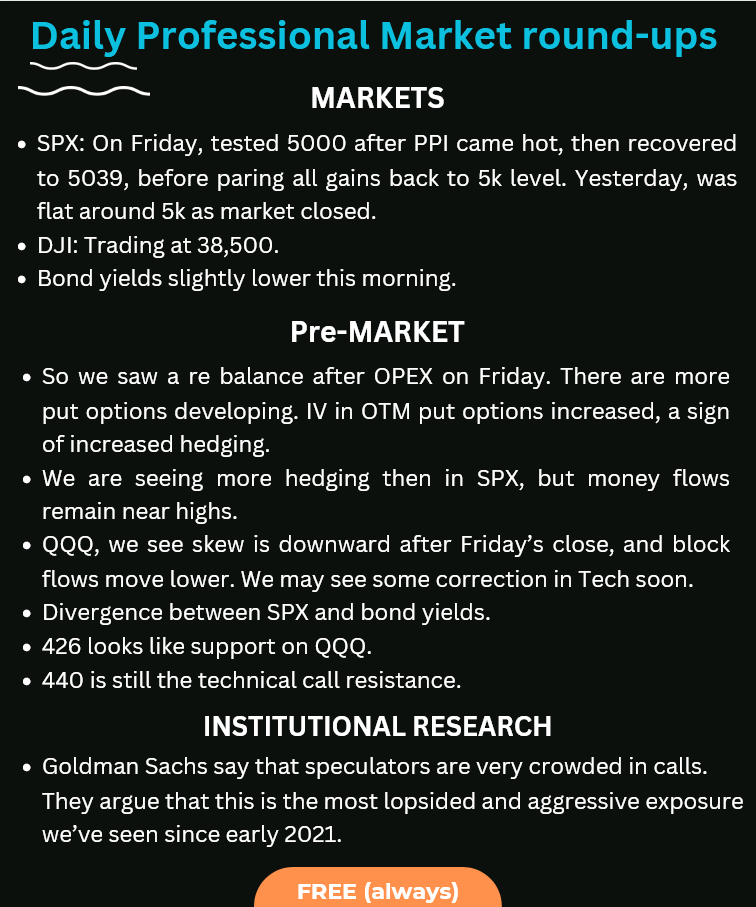

D Wave Quantum Inc Qbts Stock Market Movement Unpacking The Recent Spike

May 20, 2025

D Wave Quantum Inc Qbts Stock Market Movement Unpacking The Recent Spike

May 20, 2025 -

Update Zoey Starks Injury On Wwe Raw

May 20, 2025

Update Zoey Starks Injury On Wwe Raw

May 20, 2025