Dow Futures Fall: Moody's Downgrade Sends Dollar Lower

Table of Contents

Moody's Downgrade and its Impact on US Debt

Moody's decision to downgrade the US government's credit rating from AAA to Aa1 was a monumental event, signaling a significant loss of confidence in the nation's fiscal health. Their rationale cited the US's persistent fiscal challenges, including rising debt levels and political gridlock hindering efforts to address them. This downgrade has far-reaching implications, impacting investor confidence and potentially increasing borrowing costs for the US government.

The consequences of this downgrade are multifaceted:

- Increased interest rates on US Treasury bonds: Investors will demand higher yields to compensate for the increased perceived risk, driving up borrowing costs for the US government.

- Reduced investor appetite for US debt: The downgrade may lead to a decline in foreign investment in US Treasuries, potentially impacting the dollar's value and increasing the cost of government borrowing.

- Potential ripple effects on global financial markets: The US plays a dominant role in the global economy; therefore, the downgrade's impact will likely be felt worldwide, potentially causing uncertainty and volatility in other markets.

The Correlation Between Dow Futures Fall and Dollar Weakness

The decline in Dow Futures is directly correlated with the weakening US dollar. Typically, a strong dollar supports the Dow Futures, and vice versa. However, the Moody's downgrade created an inverse relationship. The downgrade diminishes investor confidence in the US economy, leading to a flight to safety.

Several factors contributed to this dollar weakness:

- Safe-haven assets attracting investment: Investors are seeking refuge in safer assets like gold and other less risky investments, decreasing the demand for the dollar.

- Reduced demand for the dollar as a result of the downgrade: The downgrade casts doubt on the US economy's stability, reducing its attractiveness to international investors.

- Impact of global economic uncertainty: Existing global economic uncertainties are amplified by the downgrade, leading to further uncertainty and a weaker dollar.

Market Reaction and Investor Sentiment

The market reacted swiftly to the Dow Futures fall and Moody's downgrade, displaying increased volatility and uncertainty. Investor sentiment shifted dramatically, with a clear preference for safer assets. Trading activity became more cautious, with many investors taking a wait-and-see approach.

The immediate and potential longer-term effects include:

- Increased volatility in the stock market: Expect heightened fluctuations in stock prices as investors adjust their portfolios based on the new risk assessment.

- Shift in investor strategies: Investors are likely to reassess their risk tolerance and adjust their investment strategies accordingly.

- Potential for further market corrections: The initial drop in Dow Futures may be a precursor to further market corrections as investors grapple with the implications of the downgrade.

Strategies for Navigating Dow Futures Volatility

Navigating this period of market uncertainty requires a cautious and strategic approach. Investors should consider the following:

- Diversify your portfolio: Spread your investments across different asset classes to reduce your exposure to any single market sector.

- Consider hedging strategies: Use hedging techniques like options or futures contracts to protect against potential losses in your portfolio.

- Monitor market news and economic indicators closely: Staying informed about current events and economic data is crucial to making sound investment decisions.

Conclusion: Understanding and Responding to Dow Futures Fall

The sharp "Dow Futures Fall" following Moody's downgrade underscores the interconnectedness of global financial markets and the significant impact of credit rating changes. The weakening dollar and heightened market volatility highlight the need for informed investment decisions. Understanding the underlying factors driving these market movements is crucial for navigating this period of uncertainty.

To effectively manage your investments during this volatility, stay informed about further developments related to Dow Futures and broader market trends. Consult with a qualified financial advisor to discuss personalized strategies for mitigating risk and achieving your financial goals. Further research into US debt, currency exchange rates, and effective market risk management techniques is strongly recommended.

Featured Posts

-

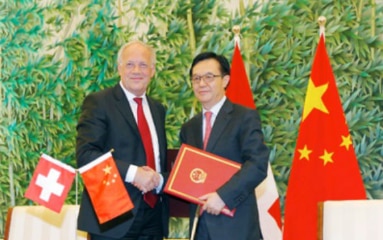

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025 -

The Old North State Report Highlights From May 9 2025

May 21, 2025

The Old North State Report Highlights From May 9 2025

May 21, 2025 -

D Wave Quantum Qbts Stock Performance A Look At Mondays Sharp Decrease

May 21, 2025

D Wave Quantum Qbts Stock Performance A Look At Mondays Sharp Decrease

May 21, 2025 -

Four Star Admirals Bribery Trial Highlights Corruption Within The Navy

May 21, 2025

Four Star Admirals Bribery Trial Highlights Corruption Within The Navy

May 21, 2025 -

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 21, 2025

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 21, 2025