Dow Jones & S&P 500: Stock Market News And Analysis For May 29

Table of Contents

Dow Jones Performance on May 29th

Daily Movement and Closing Values

The Dow Jones Industrial Average (DJIA) opened at 33,800 on May 29th, experiencing significant volatility throughout the day. It reached a high of 33,950 before encountering selling pressure, ultimately closing at 33,600. This represents a 1.5% decrease compared to the previous day's close.

- Negative Investor Sentiment: The unexpectedly high inflation data fueled concerns about further interest rate hikes by the Federal Reserve, leading to widespread selling pressure.

- Tech Stock Weakness: The technology sector, highly sensitive to interest rate changes, underperformed, dragging down the DJIA.

- High Trading Volume: The day witnessed unusually high trading volume, indicating significant investor activity and uncertainty.

- Moving Average Crossover: The 50-day moving average crossed below the 200-day moving average, a bearish technical signal.

Sector-Specific Analysis

The performance of various sectors within the Dow Jones on May 29th was uneven.

- Underperforming Sectors: Technology stocks experienced the most significant decline, with several tech giants seeing considerable drops in their share prices. The financial sector also faced pressure due to anticipated interest rate hikes.

- Top Performing Sectors: Surprisingly, the energy sector performed relatively well, benefiting from sustained high oil prices. Defensive sectors like consumer staples showed some resilience.

- Tech Stocks Under Pressure: Concerns about the impact of rising interest rates on future earnings growth heavily impacted tech stocks.

- Financial Markets Jittery: The financial sector was affected by uncertainties regarding the future trajectory of interest rates and their impact on lending and profitability.

Impact of Major Economic Indicators

The unexpected surge in inflation data directly impacted the Dow Jones.

- Inflation Concerns: The higher-than-anticipated inflation figures reinforced fears about persistent inflationary pressures, prompting investors to reassess their risk appetite.

- Federal Reserve Response: Market participants anticipated a more aggressive response from the Federal Reserve, potentially including further and faster interest rate increases.

- Economic Growth Concerns: The increased inflation fueled concerns about potential slowdowns in economic growth, leading to reduced investor confidence.

S&P 500 Performance on May 29th

Daily Movement and Closing Values

The S&P 500 index mirrored the Dow Jones's negative trajectory. It opened at 4,100, reaching a high of 4,120 before closing at 4,050, reflecting a 1.2% decline compared to the previous day. This drop impacted the overall market capitalization significantly.

- Broad-Based Selling: The selling pressure was widespread, affecting a large number of companies across diverse sectors within the S&P 500 index.

- Market Sentiment Shift: The negative economic news triggered a significant shift in market sentiment, moving away from optimism towards increased caution.

Comparison with Dow Jones Performance

Both the Dow Jones and the S&P 500 experienced declines on May 29th. However, the S&P 500's decline was marginally less pronounced than that of the DJIA.

- Divergence in Sector Weightings: The difference in performance can be partly attributed to the differing sector weightings of the two indices. The S&P 500 has a broader representation of companies and sectors, potentially leading to a less dramatic response.

- Constituent Company Differences: The specific companies included in each index also play a role. The DJIA's concentration in larger, more established companies might make it more sensitive to certain economic news.

Broader Market Trends

May 29th reflected a broader trend of increased market uncertainty.

- Market Sentiment: Investor confidence was significantly dampened by the unexpected inflation figures.

- Trading Volume: High trading volume further highlighted the volatility and uncertainty in the markets.

- Market Breadth: The number of declining stocks significantly outnumbered advancing stocks, indicating a pessimistic market outlook.

Market Outlook and Predictions

Short-Term Predictions

The market's reaction to the May 29th inflation data suggests a cautious short-term outlook.

- Further Volatility: Expect increased market volatility in the coming days and weeks as investors digest the implications of the inflation data and await further guidance from the Federal Reserve.

- Potential for Further Rate Hikes: The possibility of further aggressive interest rate hikes by the Federal Reserve will likely continue to weigh on market sentiment.

Long-Term Implications

The long-term implications of May 29th's events are less certain.

- Economic Growth Trajectory: The impact on long-term economic growth will depend on the Federal Reserve's actions and the overall response of businesses and consumers to rising inflation.

- Investment Strategies: Investors may need to re-evaluate their investment strategies, considering the increased risk environment and potential for further market corrections.

Conclusion: Recap and Call to Action

The release of strong inflation data on May 29th negatively impacted both the Dow Jones and S&P 500, creating considerable market volatility. Negative investor sentiment, fueled by concerns about further interest rate hikes and their impact on economic growth, dominated the day's trading. Sector performance was uneven, with technology and financial stocks underperforming while energy stocks showed some resilience. For a more in-depth understanding of daily stock market news and to stay updated on the Dow Jones and S&P 500, follow our analysis regularly. Stay updated on daily stock market news and check back for more in-depth stock market analysis on our website!

Featured Posts

-

Ealas Miami Quarterfinal Berth After Victory Against Keys

May 30, 2025

Ealas Miami Quarterfinal Berth After Victory Against Keys

May 30, 2025 -

Agassi Regresa Al Deporte Un Nuevo Comienzo Lejos Del Tenis

May 30, 2025

Agassi Regresa Al Deporte Un Nuevo Comienzo Lejos Del Tenis

May 30, 2025 -

Country Diary Discovering The Roastable Roots Of The Carrots Cousin

May 30, 2025

Country Diary Discovering The Roastable Roots Of The Carrots Cousin

May 30, 2025 -

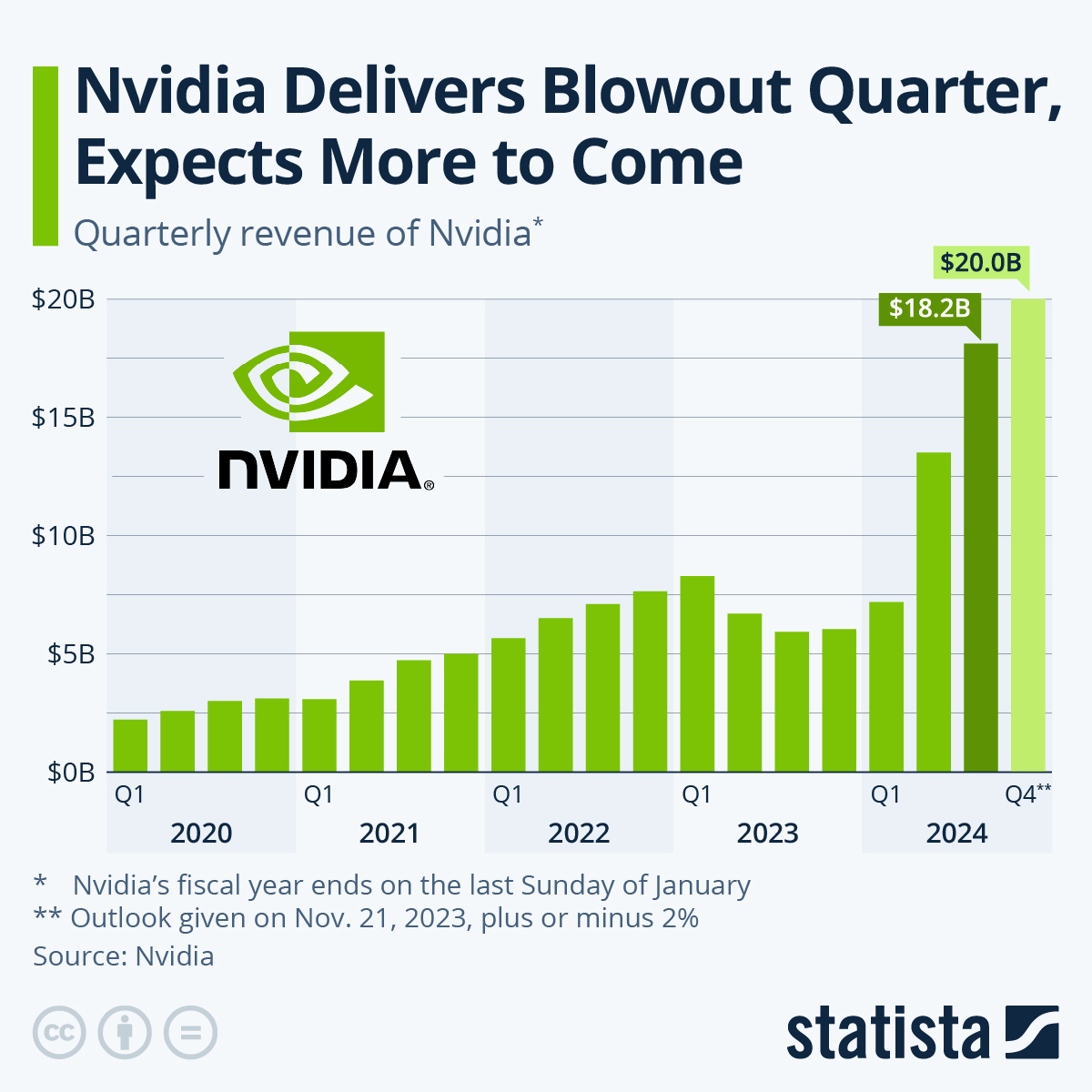

Nvidia Q Quarter Earnings Growth Forecast And Chinas Impact

May 30, 2025

Nvidia Q Quarter Earnings Growth Forecast And Chinas Impact

May 30, 2025 -

Europe 1 Soir 19 03 2025 Version Integrale

May 30, 2025

Europe 1 Soir 19 03 2025 Version Integrale

May 30, 2025