Dutch Stock Market Decline: US Trade War Impact

Table of Contents

Impact of Tariffs on Dutch Exports

The US trade war, characterized by the imposition of tariffs on various goods, directly impacted the demand for Dutch exports. This had a domino effect on the Dutch economy and, consequently, the stock market.

Reduced Demand for Dutch Goods

The increased tariffs on Dutch goods significantly reduced the demand from the US market. This had several consequences:

- Reduced export volume to the US: Dutch companies exporting to the US saw a sharp drop in sales volume, impacting their revenue streams. This is particularly true for sectors like agriculture and manufacturing, which are heavily reliant on US markets.

- Decreased profitability for Dutch exporting companies: Lower sales volumes and increased costs (discussed below) led to a decrease in profitability, affecting company valuations and stock prices. Many companies faced the difficult choice of absorbing the increased costs or raising prices, potentially losing competitiveness.

- Negative impact on Dutch GDP growth: The decline in exports directly contributed to a slowdown in Dutch GDP growth, impacting overall economic confidence and further influencing the stock market decline. This ripple effect underscores the interconnectedness of the Dutch economy and global trade.

Increased Production Costs

Tariffs weren't just imposed on finished goods; they also affected imported raw materials and intermediate goods crucial for Dutch production. This resulted in:

- Higher input costs for manufacturing: Dutch manufacturers faced increased costs for raw materials, impacting their production efficiency and profitability. This increased the cost of producing goods, making them less competitive in both the domestic and international markets.

- Price increases for consumers: To offset increased production costs, many companies were forced to raise prices for consumers, dampening consumer spending and contributing to slower economic growth. This is a classic example of how trade wars can impact everyday citizens.

- Reduced competitiveness compared to non-EU producers: Dutch companies found themselves at a competitive disadvantage compared to producers outside the EU who weren't subject to the same tariffs. This exacerbated the negative impact on Dutch exports and profitability.

Investor Sentiment and Market Volatility

The uncertainty generated by the ongoing US trade war significantly impacted investor sentiment and market volatility, contributing directly to the Dutch Stock Market Decline.

Uncertainty and Risk Aversion

The unpredictable nature of the trade war fostered a climate of uncertainty and risk aversion among investors globally. This led to:

- Withdrawal of foreign investment from the Dutch market: Investors sought safer havens, withdrawing capital from riskier assets, including Dutch stocks. This capital flight further depressed stock prices.

- Decreased investor confidence in Dutch companies: The uncertainty surrounding future trade relations and the potential for further tariffs eroded investor confidence in the profitability and stability of Dutch companies.

- Increased market volatility and price fluctuations: The combination of uncertainty and capital flight led to increased market volatility, with sharp price fluctuations making it difficult for investors to plan and manage their portfolios effectively.

Global Market Downturn

The US trade war wasn't isolated; it triggered a global market downturn. This interconnectedness had a significant impact on the Netherlands.

- Correlation between US market performance and Dutch market performance: The close correlation between the US and Dutch stock markets highlighted the global nature of the economic crisis. A decline in US markets inevitably impacted the Dutch market.

- Impact of global investor sentiment on Dutch stock prices: Negative global investor sentiment directly translated into lower stock prices on the Amsterdam Stock Exchange (AEX). This demonstrated the vulnerability of even relatively stable economies to global trade tensions.

- Decline in overall market capitalization: The cumulative effect of decreased investor confidence and global market downturn resulted in a decline in the overall market capitalization of the AEX, reflecting the broader Dutch Stock Market Decline.

Specific Sectors Affected

While the entire Dutch economy felt the impact, certain sectors were disproportionately affected by the US trade war.

Technology and Semiconductor Industry

The Dutch technology sector, particularly the semiconductor industry, faced significant challenges due to its reliance on global supply chains and imported components.

- Disruptions to global supply chains: Tariffs and trade restrictions disrupted established supply chains, leading to delays and increased costs for Dutch technology companies.

- Increased costs of imported components: The tariffs increased the cost of importing vital components, squeezing profit margins and impacting competitiveness.

- Reduced profitability in the technology sector: These combined factors resulted in reduced profitability and a decline in stock prices for many Dutch technology companies.

Agricultural Sector

The agricultural sector, a cornerstone of the Dutch economy, suffered greatly from tariffs imposed on agricultural exports to the US.

- Reduced demand for Dutch agricultural exports: Tariffs made Dutch agricultural products less competitive in the US market, leading to decreased demand.

- Lower prices for agricultural products: The reduced demand led to lower prices for agricultural products, impacting the income of Dutch farmers and agricultural businesses.

- Impact on farmers' income and livelihoods: The decline in income had a significant impact on the livelihoods of Dutch farmers and the overall viability of the agricultural sector.

Conclusion

The decline in the Dutch Stock Market is undeniably linked to the negative consequences of the US trade war. Tariffs, uncertainty, and the subsequent global market downturn all contributed to reduced investor confidence and lower stock prices. Understanding the vulnerabilities of the Dutch economy to global trade disputes is crucial for both investors and policymakers. Staying informed on the latest developments regarding the Dutch Stock Market Decline and its relation to global trade is paramount. By closely monitoring the effects of trade wars and adjusting investment strategies accordingly, investors can better manage risk and potentially identify opportunities within this challenging market environment.

Featured Posts

-

Impact Of Proposed De Minimis Tariff Changes On Chinese Goods A G 7 Perspective

May 25, 2025

Impact Of Proposed De Minimis Tariff Changes On Chinese Goods A G 7 Perspective

May 25, 2025 -

Cenovus Ceo Meg Acquisition Unlikely Amid Focus On Internal Growth

May 25, 2025

Cenovus Ceo Meg Acquisition Unlikely Amid Focus On Internal Growth

May 25, 2025 -

De Kracht Van Ai Hoe Relx Economische Uitdagingen Overwint En Groei Realiseert

May 25, 2025

De Kracht Van Ai Hoe Relx Economische Uitdagingen Overwint En Groei Realiseert

May 25, 2025 -

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 25, 2025

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 25, 2025 -

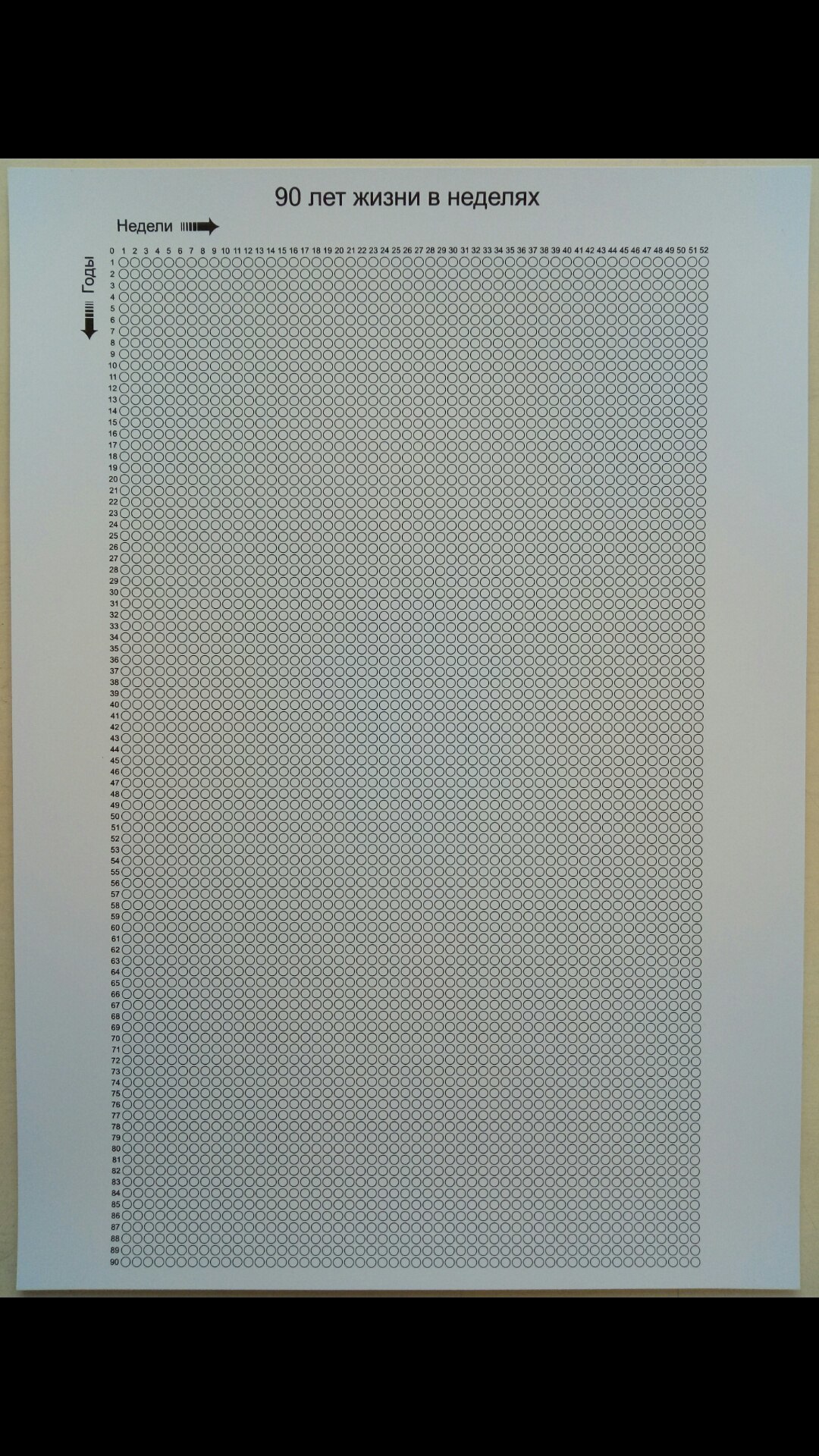

Yubiley Sergeya Yurskogo 90 Let Zhizni I Tvorchestva Legendarnogo Artista

May 25, 2025

Yubiley Sergeya Yurskogo 90 Let Zhizni I Tvorchestva Legendarnogo Artista

May 25, 2025