Dutch Stock Market Suffers Another Blow From US Trade Dispute

Table of Contents

Impact of US Tariffs on Dutch Exports

The imposition of US tariffs on various goods has dealt a considerable blow to several key sectors of the Dutch economy, significantly impacting the Dutch stock market.

Specific Sectors Affected

Dutch industries heavily reliant on exports to the US are particularly vulnerable. Agriculture, specifically dairy and horticultural products, and manufacturing, including machinery and chemicals, have been severely affected.

- Agriculture: Dairy farmers have reported a significant drop in exports, with estimates suggesting a 15-20% decrease in revenue for some companies. For example, FrieslandCampina, a major Dutch dairy cooperative, has publicly acknowledged a decline in its US market share.

- Manufacturing: The automotive sector, with companies like VDL Groep, has also been negatively impacted by tariffs on imported parts and finished vehicles. Estimates suggest a 10% reduction in export volumes for certain manufacturers.

- High-Tech: While not directly targeted by tariffs, uncertainty stemming from the trade dispute has led to decreased investment and slower growth in the Dutch high-tech sector.

These figures are based on reports from the Netherlands Bureau for Economic Policy Analysis (CPB) and the Central Bank of the Netherlands (DNB).

Reduced Consumer Confidence

The uncertainty surrounding the trade war has significantly dampened consumer and investor confidence in the Netherlands. This translates into decreased spending and investment, further impacting economic growth and the Dutch stock market.

- Reduced Consumer Spending: Consumers are delaying major purchases, particularly those related to durable goods, anticipating further price increases due to tariffs.

- Decreased Investment: Businesses are hesitant to invest in expansion or new projects due to the unpredictable economic climate. This uncertainty translates to decreased business activity and a downward pressure on the stock market.

News sources like the Financial Times and Reuters have extensively reported on declining consumer and investor confidence in Europe, including the Netherlands, due to the ongoing trade dispute.

Global Market Volatility and its Influence on the Dutch Stock Market

The US-led trade dispute isn't isolated; its effects ripple across global markets, significantly impacting the Dutch stock market.

Global Economic Uncertainty

The ongoing trade war creates a climate of uncertainty that affects investor sentiment worldwide. This uncertainty leads to a flight to safety, with investors moving their money away from riskier assets, including stocks in emerging markets and smaller European economies like the Netherlands.

- Global Market Downturns: Stock markets around the world, including those in the EU and Asia, have experienced declines correlated with the escalation of the US trade dispute.

- Investor Sentiment: Negative news surrounding the trade war fuels pessimism, leading to sell-offs and further depressing stock prices.

Weakening Euro

The weakening Euro against the US dollar further exacerbates the challenges faced by Dutch exporters. This makes Dutch goods more expensive for US consumers and reduces the profitability of exports.

- Euro-Stock Market Correlation: Historically, a weaker Euro has a negative correlation with the performance of the Dutch stock market, as export-oriented businesses suffer reduced competitiveness.

- Reduced Export Revenue: The combination of tariffs and a weaker Euro translates to significantly lower export revenue for Dutch companies, affecting their bottom lines and share prices.

Government Response and Potential Mitigation Strategies

The Dutch government has implemented several measures to mitigate the negative effects of the US trade dispute on the Dutch economy.

Government Actions

The government has focused on supporting affected industries and promoting diversification of export markets.

- Financial Aid Packages: Targeted financial aid packages have been announced to support businesses in affected sectors, particularly agriculture and manufacturing.

- Trade Negotiations: The Dutch government is actively engaging in negotiations with the EU and other trading partners to secure alternative markets and reduce reliance on the US.

- Investment Incentives: Incentives aimed at attracting foreign investment and fostering innovation within the Dutch economy have been introduced to compensate for trade disruption.

The effectiveness of these measures is still being evaluated, but initial assessments suggest a limited ability to fully counteract the negative impacts of the US trade dispute.

Long-Term Economic Outlook

The long-term consequences for the Dutch economy remain uncertain. Several scenarios are possible:

- Scenario 1 (Moderate Impact): The trade dispute is resolved relatively quickly, with minimal long-term damage to the Dutch economy. This scenario relies on a swift de-escalation of trade tensions and effective government intervention.

- Scenario 2 (Significant Impact): The trade dispute continues for an extended period, leading to significant structural changes in the Dutch economy. This could involve a shift away from reliance on US markets and a more pronounced focus on intra-EU trade.

- Scenario 3 (Severe Impact): A prolonged and intensified trade war could trigger a more severe recession in the Netherlands, with significant job losses and reduced economic growth.

Experts at the CPB and DNB continue to monitor the situation and provide updated forecasts. Their opinions highlight the significant uncertainty surrounding the long-term economic consequences.

Conclusion

The ongoing US trade dispute continues to negatively impact the Dutch stock market. Key factors contributing to this decline include US tariffs on Dutch exports, reduced consumer and investor confidence, global market volatility, and the weakening Euro. While the Dutch government is taking steps to mitigate the damage, the long-term consequences remain uncertain. Stay informed about developments and consult financial experts for guidance on navigating this challenging period for the Dutch stock market. Regularly check reputable financial news sources for updates on the Dutch Stock Market and its relation to the US Trade Dispute.

Featured Posts

-

2nd Edition Best Of Bangladesh In Europe A Platform For Collaboration And Expansion

May 24, 2025

2nd Edition Best Of Bangladesh In Europe A Platform For Collaboration And Expansion

May 24, 2025 -

Resurfaced Allegations Sean Penns Public Support For Woody Allen Sparks Debate

May 24, 2025

Resurfaced Allegations Sean Penns Public Support For Woody Allen Sparks Debate

May 24, 2025 -

Muezelerde Araba Sergileme Teknikleri Porsche 956 Oernegi

May 24, 2025

Muezelerde Araba Sergileme Teknikleri Porsche 956 Oernegi

May 24, 2025 -

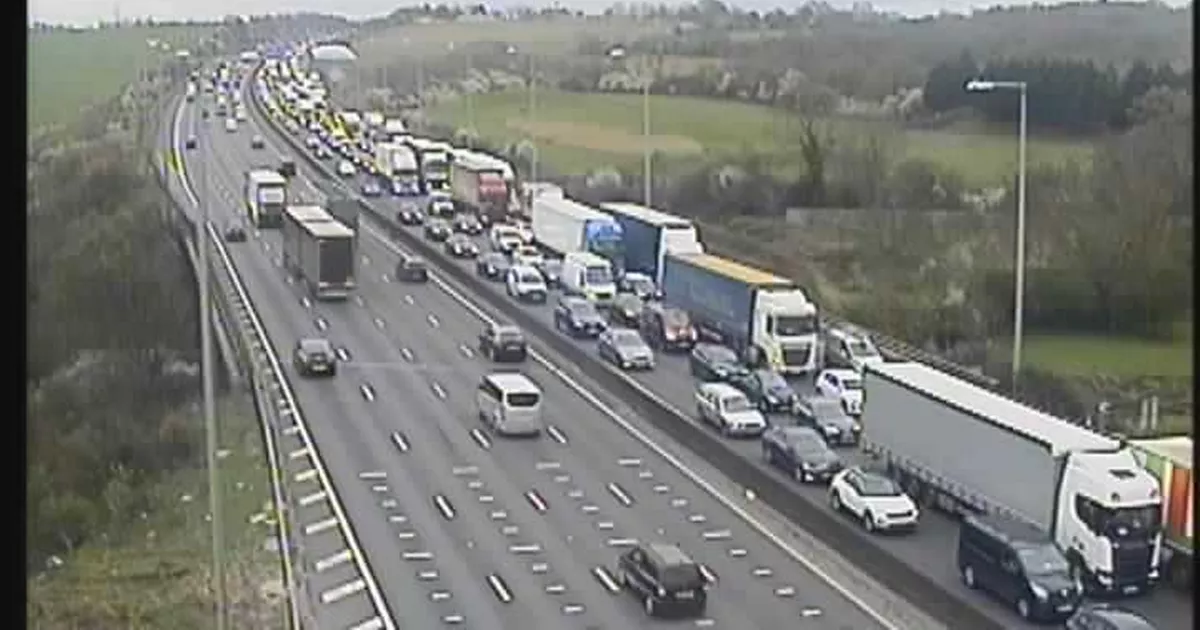

M56 Motorway Closure Live Traffic Updates Following Serious Crash

May 24, 2025

M56 Motorway Closure Live Traffic Updates Following Serious Crash

May 24, 2025 -

Trud I Istoriya Lyubvi Ili Ilicha Podrobnosti Iz Gazetnykh Publikatsiy

May 24, 2025

Trud I Istoriya Lyubvi Ili Ilicha Podrobnosti Iz Gazetnykh Publikatsiy

May 24, 2025

Latest Posts

-

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 24, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 24, 2025 -

Cassidy Hutchinson Memoir Insights From A Key January 6th Witness

May 24, 2025

Cassidy Hutchinson Memoir Insights From A Key January 6th Witness

May 24, 2025 -

The Demise Of The Penny Us Plans To Stop Minting Pennies By 2026

May 24, 2025

The Demise Of The Penny Us Plans To Stop Minting Pennies By 2026

May 24, 2025 -

The Closure Of Anchor Brewing Company Whats Next For The Brand

May 24, 2025

The Closure Of Anchor Brewing Company Whats Next For The Brand

May 24, 2025 -

U S Penny Phase Out No More Pennies In Circulation By 2026

May 24, 2025

U S Penny Phase Out No More Pennies In Circulation By 2026

May 24, 2025