EToro Resumes IPO Plans, Targeting $500 Million

Table of Contents

eToro's Renewed Pursuit of a Public Listing

Previous IPO Attempts and Reasons for Delay

eToro's journey to a public listing hasn't been without its hurdles. Previous attempts at an IPO faced delays, primarily due to challenging market conditions and regulatory complexities.

- 2018 Attempt: eToro initially explored an IPO in 2018, but the plan was shelved due to unfavorable market sentiment and concerns surrounding regulatory compliance in various jurisdictions.

- 2020-2021 Delays: Further attempts throughout 2020 and 2021 were impacted by the economic uncertainty caused by the COVID-19 pandemic and volatility in the global stock market. These factors made securing a favorable valuation difficult.

- Regulatory Hurdles: Navigating the complexities of different regulatory frameworks across various global markets also contributed to the delays. eToro needed to ensure full compliance before proceeding with a public listing.

Revised Strategy and Timeline

eToro's renewed push for an IPO reflects a refined business strategy and improved financial performance.

- Enhanced Regulatory Compliance: The company has significantly strengthened its regulatory compliance across key markets, addressing previous concerns and paving the way for a smoother IPO process.

- Strategic Partnerships: New partnerships with financial institutions and technology providers have strengthened eToro's infrastructure and expanded its reach.

- Improved Financial Performance: The company has demonstrated robust revenue growth and a larger user base, showcasing its potential for profitability and making it a more attractive prospect for investors.

- Projected IPO Timeline: While an exact date remains unannounced, eToro is actively working towards a public listing, aiming to complete the IPO process within the next [Insert timeframe, if available, otherwise remove this bullet point].

The $500 Million Valuation – A Realistic Target?

The proposed $500 million valuation is ambitious, requiring a thorough analysis of eToro's current standing.

- Revenue Growth and User Base: eToro's impressive user growth and consistent revenue increases significantly support the valuation. The platform's widespread adoption speaks volumes about its market appeal.

- Profitability and Market Share: While profitability might not be immediately evident, eToro's significant market share in the social trading space indicates a strong foundation for future growth and profitability.

- Comparison to Competitors: A comparative analysis with similar publicly traded fintech companies provides a benchmark for assessing the reasonableness of the $500 million target. Factors like revenue multiples and user acquisition costs will be vital in this assessment.

Impact on Investors and the Fintech Market

Opportunities for Investors

eToro's IPO presents both exciting opportunities and potential risks for investors.

- Potential Returns: A successful IPO could yield substantial returns for early investors, particularly if eToro's growth trajectory continues.

- Risk Assessment: However, investing in IPOs always carries inherent risks, including market volatility and the uncertainty surrounding a newly public company's performance. Due diligence is crucial.

- Investment Strategies: Investors should carefully consider their risk tolerance and investment goals before participating in the eToro IPO. Diversification is key.

eToro's Position in the Competitive Fintech Landscape

eToro operates in a highly competitive fintech market.

- Key Competitors: Companies such as Robinhood, Interactive Brokers, and others pose significant competitive challenges.

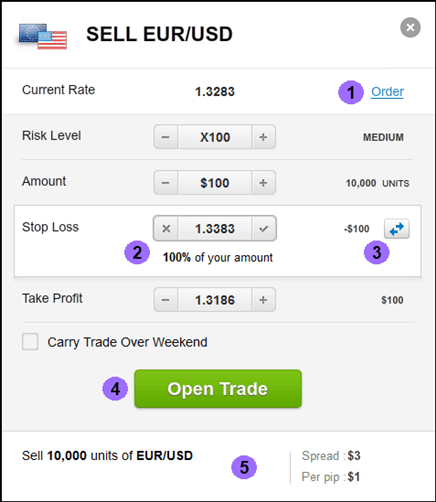

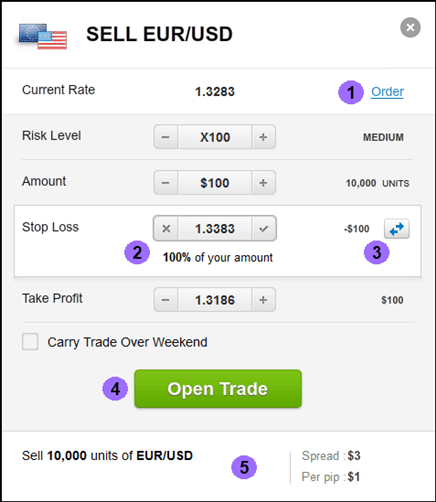

- Unique Selling Points: eToro differentiates itself through its social trading features, copy trading capabilities, and diverse asset offerings, including cryptocurrencies.

- Market Trends and Growth Potential: The ever-growing popularity of online investing and the increasing adoption of cryptocurrencies suggest a promising future for eToro.

Implications for the Broader Fintech Sector

eToro's IPO will have broader implications for the fintech industry.

- Catalyst for Other IPOs: A successful eToro IPO could encourage other fintech companies to pursue public listings, increasing competition and investment in the sector.

- Investor Sentiment: The IPO's success or failure will influence investor sentiment towards the fintech sector, potentially affecting funding rounds and valuations of other companies.

- Industry Growth: eToro's public listing could contribute to the overall growth and maturity of the fintech industry, signaling its increasing importance in the global financial landscape.

Conclusion

eToro's renewed IPO plans, targeting a $500 million valuation, represent a significant development in the fintech space. While the $500 million target is ambitious, eToro's growth trajectory, strategic adjustments, and positioning within the competitive landscape suggest a reasonable chance of success. Investors should carefully weigh the potential risks and rewards before participating, while recognizing the broader impact on the fintech market. Stay updated on the latest news about the eToro IPO and learn more about investing in the growing fintech market. Don't miss out on potential investment opportunities related to the eToro IPO and similar ventures.

Featured Posts

-

Where To Stream Captain America Brave New World On Pvod Online

May 14, 2025

Where To Stream Captain America Brave New World On Pvod Online

May 14, 2025 -

Urgent Recall Walmart Pulls Orvs Oysters And Electric Scooters Nationwide

May 14, 2025

Urgent Recall Walmart Pulls Orvs Oysters And Electric Scooters Nationwide

May 14, 2025 -

The Censori Sisters Bianca And Angelina

May 14, 2025

The Censori Sisters Bianca And Angelina

May 14, 2025 -

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025 -

Dodgers Comeback Ohtanis Historic 6 Run 9th Inning

May 14, 2025

Dodgers Comeback Ohtanis Historic 6 Run 9th Inning

May 14, 2025