EToro's Return To The IPO Market: A $500 Million Goal

Table of Contents

eToro's Renewed IPO Push: Why Now?

eToro's decision to pursue an IPO now is driven by a confluence of factors indicating improved market conditions and strong company performance. Compared to previous attempts, the current market environment appears more receptive to tech IPOs, particularly those in the burgeoning fintech sector. eToro's recent growth in user base and revenue is a key driver. The company has experienced substantial growth, fueled by increased adoption of social trading and the growing interest in cryptocurrency investments. A public listing offers several strategic advantages. Going public provides increased brand visibility, attracting a wider range of users and investors. Crucially, an IPO grants eToro access to significant capital for further expansion and innovation.

- Increased user adoption of social trading and crypto investments: eToro has successfully capitalized on the growing popularity of both sectors.

- Expansion into new markets and product offerings: The company continues to expand its geographical reach and diversify its product portfolio.

- Improved financial performance and profitability: eToro's financial performance has strengthened, making it a more attractive prospect for investors.

- Strategic partnerships and collaborations: Strategic alliances have enhanced eToro's market position and broadened its reach.

Keywords: eToro market conditions, eToro growth, eToro revenue, eToro market strategy, social trading growth

Challenges Facing eToro's $500 Million IPO Goal

Despite the positive outlook, eToro faces several challenges in achieving its $500 million IPO goal. Navigating regulatory hurdles and ensuring full compliance with various jurisdictions' requirements will be crucial. Market volatility presents a significant risk, potentially impacting the final IPO valuation. The competitive landscape is crowded, with established brokerage firms and other investment platforms vying for market share.

- Navigating fluctuating investor sentiment: The overall investor sentiment towards tech IPOs can shift rapidly, impacting the success of the offering.

- Competition from established brokerage firms: eToro faces competition from well-established players with significant resources and brand recognition.

- Addressing regulatory scrutiny in various jurisdictions: Compliance with evolving regulations in different markets is a complex and ongoing challenge.

- Maintaining user growth and engagement: Sustaining the current growth trajectory and keeping users engaged will be critical to the long-term success of the company.

Keywords: eToro regulation, eToro competition, IPO risks, market volatility, investment platform competition

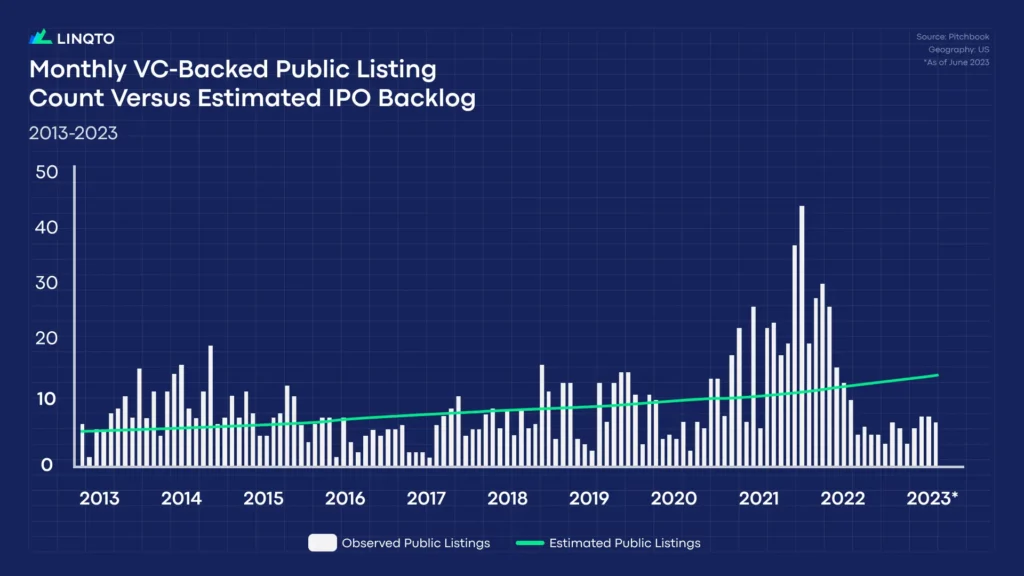

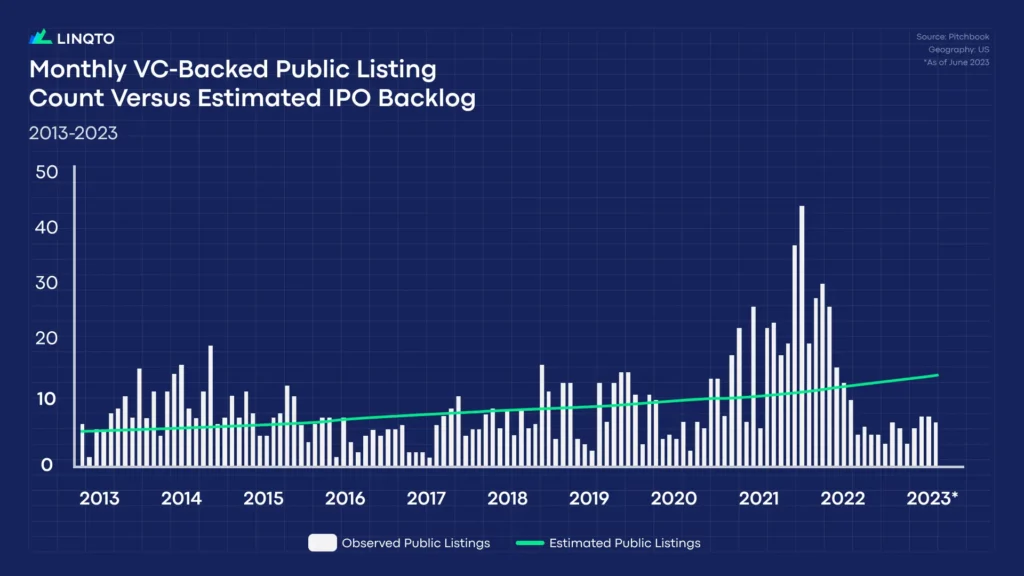

Investor Sentiment and Market Expectations

Investor interest in the social trading sector is growing, presenting a potentially positive outlook for eToro's IPO. The demand for eToro's shares will depend on various factors, including the company's financial performance, market conditions, and the IPO pricing. Analysts are providing projections and ratings, which will influence investor decisions. Comparisons with similar publicly traded companies will be made to gauge a suitable valuation range. Macroeconomic factors will also influence investor appetite. Oversubscription or undersubscription are both possibilities, depending on these dynamic factors.

- Analyst projections and ratings: Independent analysts' opinions will heavily influence investor perception.

- Comparison with similar publicly traded companies: Benchmarking against competitors will help determine a fair valuation.

- Impact of macroeconomic factors on investor appetite: Global economic conditions can significantly affect investor risk tolerance.

- Potential for oversubscription or undersubscription: The level of demand will determine the success of the IPO.

Keywords: eToro investor sentiment, eToro stock price prediction, IPO valuation, social trading investment, investor demand

The Implications of a Successful eToro IPO

A successful eToro IPO will provide significant benefits, including substantial access to capital for further expansion and enhancing the company's brand reputation. This will have a ripple effect on the broader social trading market, potentially attracting further investment and innovation. eToro can utilize the funds raised to accelerate growth through research and development, acquisitions, expansion into new geographic markets, and the development of new trading products and services.

- Funding for research and development: Capital raised can fuel innovation and the development of new features.

- Acquisitions of competing companies or technologies: eToro could strengthen its market position through strategic acquisitions.

- Expansion into new geographic markets: The IPO could provide the resources for expansion into underserved markets.

- Development of new trading products and services: eToro can invest in new products and services to cater to evolving investor needs.

Keywords: eToro future growth, eToro expansion, social trading future, IPO benefits, market impact

Conclusion:

eToro's renewed pursuit of a $500 million IPO represents a significant milestone for the social trading platform. While challenges undoubtedly exist, the company's impressive recent growth and the generally favorable market conditions suggest a positive outlook. The success of this IPO will not only shape eToro's future but also significantly influence the trajectory of the social trading industry. Stay informed about the eToro IPO and consider adding eToro stock to your investment watchlist if you're interested in participating in this exciting development. Keep a close eye on this key event in the world of social trading IPOs.

Featured Posts

-

Sigourney Weavers Snow White And Disneys Remake A Comparison Of Key Differences

May 14, 2025

Sigourney Weavers Snow White And Disneys Remake A Comparison Of Key Differences

May 14, 2025 -

Uruguay Despide A Su Expresidente Jose Mujica A Los 89 Anos

May 14, 2025

Uruguay Despide A Su Expresidente Jose Mujica A Los 89 Anos

May 14, 2025 -

Bianca Censoris Racy Roller Skating Outfit Bra And Thong Look

May 14, 2025

Bianca Censoris Racy Roller Skating Outfit Bra And Thong Look

May 14, 2025 -

Saechsische Schweiz Osterzgebirge Entwarnung Fuer Hohburkersdorf Lagebericht

May 14, 2025

Saechsische Schweiz Osterzgebirge Entwarnung Fuer Hohburkersdorf Lagebericht

May 14, 2025 -

Carriere A La Societe Generale Processus De Recrutement Et Nominations

May 14, 2025

Carriere A La Societe Generale Processus De Recrutement Et Nominations

May 14, 2025