Effective Succession Planning: Protecting Ultra-High-Net-Worth Families' Legacies

Table of Contents

Assessing and Defining Family Goals and Values

Before diving into the complexities of wealth management and estate planning, UHNW families must first understand their shared goals and values. This foundational step is crucial for creating a succession plan that truly reflects the family's aspirations and ensures long-term harmony.

Understanding Family Dynamics

Open communication is the bedrock of effective family governance. Understanding individual aspirations, concerns, and potential conflicts regarding the family's wealth and legacy requires careful consideration.

- Identify key family members involved: Clearly define who will participate in the planning process, ensuring representation across generations.

- Conduct family meetings facilitated by a neutral party: A professional mediator or family therapist can guide discussions, fostering open communication and resolving potential conflicts constructively. This neutral perspective aids in objective decision-making during family wealth transfer.

- Develop a family constitution outlining shared values and goals: This formal document serves as a guide for future generations, clarifying expectations and principles for managing family wealth and business interests. It establishes clear guidelines for family governance.

Defining Legacy Goals

The legacy of a UHNW family extends far beyond financial wealth. Consider intangible aspects that contribute to a lasting positive impact.

- Establish charitable giving strategies: Planned philanthropy can align with family values and create a lasting social impact, leaving a legacy that benefits future generations and the wider community.

- Document family history and traditions: Preserving family history ensures that future generations understand their roots and heritage, strengthening family bonds and providing a sense of continuity. This is a vital part of legacy planning.

- Define family values and principles: Identifying core values like integrity, responsibility, and philanthropy guides decision-making and ensures that wealth is managed in a way consistent with the family’s core beliefs.

Developing a Comprehensive Wealth Preservation Strategy

A robust wealth preservation strategy is essential for protecting the family's financial well-being across generations. This involves diversification, tax optimization, and proactive measures to mitigate potential disputes.

Diversifying Assets

Diversification is a cornerstone of risk management in wealth preservation. Spreading investments across various asset classes mitigates the impact of market fluctuations.

- Consult with experienced financial advisors: Seek professional guidance to create a diversified portfolio tailored to the family's risk tolerance and long-term goals.

- Explore alternative investments: Consider options such as private equity, hedge funds, and real estate to further diversify holdings and potentially enhance returns.

- Implement robust risk management strategies: Develop comprehensive plans to address potential threats to the family's assets, including legal challenges, market downturns, and unforeseen circumstances.

Tax Optimization and Estate Planning

Minimizing tax liabilities is crucial for maximizing the transfer of wealth to future generations. Sophisticated estate planning techniques can help achieve this goal.

- Work with estate planning attorneys and tax specialists: Utilize expert legal and financial advice to create a tax-efficient estate plan.

- Explore various trust structures: Different trust structures offer varying degrees of control and tax advantages, allowing for customized solutions to fit specific family needs.

- Consider gifting strategies: Strategic gifting during life can reduce estate taxes and allow for greater control over the timing and manner of wealth transfer.

Protecting Against Family Disputes

Clear guidelines for wealth distribution and governance are critical in preventing conflicts and ensuring family harmony.

- Develop a clear family governance structure: Establish clear roles and responsibilities for managing family assets and investments. This often includes establishing a family council or trust board.

- Implement binding arbitration agreements: These agreements can help resolve disputes efficiently and amicably, avoiding costly and protracted litigation.

- Utilize mediation services if disputes arise: Mediation provides a neutral platform for family members to communicate and work towards mutually acceptable solutions.

Ensuring Business Continuity for Family-Owned Enterprises

For UHNW families with family-owned businesses, succession planning is vital for maintaining operational efficiency and preserving the family's legacy.

Identifying and Developing Future Leaders

Investing in the next generation of leaders is crucial for ensuring a smooth transition and continued business success.

- Implement leadership development programs: Provide training and mentorship opportunities to prepare the next generation for management responsibilities.

- Create succession timelines and milestones: Establish a clear roadmap for the transfer of ownership and management responsibilities, outlining key milestones and deadlines.

- Provide mentorship from experienced executives: Pairing younger family members with seasoned professionals can accelerate their development and ensure a seamless transition.

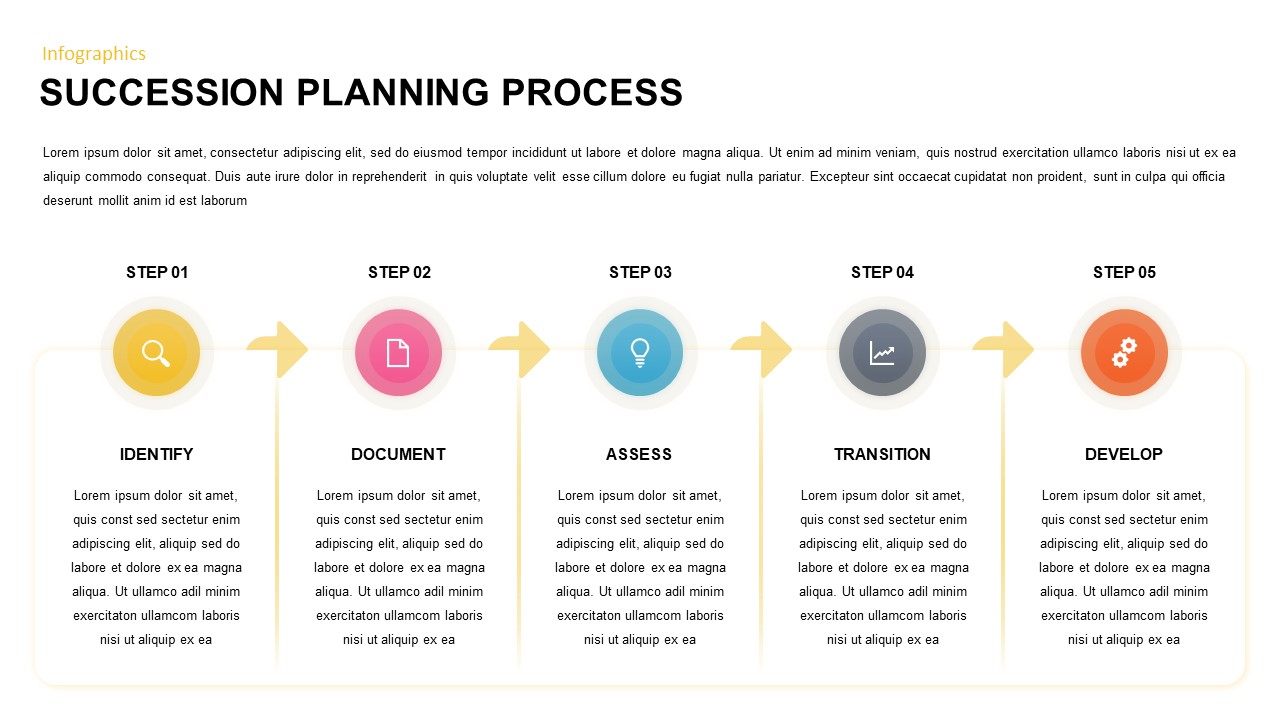

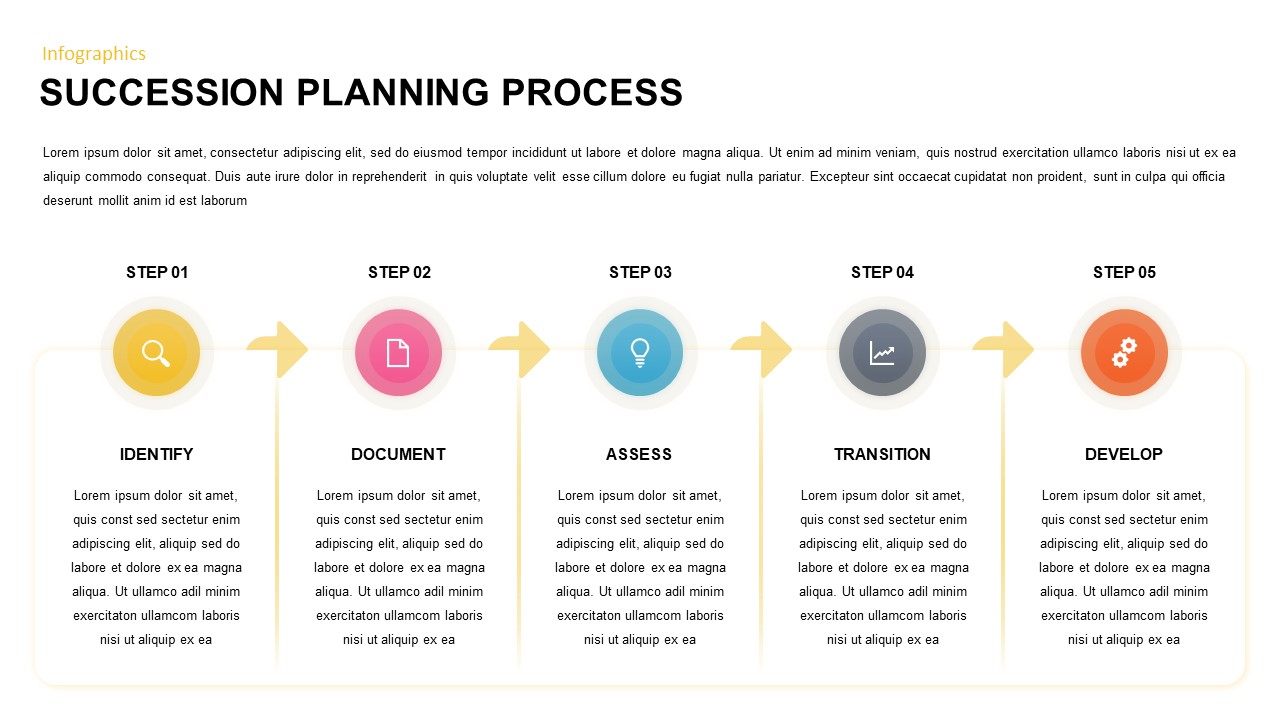

Creating a Formal Transition Plan

A detailed plan outlining the transfer of ownership and management responsibilities is essential for minimizing disruption and maximizing success.

- Develop a buy-sell agreement: This legally binding document outlines the process for transferring ownership shares within the family.

- Establish clear performance metrics for successors: Setting clear objectives and metrics helps to assess the progress of the next generation of leaders.

- Implement succession plans for key employees: Ensuring the continuity of other essential personnel is crucial for maintaining business operations.

Conclusion

Effective succession planning is essential for UHNW families to protect their legacies and ensure the long-term prosperity of future generations. By carefully assessing family goals, developing a comprehensive wealth preservation strategy, and establishing a plan for business continuity, UHNW families can safeguard their assets and values while fostering unity and collaboration. Don't delay; begin your family's effective succession planning today to secure a brighter future. Contact a qualified financial advisor and estate planning attorney to discuss your specific needs and develop a customized succession plan tailored to protect your ultra-high-net-worth family's legacy.

Featured Posts

-

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Switzerland Issues Statement On Chinese Military Activity

May 22, 2025

Switzerland Issues Statement On Chinese Military Activity

May 22, 2025 -

Wordle Today 1408 Hints Clues And Answer For April 27th

May 22, 2025

Wordle Today 1408 Hints Clues And Answer For April 27th

May 22, 2025 -

Summer Travel Mayhem Airlines Prepare For Difficult Season

May 22, 2025

Summer Travel Mayhem Airlines Prepare For Difficult Season

May 22, 2025 -

Nato Zirvesi Tuerkiye Nin Etkisi Ve Ittifakin Gelecegi Icin Oenemi

May 22, 2025

Nato Zirvesi Tuerkiye Nin Etkisi Ve Ittifakin Gelecegi Icin Oenemi

May 22, 2025