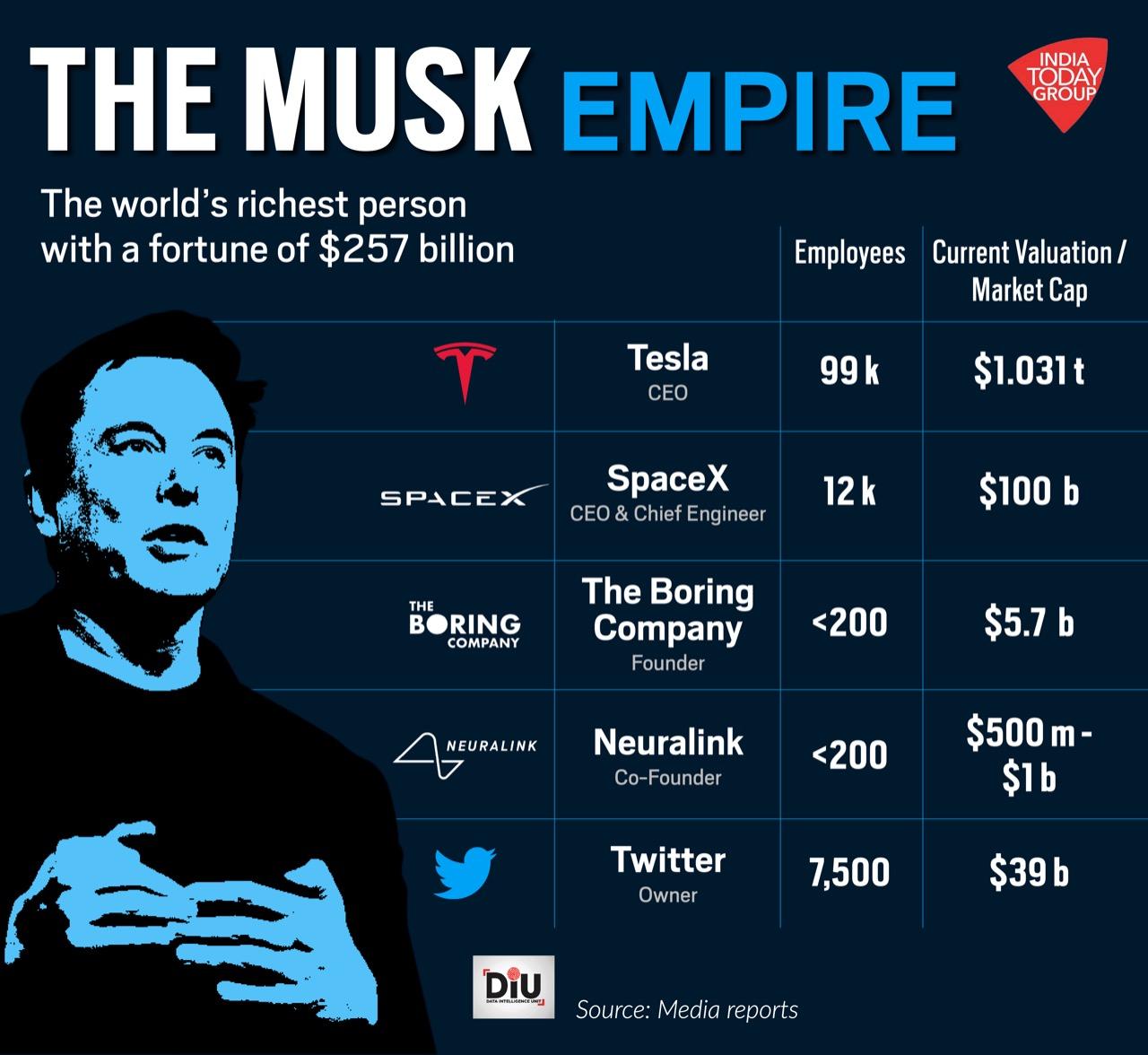

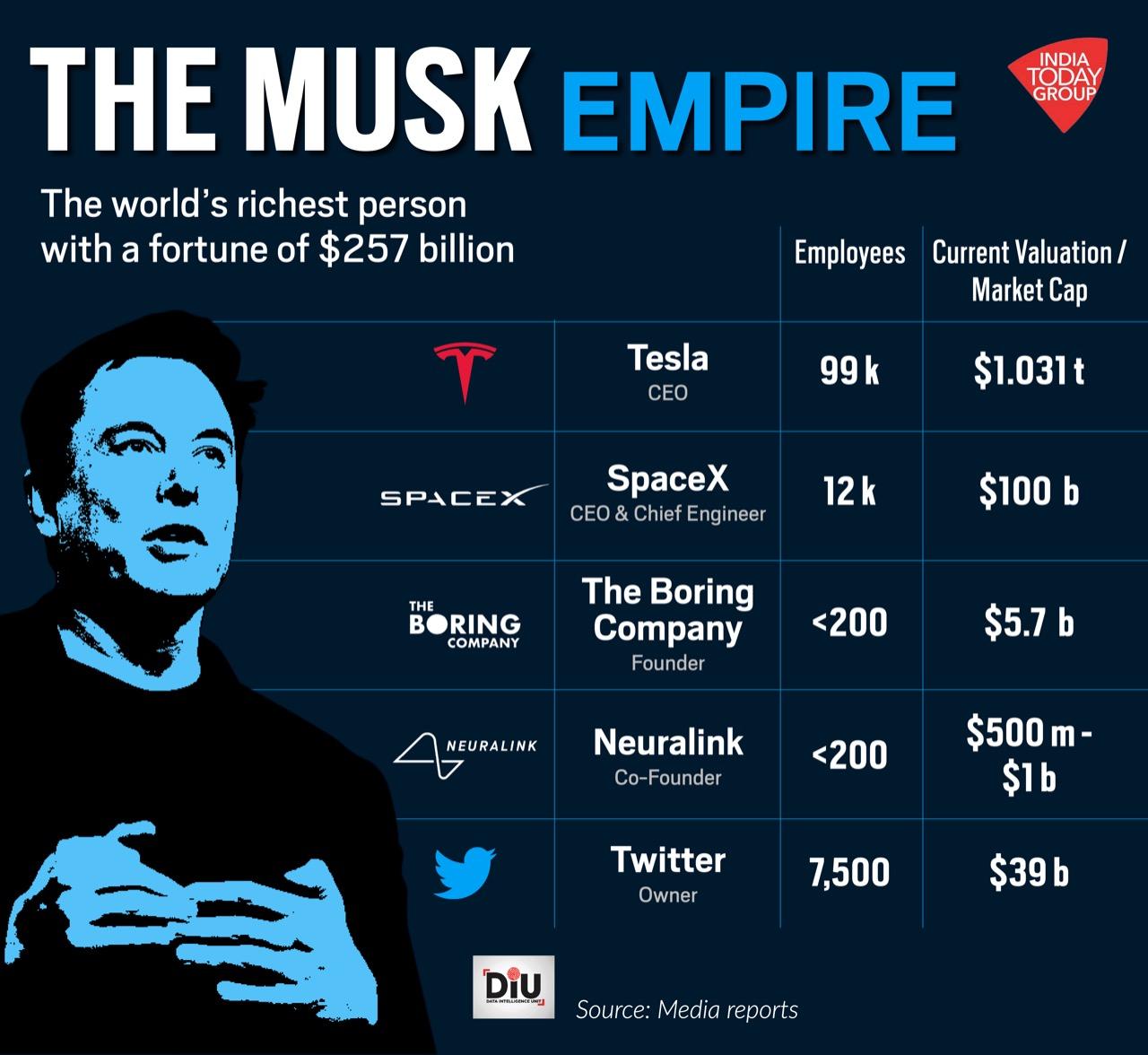

Elon Musk Net Worth: The Influence Of US Politics On Tesla And SpaceX

Table of Contents

Government Regulations and Their Impact on Tesla's Valuation

Government regulations significantly impact Tesla's operations and, consequently, Elon Musk's net worth. Favorable policies can boost the company's value, while stricter regulations can create hurdles and dampen growth.

Environmental Policies and Tax Credits: The US government's commitment to combating climate change has been a significant boon for Tesla.

- Clean Air Act: Regulations under the Clean Air Act incentivize the adoption of electric vehicles, creating a strong market for Tesla's products.

- Federal and State Tax Credits: Tax credits for purchasing electric vehicles, offered at both the federal and state levels, have substantially lowered the cost of Tesla vehicles, making them more accessible to consumers and driving sales. These credits have directly contributed billions of dollars to Tesla’s valuation, significantly impacting Elon Musk's net worth. For example, it's estimated that the initial tax credits added over $5 billion to Tesla's value in its early years.

- State-Level Incentives: Several states have implemented additional incentives, such as HOV lane access for electric vehicles, further boosting Tesla's appeal and market share.

Safety and Autonomous Driving Regulations: The regulatory environment surrounding vehicle safety and autonomous driving technology presents both opportunities and challenges for Tesla.

- Safety Standards: Meeting stringent safety standards increases Tesla's production costs but simultaneously enhances consumer confidence. Failure to meet these standards could have severe financial repercussions.

- Autonomous Driving Regulations: The development and deployment of Tesla's Autopilot and Full Self-Driving capabilities are heavily influenced by evolving regulations at both the federal and state levels. Regulatory delays or stringent requirements can significantly impact Tesla's development timeline and ultimately its market valuation, directly affecting Musk's net worth. A delay in full autonomy could cost the company billions in projected revenue.

SpaceX and the US Government's Space Exploration Agenda

SpaceX's trajectory is intrinsically linked to the US government's space exploration ambitions. Government contracts and funding are crucial for SpaceX's growth, directly influencing Elon Musk's net worth.

NASA Contracts and Funding: NASA's partnership with SpaceX has been instrumental in the company's success.

- Commercial Crew Program: The awarding of contracts under the Commercial Crew Program, such as the Crew Dragon mission, provided SpaceX with substantial funding and propelled its technological advancements, contributing significantly to its valuation and therefore to Elon Musk's net worth. These contracts are worth billions of dollars.

- Cargo Resupply Missions: SpaceX's success in securing contracts for cargo resupply missions to the International Space Station further solidified its position as a key player in the space industry. This consistency of government contracts ensures a steady stream of revenue crucial for growth.

Geopolitical Factors and Competition: The global geopolitical landscape also significantly impacts SpaceX.

- International Space Collaboration: International collaborations on space exploration projects can open up new avenues for SpaceX, increasing its potential revenue streams.

- Competition from Other Space Agencies: The increasing competitiveness from other space agencies, notably China's ambitious space program, creates both challenges and opportunities for SpaceX. The resulting dynamic competition can influence investor confidence and subsequently Musk's net worth.

Political Narratives and Public Opinion

Public perception, shaped by political narratives and media coverage, plays a crucial role in the success of both Tesla and SpaceX, ultimately influencing Elon Musk's net worth.

Media Coverage and Public Perception: The media plays a powerful role in shaping public opinion about Tesla and SpaceX.

- Positive Coverage: Positive media coverage can boost consumer confidence and attract investors, leading to higher stock prices.

- Negative Coverage: Conversely, negative coverage, often fueled by political controversies or criticisms, can erode investor confidence and negatively impact stock prices. This fluctuation is directly reflected in Elon Musk's net worth.

Political Polarization and its Influence: The highly polarized political climate in the US can create both opportunities and challenges for Tesla and SpaceX.

- Consumer Choices: Political affiliations can influence consumer choices regarding purchasing Tesla vehicles or supporting SpaceX projects.

- Investor Decisions: Political polarization can also influence investor decisions, affecting stock valuations and ultimately impacting Elon Musk's net worth.

Conclusion:

In conclusion, Elon Musk's net worth is not solely a reflection of his entrepreneurial vision but also a compelling indicator of the complex interplay between US politics, technological innovation, and the valuation of his companies, Tesla and SpaceX. Government regulations, funding initiatives, political narratives, and public opinion all significantly influence the market value of these companies, directly impacting Elon Musk's immense wealth. Staying informed about the intersection of politics, business, and technology is crucial for understanding the dynamics of Elon Musk’s net worth and the ever-evolving landscape of these influential companies. Further research into the specifics of legislation, funding allocation, and public opinion trends will provide a more complete picture of this intricate relationship.

Featured Posts

-

Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025

Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025 -

Inters Shock Win Against Bayern Champions League First Leg Report

May 09, 2025

Inters Shock Win Against Bayern Champions League First Leg Report

May 09, 2025 -

Vozmozhniy Noviy Pritok Ukrainskikh Bezhentsev V Germaniyu Analiz Riskov

May 09, 2025

Vozmozhniy Noviy Pritok Ukrainskikh Bezhentsev V Germaniyu Analiz Riskov

May 09, 2025 -

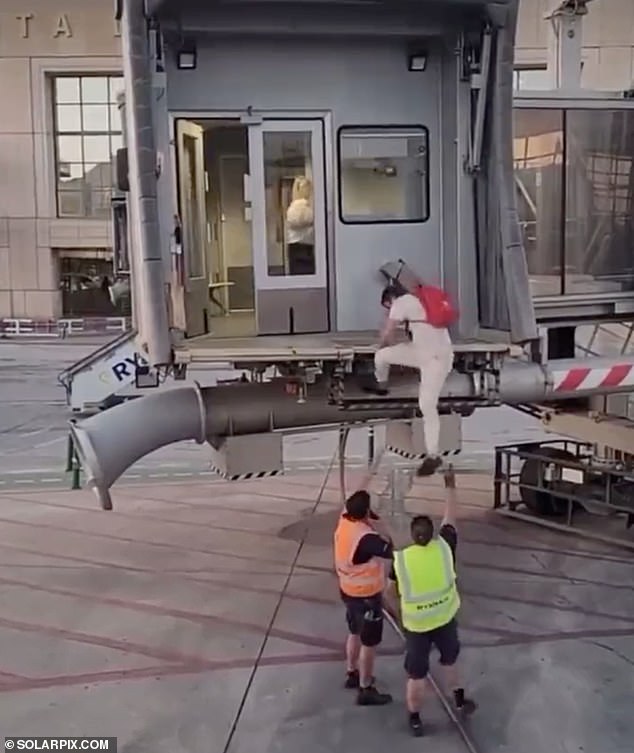

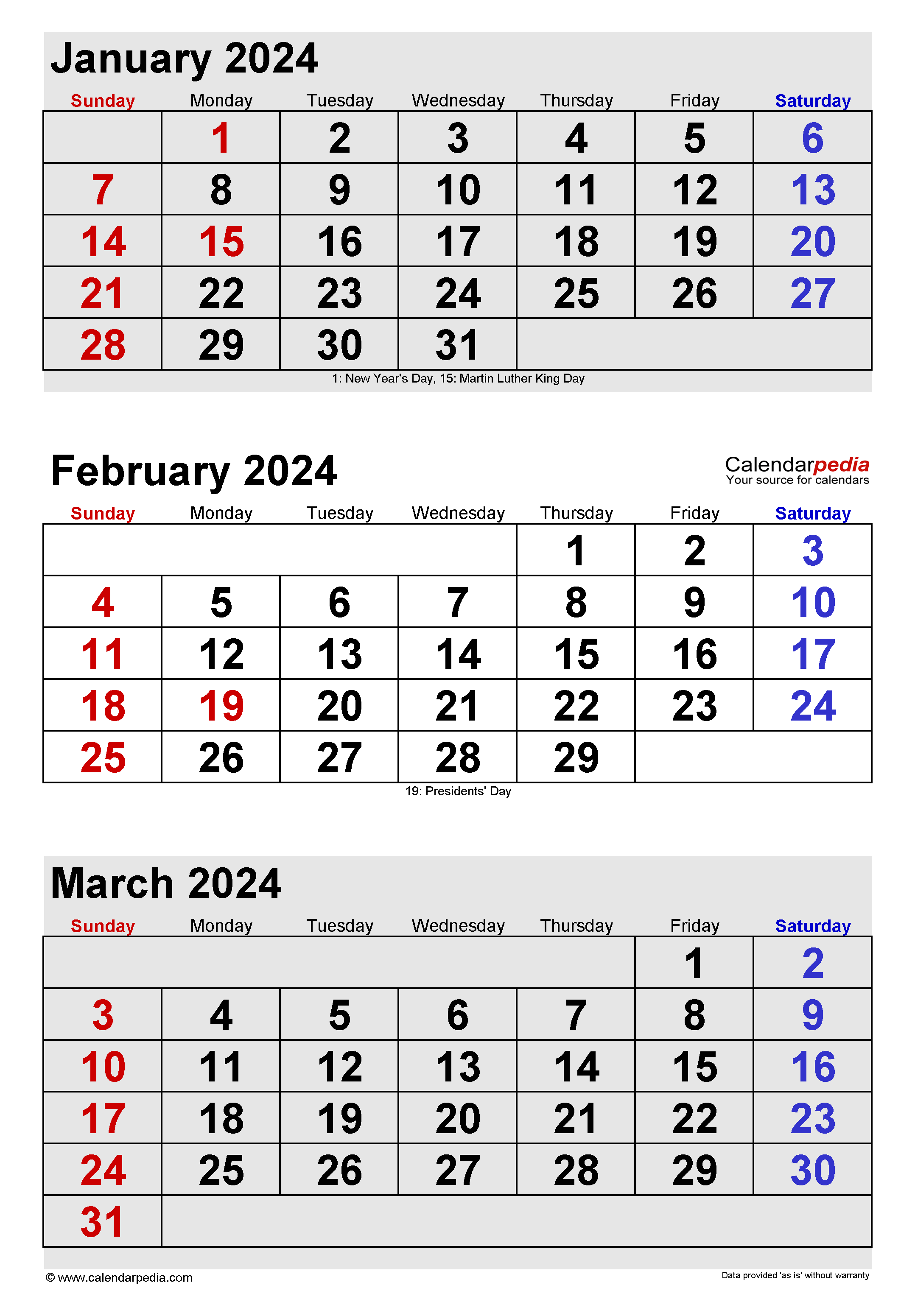

February And March 2024 Elizabeth Line Strike Impact On Routes And Schedules

May 09, 2025

February And March 2024 Elizabeth Line Strike Impact On Routes And Schedules

May 09, 2025 -

Uk Visa Restrictions Nigerians And Pakistanis Face Scrutiny

May 09, 2025

Uk Visa Restrictions Nigerians And Pakistanis Face Scrutiny

May 09, 2025