Elon Musk's $300 Billion Net Worth Milestone Broken: Analysis Of Tesla And Market Factors

Table of Contents

Tesla's Market Dominance and Stock Performance

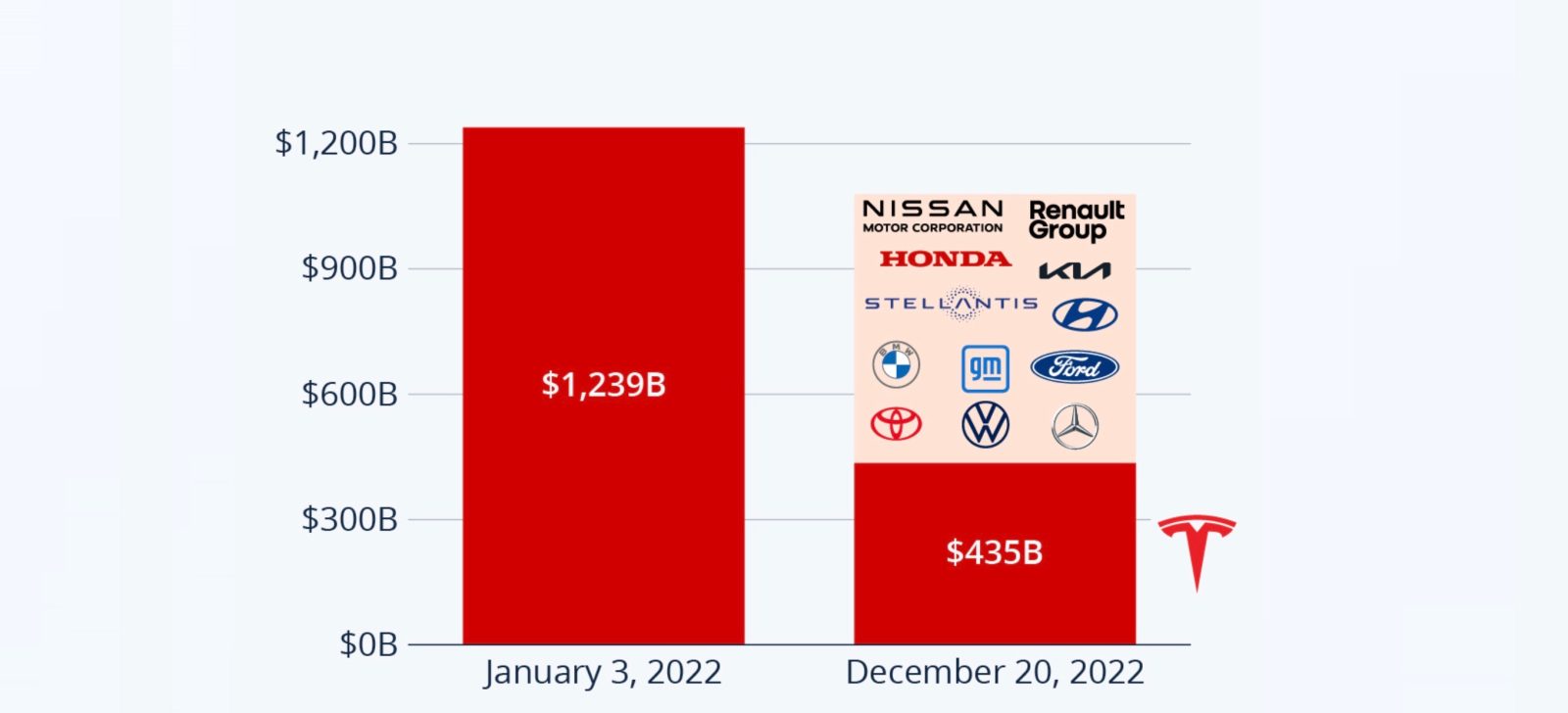

Explosive Growth of Tesla's Market Capitalization

Tesla's impressive market cap growth over the years is nothing short of remarkable. From a relatively small company, it has become a global giant, consistently outpacing its competitors. Several key milestones contributed to this explosive growth:

- Significant stock price increases: Tesla's stock price has experienced dramatic increases, fueled by strong sales figures, positive investor sentiment, and innovative product launches.

- Expansion into new markets (e.g., China): Successfully penetrating the lucrative Chinese EV market significantly boosted Tesla's production and sales volumes, adding billions to its market cap.

- Increasing production capacity: Tesla's Gigafactories have played a crucial role, expanding its manufacturing capabilities and enabling it to meet growing global demand for its vehicles.

- Successful product launches (Model 3, Model Y, Cybertruck anticipation): Each new model launch, particularly the mass-market Model 3 and Model Y, has injected further momentum into Tesla’s stock price and market valuation. The anticipation surrounding the Cybertruck further fuels investor enthusiasm.

Data points paint a clearer picture. For instance, between 2019 and 2023, Tesla's market capitalization increased by over 1000%, demonstrating the rapid acceleration of its growth. While experiencing fluctuations, its stock price consistently outperforms industry averages. Tesla's market share in the premium EV segment also solidified its position as a market leader.

Investor Confidence and Future Projections

Investor confidence in Tesla remains high, largely driven by its technological leadership and strong future projections. Analysts consistently cite factors like:

- Analyst ratings: Many prominent financial analysts maintain positive ratings on Tesla stock, predicting continued growth and market dominance.

- Predictions for future sales: Forecasts suggest a continued increase in vehicle deliveries in the coming years, further solidifying Tesla’s market position.

- Impact of new technologies (e.g., autonomous driving, battery technology): Tesla's advancements in autonomous driving and battery technology are considered key drivers of future growth and profitability.

- Discussion of potential risks and challenges: Despite the optimism, challenges remain, including competition from established automakers, supply chain disruptions, and potential regulatory hurdles. These risks are factored into analyst predictions.

Quotes from leading financial experts emphasize the company's potential, while acknowledging the inherent volatility of the stock market and the competitive landscape within the electric vehicle industry.

Impact of Innovation and Technological Advancements

Tesla's Role in Driving EV Adoption

Tesla's impact on the broader EV market is undeniable. Its innovative approach has not only driven its own success but has also accelerated the adoption of electric vehicles globally. Key aspects include:

- Technological leadership in battery technology: Tesla's advancements in battery technology, including its proprietary cell designs and energy density improvements, have significantly impacted the range and performance of electric vehicles.

- Charging infrastructure: Tesla's Supercharger network has played a vital role in addressing “range anxiety,” a key barrier to EV adoption. This infrastructure has encouraged others to invest in charging solutions.

- Autonomous driving features: Tesla's Autopilot and Full Self-Driving capabilities, despite ongoing development, have pushed the boundaries of autonomous driving technology and attracted considerable attention.

- Design innovations: Tesla's sleek and modern vehicle designs have redefined the aesthetics of electric vehicles, contributing to their appeal among consumers.

The “Tesla effect” refers to the impact Tesla’s advancements have on its competitors. It spurred other automotive companies to accelerate their EV development and invest heavily in electric vehicle technology.

Future Technological Advancements and Their Potential Impact on Net Worth

Future innovations will significantly influence Musk's net worth. Several potential avenues for growth exist:

- Potential for diversification beyond electric vehicles: Tesla's expansion into energy storage solutions (Powerwall, Powerpack) and solar energy demonstrates a diversification strategy that could further boost its valuation.

- Expansion into new technological sectors: Musk's involvement in SpaceX and Neuralink presents opportunities for significant wealth creation in space exploration and neurotechnology.

- The role of SpaceX and other ventures: The success of SpaceX, with its ambitions in space travel and satellite internet, could significantly contribute to Musk's overall wealth.

Battery breakthroughs, advancements in artificial intelligence, and successes in space exploration could all dramatically increase Tesla’s value and, consequently, Elon Musk's net worth.

Macroeconomic Factors and Market Sentiment

Global Economic Conditions and their Influence on Tesla's Stock

Tesla's stock price, and thus Musk's net worth, is also heavily influenced by broader macroeconomic conditions:

- Impact of interest rates: Rising interest rates can impact investor sentiment and lead to decreased investment in high-growth stocks like Tesla.

- Inflation: Inflationary pressures can affect consumer spending and impact the demand for luxury goods, potentially slowing Tesla's sales.

- Global supply chain disruptions: Disruptions to global supply chains can impact Tesla's production capacity and lead to delays in vehicle deliveries.

- Geopolitical events: Geopolitical instability and international conflicts can create uncertainty in the market and negatively affect investor confidence.

There's a strong correlation between positive global economic sentiment and Tesla’s robust stock performance.

Speculative Investment and Market Volatility

The role of speculative investment and market volatility is significant. Factors such as:

- Influence of social media: Social media platforms can amplify both positive and negative news about Tesla, leading to rapid price fluctuations.

- Meme stocks: Tesla has been identified as a meme stock, attracting significant attention from retail investors, contributing to increased volatility.

- Retail investor behavior: The actions of retail investors, often influenced by social media trends, can contribute to market swings and price volatility.

The high market capitalization of Tesla makes it susceptible to significant price fluctuations, driven by speculative trading and shifts in investor sentiment. This volatility is inherent to high-growth, high-market cap stocks and presents both significant opportunities and substantial risks.

Conclusion

Elon Musk's $300 billion net worth milestone is a testament to Tesla's phenomenal success, driven by a combination of market dominance, technological innovation, and favorable market conditions. Tesla's explosive market capitalization growth, fueled by strong stock performance and investor confidence, is a key factor. The company's innovative approach to electric vehicle technology, its expanding production capacity, and its positive influence on the broader EV market have all contributed significantly. However, macroeconomic factors and market volatility play a crucial role, highlighting the inherent risks and rewards associated with such a high-growth company.

Call to Action: Learn more about the factors driving the electric vehicle market and the future of Elon Musk’s net worth by following our blog for further analysis on Tesla and other market-leading companies. Stay updated on the evolving landscape of Elon Musk’s net worth and its impact on the global economy. Keywords: Tesla stock, Elon Musk wealth, EV market analysis, investment strategies.

Featured Posts

-

Download Madhyamik 2025 Result And Merit List Pdf

May 10, 2025

Download Madhyamik 2025 Result And Merit List Pdf

May 10, 2025 -

The Kreischer Marriage Netflix Comedy And The Jokes His Wife Hears

May 10, 2025

The Kreischer Marriage Netflix Comedy And The Jokes His Wife Hears

May 10, 2025 -

From Scatological Data To Insightful Podcast The Power Of Ai Digestion

May 10, 2025

From Scatological Data To Insightful Podcast The Power Of Ai Digestion

May 10, 2025 -

France And Poland To Formalize Friendship With Treaty Signing

May 10, 2025

France And Poland To Formalize Friendship With Treaty Signing

May 10, 2025 -

Nottingham Attacks Inquiry Judge Who Jailed Becker Appointed Chair

May 10, 2025

Nottingham Attacks Inquiry Judge Who Jailed Becker Appointed Chair

May 10, 2025