Emerging Market Stocks: A Strong Performance Against US Downturn

Table of Contents

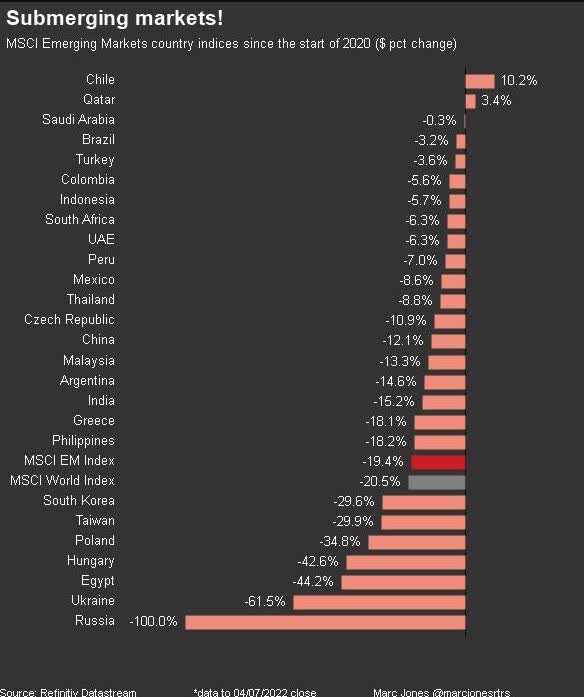

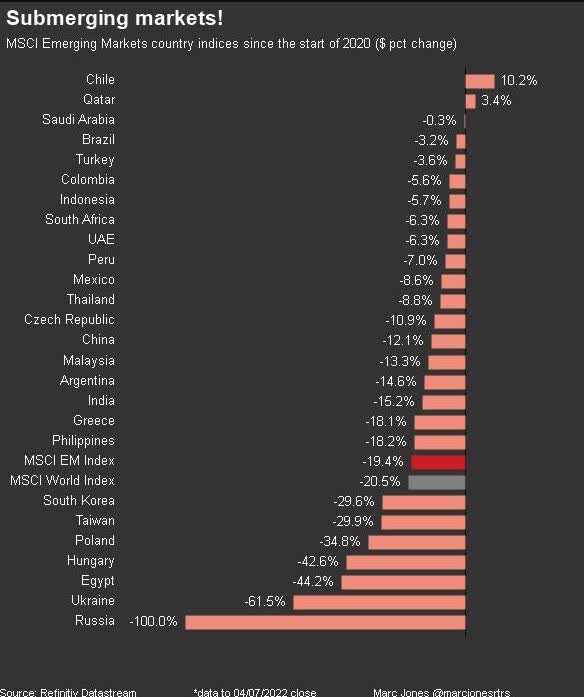

Why Emerging Markets Outperform During US Downturns

Emerging markets, encompassing countries with rapidly developing economies, often exhibit characteristics that allow them to outperform during US economic downturns. This outperformance stems from several key factors.

Decoupling from the US Economy

A significant advantage of emerging market stocks lies in their reduced correlation with US economic cycles.

- Less correlation with US economic cycles: Many emerging economies are less reliant on US demand, making them less susceptible to US recessions. Their growth is often driven by internal factors, such as population growth and infrastructure development.

- Independent growth drivers: Emerging markets boast diverse economies with independent growth drivers. For instance, robust domestic consumption in countries like India and China can offset external pressures.

- Diversification reduces portfolio risk: Incorporating emerging market stocks into a portfolio significantly reduces overall risk by diversifying away from US-centric investments. This helps cushion the impact of US market downturns.

- Examples of economies less affected by US downturns: Countries like Vietnam, Indonesia, and certain African nations have demonstrated relative resilience during past US economic slowdowns, highlighting their potential as safe havens.

Stronger Growth Potential

Emerging markets frequently exhibit significantly higher growth potential compared to developed economies.

- Higher GDP growth rates: Many emerging markets consistently report higher GDP growth rates than developed nations like the US, offering investors greater potential returns.

- Growing middle classes fueling consumer spending: The expanding middle classes in these economies drive increased consumer spending, creating opportunities in consumer goods, retail, and related sectors.

- Infrastructure development creating investment opportunities: Massive investments in infrastructure – roads, railways, energy grids – present lucrative investment opportunities in construction, materials, and related industries.

- Technological advancements driving innovation: Rapid technological adoption in emerging markets fuels innovation and growth across various sectors, particularly in technology and fintech.

Currency Fluctuations

Currency movements can significantly impact returns from emerging market investments.

- Opportunities from currency appreciation against the US dollar: When the US dollar weakens, investors holding emerging market assets can benefit from currency appreciation, boosting overall returns.

- Hedging strategies to mitigate currency risk: Strategies like currency hedging can help mitigate potential losses from currency fluctuations, protecting investment capital.

- Importance of understanding currency dynamics in emerging markets: Understanding the currency dynamics specific to each emerging market is crucial for informed investment decisions.

Identifying Promising Emerging Market Stocks

Identifying promising emerging market stocks requires a strategic approach, focusing on sector-specific opportunities and rigorous risk assessment.

Sector-Specific Opportunities

Certain sectors within emerging markets offer particularly compelling investment opportunities.

- Technology and Fintech: Rapid growth in mobile payments, e-commerce, and digital services creates significant opportunities in this sector.

- Infrastructure: Massive investments in transportation, energy, and communication infrastructure present substantial investment potential.

- Consumer Goods: The expanding middle class fuels increased demand for consumer goods, driving growth in this sector.

- Healthcare: Developing healthcare systems in many emerging nations create opportunities for healthcare providers and related companies.

Evaluating Risk and Return

Thorough due diligence is paramount when investing in emerging markets.

- Due diligence is crucial: Rigorous research is essential to evaluate the financial health, growth prospects, and overall risk profile of individual companies.

- Consider political and economic stability: Assess the political and economic stability of the country in which the company operates.

- Understand the regulatory environment: Familiarize yourself with the regulatory landscape and potential policy changes that might impact the company's operations.

- Analyze company financials and growth prospects: Scrutinize the company's financial statements, growth trajectory, and competitive landscape.

Diversification Strategies

Diversification is key to mitigating risk in emerging market investments.

- Invest in a diversified portfolio of emerging market stocks: Don't put all your eggs in one basket. Spread your investments across various companies and sectors.

- Consider ETFs and mutual funds for broad exposure: Exchange-traded funds (ETFs) and mutual funds offer diversified exposure to a range of emerging market stocks.

- Geographic diversification across various emerging markets: Diversify geographically to reduce exposure to risks specific to a single country or region.

Navigating the Risks of Emerging Market Investments

While emerging market stocks offer significant growth potential, they also carry inherent risks.

Political and Economic Instability

Political and economic instability is a significant risk factor in many emerging markets.

- Geopolitical risks and potential for political upheaval: Political instability can significantly disrupt business operations and negatively impact investment returns.

- Currency fluctuations and inflation: Currency fluctuations and high inflation can erode the value of investments.

- Regulatory uncertainty and potential policy changes: Changes in government regulations can impact the profitability and viability of businesses.

Liquidity Concerns

Liquidity can be a concern in some emerging markets.

- Lower trading volumes in some emerging markets: This can make it challenging to buy or sell investments quickly.

- Difficulty in exiting investments quickly: Limited liquidity can result in potential losses if investors need to sell their holdings urgently.

- Potential for illiquidity in certain sectors: Some sectors within emerging markets may exhibit lower liquidity than others.

Transparency and Corporate Governance

Transparency and corporate governance standards may differ from those in developed markets.

- Differences in accounting standards and corporate governance practices: These differences can make it more challenging to assess the true financial health and risk profile of companies.

- Importance of thorough due diligence: Conduct thorough due diligence to understand the corporate governance practices and accounting standards in place.

- Potential for higher information asymmetry: Information asymmetry – the unequal distribution of information – can be higher in emerging markets, increasing investment risks.

Conclusion

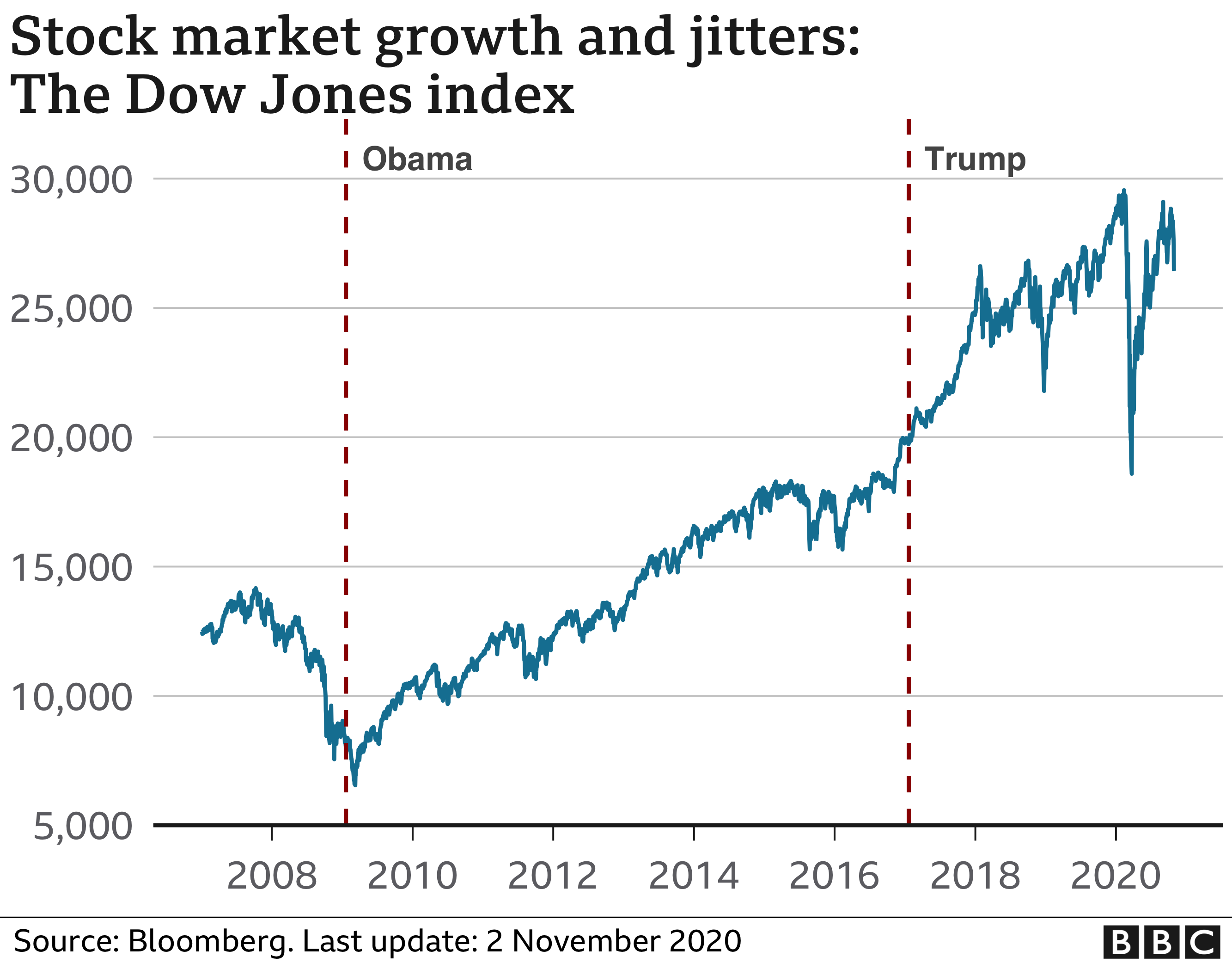

Emerging market stocks offer a compelling investment opportunity, especially during periods of US economic uncertainty. Their higher growth potential, relative decoupling from the US economy, and sector-specific opportunities outweigh the associated risks for well-diversified and informed investors. However, thorough research, risk understanding, and appropriate diversification strategies are vital. Don't miss the potential of emerging market stocks – start exploring your options today. Consider consulting a financial advisor for personalized guidance on incorporating emerging market stocks into your investment portfolio.

Featured Posts

-

Analyzing The Business Model Why A Startup Airline Is Utilizing Deportation Flights

Apr 24, 2025

Analyzing The Business Model Why A Startup Airline Is Utilizing Deportation Flights

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Next Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Next Move

Apr 24, 2025 -

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025 -

Liams Secrecy Steffys Rage A Bold And The Beautiful Recap April 9

Apr 24, 2025

Liams Secrecy Steffys Rage A Bold And The Beautiful Recap April 9

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu 24 Shines In Fashion Magazine

Apr 24, 2025

John Travoltas Daughter Ella Bleu 24 Shines In Fashion Magazine

Apr 24, 2025

Latest Posts

-

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025 -

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025 -

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025