Energy Giant SSE Cuts Spending By £3 Billion Due To Slowing Growth

Table of Contents

The Scale of SSE's Spending Cuts and Their Impact

The £3 billion reduction in SSE's capital expenditure represents a significant strategic shift. This SSE budget cut is not a minor adjustment; it's a substantial reshaping of the company's investment plans.

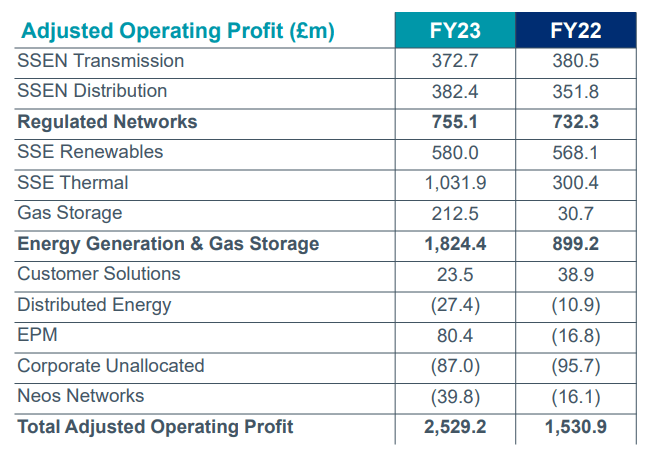

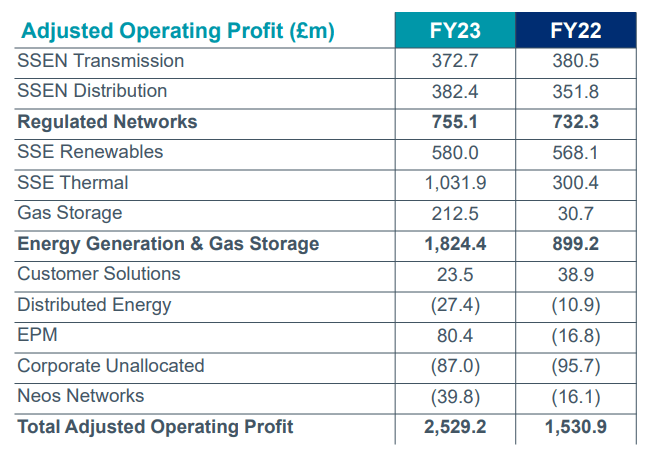

£3 Billion Reduction: A Detailed Breakdown

While SSE hasn't provided a completely itemized breakdown, reports suggest the SSE spending cuts affect several key areas:

- Renewable Energy Projects: Several large-scale renewable energy projects, including wind farms and potentially some solar initiatives, are expected to be delayed or scaled back. This directly impacts SSE's ambitious renewable energy targets.

- Network Infrastructure: Investment in upgrading and expanding the electricity network infrastructure may also be curtailed, potentially leading to longer-term limitations on grid capacity.

- Operational Expenses: The company is likely streamlining operational costs across various departments to contribute to the overall £3 billion reduction.

Bullet Points:

- Specific examples of projects delayed or cancelled: Specific project names haven't been publicly released yet, but industry analysts speculate several wind farm developments in Scotland and England are affected.

- Impact on SSE's workforce: While official announcements haven't been made, some job losses or restructuring within the company are anticipated due to these SSE capital expenditure reductions.

- Effect on SSE's future renewable energy targets: The delay or cancellation of renewable energy projects will undoubtedly impact SSE's ability to meet its previously stated targets for renewable energy generation.

- Analysis of the financial implications for SSE: The SSE spending cuts are expected to improve short-term financial performance, but the long-term consequences for growth and market share remain uncertain. Analysts are closely monitoring the impact on the company's profitability and investor confidence.

Underlying Reasons for the Slowing Growth and Spending Cuts

The SSE spending cuts are a direct response to several interconnected factors impacting the global energy landscape.

Impact of the Energy Crisis

The ongoing global energy crisis, characterized by volatile energy prices and supply chain disruptions, has significantly impacted SSE's investment plans. The increased cost of materials and the uncertainty surrounding future energy prices have made large-scale projects less financially viable.

Challenges in the Renewable Energy Sector

The renewable energy sector, while experiencing rapid growth, faces its own unique challenges.

Bullet Points:

- Rising interest rates and their impact on investment decisions: Higher interest rates increase the cost of borrowing, making it more expensive for SSE to finance major projects.

- Increased material costs for renewable energy projects: The cost of materials such as steel, concrete, and specialized components used in renewable energy projects has increased dramatically.

- Government policies and their influence on energy investment: Changes in government policies and regulations related to energy production and investment can create uncertainty and affect investment decisions.

- Competition within the energy sector: Increased competition from other energy companies is putting pressure on SSE's margins and investment strategies.

Industry Response and Future Outlook for SSE

The market's reaction to the SSE spending cuts has been mixed, reflecting the uncertainty surrounding the long-term implications.

Reactions from Investors and Analysts

SSE's share price initially dipped following the announcement of the SSE budget cuts, but has since shown some signs of recovery. Analysts' opinions are divided, with some expressing concerns about the impact on long-term growth and others viewing the cost-cutting measures as a necessary step to improve short-term financial stability.

SSE's Strategic Response

SSE is likely to refocus its investments on projects with a higher likelihood of success and a quicker return on investment. This might involve prioritizing smaller-scale projects or concentrating on specific areas of the renewable energy sector where the risks are perceived as lower.

Bullet Points:

- Predictions for SSE's future performance: The long-term impact of the SSE spending cuts on the company's performance is difficult to predict. Much depends on the success of the company's revised strategy and the overall evolution of the energy market.

- Potential implications for the wider energy sector: SSE's decision could signal a broader trend of reduced investment in the energy sector, potentially impacting the pace of the energy transition.

- Comparison with other energy companies' strategies: Other energy companies are likely facing similar challenges and may adopt similar cost-cutting measures.

- Potential for future investment announcements from SSE: SSE may announce further investment decisions in the coming months, clarifying its revised investment strategy.

Conclusion

SSE's £3 billion spending cuts represent a significant development in the energy sector, reflecting the challenges of navigating the global energy crisis and maintaining profitability in a competitive market. The reasons behind these SSE budget cuts are multifaceted, stemming from the energy crisis, challenges within the renewable energy sector, and broader economic factors. The impact on SSE’s future growth, its renewable energy targets, and the wider energy market will unfold over time.

Key Takeaways:

- SSE's significant reduction in spending reflects the challenging environment facing the energy sector.

- The decision impacts renewable energy projects, network infrastructure, and potentially the workforce.

- The long-term consequences for SSE and the industry remain uncertain.

Call to Action: Stay updated on the evolving situation with SSE spending cuts and the future of energy investment by following our updates. Continue to monitor the impact of these significant changes in the energy sector and how other energy companies respond to similar challenges.

Featured Posts

-

Naomi Campbell Met Gala Ban Feud With Anna Wintour

May 26, 2025

Naomi Campbell Met Gala Ban Feud With Anna Wintour

May 26, 2025 -

G7 Meeting Tariffs Omitted From Final Communique Despite Concerns

May 26, 2025

G7 Meeting Tariffs Omitted From Final Communique Despite Concerns

May 26, 2025 -

Desinformation La Rtbf Et La Journee Mondiale Du Fact Checking

May 26, 2025

Desinformation La Rtbf Et La Journee Mondiale Du Fact Checking

May 26, 2025 -

T Bird Girls Relay Sweep A Winning Strategy For Home Invite

May 26, 2025

T Bird Girls Relay Sweep A Winning Strategy For Home Invite

May 26, 2025 -

The Saint Itv 4 Complete Tv Guide And Schedule

May 26, 2025

The Saint Itv 4 Complete Tv Guide And Schedule

May 26, 2025