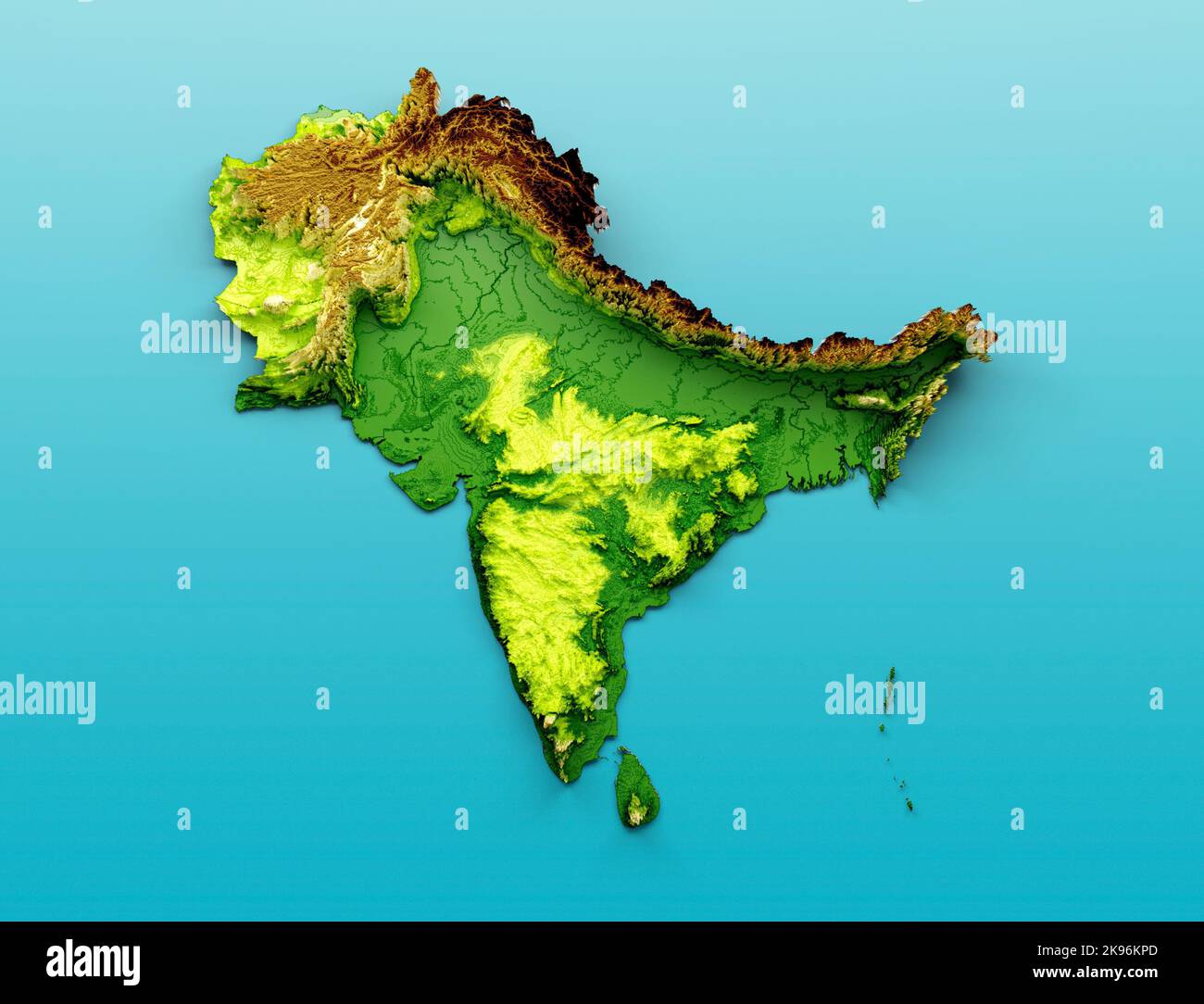

Enhanced Capital Market Cooperation: A Step Forward For Pakistan, Sri Lanka, And Bangladesh

Table of Contents

Economic Benefits of Regional Capital Market Integration for Pakistan, Sri Lanka, and Bangladesh

Regional capital market integration offers substantial economic benefits for Pakistan, Sri Lanka, and Bangladesh. By fostering closer collaboration, these nations can unlock significant opportunities for growth and stability.

Increased Investment Opportunities

An integrated capital market significantly expands investment opportunities. Reduced investment barriers, facilitated by streamlined regulations and harmonized standards, attract both domestic and foreign direct investment (FDI). Access to a wider pool of capital enables businesses to expand, innovate, and create jobs. Diversification of investment portfolios becomes easier, reducing risk for investors. For example, the successful integration of European capital markets has demonstrated a substantial increase in FDI flows. Similar growth could be seen in the PSB region with improved CMC.

- Reduced investment barriers: Simplified cross-border investment regulations.

- Access to a wider pool of capital: Attracting investors from diverse geographical locations.

- Diversification of investment portfolios: Reducing risk through broader investment options.

Data shows that FDI flows in South Asia lag behind other regions. Enhanced CMC could significantly boost these numbers by attracting international investors seeking higher returns and diversification in emerging markets. While precise figures require detailed econometric modeling, anecdotal evidence and successful examples from other regions strongly support this claim.

Enhanced Financial Stability

Capital market cooperation enhances financial stability across the PSB region. A more integrated market reduces volatility by allowing for better risk sharing and diversification. Improved access to liquidity during times of stress strengthens resilience against economic shocks. Examples from the ASEAN region, where closer financial ties have mitigated the impact of regional crises, showcase the potential benefits.

- Reduced volatility: Smoother market fluctuations, leading to greater predictability.

- Better risk management: Shared risk assessment and mitigation strategies.

- Improved access to liquidity: Easier access to funds during economic downturns.

Boosting Economic Growth

The combined effects of increased investment and enhanced financial stability translate directly into higher GDP growth. This growth fuels productivity improvements, job creation, and a rise in living standards across Pakistan, Sri Lanka, and Bangladesh.

- Increased productivity: Access to capital allows for technological upgrades and efficiency gains.

- Job creation: Investment fuels economic activity, leading to more employment opportunities.

- Improved living standards: Higher incomes and greater economic opportunities improve quality of life.

Numerous studies have demonstrated a strong correlation between capital market development and economic growth. Investing in enhanced CMC is therefore a crucial step towards achieving sustainable and inclusive economic development in the PSB region.

Challenges and Barriers to Enhanced Capital Market Cooperation in the PSB Region

Despite the significant potential, several challenges hinder enhanced capital market cooperation in the PSB region. Addressing these obstacles is crucial for realizing the full benefits of integration.

Regulatory Differences

Differing regulatory frameworks across Pakistan, Sri Lanka, and Bangladesh create significant barriers to seamless integration. Harmonizing regulations related to listing requirements, investor protection, and cross-border transactions is crucial.

- Harmonization of regulations: Establishing common standards for corporate governance, accounting practices, and securities regulation.

- Cross-border listings: Facilitating the listing of companies from one country on the exchanges of others.

- Investor protection: Ensuring consistent and strong investor protection mechanisms across the region.

Infrastructure Limitations

Inadequate technological infrastructure further hinders cooperation. This includes limitations in data sharing, settlement systems, and the overall digitalization of capital markets. Investment in modern technology is crucial to facilitate efficient and secure cross-border transactions.

- Lack of technology infrastructure: Upgrading outdated systems to support real-time trading and data exchange.

- Data sharing: Establishing secure platforms for efficient data exchange between regulatory bodies and market participants.

- Settlement systems: Implementing robust and reliable systems for clearing and settling cross-border transactions.

Political and Geopolitical Risks

Political instability and geopolitical tensions can significantly impact investor confidence and hinder cross-border transactions. Policy uncertainty and unpredictable regulatory changes create risks for investors and can deter participation in the integrated market.

- Investor confidence: Maintaining a stable and predictable policy environment to attract foreign investment.

- Cross-border transactions: Ensuring a secure and reliable framework for cross-border payments and settlements.

- Policy uncertainty: Minimizing regulatory changes and promoting transparency in policymaking.

Strategies for Promoting Enhanced Capital Market Cooperation in the PSB Region

Overcoming the challenges requires a multi-pronged approach that involves regulatory harmonization, technological upgrades, and strengthening institutional frameworks.

Regulatory Harmonization

Streamlining regulations requires a collaborative effort. Joint working groups composed of representatives from regulatory bodies in Pakistan, Sri Lanka, and Bangladesh can facilitate the process. Mutual recognition of regulatory standards and capacity building initiatives will play a vital role in achieving this goal.

- Joint working groups: Facilitating dialogue and collaboration between regulatory bodies.

- Mutual recognition of regulatory standards: Reducing duplication and simplifying compliance requirements.

- Capacity building: Providing training and support to regulatory staff to enhance their expertise.

Technological Upgrades

Investment in modern technology infrastructure is essential for efficient cross-border transactions. Digitalization of capital markets, the adoption of blockchain technology for secure transactions, and utilization of data analytics for risk management are all crucial steps.

- Digitalization of capital markets: Modernizing trading platforms and infrastructure to support electronic trading and data exchange.

- Blockchain technology: Utilizing blockchain for secure and transparent record-keeping and cross-border payments.

- Data analytics: Leveraging data analytics for improved risk assessment and regulatory oversight.

Strengthening Institutional Frameworks

Regional organizations, such as SAARC, can play a crucial role in fostering cooperation. Collaborative initiatives, including joint research, knowledge sharing, and the development of common standards, can significantly contribute to building a more integrated capital market.

- SAARC and other regional bodies: Leveraging existing regional frameworks to promote cooperation.

- Collaborative initiatives: Joint research, knowledge sharing, and the development of common standards.

Conclusion: A Collaborative Future for Enhanced Capital Market Cooperation in South Asia

Enhanced capital market cooperation offers immense potential for economic growth and development in the PSB region. While challenges related to regulatory differences, infrastructure limitations, and geopolitical risks exist, these can be overcome through collaboration and strategic planning. Investing in enhanced capital market cooperation offers a transformative opportunity to unlock the immense potential of the PSB region. Let's work collaboratively to build a more integrated and prosperous future. The future of economic prosperity for Pakistan, Sri Lanka, and Bangladesh lies in embracing and actively pursuing strategies for enhanced capital market cooperation.

Featured Posts

-

Nottingham A And E Records Accessed Families Of Stabbing Victims Demand Answers

May 10, 2025

Nottingham A And E Records Accessed Families Of Stabbing Victims Demand Answers

May 10, 2025 -

Melanie Griffith And Daughter Dakota Johnson Attend Materialists Premiere

May 10, 2025

Melanie Griffith And Daughter Dakota Johnson Attend Materialists Premiere

May 10, 2025 -

Nhl Kucherovs Lightning Shut Out Oilers 4 1

May 10, 2025

Nhl Kucherovs Lightning Shut Out Oilers 4 1

May 10, 2025 -

Punjab Launches Technical Training Program For Transgender Individuals

May 10, 2025

Punjab Launches Technical Training Program For Transgender Individuals

May 10, 2025 -

Universitaria Transgenero Arrestada El Uso Del Bano Femenino Y La Ley

May 10, 2025

Universitaria Transgenero Arrestada El Uso Del Bano Femenino Y La Ley

May 10, 2025